Ethereum Defies Market Crash—Why $4,500 Is Still the Make-or-Break Price Zone

While the crypto market bleeds, ETH stands firm—but don’t pop the champagne yet.

Key level to watch: $4,500. Break it, and bulls charge. Fail, and it’s back to hopium.

Here’s why Ethereum’s resilience might just be the calm before the storm—or the setup for a legendary reversal. (Spoiler: Traders are already over-leveraged.)

Ethereum Has A Long Way To Go

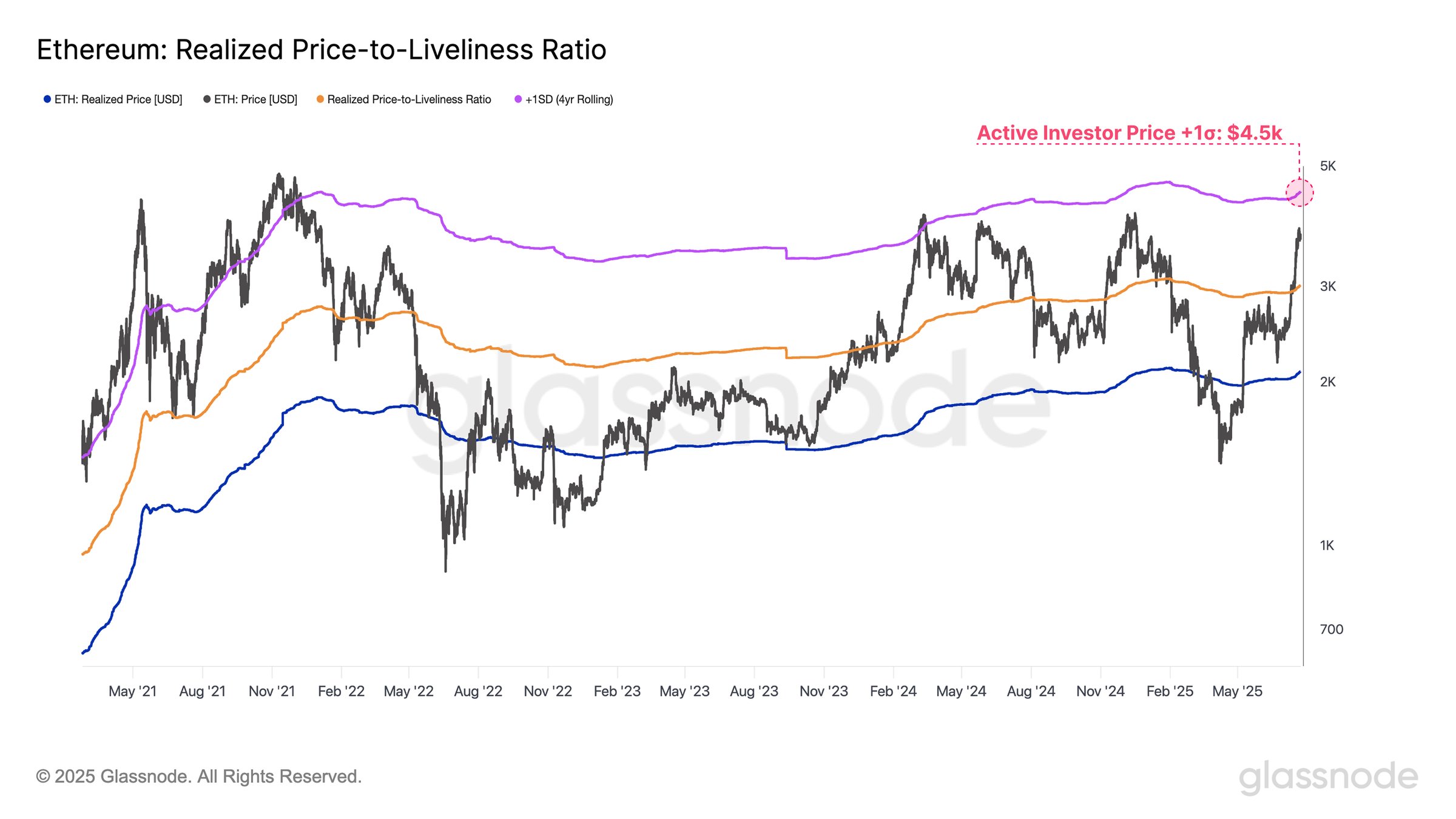

Ethereum’s Realized Price to Liveliness ratio is showing signs of an important threshold for the current rally. The ratio indicates that the current upside resistance for ethereum is at $4,500, a level that has acted as a significant barrier in past market cycles. Notably, this price point acted as resistance in March 2024 and during the 2020–2021 market cycle.

Historically, breakouts above $4,500 signal market euphoria and an increased risk of structural instability, making it a critical structural pivot for Ethereum. As a result, this price level is not just a resistance but also the potential absolute reversal point for Ethereum.

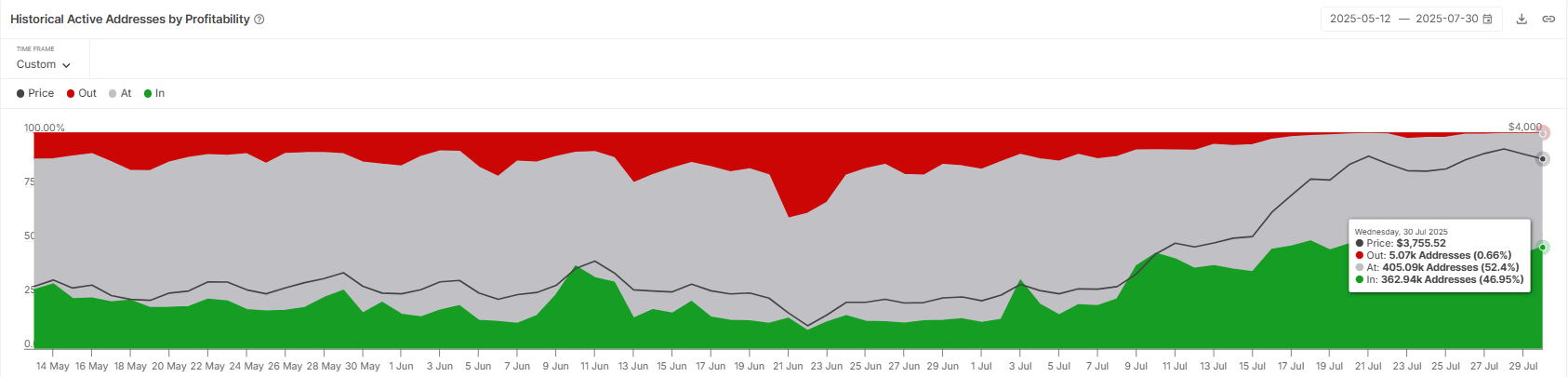

Ethereum’s macro momentum is influenced by the concentration of active addresses. Nearly 47% of these addresses belong to investors who are currently sitting in profit. While this may seem like a positive sign, it raises concerns in the short term.

Investors in profit are more likely to book their gains, which could lead to increased selling pressure on Ethereum. This could slow down Ethereum’s potential rise, preventing the altcoin from experiencing significant gains in the NEAR future.

ETH Price Is Holding Above Support

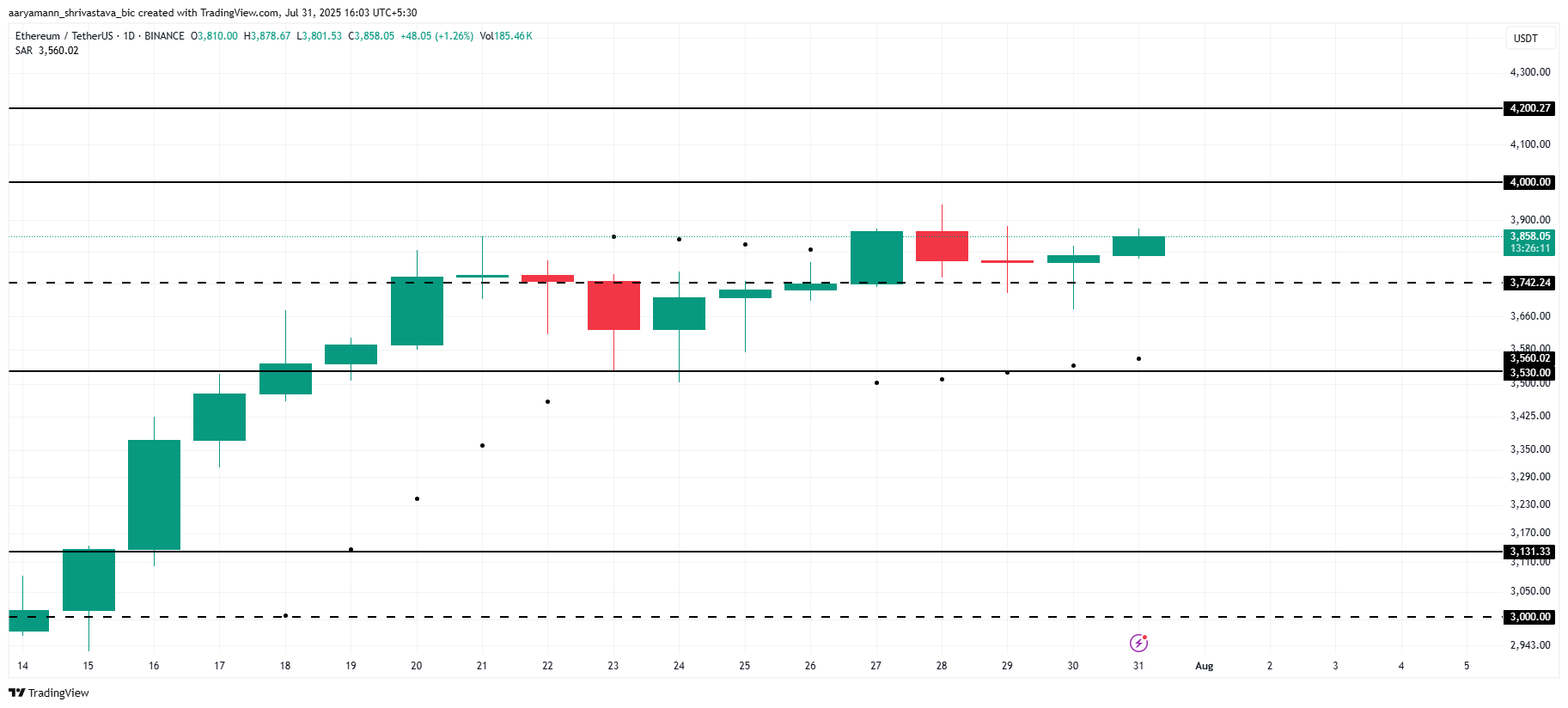

Ethereum is currently trading at $3,858, sitting comfortably above the local support level of $3,742. The Parabolic SAR indicator is positioned below the candlesticks, signaling an active uptrend.

This suggests that Ethereum is showing a moderately bullish trend at the moment, with the potential to rise further. Given the current market sentiment and price action, Ethereum could move towards the $4,000 level, with the potential to flip it into support and push higher to $4,200 in the near future.

However, there’s a caveat. Should Ethereum experience intensified selling pressure, driven by investor profit-taking or broader market conditions, the price could slip down to the $3,530 support level. If Ethereum falls below this crucial support, it WOULD invalidate the bullish thesis and indicate a reversal in market sentiment.