Bitcoin’s Post-ATH Amnesia: Trapped in a Low-Liquidity Void—What’s Next?

Bitcoin's price action has entered uncharted territory—again. After smashing through its all-time high (ATH), the crypto king now drifts in a low-liquidity purgatory, leaving traders scratching their heads. No clear support, no clear resistance—just a market screaming for direction.

### The ATH Hangover

Remember the euphoria? Neither does Bitcoin. The post-peak amnesia is real, with price action stuck in what analysts call an 'air gap'—a zone so thinly traded that even a whale's sneeze could trigger volatility. Liquidity? More like a desert mirage.

### Wall Street's Cynical Take

Traditional finance wonks are predictably smug. 'See? Told you it was a casino,' they chirp—ignoring their own debt-laden balance sheets. Meanwhile, crypto OGs shrug. This isn’t their first rodeo.

### What Breaks the Stalemate?

Watch for catalysts: ETF flows, macro tremors, or a surprise regulatory nod (or crackdown). Until then, Bitcoin’s stuck in limbo—volatile, unpredictable, and utterly fascinating. Just how we like it.

Between the Peaks, Bitcoin’s Air Gap Signals a Market on Edge

Bitcoin’s post-all-time high correction has driven the BTC price below the $116,000 support level. On the one hand, short-term holders are rattled, while on the other, opportunistic buyers are unable, at least so far, to reclaim the cost basis of recent top buyers.

On July 31, Bitcoin broke below a critical support cluster between $116,000 and $123,000, entering a thin liquidity zone stretching to $110,000.

This “air gap” is a region where few coins have previously changed hands. Such zones typically require significant new demand or capitulation to establish a fresh base.

Glassnode’s data shows that around 120,000 BTC was acquired between July 31 and August 4, after prices rebounded from a local low of around $112,000. While this signals buy-the-dip interest, it has not been enough.

The Bitcoin price still hovers below the key resistance at $116,900, now the cost basis for short-term holders who bought near the local top.

“The rebound has thus far lacked sufficient strength to reclaim resistance. Without a quick rebound in demand, confidence amongst these new investors may start to weaken,” Glassnode noted.

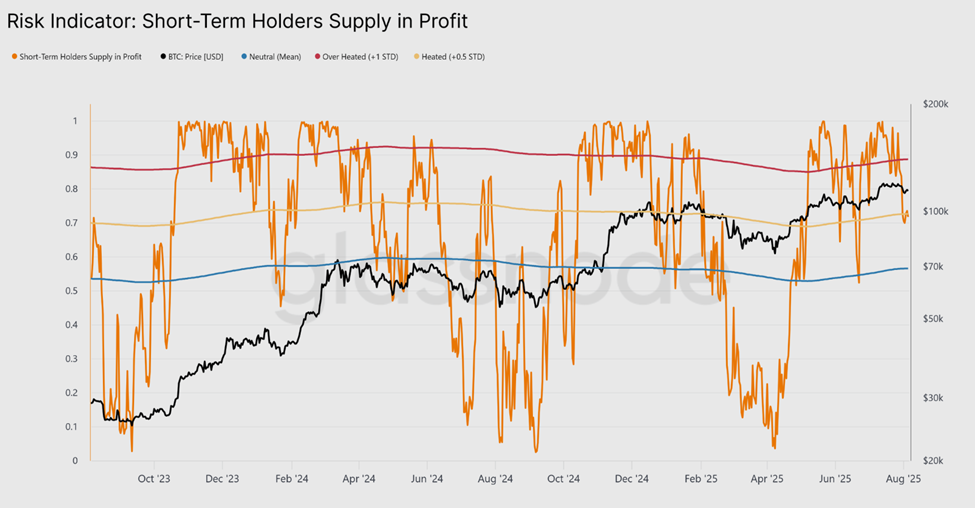

Short-term holder (STH) profitability, often used as a measure of confidence, is already feeling the pressure. According to Glassnode data, this metric has dropped from 100% to 70%, aligning with historical bull market midlines.

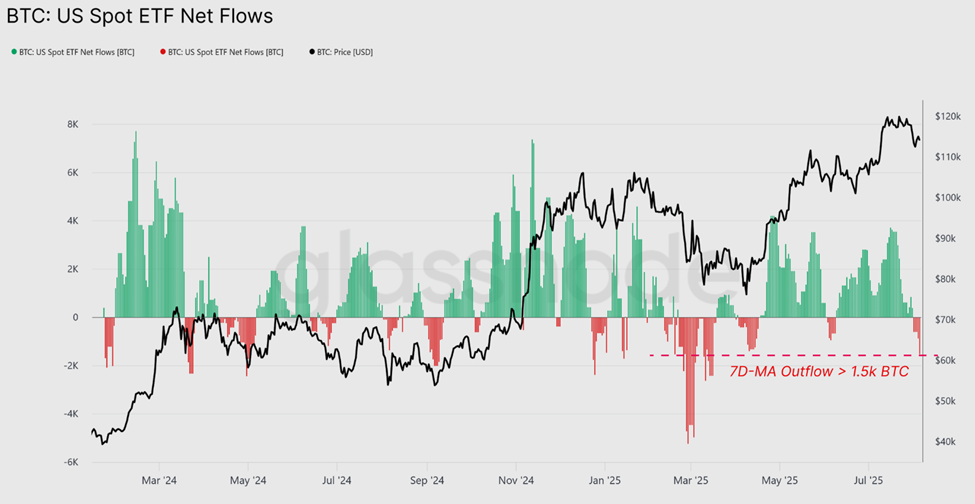

Though not yet alarming, any deeper correction could turn sentiment sharply. Meanwhile, ETF flows have not helped either. A 1,500 BTC outflow on August 5 marked the largest since April, adding to short-term bearish pressure.

BTC Needs Fresh Demand Amid Cooling Leverage and Flickering Accumulation

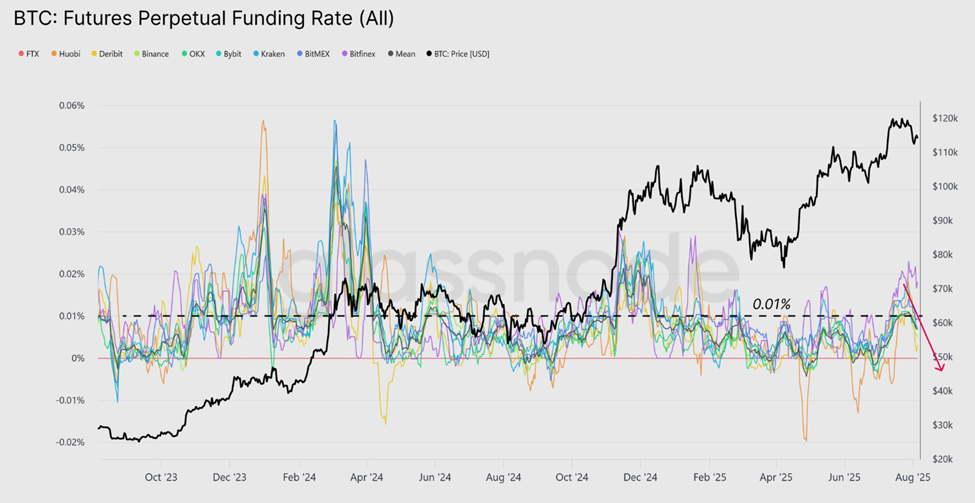

Meanwhile, funding rates across perpetual futures have cooled, slipping below the 0.1% range. This drop in premiums signals waning enthusiasm for Leveraged longs, reflecting the current market hesitation.

Despite the weakness, the broader macro structure remains intact. Bitcoin’s monthly closing in July se was the highest in its history.

Analysts at QCP Capital say the drawdown is more corrective than capitulatory, coming at a time when macro and structural tailwinds remain supportive.

Historical data suggests these shakeouts, especially those that flush excess leverage, often precede renewed accumulation phases.

Glassnode’s heatmap confirms accumulation behavior, with all wallet categories flashing green. However, recovery hinges on demand. A sustained move above $116,900 WOULD be a strong signal that buyers are regaining control.

Until then, BTC appears locked between two key levels, the floor at $110,000 and a ceiling at $116,000. ETF inflows, volatility compression, and options market behavior could offer early signs of recovery.

Bitcoin is in a post-ATH amnesia, caught between fading momentum and fragile confidence, waiting for its next move.