3 Made-In-USA Crypto Gems to Buy Before Trump’s August 7 Tariff Bomb Drops

Brace for impact—Washington's playing economic hardball, and these homegrown tokens could be the ultimate hedge.

Trump's August 7 tariff deadline looms like a crypto whale's sell order—everyone sees it coming, but nobody's sure how brutal the fallout will be. While traditional markets sweat over trade wars, three American-made altcoins are flashing bullish signals.

Made-in-USA tokens: The ultimate tariff loophole?

Forget dodging import duties—these decentralized assets bypass borders entirely. We're not naming names (this isn't financial advice, suit-wearing SEC lurkers), but the smart money's eyeing projects with 100% US-based dev teams, infrastructure, and legal moats.

Pump-and-tariff protection playbook

History doesn't repeat in crypto—it gets front-run by algos. When 2018's trade wars hit, commodities tanked while Bitcoin gained 200%. This time, homegrown utility tokens might steal the spotlight from store-of-value narratives.

Just remember: In the land of the free and home of the leveraged, even 'patriotic' crypto plays can rug-pull faster than a politician flip-flops on CBDCs.

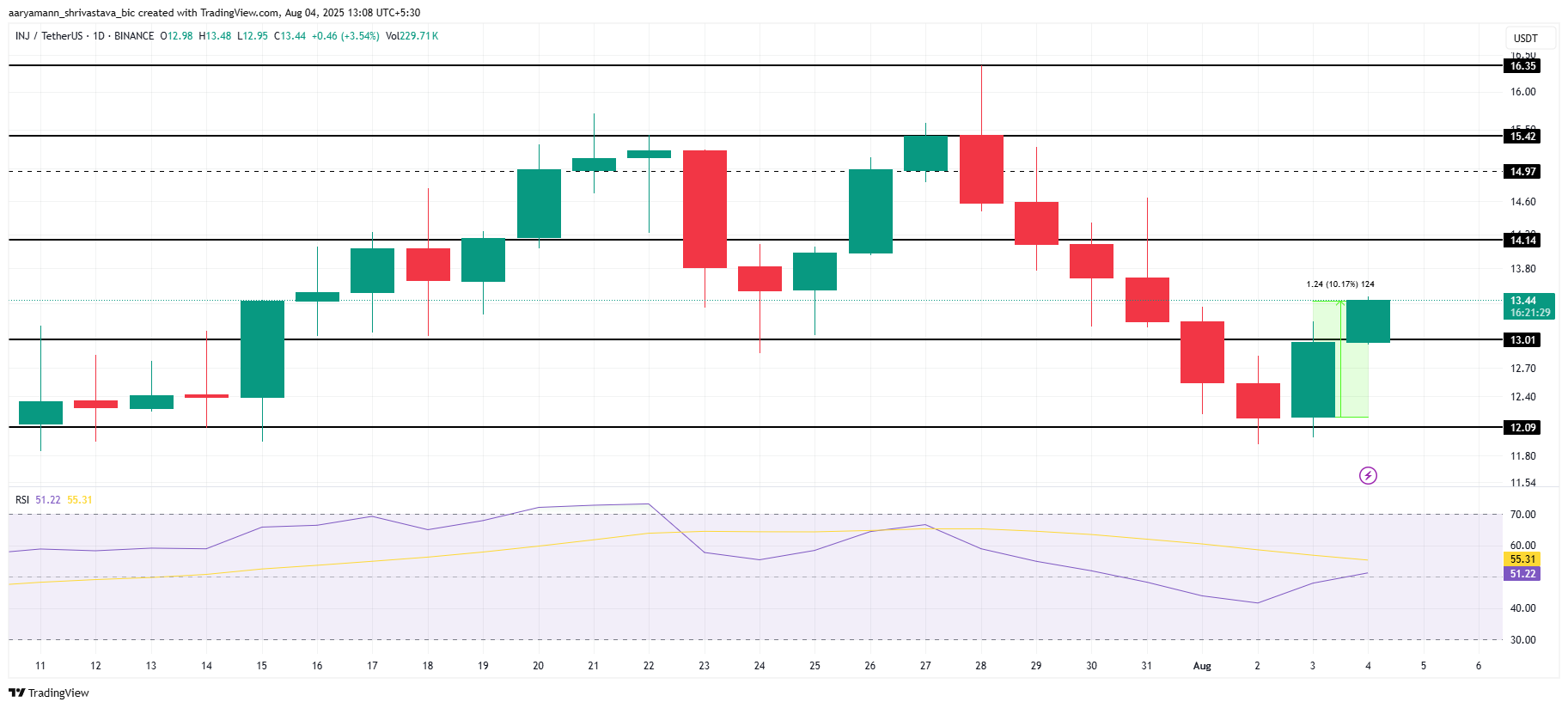

Injective (INJ)

INJ price has surged by 10% over the last 24 hours, benefiting from bullish market trends. The Relative Strength Index (RSI) has moved into the bullish zone above the neutral mark of 50.0, signaling increased buying interest and potential for further upside movement in the altcoin.

With the RSI showing bullish momentum, INJ is poised for a potential recovery. If the price manages to flip the $14.14 resistance into support, it could rally toward $15.42. This WOULD help the altcoin recover recent losses and reinforce the upward momentum seen in the broader market.

: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

However, if selling pressure builds up and investors decide to exit their positions, INJ could slip below the support level of $13.01. A drop to $12.09 could follow, and if this support fails, the bullish outlook for INJ would be invalidated, signaling a shift toward further declines.

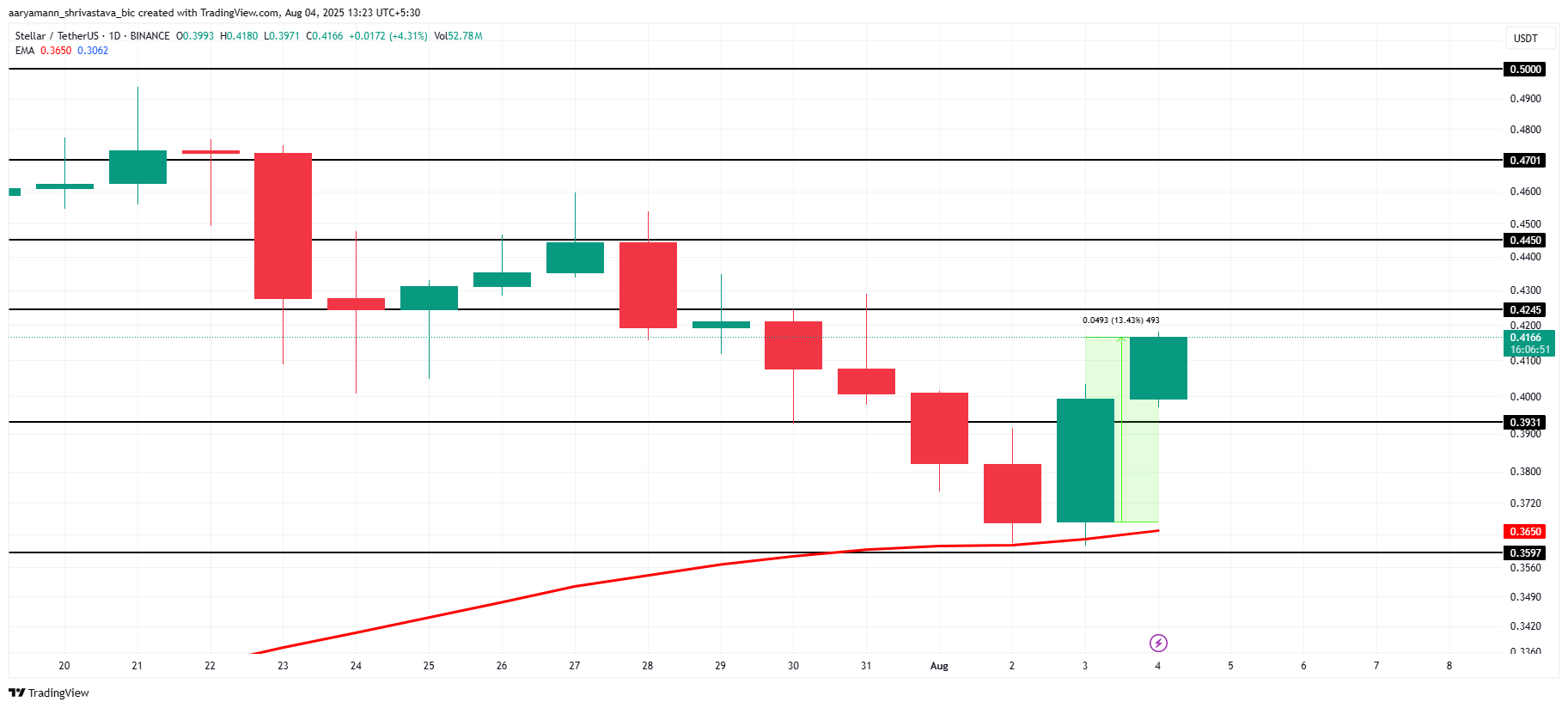

Stellar (XLM)

XLM price has increased by 13% over the last 24 hours, positioning it among the top-performing altcoins. Trading at $0.4166, the altcoin remains under the resistance of $0.4245. This indicates potential for a breakout if broader market conditions stay favorable and support the bullish trend.

The 50-day exponential moving average (EMA) provides strong support, signaling that the broader market momentum is bullish. This support could propel XLM towards $0.4450, with further gains potentially pushing it to $0.4701, confirming the continuation of its positive trajectory in the market if conditions remain favorable.

However, if market conditions worsen, especially with the upcoming August 7 announcements, XLM might fail to breach $0.4245. In this case, the price could fall to $0.3597, and losing this support would invalidate the bullish outlook for XLM, signaling potential downside risks in the coming days.

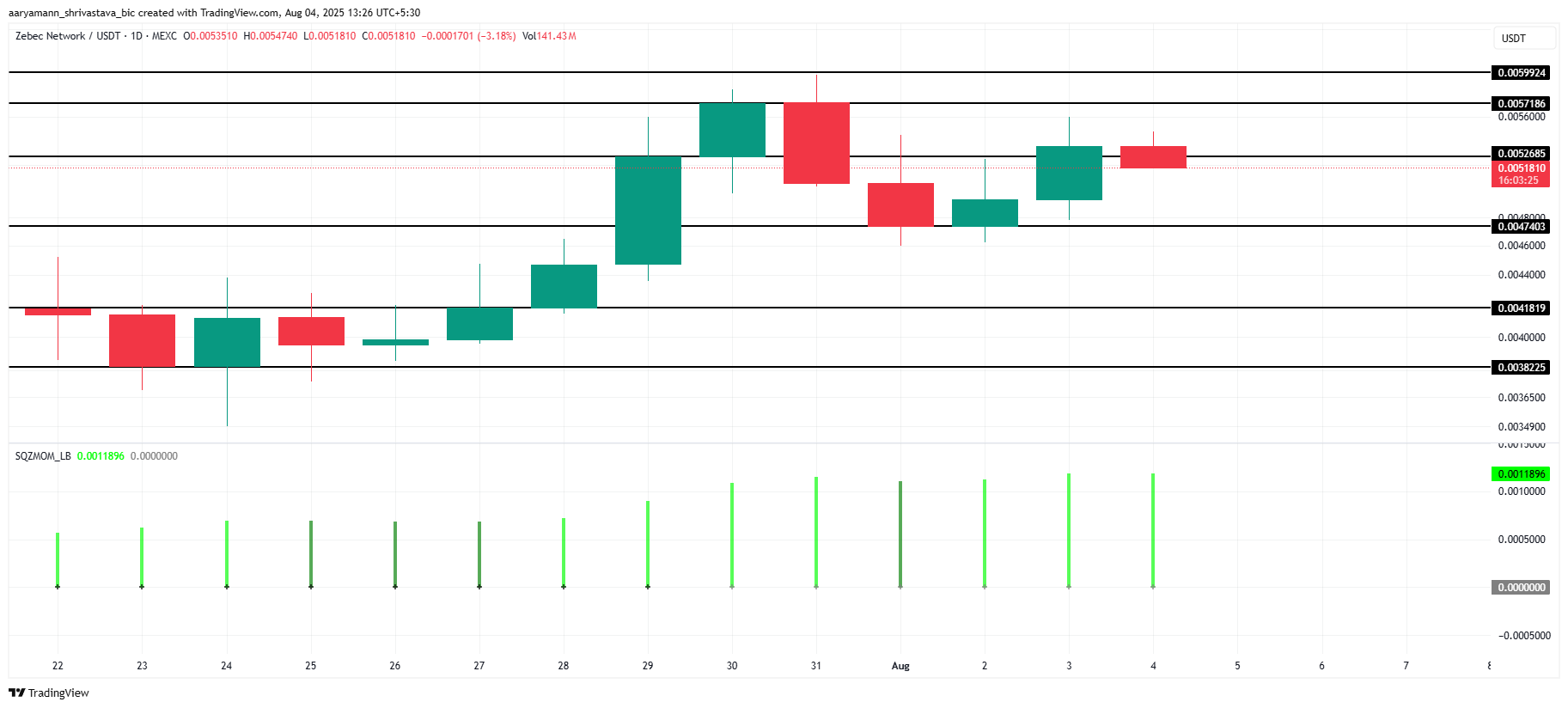

Zebec Network (ZBCN)

ZBCN is an emerging altcoin from the US, having risen 27% in the past week. The cryptocurrency is currently trading at $0.0051, just below the resistance levels of $0.0057 and $0.0052. These resistance points are key for further upward movement in the near term, contingent on market conditions.

The Squeeze Momentum Indicator is signaling a squeeze release with bullish momentum as bars indicate positive pressure. This suggests that ZBCN is experiencing a strong bullish trend, which may help push the altcoin past the resistance at $0.0057. If successful, the price could surge toward $0.0059.

However, if investor sentiment shifts negatively or tariff wars impact market conditions, ZBCN may face selling pressure. In such a scenario, the price could drop to $0.0047, potentially falling further to $0.0041, thereby invalidating the bullish outlook for ZBCN.