Bitcoin at $100K? Arthur Hayes Predicts a Drop—Here’s Why It Matters

Bitcoin's bull run faces a reality check as Arthur Hayes forecasts a plunge to $100,000. The crypto king’s volatility is back in the spotlight—just when Wall Street thought it had everything under control.

Hayes, never one to mince words, cites macroeconomic turbulence and overleveraged institutional players as key triggers. Sound familiar? It’s the same script from 2021—only this time, the stakes are higher.

Meanwhile, crypto maximalists shrug. 'Buy the dip' isn’t just a mantra; it’s a reflex. After all, what’s a 30% correction when you’ve ridden a 500% rally?

Wall Street’s latest 'safe-haven' asset? More like a rollercoaster with a side of schadenfreude. Buckle up.

Crypto Market Hit by $372 Million Losses Following Hayes’ Warning

In an August 2 post on X (formerly Twitter), Hayes attributed his prediction to the upcoming US tariff bill, expected in the third quarter. He also pointed to broader economic challenges as a contributing factor.

Additionally, the BitMEX co-founder pointed out that no major economy is expanding credit quickly enough to boost nominal GDP. According to him, this could lead to a correction in the cryptocurrency market.

Y? US Tariff bill coming due in 3q … at least the mrkt believes that after NFP print. No major econ is creating enough credit fast enough to boost nominal gdp. So $BTC tests $100k, $ETH tests $3k. Come see my @WebX_Asia Tokyo keynote Aug 25 for more info. Back to the beach. https://t.co/zuHlwgQKC7

— Arthur Hayes (@CryptoHayes) August 2, 2025Hayes’ bearish stance seems to align with the broader market sentiment. The total cryptocurrency market capitalization has dropped by more than 3% in the last 24 hours, now standing at $3.76 trillion.

According to BeInCrypto data, Bitcoin experienced significant volatility during the last 24 hours, dipping from nearly $114,000 to a multi-week low of $112,113. However, it has slightly recovered to $113,494 as of press time.

Ethereum followed a similar trend, falling from over $3,500 to $3,373, only to regain some ground.

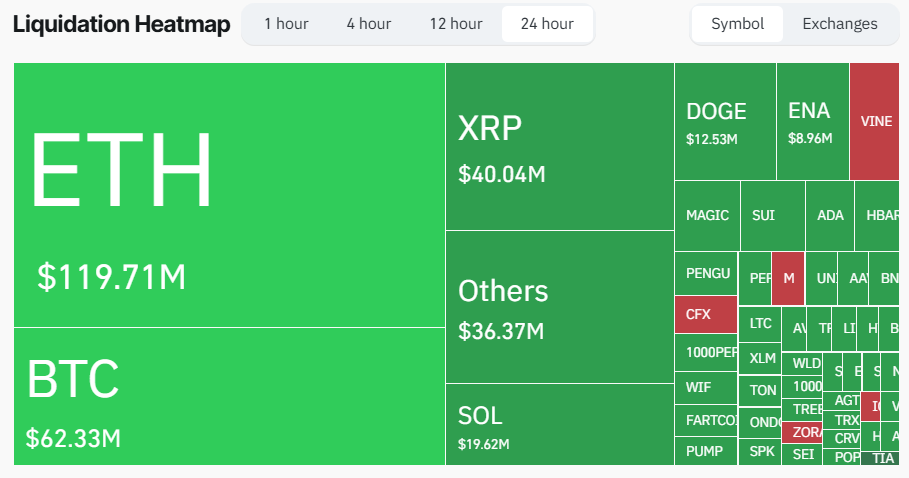

This sharp market downturn has triggered nearly $372 million in liquidations over the past 24 hours, affecting more than 115,000 traders.

Long traders, betting on a market rebound, dominated the liquidation volume, accounting for around $322 million of the losses.

On the other hand, Short traders, who expected further price declines, saw only $65 million in liquidations.

Across assets, ethereum led the liquidation sweep, with around $119 million liquidated, followed by Bitcoin at $62 million.

Despite the pullback, Eric Trump, son of US President Donald Trump, encouraged Bitcoin and Ethereum investors to take advantage of the lower prices. He suggested that now is a good time to buy the dip.

Let me say it again:

₿uy the dips!!! $BTC $ETH https://t.co/VSOvTgnlOT

Notably, his previous advice to purchase bitcoin during price corrections saw the asset rise by 15%, while Ethereum increased by 20%.

Investors now hope that Trump’s current call will similarly mirror the positive market outcomes of the past.