Litecoin Hits 4-Month High—Why This Might Be the Launchpad for a Parabolic Rally

Litecoin just punched through its highest price since April 2025—and traders aren’t blinking. Here’s why the ‘silver to Bitcoin’s gold’ could be gearing up for a monster move.

The breakout playbook

LTC’s 120-day resistance crack mirrors historic pre-bull patterns. No guarantees, but when this coin wakes up, it tends to move fast.

Miners vs. whales: The liquidity tug-of-war

On-chain data shows accumulation wallets swallowing supply while mining rewards dwindle. Classic squeeze setup—if you believe the hype (and ignore the bagholders from ‘23).

Macro tailwinds or just crypto being crypto?

With Fed rate cuts looming and institutional FOMO creeping back, Litecoin’s cheap transactions and battle-tested network might finally get their Wall Street close-up. Or it’ll dump 40% next week—welcome to digital asset ‘investing.’

Litecoin Price Hits 4-Month High Amid Rising Adoption

Data from BeInCrypto Markets revealed that Litecoin’s price has appreciated 40.5% over the past month. In fact, earlier today, LTC went as high as $125, a level last seen in early March.

At the time of writing, the altcoin was trading at $121.8, up 9.43% over the past day. In addition, the trading volume also surged 210% to reach $1.7 billion, signalling heightened market activity.

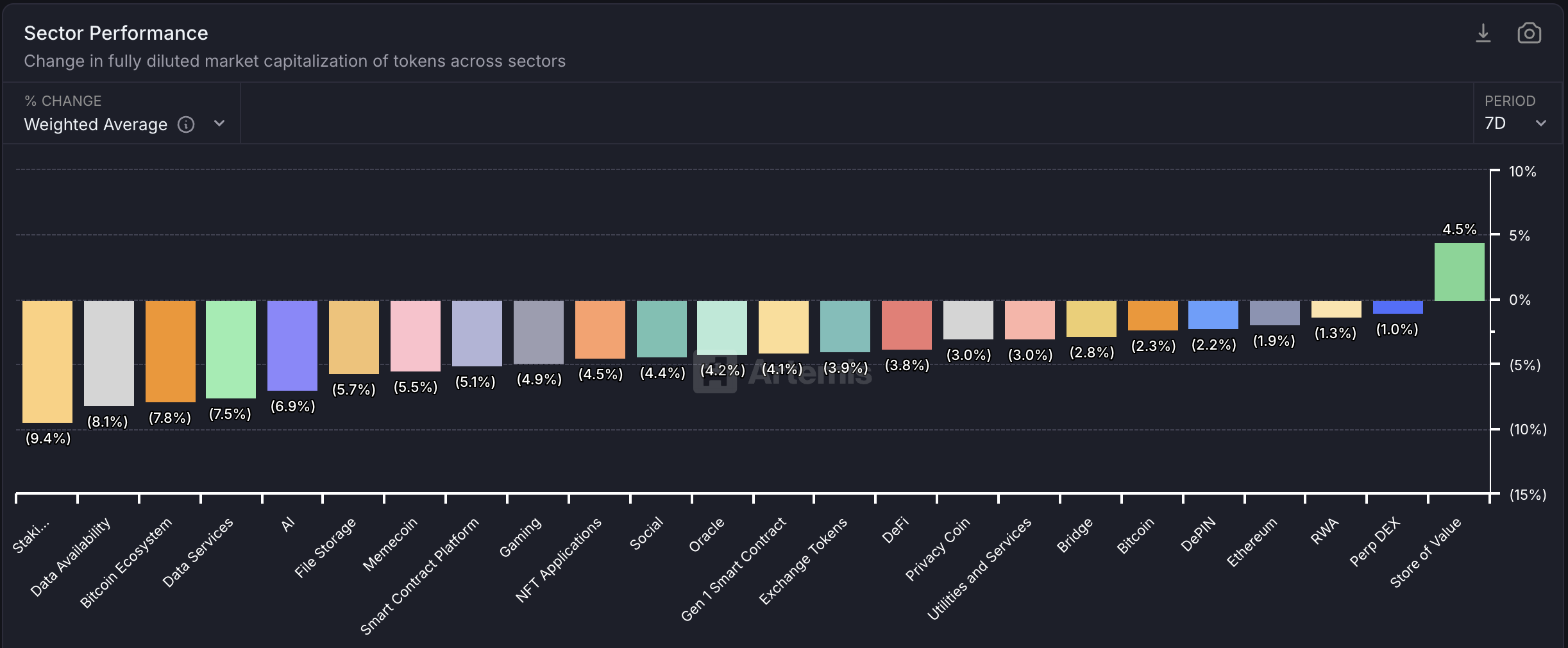

On CoinGecko, Litecoin has topped the weekly gainer chart, with gains exceeding 15%. Furthermore, data from Artemis showed that Litecoin’s strong performance over the past seven days has even made the ‘Store of Value’ category the best-performing segment in the market.

Besides market performance, Litecoin adoption has also increased. CoinGate, a crypto-payment provider, observed a shift in crypto payment preferences. While Bitcoin continues to hold the leading position, Litecoin has climbed to the second position.

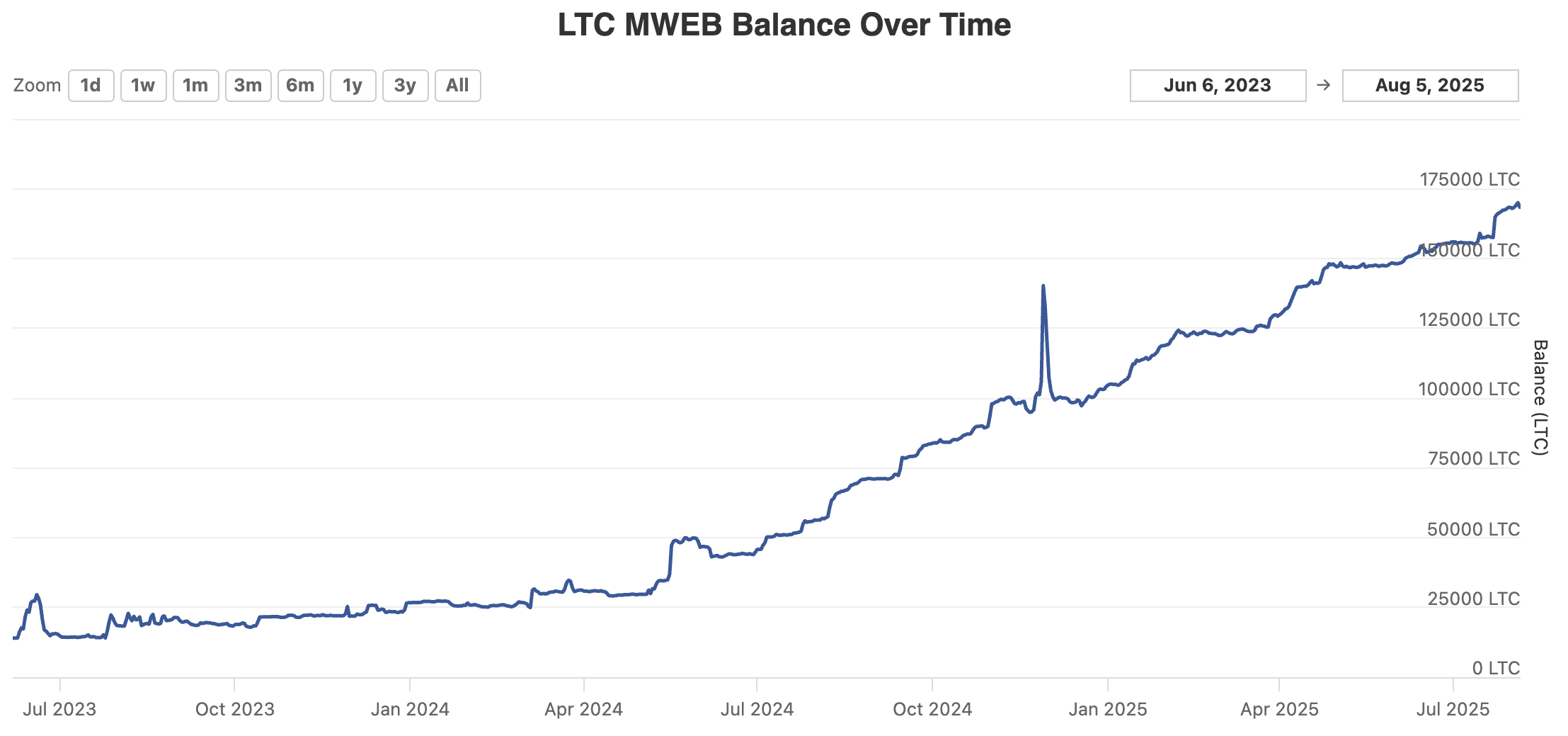

Moreover, the Litecoin MWEB Balance has nearly hit 170,000 LTC and has been steadily increasing since mid-2023. This shows growing demand.

Litecoin Price Prediction: What Do Analysts Think?

Meanwhile, analysts are pointing out reasons why Litcoin could be poised for significant growth in 2025. From a fundamental perspective, Tanaka highlighted several factors that could support Litecoin’s rally.

- Institutional Interest: The analyst pointed out that if MEI Pharma expands its Litecoin treasury to $400 million, $600 million, or more, it could remove 4-5% of Litecoin’s supply from circulation, tightening supply.

- Fixed Supply: Tanaka noted that about 5% of the total supply could be locked away permanently. This scarcity may drive Litecoin’s price upward as supply shrinks.

- Undervaluation: Despite offering faster and cheaper transactions than Bitcoin, Litecoin remains undervalued. It trades at a fraction of Bitcoin’s price while seeing growing real-world adoption.

- Technological Advancements: The analyst added that Litecoin was the first to implement SegWit, host the first Lightning Network transaction, and add privacy upgrades like MWEB. Furthermore, it has maintained 13 years of uptime without any hacks, scandals, or issues.

- Core Focus: Unlike other blockchain networks, Litecoin has remained focused on being ‘simple sound money.’

“Litecoin isn’t trying to be the next Solana, not chasing AI, gaming, or meme coins…No pre-mine, no central issuer, no VC tax, no ambiguity. Just pure, peer-to-peer digital cash the way Satoshi intended. Sometimes, you just need to pay attention to what’s quietly winning. Litecoin might be the most inevitable,” Tanaka stated.

Tanaka also hypothesized that if bitcoin reaches $500,000, Litecoin could rise to $25,000 at just 5% of Bitcoin’s value. Similarly, if Bitcoin hits $1 million, Litecoin could climb to $100,000.

“Even conservatively, LTC at $1,000 is a fundamentally sound bet, not just hopium,” he wrote.

From a technical perspective, an analyst pointed out that Litecoin is exhibiting the same pattern it followed before its 5x price surge in 2020.

“This time, the next target isn’t just high — it’s ATH territory,” the post read.

Been waiting for this in Litecoin.

The weekly 100/200 EMA golden cross triggered for the second time ever.

Back then, the 20/50 EMAs were stacked above, just like now.

2020 didn't have this set up.

This looks like 2017. pic.twitter.com/qM8FoogtTJ

Another analyst pointed out $150 as the next short-term target. He also noted that LTC is demonstrating greater strength compared to many altcoins, and a return to its all-time highs may be on the horizon.

However, the chances of Litecoin hitting these ambitious targets are debatable. Investors should do their own research before making investment decisions.