August Crypto Fire Sale? Why Dumping Digital Assets Now Could Torch Your Portfolio

Crypto's summer slump has weak hands sweating—but capitulating now might be the ultimate 'buy high, sell low' maneuver.

The seasonal bleed isn't a death sentence

Markets move in cycles, and August's traditional liquidity crunch doesn't negicate crypto's long-term trajectory. Remember: Bitcoin survived 14,000% drops before.

Institutions aren't budging

While retail panics, BlackRock's BTC holdings hit new ATHs last week. Smart money treats dips like Black Friday sales.

Tax-loss harvesting comes later

Selling now wastes potential December write-offs—unless you enjoy giving the IRS free alpha.

Bottom line: Only paper-handed tourists exit during August's thin volume. The real play? Stack sats while Wall Street's on vacation—just don't expect your traditional finance advisor to understand (they're still waiting for that 'blockchain, not Bitcoin' thesis to pan out).

Why Selling in August Might Be a Big Mistake

Compared to the $4 trillion market cap peak in July, the market has corrected by 6.7%, now at $3.67 trillion.

Although this isn’t a major correction, new developments in August have sparked concern. These include awakened whales, a slowdown in ETF inflows, renewed tariff pressure, and a rebound in the DXY (US Dollar Index). Together, these elements raise fears of a stronger August correction.

However, for Bitcoin, Swissblock’s latest report sees the recent price drop as a positive phase. It views the pullback as a necessary cooldown after the previous price surge.

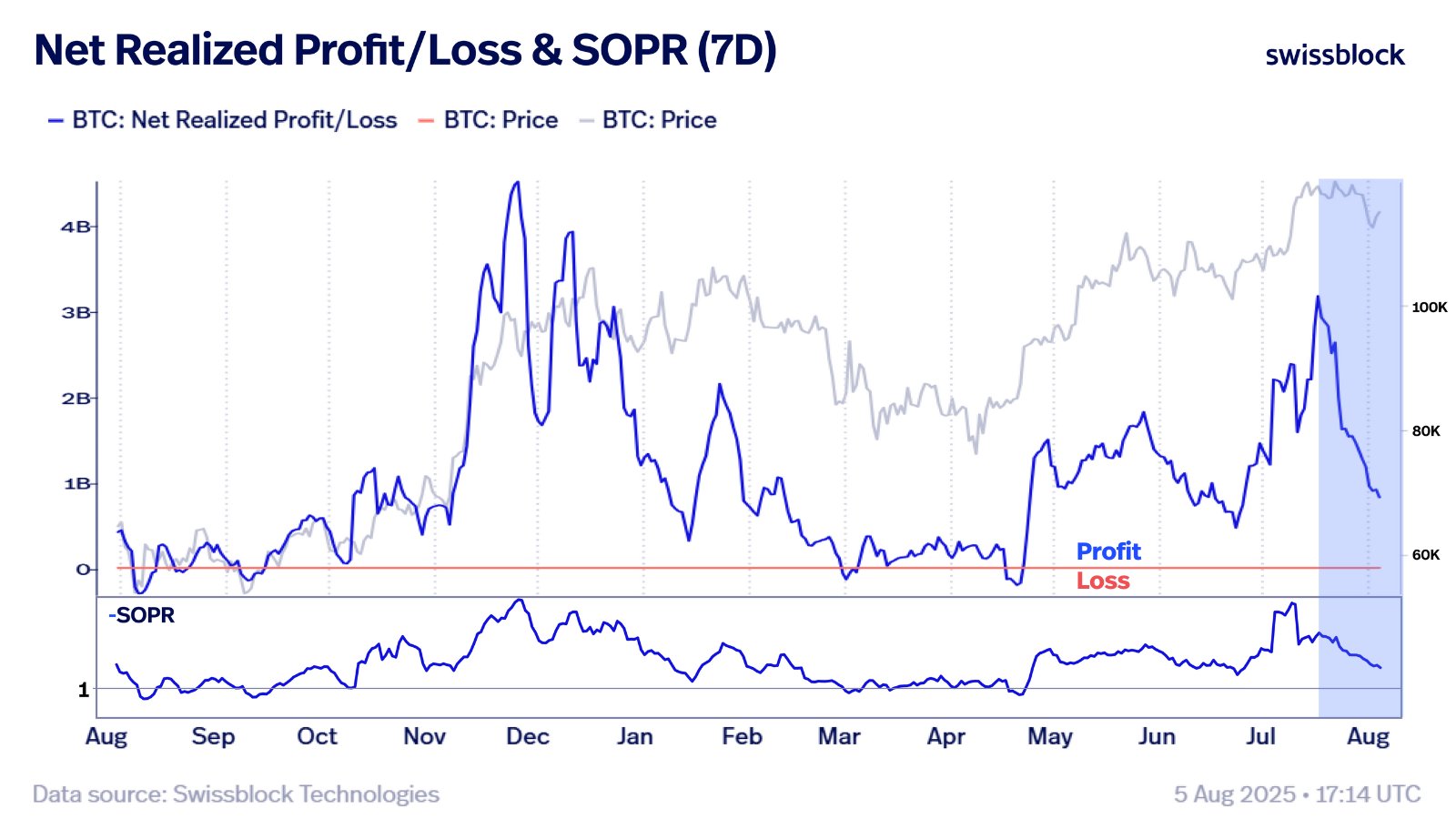

The report focuses on two key indicators: Net Realized Profit/Loss (PnL) and 7-Day SOPR (Spent Output Profit Ratio). Both metrics have been falling, but not alarmingly.

“This correction is a healthy cooldown, not structural weakness. Net Realized PnL is dropping sharply, selling intensity is low. SOPR is drifting lower, not collapsing. Investors are taking profits, not exiting in fear—they want to sell higher. This is a constructive reset,” Swissblock noted.

Although the report doesn’t predict a specific price level for a Bitcoin rebound, other analysts believe BTC might correct to around $95,000 before recovering.

For altcoins, the altcoin market capitalization (TOTAL3) has dropped over 10%, falling from $1.1 trillion in July to $963 billion in August.

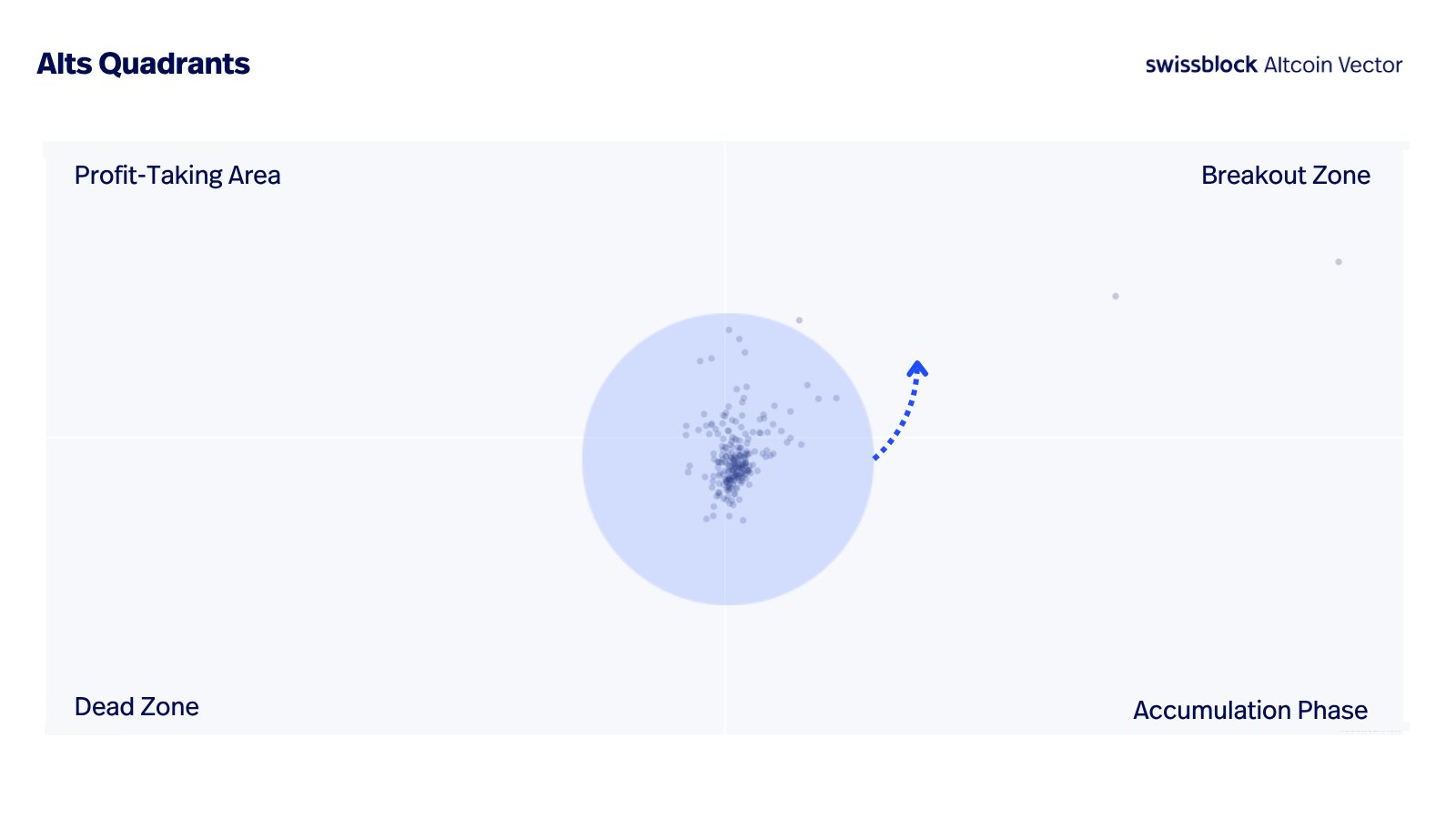

Yet a report from Altcoin Vector maintains that altcoins remain highly promising.

The report uses a quadrant chart that segments the altcoin cycle into four phases. Since July, the chart has moved counterclockwise and is now heading toward the “Breakout Zone.”

“Smart capital rotates here, before the crowd sees it. Momentum is turning, structure is stabilizing. This isn’t a breakout: now pre-positioning begins,” according to Altcoin Vector.

Crypto analyst VirtualBacon also explained why selling in August could be a costly mistake.

![]() Why Selling in August is a Big Mistake

Why Selling in August is a Big Mistake![]()

Markets look shaky. FUD is everywhere. But if you sell now, you could miss the best setup of the year.

Here’s why I’m staying patient and what I’m doing instead![]()

![]()

He acknowledged that while some events may seem concerning, there’s no need to panic because:

- The tariff announcement on August 7 might be nothing more than short-term noise, similar to past events.

- Weak labor data may increase the Fed’s chances of cutting interest rates.

- The US Treasury may withdraw $500 billion, causing short-term volatility, but not a full-blown liquidity crisis.

Moreover, market sentiment has cooled down. In July, it was firmly in the “Greed” territory, but now it has retreated to a “Neutral” zone. Since February, the market has not entered a state of “extreme greed,” which is generally regarded as the ideal time for making selling decisions.