Vitalik Buterin’s Ethereum Fortune Surges Past $1B as Crypto Whales Battle for Shrinking ETH Supply

Ethereum's co-founder just joined the ten-figure club—while institutional players scramble for scraps.

The supply squeeze is real. With ETH's circulating stock tighter than a VC's purse strings, whales are turning the market into a high-stakes bidding war. Vitalik's stash? Now worth more than most small nations' GDP.

Meanwhile, Wall Street 'experts' still can't decide if crypto's a scam or the future. Place your bets.

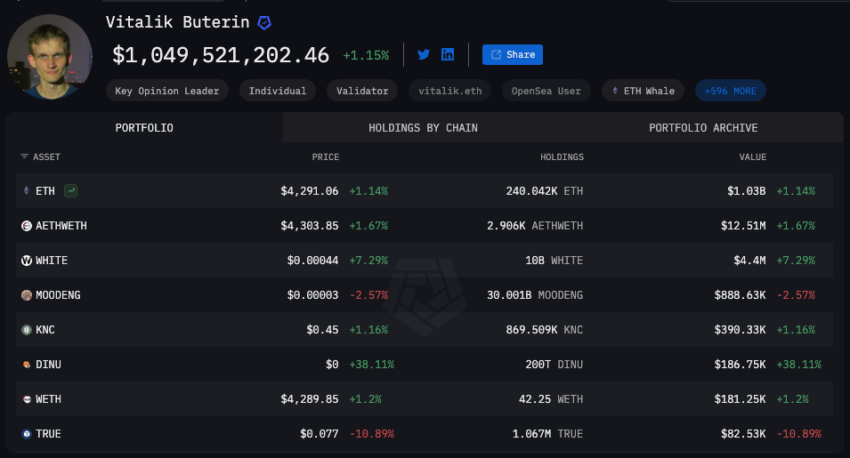

The Billion-Dollar ETH Portfolio: Full Transparency

As of mid-2024, Buterin’s known ethereum addresses are documented with holdings above $1 billion. Both entity-level dashboards and public explorers list these wallets. Arkham’s platform shows more than 240,000 ETH and details validator roles and transactions. Arkham entity data on Vitalik Buterin remains a central reference for monitoring balances.

While Buterin’s fortune draws headlines, a different story is building among OTC desks. The private market for large ETH trades is reportedly facing a sharp supply squeeze.

“In the past hour, Binance, Coinbase & Bitstamp moved ~$160M in ETH to Galaxy Digital’s OTC desk. Largest single tx: 4.5K ETH ($18.99M). Ethereum whales are moving heavy today,” CryptosRus said.

Large transfers reveal the scale of activity moving through OTC channels. However, observers also report shortfalls at active desks.

“WinterMute, known Market Maker, have run out of Ethereum on their OTC desk. This means the only way to buy ETH is by the public open market. I wonder if Ethereum can punch $5,000 soon?” yourfriendSOMMI wrote on X.

hearing there is just 42 ETH left on OTC desks

if true, ETH is going straight to $80,000!!

Such posts illustrate broad speculation. If demand persists, scarce OTC supply could push buying back onto public markets.

The ETH vs. BTC Debate Returns

The debate over Ethereum’s place relative to Bitcoin tends to flare when liquidity tightens. It also resurfaces when ETH gains market share.

A popular post recalls a moment when ETH nearly matched Bitcoin’s dominance:

“You may not know, but Ethereum almost surpassed BTC to become the coin with the largest market capitalization on June 18, 2017. At that time, BTC held 37.8% of the market share, while ETH reached 31.2%. However, in the end, that didn’t happen; BTC regained its dominance and has maintained a significant gap with ETH ever since.”ThuanCapital said.

That history colors current analysis. With OTC supply tight, some market voices again mention a possible flippening, even if brief. Meanwhile, Buterin’s on-chain stake, visible on mainnet and via third-party trackers, signals his alignment with Ethereum’s future.

Greater transparency across on-chain assets and OTC channels keeps attention on Ethereum. Ultimately, traders will gauge whether scarcity and demand can challenge the status quo in the months ahead.