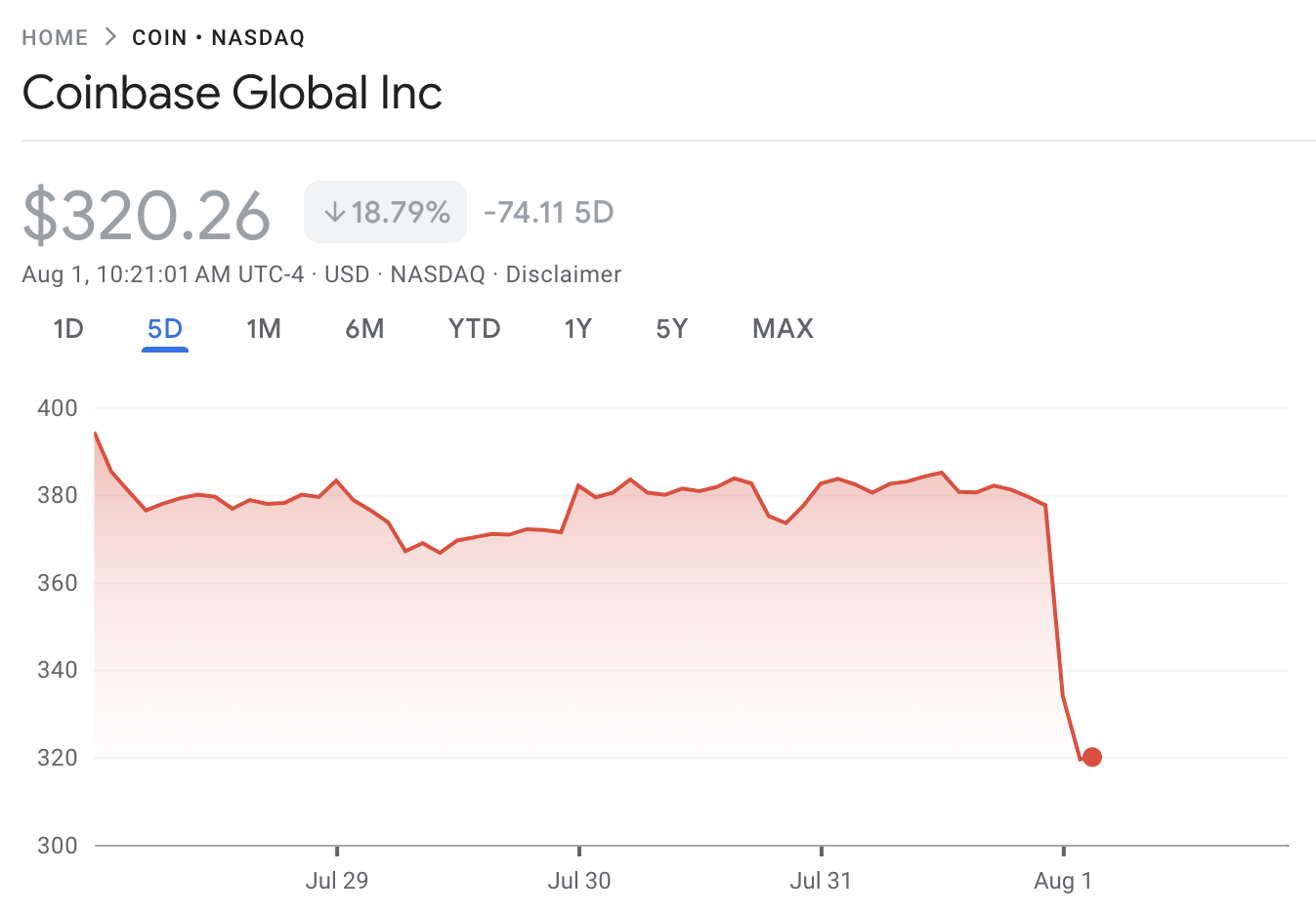

Coinbase Stock Tanks 15% Post-Earnings—Crypto Winter Chills Wall Street Again

Another quarter, another crypto casualty. Coinbase shares cratered after reporting Q2 earnings that left analysts colder than a forgotten Bitcoin wallet.

The Numbers Don't Lie

While exact figures weren't disclosed, the market's brutal reaction tells the story—traders dumped COIN stock faster than a shitcoin rug pull. The NASDAQ's favorite crypto canary continues coughing.

Silver Linings Playbook?

Bulls whisper about institutional adoption and Base chain growth, but let's be real—when traditional finance smells blood in the water, they short first and ask questions never. One thing's certain: in crypto, the only thing harder than HODLing is explaining red numbers to shareholders.

Coinbase Report: Underperformance and Decline

Coinbase, one of the world’s largest crypto exchanges, has exhibited mixed results in the last few months. After a strong Q4 2024, earnings severely underperformed expectations in Q1.

Last month, its stocks hit an all-time high, but analysts warned of overvaluation. Yesterday, Coinbase released its Q2 2025 Earnings Report, and the results speak for themselves:

Coinbase’s price slump clearly springs from this Earnings Report. At the top level, there are plenty of warning signs that explain this. Adjusted net income fell from $527 million in Q1 to $33 million, and total revenue fell by $500 million.

As Juan Leon, Senior Investment Strategist at Bitwise, explained, this reflects immense leverage pressures on the firm.

These pressures were particularly severe because of lower market volatility, which impacted user activity. Coinbase reported a 39% reduction in trade revenue QoQ as global crypto spot volumes fell 32%.

The exchange attributes its underperformance to a change in stablecoin strategy that impacted user prices.

However, this stablecoin strategy may have paid off dividends in other areas. Coinbase integrated some of Circle’s infrastructure several years ago, and the two firms remain closely linked.

The report claims that Coinbase’s subscription and services revenue only fell by 6% QoQ, and that it was buoyed by a 13% increase in average USDC balances.

In other words, USDC users turned to Coinbase to host staking and other services, which turned this sector into a growth area in Q2. Stablecoin revenue across the board ROSE 12% QoQ to $332 million, underpinned by expanded rewards and off-platform USDC growth to $47.4 billion.

Additionally, Coinbase reported that regulatory breakthroughs gave the exchange some positive momentum for the future. Obviously, major legislation like the CLARITY Act is bullish for exchanges, but CFTC-regulated derivatives and futures contracts boosted Coinbase specifically. These advancements helped the platform mature its on-chain financial infrastructure.

So, to summarize, Coinbase’s report points to some serious problems in user activity, but it’s not all bad. The firm suggested that it weathered a turbulent market period admirably, and that raising asset prices and stablecoin volumes will bring in more profits in Q3.

It’s difficult to say how this strategy will actually materialize, but there’s a clear vision here.