Stellar (XLM) Chart Flashes Red Alert – Is a Price Collapse Imminent?

Stellar's XLM is painting a worrying picture on the charts—technical indicators scream caution as the asset teeters on the edge of a breakdown.

Bearish signals intensify. The XLM chart shows a textbook bearish pattern—descending triangle, weakening volume, and a death cross lurking. If support cracks, traders could see a 20% nosedive toward yearly lows.

Market psychology turns sour. Retail investors are panic-selling while whales accumulate—classic 'weak hands vs. smart money' theater. Meanwhile, Bitcoin's sideways action isn’t helping altcoins like XLM find momentum.

Make or break moment. A close below $0.10 would confirm the bearish thesis, potentially triggering stop-loss cascades. Bulls need a miracle—or at least a tweet from Jed McCaleb.

Bonus jab: Another day, another altcoin begging for attention while Wall Street laughs into their coffee. At least the volatility keeps things interesting—right until your portfolio gets rekt.

2-Hour Chart Flashes a Bearish Signal; And Netflows Confirm It

To understand if this weakness is just a quick dip or the start of a larger correction, it’s worth examining short-term timeframes. On the 2-hour chart, the 20-period Exponential Moving Average (EMA) or the red line has crossed under the 50-period EMA (orange line), a setup often called a “death crossover.” This usually signals growing momentum from short-term sellers.

: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

An EMA crossover happens when one moving average line crosses another on a chart. A short-term EMA (like a 20-period) crossing below a longer-term EMA (like a 50-period) means short-term selling may be picking up.

Backing this up is the shift in net exchange flows. For the past two weeks, netflows were slightly negative, meaning more tokens were leaving exchanges than entering. But this week, the flows finally flipped positive (even though it’s just a small speck of green). That’s a red flag because it often means holders are preparing to sell.

Bearish Momentum Is Building, And The Market Bias Backs It

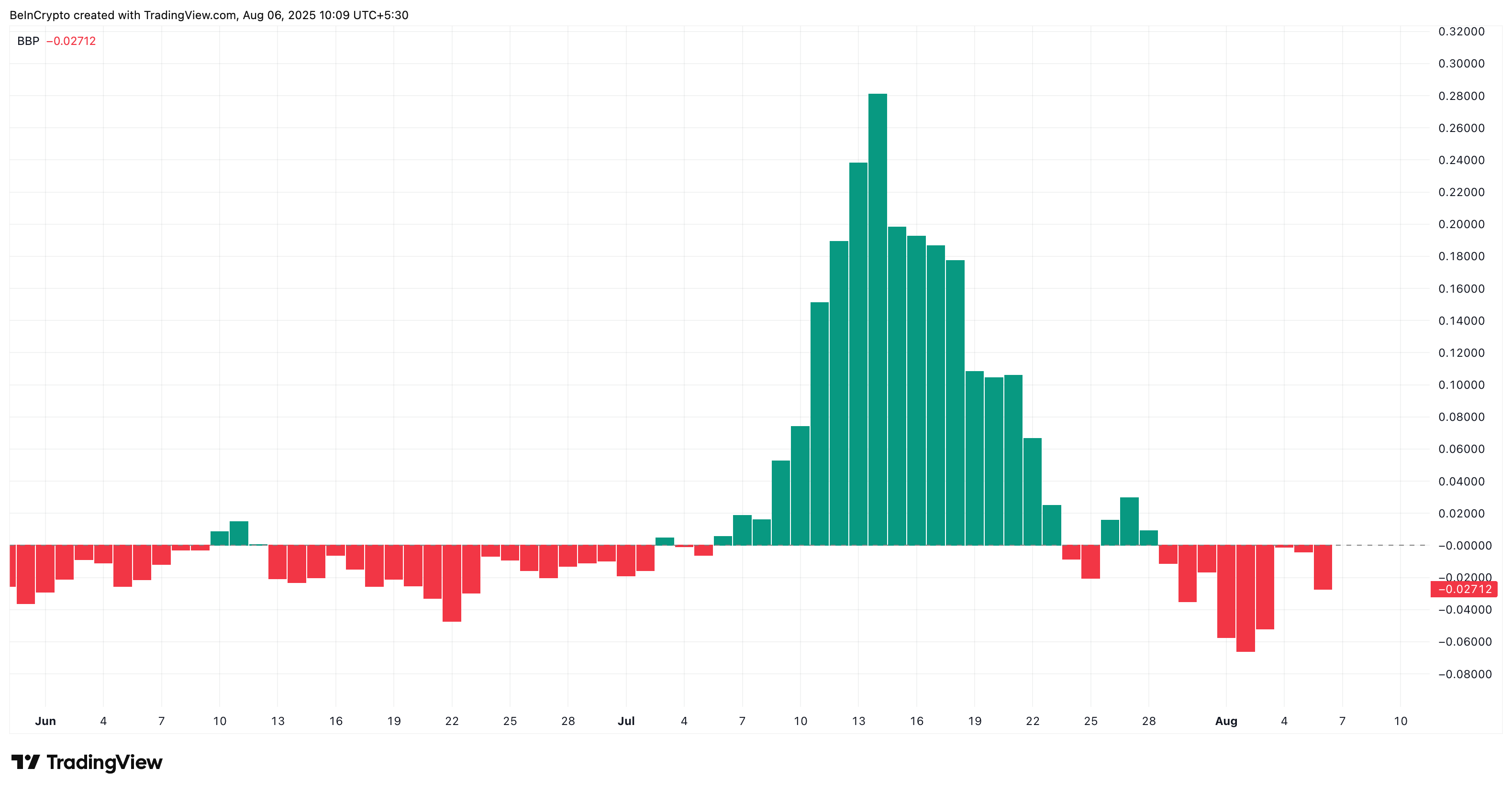

Even beyond the chart signals, market sentiment shows that bearish momentum is creeping back in. The Bull-Bear Power (BBP) index, which compares recent highs and lows to spot buying power, flipped sharply back toward the bears over the last two sessions. That suggests buyers are struggling to keep up, and sellers are pushing the stellar price lower.

BBP measures the strength of buyers (bulls) vs sellers (bears) in recent price movements. When it’s negative, it shows bears are in control.

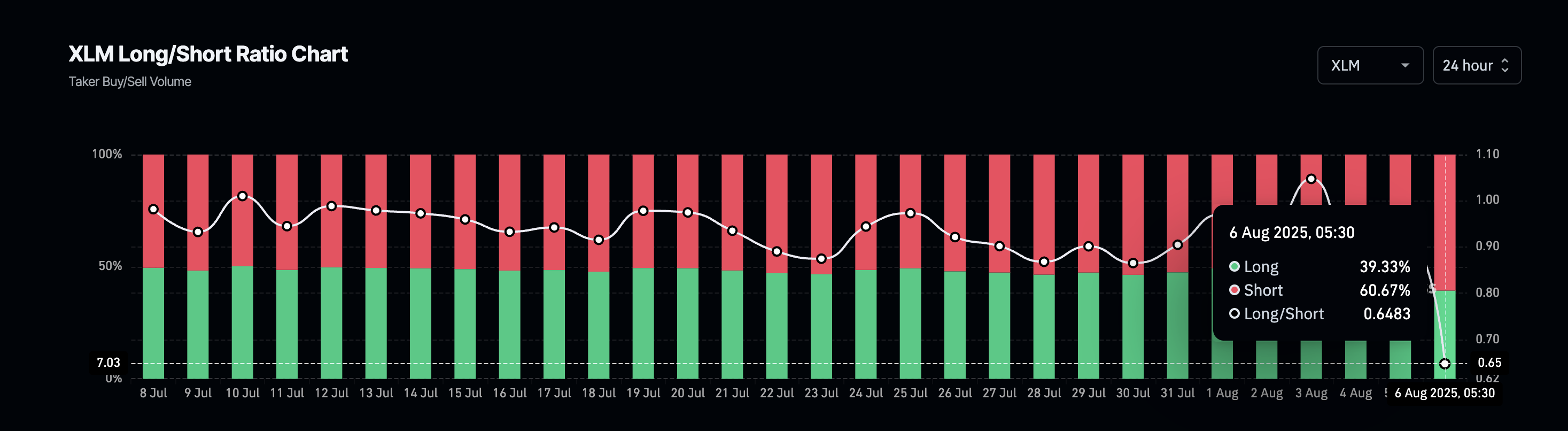

The shift is also clear in the long/short account ratio. According to Coinglass, 60.67% of traders are currently holding short positions on XLM, a sign that most expect the Stellar (XLM) price to fall further. While a heavily shorted market can sometimes lead to a short squeeze, in this case, it aligns with the negative Stellar price action and trend indicators.

The Long-Short ratio shows how many traders are betting on the price going up (long) versus down (short). A high short ratio means the majority expect an XLM price drop.

Support Levels to Watch as Stellar (XLM) Price Teeters on a Breakdown

The XLM price is currently trading around $0.38, right above a short-term support zone at $0.37. A break below $0.37 followed by $0.33 would likely lead to a deeper sell-off. If $0.33 level doesn’t hold, the Stellar price could revisit $0.28. A dip below that would confirm a full breakdown in momentum.

If bulls can hold $0.37 and push back the XLM price above $0.40 and $0.45, there’s still hope for a recovery. A move beyond $0.40 WOULD invalidate the short-term bearish hypothesis.

The real test comes at $0.52. Only a clean break above this resistance would fully confirm a new bullish trend. Until then, the Stellar (XLM) structure remains fragile.