HBAR Bulls Rekt: Long Liquidations Wipe Out Futures Traders in Bloodbath

HBAR's rally just got ambushed—liquidation engines are firing on all cylinders as overleveraged longs get steamrolled. The futures market's playing for keeps, and today it's taking no prisoners.

When the squeeze comes, it comes fast. Traders who bet big on HBAR's upside got caught with their pockets inside out when cascading liquidations triggered a domino effect. The usual suspects—excessive leverage, crowded positioning—left no room for error when momentum flipped.

Meanwhile, perpetual swap funding rates suggest the market's still stubbornly bullish despite the carnage. Some never learn—Wall Street's 'buy the dip' mantra works until it doesn't. Remember kids: the market can stay irrational longer than you can stay solvent.

HBAR Faces Long Liquidations as Bearish Pressure Climbs

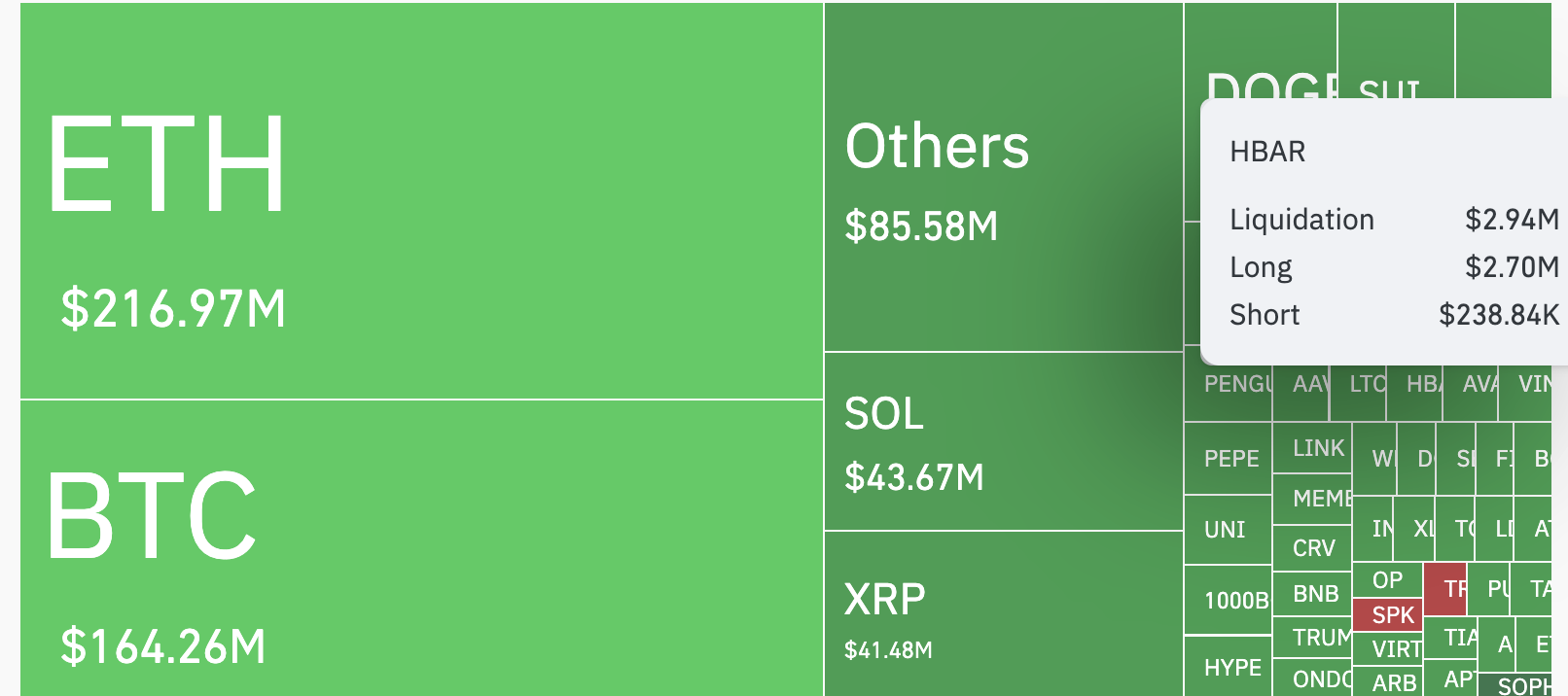

In the past 24 hours, HBAR’s price has plunged by 9%, deepening the losses for bullish traders. Data from Coinglass shows that long liquidations alone accounted for $2.70 million of the total $2.94 million wiped from the HBAR futures market during this period.

: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

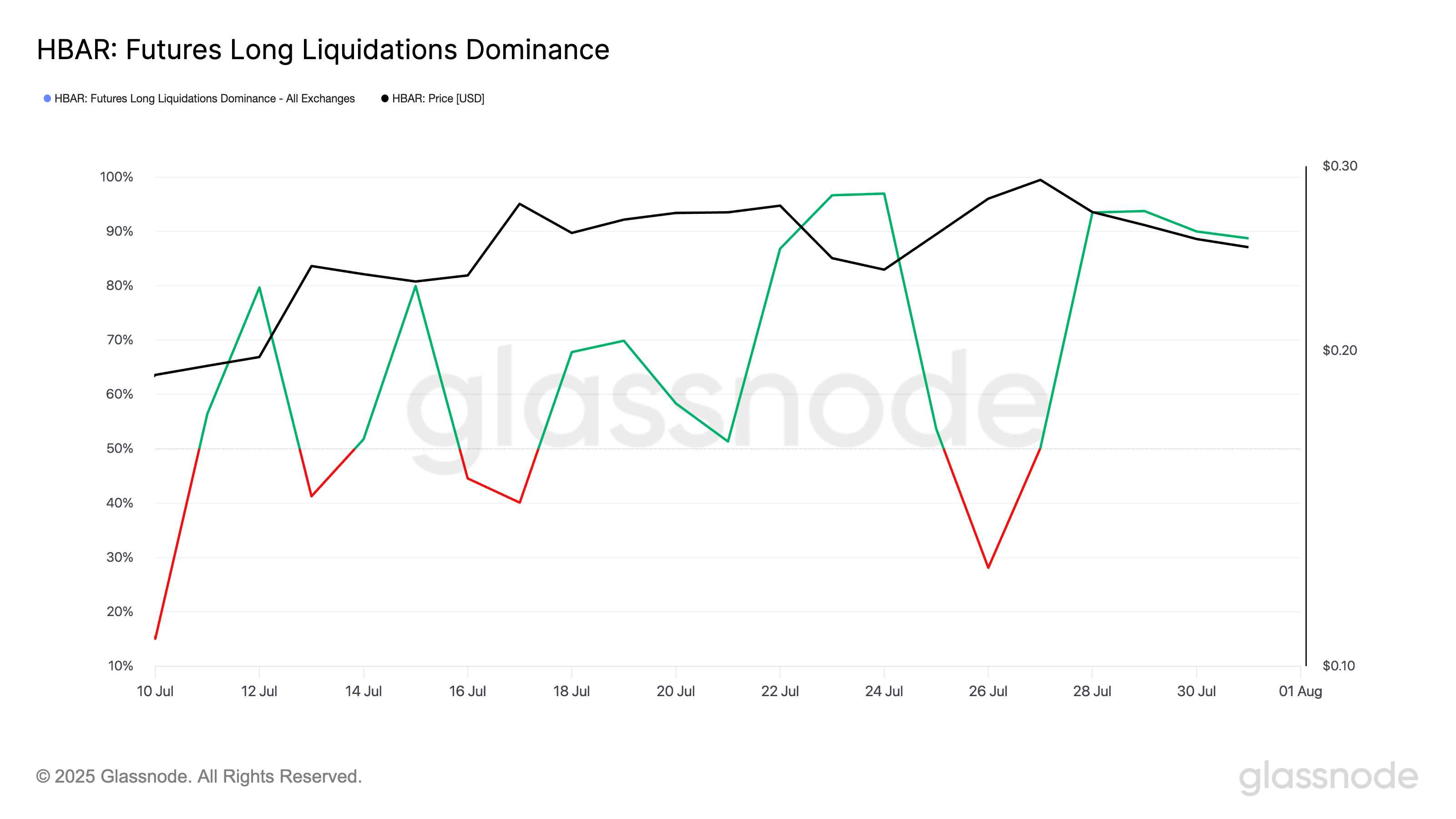

Long-position holders have faced a wave of liquidations as HBAR’s price continues to fall. According to Glassnode, the token’s Futures Long Liquidations Dominance surged past 88% on Thursday, marking another day of aggressive shakeouts for bullish traders this week.

This metric measures the proportion of total futures liquidations that come from long positions. When it spikes, it indicates that most liquidations are coming from traders who bet on rising prices due to a downward price trend.

In HBAR’s case, the metric confirms that bearish momentum has overwhelmed bullish sentiment. This has triggered a cascade of forced sell-offs that could further pressure the token’s price.

HBAR’s Smart Holders Hit the Exit

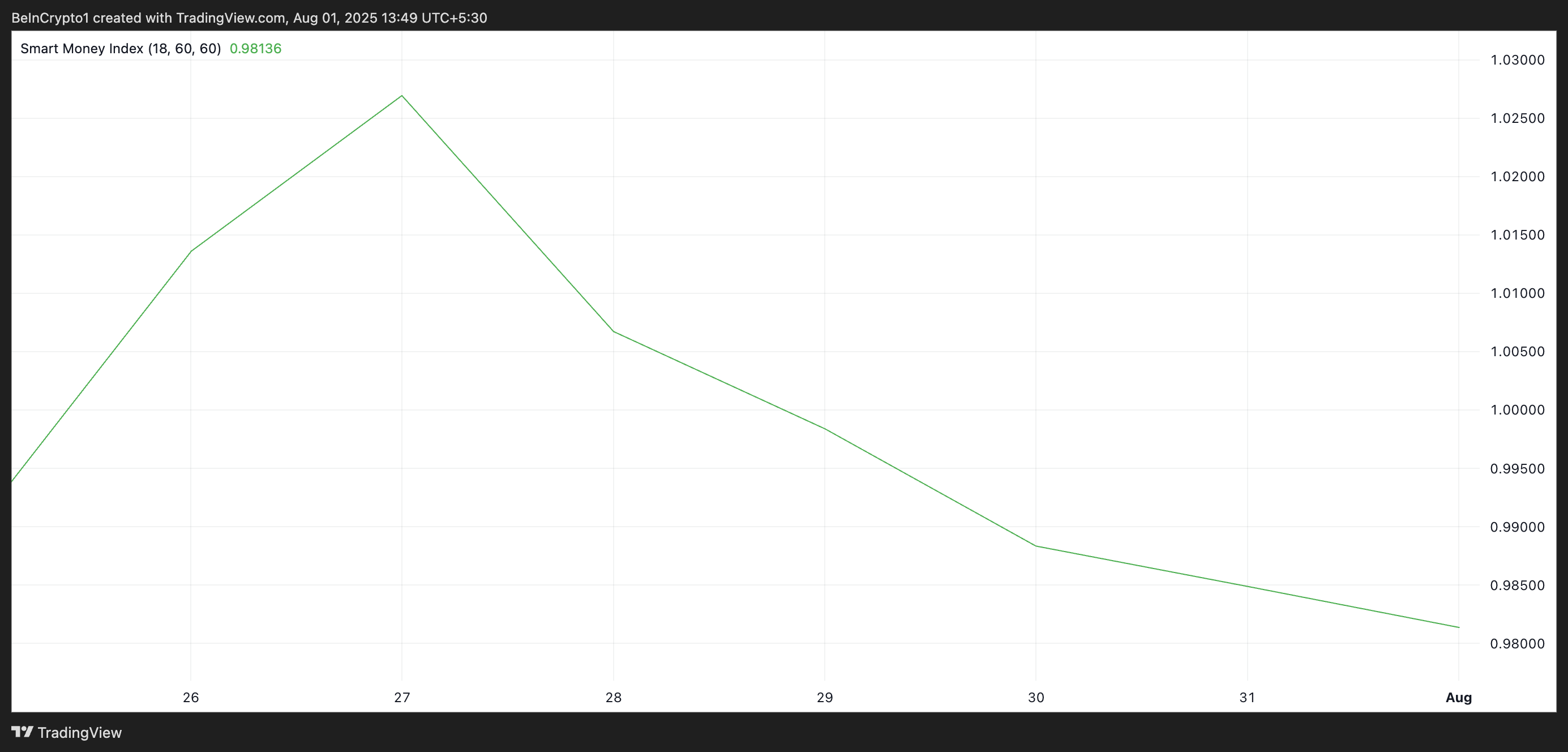

Selling activity has also rocketed among HBAR “smart holders.” Readings from the token’s Smart Money Index (SMI) indicator reveal a steady decline in demand among these investors since Sunday. At press time, it stands at 0.98.

Smart money refers to capital controlled by institutional investors or experienced traders who understand market trends and timing more deeply. The SMI tracks the behavior of these investors by analyzing intraday price movements.

It measures selling in the morning (when retail traders dominate) versus buying in the afternoon (when institutions are more active).

A rising SMI signals that smart money is accumulating an asset, often ahead of major price moves.

However, when this momentum indicator falls, experienced traders are pulling back from the market. This trend signals weakening confidence in HBAR’s short-term price stability as the market enters a new trading month.

HBAR Holds the Line at $0.24 — But Will the $0.22 Floor Collapse?

HBAR trades at $0.24 at press time, holding just above a key support level at $0.22. If sell-side pressure intensifies, a drop below this floor could be imminent, potentially driving the token’s price down to $0.18.

Conversely, a resurgence in buying interest could trigger a bullish reversal. HBAR may attempt to break above the $0.26 resistance level in that scenario.