🚀 Altcoin Inflows Hit 8-Month Peak—Time to Cash Out or Double Down?

Altcoins are back in the spotlight—but is this a bull trap or the real deal?

### The Surge No One Saw Coming

Money’s flooding into altcoins at a pace not seen since December 2024. Retail traders are piling in, hedge funds are quietly repositioning, and your Uber driver just mentioned 'the next Solana.' Classic.

### The Elephant in the Room

Historically, spikes like this precede corrections. But with Bitcoin dominance slipping and ETH ETFs live, maybe this time’s different—or maybe Wall Street’s just better at pumping bags now.

### The Verdict

Watch BTC’s next move. If it stalls, alts could get slaughtered. If not? Buckle up for a September to remember. (Pro tip: That 'next Solana' is probably a dogcoin with a TikTok filter.)

Binance Sees Altcoin Surge: What Does It Mean?

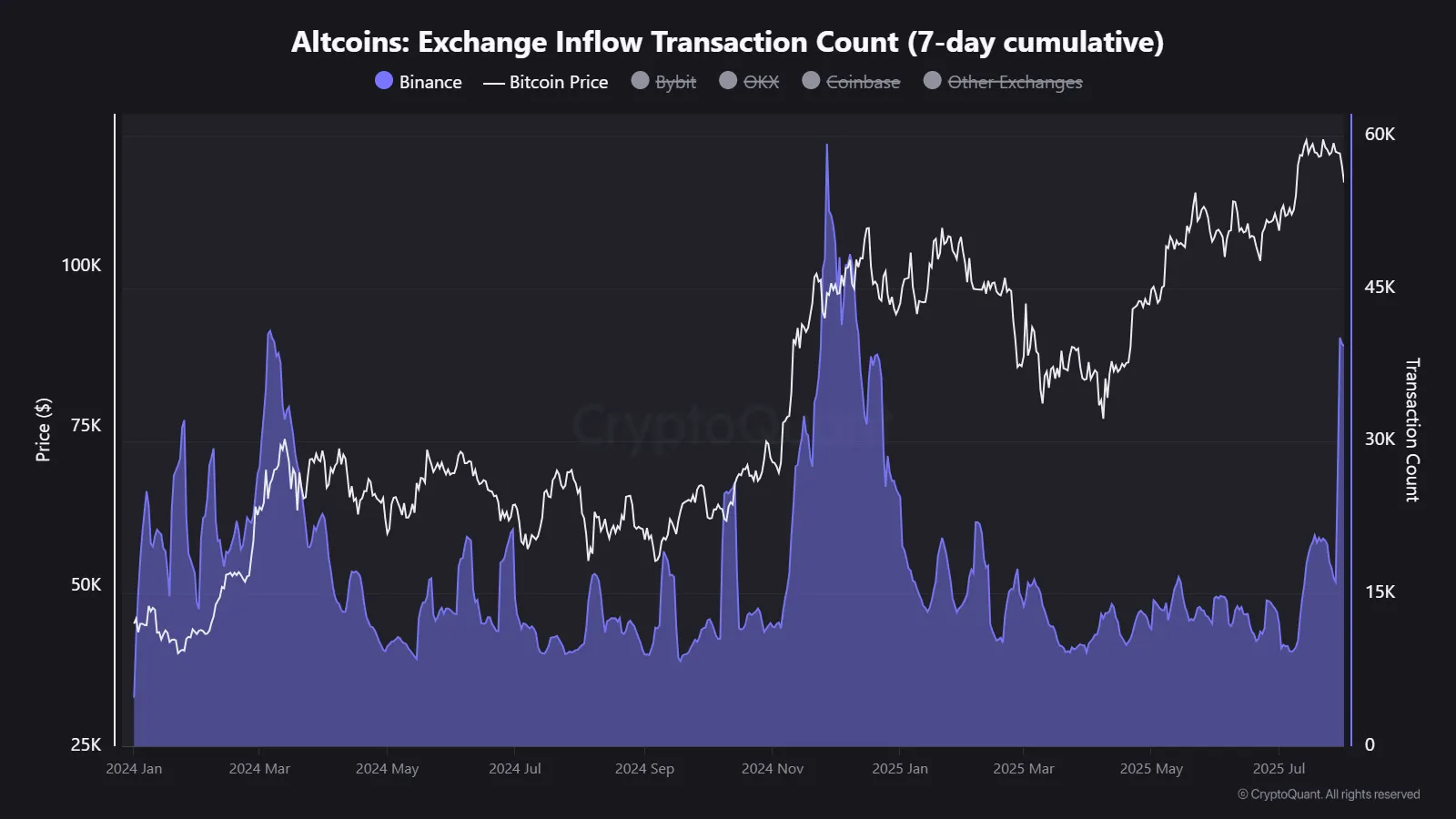

Maartunn, a community analyst for CryptoQuant, recently highlighted this shift in a post. He noted that altcoin deposits had been steady for the past few months, with little change in activity. This occurred during a period when Bitcoin’s price moved sideways.

However, he observed that deposits have been increasing recently, with the 7-day transaction count surging above 45,000. This represented the highest level seen since late 2024.

“This increase may point to more traders getting ready to act,” Maartunn said.

The analyst added that this increase in altcoin activity follows a recent surge in Bitcoin’s price, which has recently surpassed $112,000. According to him, this price movement has attracted more attention to altcoins. Still, it is worth noting that increased exchange inflows typically point to selling pressure rather than buying interest.

“When deposits like these rise, it usually means users are moving funds onto the exchange to trade, and not to hold. Whether this leads to more buying (in case of USDT/USDC deposit) or selling (Altcoins to stablecoins) depends on how the market moves next but activity is clearly rising,” he added.

That’s not all. CryptoQuant data showed a notable increase in the address count and cumulative transaction count for altcoin inflows. This suggested a higher level of trading activity occurring in the altcoin market.

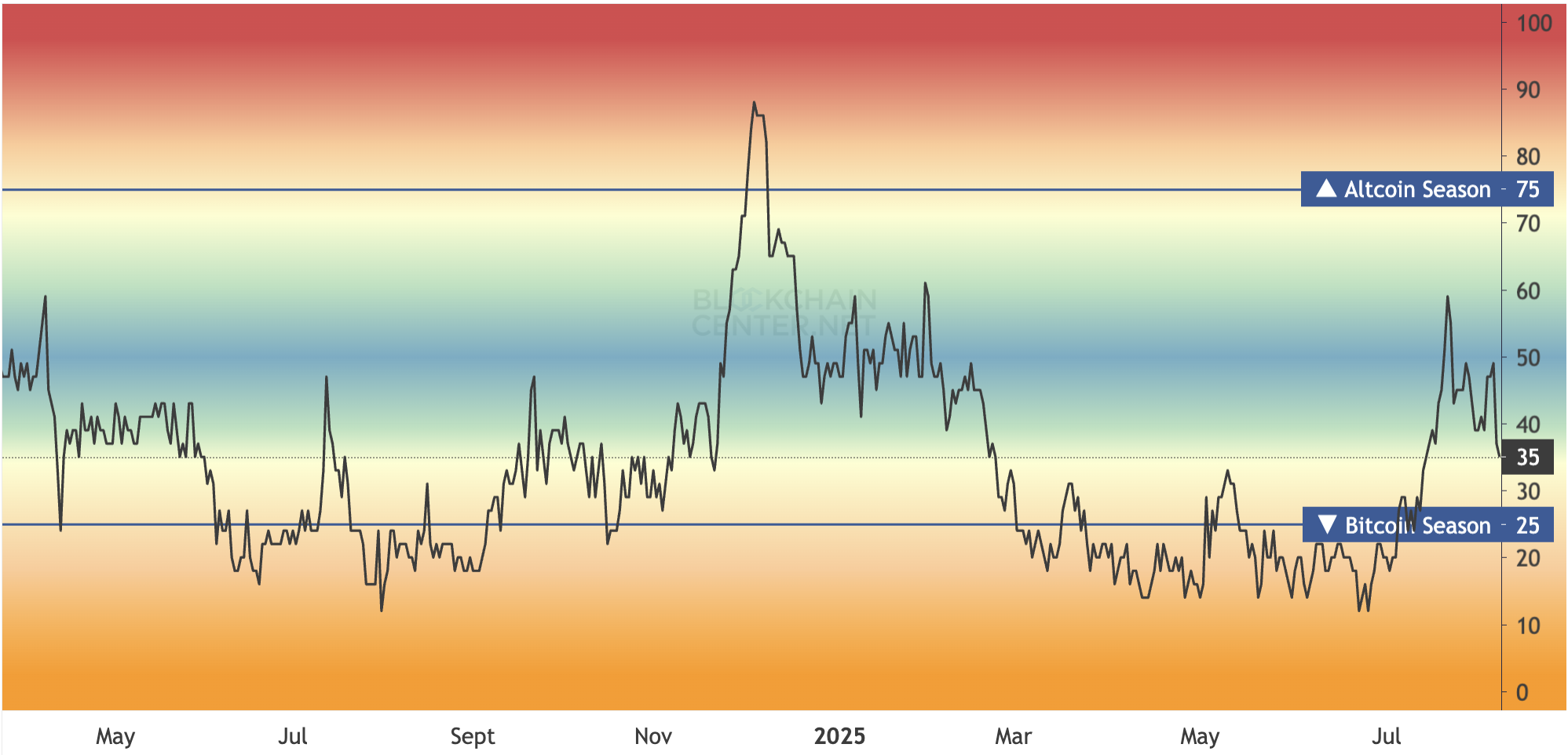

Despite the rising activity, the Altcoin Season Index shows no official return for the altseason as of now. The index, which tracks the performance of the top 50 cryptocurrencies (excluding stablecoins and wrapped tokens) against Bitcoin over a 90-day period, designates an altseason when 75% of these coins outperform Bitcoin.

Current metrics fall short of this threshold, indicating that bitcoin continues to dominate market sentiment.

Moreover, a trader and analyst argues that altseason is over due to an oversupply of altcoins, insufficient liquidity, and fragmented retail investor attention.

“Altseason is dead—and it’s not coming back. Altseason used to mean 50 projects running 20–100x. Now it’s 5 cult coins mooning while 5,000 others bleed in silence,” he remarked.

According to him, instead of a broad altcoin rally, it’s now about ‘narrative season,’ where only the most popular projects thrive.

Nonetheless, other analysts remain optimistic that an altcoin season is imminent.

“ALTCOIN SEASON IS CHARGING. We’re back in the same zone that birthed 5x–20x moves in 2019 & 2020. BTC dominance peaking. Alts coiling for a violent breakout. When this spring releases… it’s game on,” Merlijn The Trader wrote.

#AltSeason Index is looking like this, and people are calling for a top.

We're in a post-halving year, and yet it's #Bitcoin season.

This is your best opportunity to stack utility alts before they go parabolic. pic.twitter.com/bkHPAK0ZaK

Another analyst pointed out that although it’s not yet altcoin season, the conditions are starting to take shape. She suggested that September could be the key month for a breakout.

“Alt momentum: Building slowly across ETH, meme tokens, and DeFi. Accumulation phase likely underway, classic August pattern,” Lucie stated.

BeInCrypto also highlighted that the altcoin market mirrors the performance of US small-cap stocks, both seen as high-risk, high-reward investments. With rising small business optimism, there’s potential for continued growth, suggesting that the altcoins may have more room to expand.