Fed Policy Sparks US Stagflation Panic: Bitcoin & Stocks Brace for Impact

Markets shudder as the ghost of stagflation rears its head—and the Fed's playbook looks dangerously outdated.

The domino effect: Bitcoin's correlation with traditional markets tightens just as rate-cut hopes evaporate. Liquidity's draining, and Wall Street's algo-driven panic looks increasingly like 2008 deja vu.

Crypto's paradox: Digital gold narrative clashes with risk-asset reality. Miners capitulate while ETF flows flatline—proving once again that institutional 'adoption' vanishes when T-bills yield 6%.

The kicker? Washington's still debating inflation metrics while Main Street burns. Some things never change.

Economic Data Shows Warning of US Stagflation

The Institute for Supply Management reported disappointing services data on Tuesday. The US Services PMI for July came in at 50.1, below expectations of 51.5. While still above the 50 expansion mark, meaning that the services sector is expanding, it dropped 0.7 points from June’s 50.8.

In short, the US service economy is still growing, but much slower than expected, and it’s dangerously close to shrinking.

The employment index fell to 46.4, down 0.8 points from the previous month. When this goes below 50, it means that businesses are cutting jobs, and it marks the lowest level since March. Conversely, the price index jumped 2.4 points to 69.9—the highest since October 2022. When this goes above 50, it means that prices are rising fast.

This combination creates stagflation, where fewer jobs exist while prices rise simultaneously. For regular people, it’s harder to find work while everything costs more. Policymakers face an impossible choice between fighting unemployment and controlling inflation.

For central banks, combating inflation requires rate hikes, while stimulating growth demands rate cuts. Both problems cannot be solved simultaneously. In stagflation, central banks may struggle to lower rates decisively.

More Signs of Stagflation Will Crush the Crypto Market

This backdrop weighed heavily on the US financial markets on Tuesday. The Dow Jones fell 61.90 points (0.14%) to 44,111.74. The S&P 500 dropped 30.75 points (0.49%) to 6,299.19. The Nasdaq declined 137.03 points (0.65%) to close at 20,916.55. Bitcoin also fell by approximately 1%.

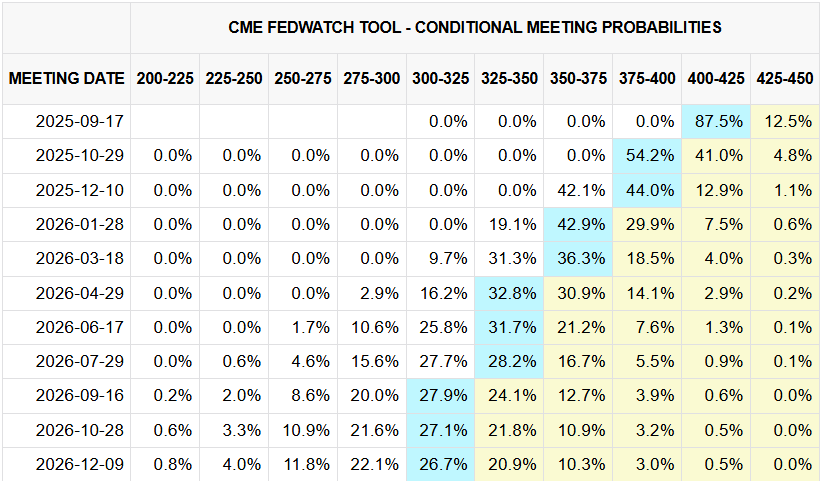

After the July jobs report, expectations changed for Federal Reserve policy. Markets now expect two rate cuts this year instead of three. According to CME Group’s FedWatch tool, markets expect 25-basis-point cuts in September and October.

The probability gap between a rate hold and cut in December is just 2%. However, if stagflation signals strengthen, this gap will likely widen.

This issue could significantly impact crypto prices. Since Congress passed the GENIUS Act on July 18, bitcoin has shown increasing sensitivity to economic data. Most altcoins have been tracking Bitcoin’s movement accordingly.