$5 Billion Crypto Bomb Drops Today: Bitcoin & Ethereum Options Expiry Looms – Brace for Impact

Today's the day traders circled in blood-red ink: nearly $5 billion in Bitcoin and Ethereum options contracts expire. Buckle up.

Why it matters: When this much notional value hits the market at once, even crypto's most hardened degens pay attention. Liquidity gets weird, volatility gets wild, and leverage gets liquidated.

The mechanics: Options expiries don't move markets directly – but the gamma squeeze potential does. Market makers hedging their positions create artificial buy/sell pressure that often overshoots fundamentals. Classic crypto.

Watch these levels: Key strike prices become magnets as expiry approaches. If BTC holds above $60K or ETH above $3K? Bullish flush. If not? Strap in for some good old-fashioned Wall Street manipulation dressed in decentralized clothing.

The bottom line: Smart money's already positioned – this expiry's more about cleaning up overleveraged retail traders. As always in crypto, the house wins. (And by house, we mean the whales who wrote these options.)

Bitcoin, Ethereum Options Expiry Looms With $4.96 Billion at Stake

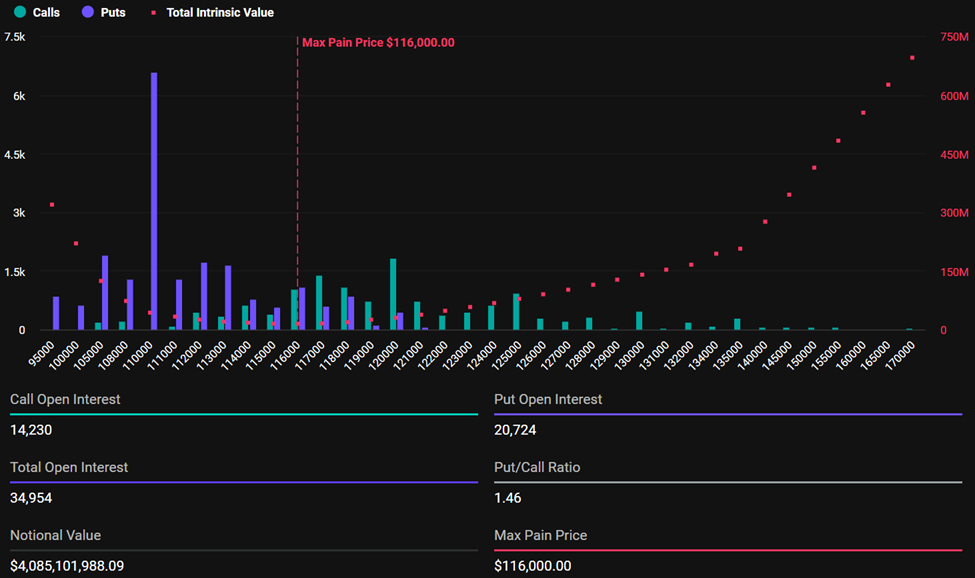

According to data from Deribit, Bitcoin leads with option contracts worth $4.09 billion set to expire. The max pain point, representing the level at which the most options expire worthless and dealers experience the least loss, is $116,000.

The total open interest (OI) for these expiring bitcoin options is 34,954 contracts and a put-to-call ratio (PCR) of 1.46.

This PCR suggests a slightly bearish lean, with more puts (Sale options) than calls (Purchase contracts) in play.

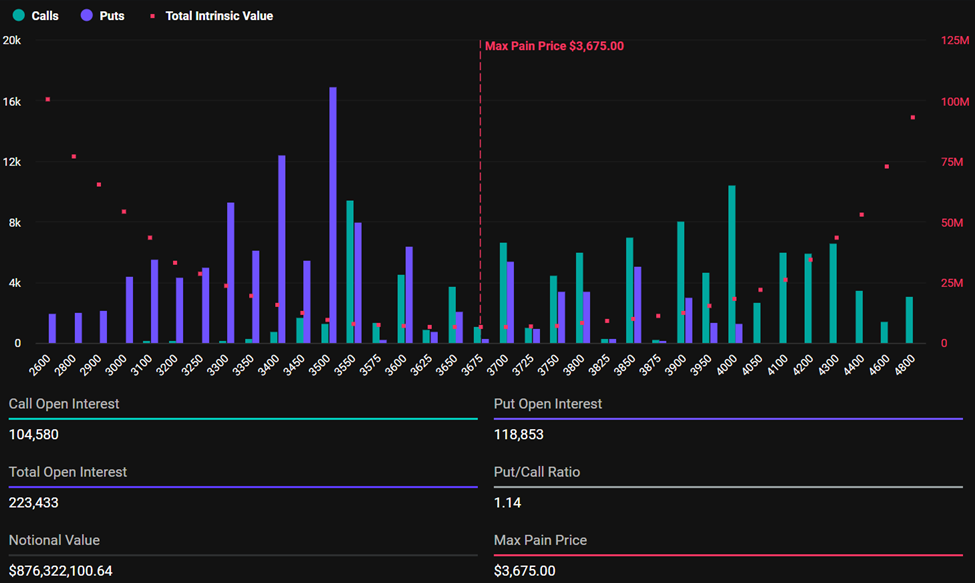

For Ethereum, the figures are more modest but still significant. At 8:00 UTC on Deribit, $876 million in ethereum options will expire today, with 223,433 contracts outstanding.

The max pain level, $3,675, is aligned with the notional value of $876.3 million, and the PCR of 1.14 indicates a more neutral sentiment than Bitcoin.

Deribit analysts highlighted the current open interest (OI) distribution, noting a large cluster of put positions below spot and call positions stacked above.

“OI distribution hints at puts clustered below spot, calls stacked higher. Do you think the expiry could shake things up?” Deribit analysts posed.

However, this skew may act as a gravitational force keeping prices range-bound, but only until expiry, which happens today, at 8:00 UTC on Deribit.

Low Volatility Dominates Market Sentiment

Options analysts at Greeks.live note a mixed sentiment across the market, with many traders adapting to a low-volatility environment.

Despite concerns around 32% implied volatility (IV), traders aggressively sell puts, especially around the BTC 112,000 strike for end-of-week expiration. This suggests most are betting on price stability or mild upside, ideal conditions for harvesting premiums.

“Traders are actively selling puts at 112,000 strike rice for end-of-week expiration despite 32% implied volatility concerns,” said analysts at Greeks.live.

They also point to strong confidence in premium selling strategies, indicating that successful trades generate profits as the underlying moves favorably.

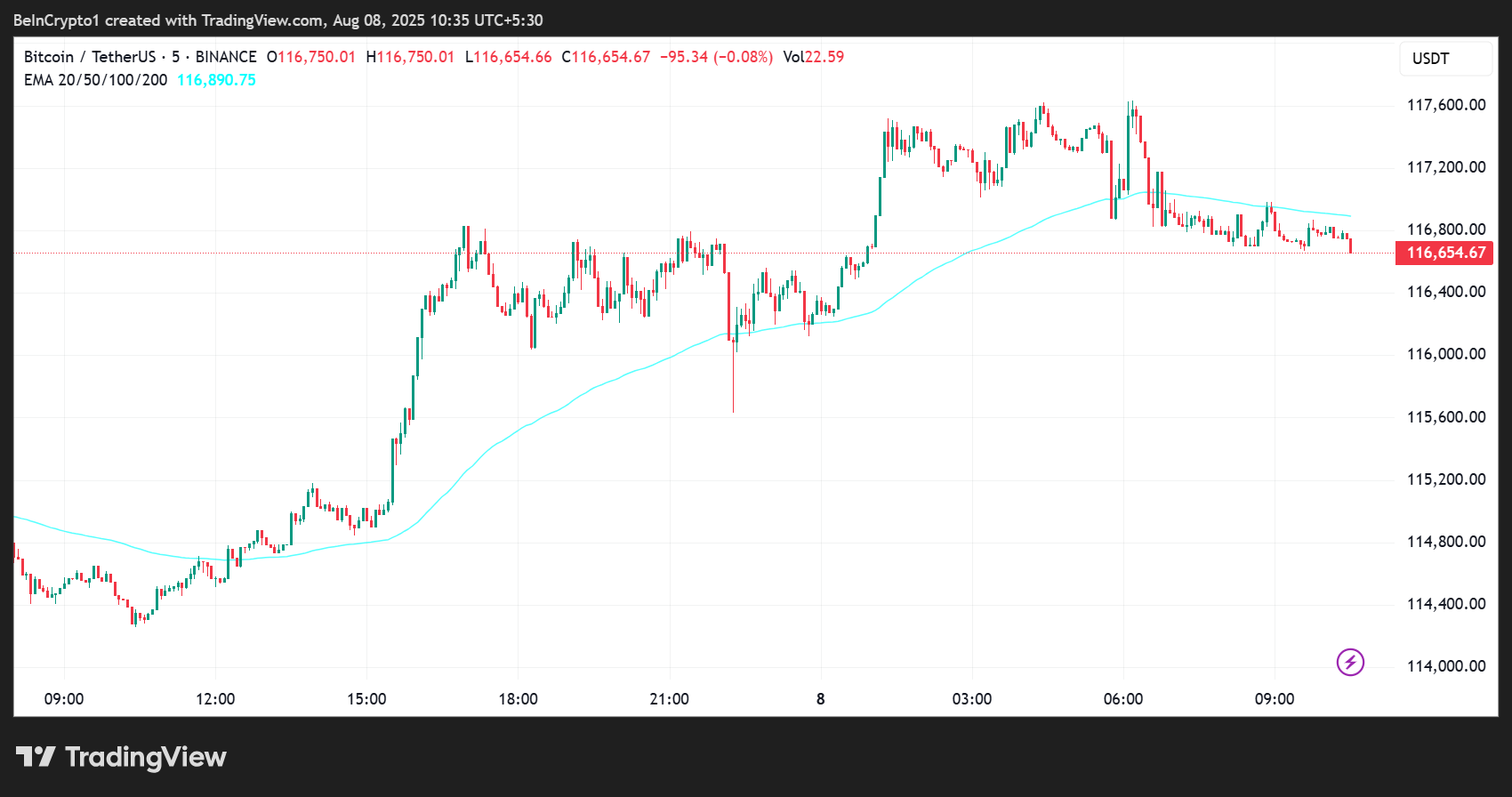

Further, the BTC 5-minute EMA100 is a key technical battleground, with the analysts highlighting it as both resistance and support in recent sessions. With the Bitcoin price now below this moving average, it typically indicates short-term bearish momentum.

This could trigger defensive action from Put sellers. With large open interest NEAR the $112,000 strike, traders may attempt to push prices higher to avoid losses. The move could increase volatility around today’s $5 billion options expiry.

Could expiry bring a volatility spike? That is the open question. With such a large volume of contracts coming off the board, there is always a risk of sudden repositioning, especially if BTC or ETH break technical thresholds.

However, with the bulk of traders positioned as volatility sellers, the consensus is still tilted toward muted action.

Still, once these positions are unwound, the post-expiry environment could open up fresh directional opportunities, especially if macro catalysts emerge or liquidity shifts.

Meanwhile, as traders play defense, harvesting what they can in a week of compressed volatility, it is imperative to note that things could change anytime.