Standard Chartered Bets Big on Ethereum Treasury Firms—Leaves Spot ETFs in the Dust

Wall Street's latest crypto play just flipped the script—and it's not what you'd expect.

Ethereum's institutional end-run

While retail traders obsess over spot ETF approvals, banking giant Standard Chartered just placed its chips on Ethereum treasury management firms. No slow-moving SEC paperwork here—just direct exposure to ETH's institutional infrastructure boom.

The unsexy (but lucrative) crypto play

Forget moonboy speculation. The real money's in servicing corporations hoarding ETH like digital gold. These treasury platforms offer something ETFs never can: actual utility beyond speculative trading. Though let's be real—the banks will probably package those too eventually.

One thing's clear: When traditional finance bypasses its own products to chase crypto-native solutions, the game's changed. Just don't expect them to admit it at the next shareholder meeting.

ETF or Stocks? Which One Provides Better Ethereum Exposure

In an exclusive statement to BeInCrypto, Kendrick explained that ethereum purchases by these treasury firms have equaled those of ETFs since early June. Both groups have acquiredover the last two months.

He emphasized that the NAV multiples—the market cap divided by the value of ETH held—have started to normalize. SharpLink Gaming (NASDAQ: SBET), one of the earliest and largest ETH-holding firms, now trades just above a NAV multiple of 1.0.

“I see no reason for the NAV multiple to go below 1.0. These firms offer regulatory arbitrage for investors. Given NAV multiples are currently just above one, I see the ETH treasury companies as a better asset to buy than the US spot ETH ETFs,” Kendrick said.

According to Kendrick, treasury firms provide direct exposure to ETH price upside, increasing ETH per share, and staking rewards.

He noted that SBET’s Q2 earnings report, due August 15, will offer further insight into this growing asset class.

Ethereum Treasury Companies Accelerate

Since emerging in stealth earlier this year, Ethereum treasury companies have quietly accumulated over 2 million ETH, with Standard Chartered projecting another 10 million ETH could follow.

In the past month alone, these firms added 545,000 ETH—worth around $1.6 billion. SharpLink Gaming reportedly bought 50,000 ETH during that period, bringing its total to over 255,000 ETH.

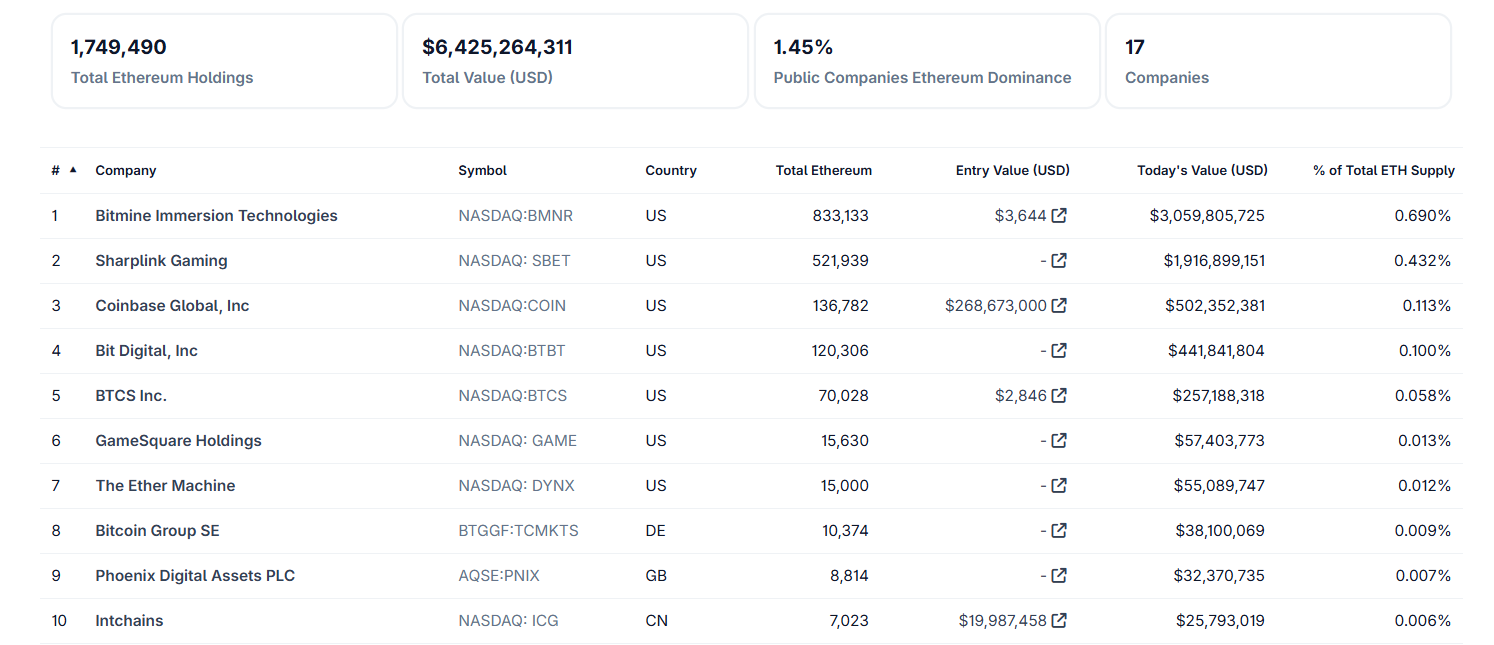

Kendrick’s remarks come amid a broader institutional trend. As of August, abouthold, including BitMine Immersion Technologies, Coinbase, and Bit Digital.

Combined, public firms now own 0.83% of the total ETH supply, according to CoinGecko.

Spot Ethereum ETFs See Inflows—and Outflows

The comments also follow turbulent weeks for Ethereum spot ETFs. After $5.4 billion in inflows during July, US ETFs saw major reversals.

On August 1, ETFs recorded $152 million in net outflows, followed by $465 million outflows on August 4—the largest ever in a single day. BlackRock’s ETHA accounted for $375 million of that.

The market partially recovered on August 5, with ETFs attracting $73 million in net inflows. BlackRock again led the charge, while Grayscale’s funds saw modest redemptions.

Despite volatility, structural improvements continue.

In late July, the SEC approved in-kind creation and redemption mechanisms for crypto ETFs, allowing them to operate more like traditional commodity ETFs.

Standard Chartered’s endorsement highlights a shifting dynamic in institutional Ethereum investment. With NAV multiples stabilizing and staking benefits accruing, ETH treasury firms are positioning themselves as high-efficiency alternatives to ETFs.

Investors will watchclosely. As Kendrick notes, it could further validate Ethereum treasury firms as a viable institutional-grade asset class.