Ethereum’s August Stall: 2 Key Factors Putting the Brakes on ETH’s Rally

Ethereum's momentum hits a speed bump—just as traders were ready to pile in. Here's why ETH's price action is stuck in neutral this month.

Reason 1: Macro Headwinds Bite

Global liquidity crunch? Check. Risk-off sentiment? Double-check. Crypto isn't immune to old-school finance woes—even if maximalists pretend otherwise.

Reason 2: Layer-2 Drama Intensifies

Scaling solutions are eating ETH's lunch. Arbitrum and Optimism now handle more transactions than mainnet—a brutal reality for gas fee apologists.

Bottom line: Ethereum's fundamentals remain strong, but August looks like a waiting game. Meanwhile, Wall Street still can't tell the difference between a smart contract and a Starbucks loyalty program.

Ethereum’s Big Players Step Back

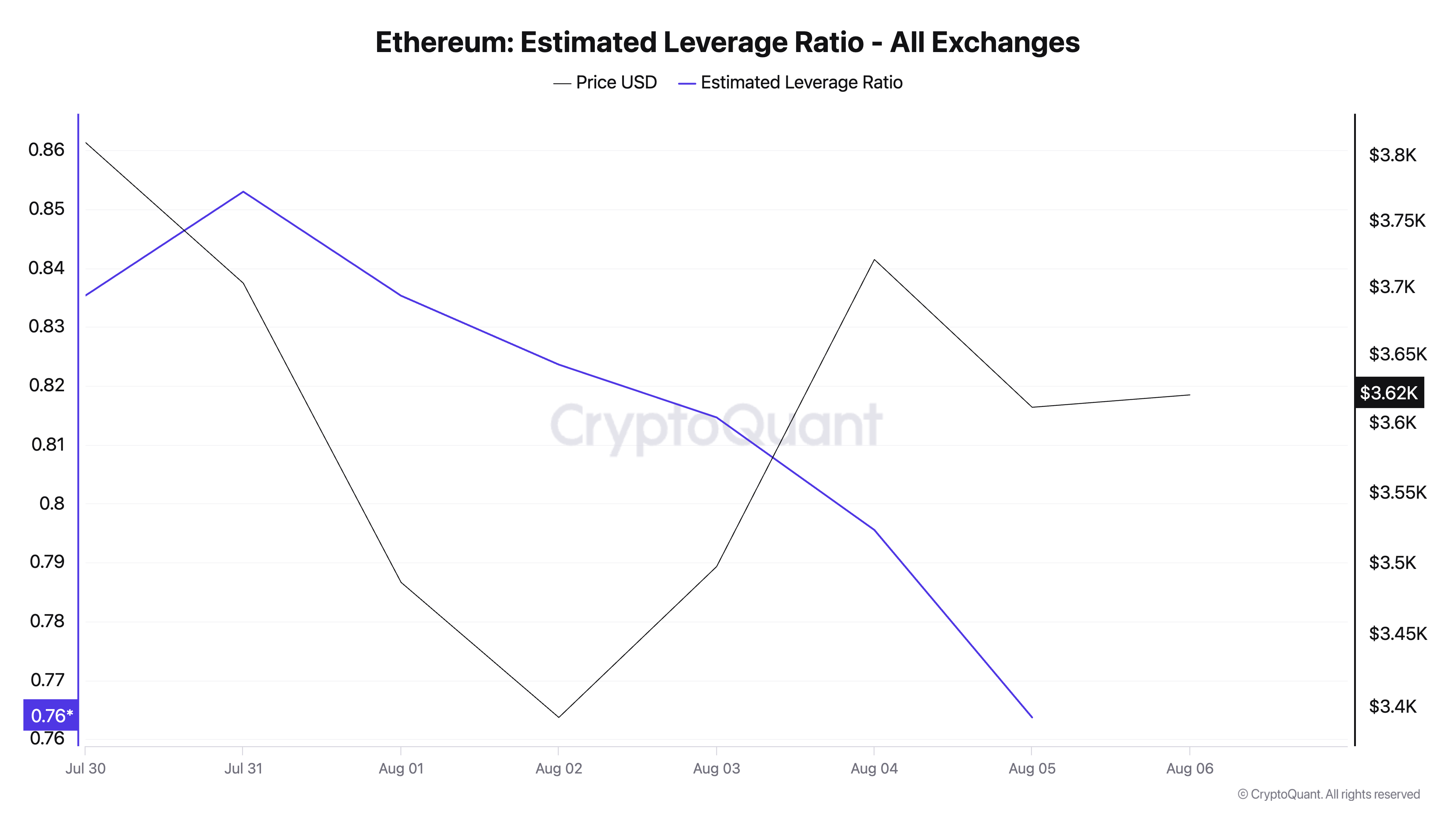

According to CryptoQuant’s data, ETH’s falling estimated leverage ratio (ELR) across all cryptocurrency exchanges reflects waning investor confidence and a declining appetite for risk among its futures traders. Per the data provider, ETH’s ELR now sits at a weekly low of 0.76.

: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

The ELR metric measures the average amount of leverage traders use to execute trades on an asset on a cryptocurrency exchange. It is calculated by dividing the asset’s open interest by the exchange’s reserve for that currency.

ETH’s declining ELR signals a market environment where traders avoid high-leverage bets. Its investors are growing cautious about the coin’s short-term prospects and are not taking high-leverage positions that could amplify potential losses.

If this pullback in speculative activity continues, it will reduce the likelihood of a near-term breakout and increase the chances of ETH remaining range-bound.

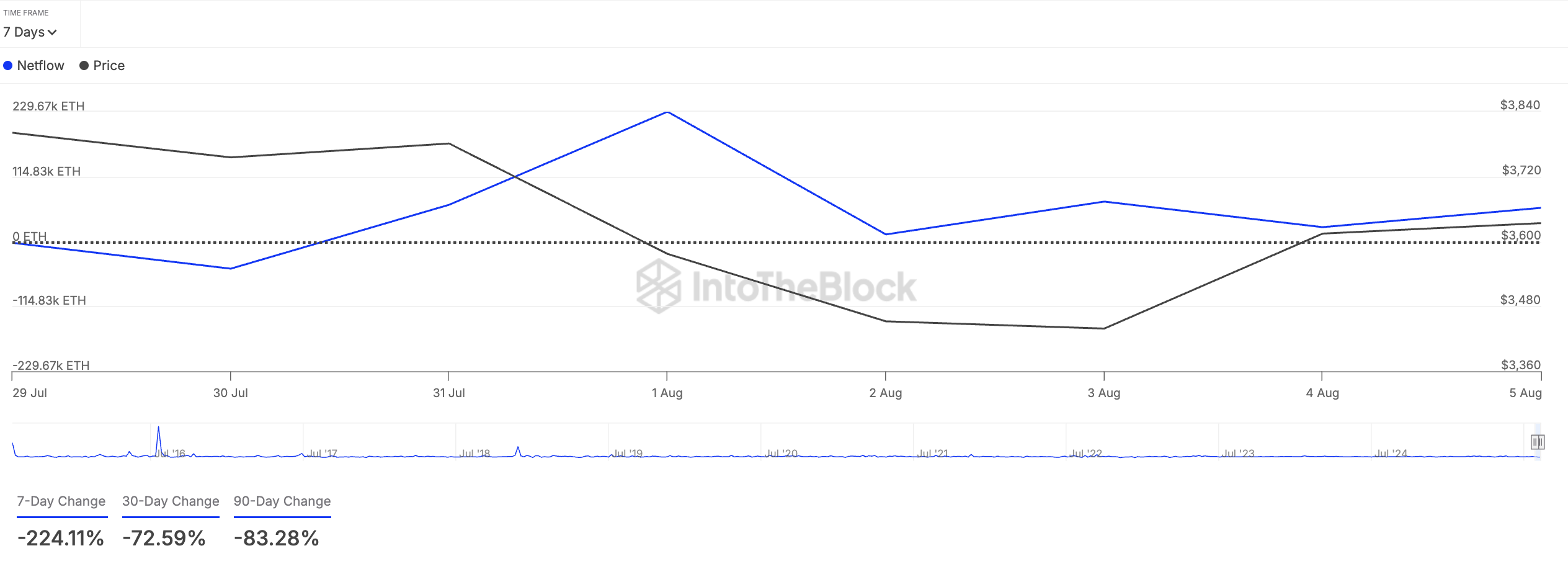

Furthermore, ETH whales have also reduced their accumulation over the past week, possibly to lock in profit. According to IntoTheBlock’s data, the coin’s large holders’ netflow is down 224% in the last seven days, showing the retreat from ETH’s key holders.

Large holders are whale addresses controlling over 0.1% of an asset’s circulating supply. Their netflow tracks the difference between the coins they buy and the amount they sell over a specific period.

When an asset’s large holders’ netflow increases, whales are buying more of its coins/tokens on exchanges, potentially in anticipation of a price rally.

On the other hand, as with ETH, when it declines, it signals reduced activity and profit-taking among these key investors.

ETH Bulls and Bears Face Off: Will $3,524 Hold or Break?

The metrics above highlight waning confidence in ETH’s near-term price gains and a reluctance among its key holders to commit significant capital to the market right now. If this persists, bearish pressure on the coin will increase, potentially triggering a breach of support at $3,524.

If this happens, the coin could extend its dip to $3,067.However, if the bulls regain dominance, they could drive a break above the resistance at $3,859. If successful, ETH’s price could climb above $4,000.