$42M in Shorts at Risk—Will HBAR Trigger a Massive Squeeze?

Hedera's HBAR faces a make-or-break moment as $42 million in short positions hang in the balance. Traders are bracing for volatility—will the underdog crypto defy expectations?

The setup: A perfect storm for a short squeeze. With bears heavily positioned against HBAR, even a modest rally could force cascading liquidations. Market makers are watching order books like hawks.

Why this matters: Crypto's perpetual futures market turns every altcoin into a high-stakes poker game. Meanwhile, traditional finance still thinks 'blockchain' is a spreadsheet upgrade.

The bottom line: In the casino of crypto derivatives, sometimes the house loses. Whether HBAR pumps or dumps, someone's getting rekt—the only question is which side of the trade you're on.

HBAR Traders Beware

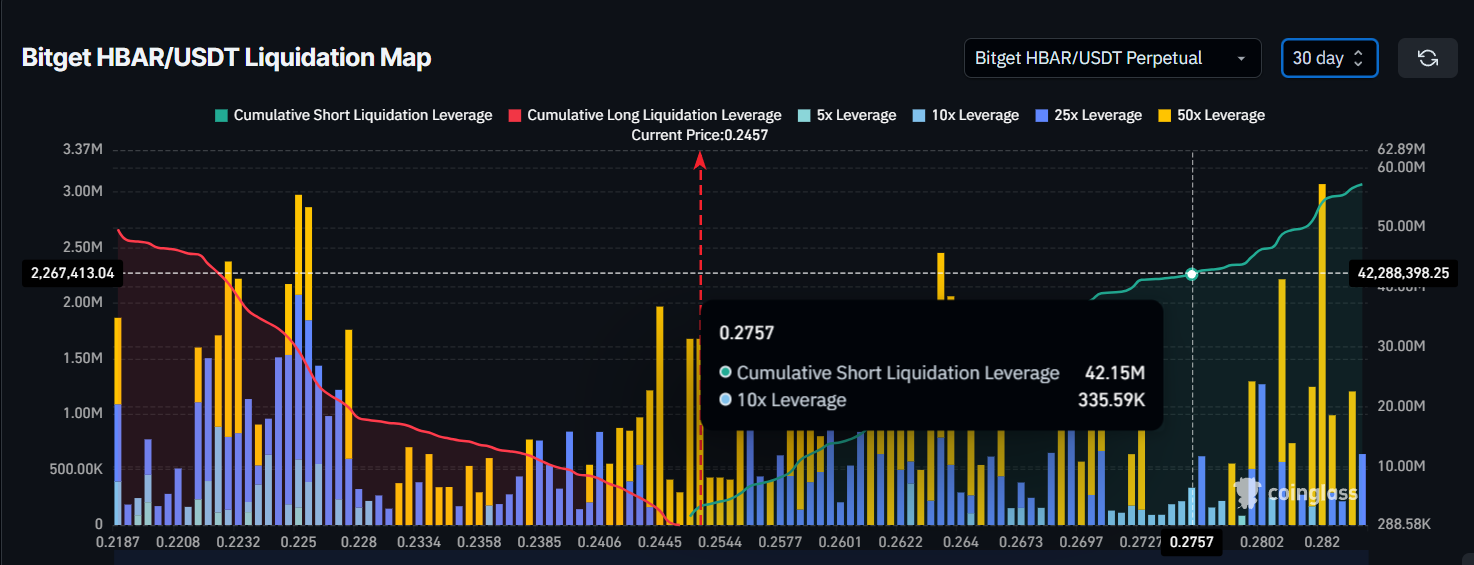

Recent data from the liquidation map reveals that about $42 million worth of short contracts could be liquidated if HBAR manages to recover and reach the $0.276 resistance level. This price point serves as a significant barrier to HBAR’s recovery.

The large volume of shorts at this level shows that many traders are not optimistic about a potential recovery. If the price crosses this barrier, it could spark a squeeze, benefiting those with long positions.

: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

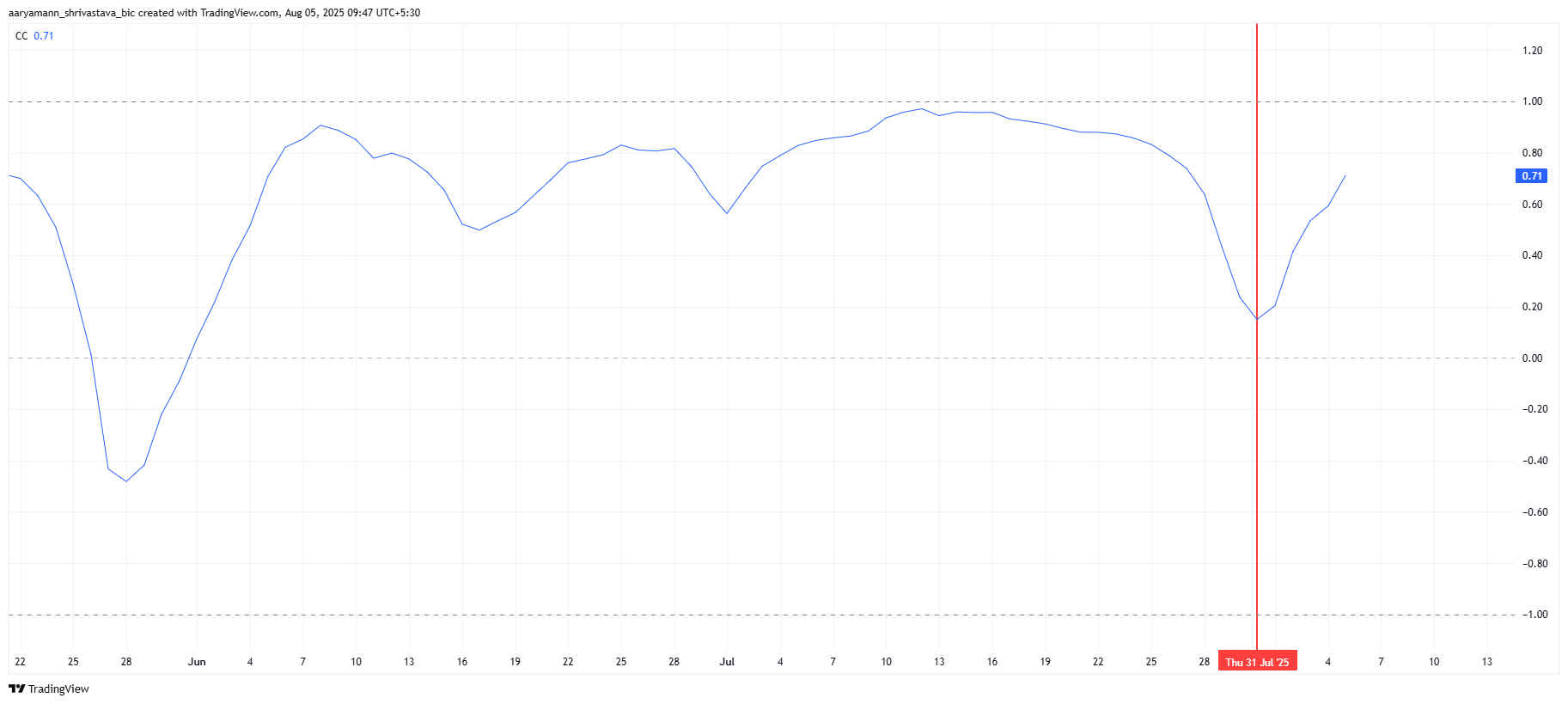

HBAR’s correlation with Bitcoin has surged significantly, from 0.19 to 0.71 in just five days. This sharp increase suggests that HBAR is now more likely to follow Bitcoin’s price movements.

If bitcoin successfully breaks the $115,000 resistance and holds it as support, HBAR may see a continued rise as well. This could provide the necessary momentum for HBAR to breach its resistance levels and recover some of its recent losses.

HBAR Price Is Looking For a Bounce

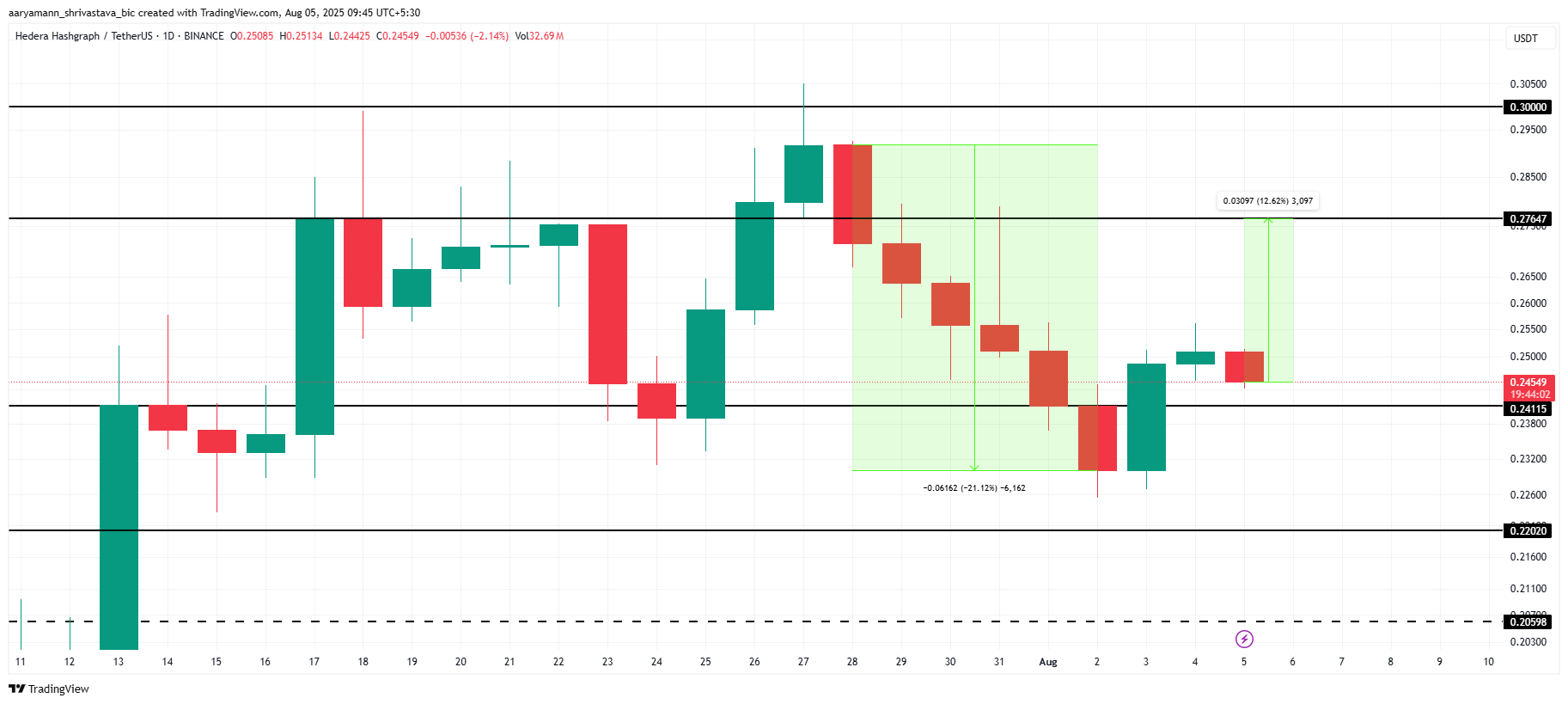

HBAR is currently trading at $0.245, sitting 12.6% below its next major resistance level of $0.276. Breaking this resistance is essential for HBAR to recover the 21% loss it incurred at the end of July.

If HBAR can secure the $0.241 support level, it WOULD be poised to push towards $0.276. This would open the door for further price appreciation and potentially trigger the liquidation of short positions.

However, if HBAR fails to maintain support at $0.241 and market sentiment remains weak, the price could continue its downward trend. A fall below $0.241 would suggest a further decline, with the next support at $0.220, invalidating the bullish outlook and shifting the focus to potential further losses.