Ripple’s Legal Triumph Ignites Market Frenzy—Will BlackRock Dive Headfirst Into XRP?

Ripple’s courtroom win just sent shockwaves through crypto—and Wall Street’s vultures are circling. With regulatory fog lifting, XRP’s price action looks like a Vegas slot machine on triple espresso. Now the trillion-dollar question: Is BlackRock about to place its bets?

The institutional floodgates creak open

Hedge funds love nothing more than a distressed asset with fresh loopholes. Ripple’s partial victory against the SEC handed them both—cue the speculative frenzy. Liquidity’s pooling, derivatives are heating up, and suddenly every fund manager ‘always believed in blockchain’.

BlackRock’s poker face slips

The asset management giant’s crypto custody service went live suspiciously close to Ripple’s legal breakthrough. Coincidence? In finance? Please. Their XRP ETF rumors have more smoke than a post-Miami Bitcoin conference.

Market mechanics get weird

Watch the order books—whales are testing waters with carefully sized positions. Retail traders are piling in late (as usual). And the SEC? Probably drafting another motion that’ll arrive just in time for the next bull run’s peak.

One thing’s certain: When BlackRock sneezes, the market catches pneumonia. Whether that means buying the rumor or shorting the news depends entirely on which desk’s bonus structure we’re talking about.

Will BlackRock File for an XRP ETF?

BeInCrypto reported that both parties dismissed their appeals on August 7. Now, industry experts are turning their attention to the implications for XRP’s future.

In a latest post on X (formerly Twitter), Nate Geraci, President of NovaDius Wealth Management, suggested that BlackRock may consider filing for an ‘iShares XRP ETF’ after the lawsuit’s closure.

“I’ll own it if I’m wrong. IMO, makes *zero* sense for them to ignore crypto assets beyond BTC and ETH,” he said.

Geraci further emphasized that for BlackRock to focus solely on Bitcoin and ethereum would imply that the company believes the two largest cryptocurrencies are the only ones with value.

However, Bloomberg’s senior ETF analyst, Eric Balchunas, disagreed with Geraci’s view.

“I just think they are happy w the two. Law of diminish returns from here on out. But again I’ve nothing to go on but my own spidey sense here,” he replied.

While views on BlackRock’s potential involvement with XRP may differ, an ETF application from the asset manager could be highly beneficial for XRP. BlackRock manages the leading Bitcoin and Ethereum ETFs, the iShares Bitcoin Trust (IBIT) and the iShares Ethereum Trust (ETHA). It has established itself as a key player in the cryptocurrency space.

BlackRock’s support for XRP could bring credibility and institutional backing to the digital asset, potentially increasing investor confidence and market adoption. Nevertheless, while BlackRock’s involvement WOULD undoubtedly be positive for XRP, it’s important to note that the asset is not without other filings.

Major asset managers, including Bitwise, 21Shares, Canary Capital, Grayscale, Franklin Templeton, ProShares, WisdomTree, and others, have already filed to launch XRP ETFs. This indicates a growing interest in the asset.

End of Ripple-SEC Case Pushes XRP Price and ETF Approval Odds Up

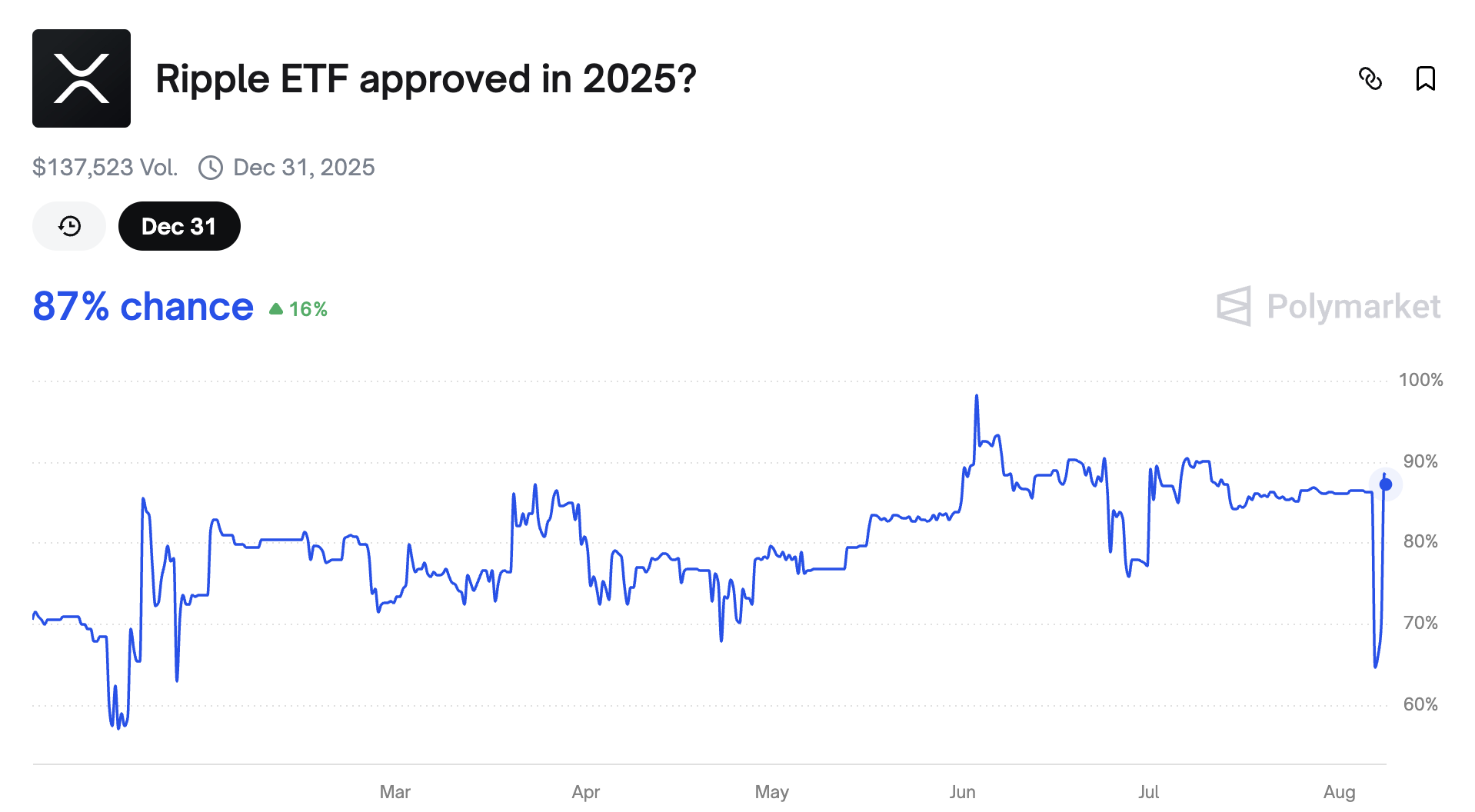

While BlackRock may or may not file for an XRP ETF, the Ripple-SEC development has certainly increased the odds of one being approved by the end of the year. According to the latest data from Polymarket, traders have assigned a 87% probability of an XRP ETF being approved by December 2025.

The number is notable especially since the odds fell as low as 62% after SEC Commissioner Caroline Crenshaw voted against approving several crypto ETFs.

“Interesting, trades reporting how Polymarket odds of XRP ETF approval went down to 62% after the votes were disclosed, showing Crenshaw voting no, but a) she’s gonna vote no on EVERYTHING and b) it’s meaningless, she’s outnumbered = we haven’t changed our odds, still at 95%,” Balchunas stated.

Lone Democrat @SECGov commissioner Caroline Crenshaw is sending a clear message: she remains firmly opposed to crypto ETFs. https://t.co/NT4gCLH2k9

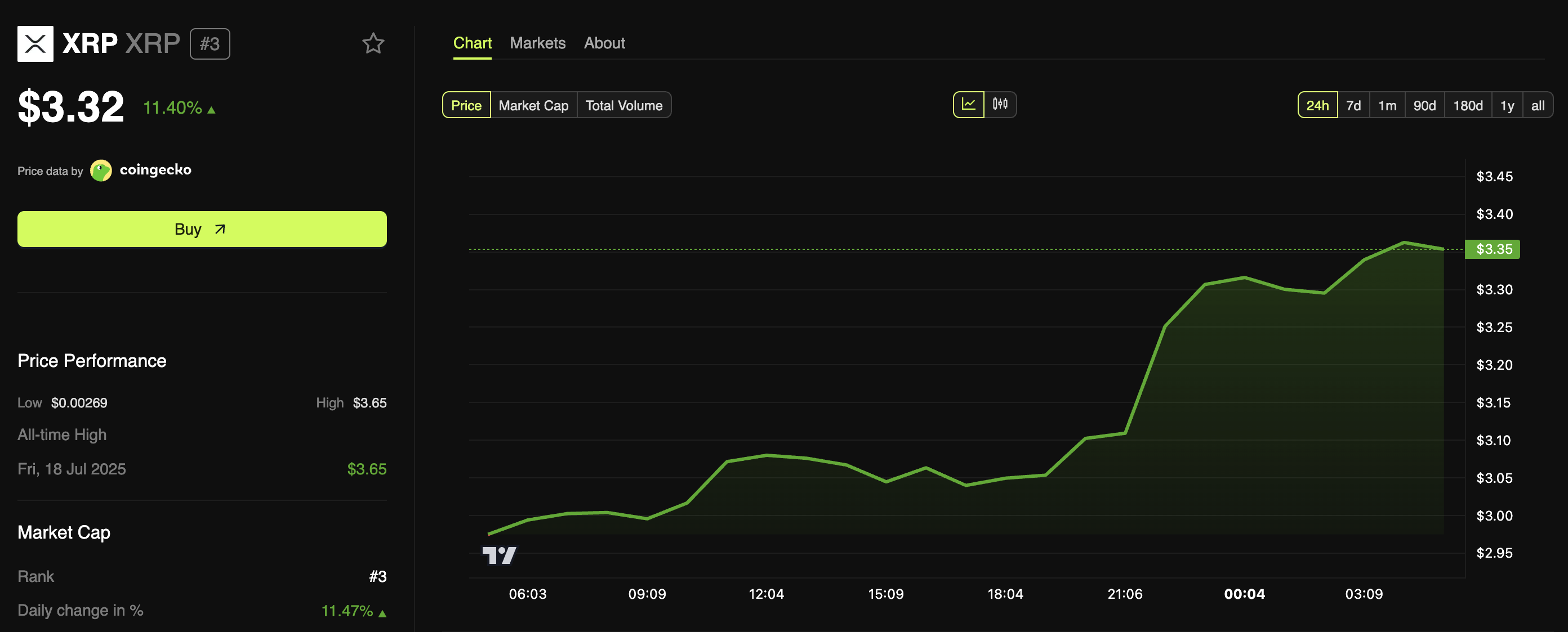

— Eleanor Terrett (@EleanorTerrett) August 7, 2025Besides the approval odds, XRP’s price also saw a notable uptick. The altcoin’s value has appreciated 11.4% over the past day, marking the highest gains among the top 10 coins.

According to BeInCrypto Markets data, XRP’s trading price stood at $3.32 at the time of writing.