Crypto Whales’ August Shopping List: The Big Bets for Maximum Gains

Crypto's deep-pocketed players are placing their chips—here's where they're doubling down before the August rally.

The blue-chip gambit: Ethereum and beyond

Whales aren't just surfing—they're owning the wave. ETH accumulation wallets hit record levels last week while institutional inflows quietly tripled. The merge narrative's gone stale? Tell that to the OTC desks clearing eight-figure blocks.

Altcoin alley: High-risk, high-reward plays

From privacy coins to DeFi sleepers, the smart money's diversifying beyond the usual suspects. One obscure interoperability token saw 400% whale accumulation last month—because nothing screams 'asymmetric upside' like a project even its developers struggle to explain.

The stablecoin shell game

Circle's latest attestation shows $3B in fresh USDC minted for 'unknown institutional clients'—right as Tether's market cap shrinks for the third straight month. When whales play musical chairs with stablecoins, retail better watch the exits.

Remember: When elephants dance, the mice get trampled. Or in crypto terms—when whales accumulate, exchanges mysteriously 'experience technical difficulties' right before the pump.

Cardano (ADA)

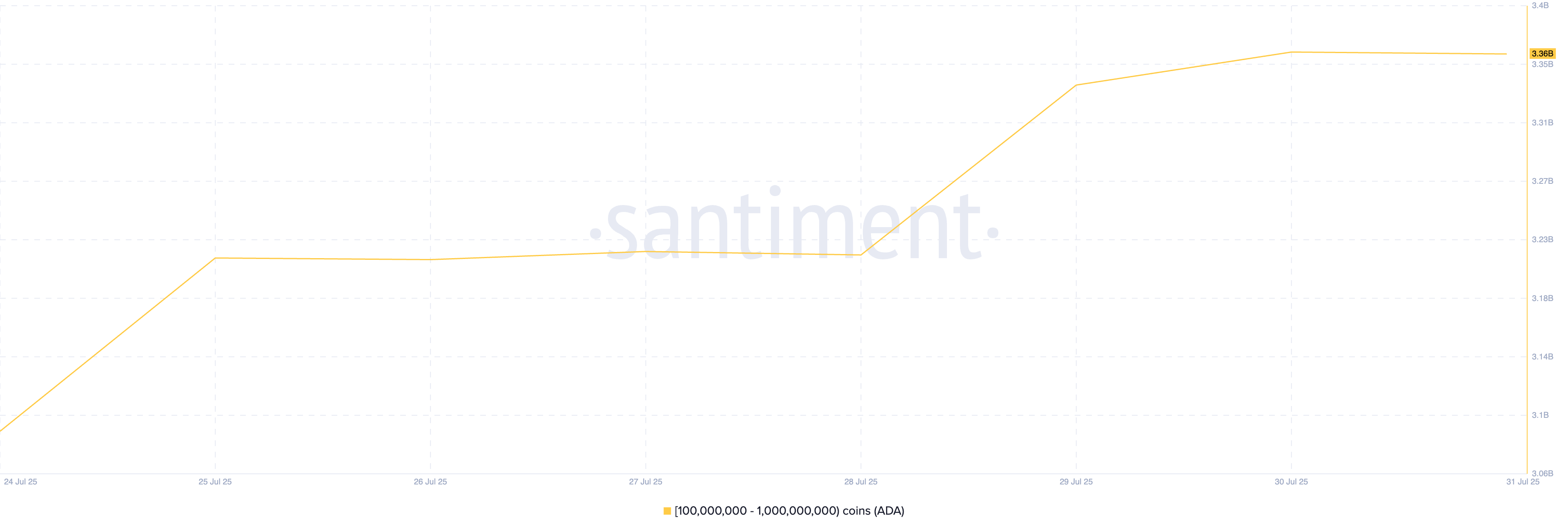

Layer-1 (L1) token Cardano (ADA) has emerged as a top pick among crypto whales eyeing gains in August. On-chain data reveals that since July 24, large holders with wallets containing between 100 million and 1 billion ADA have accumulated 270 million tokens, valued at over $210 million at current market prices.

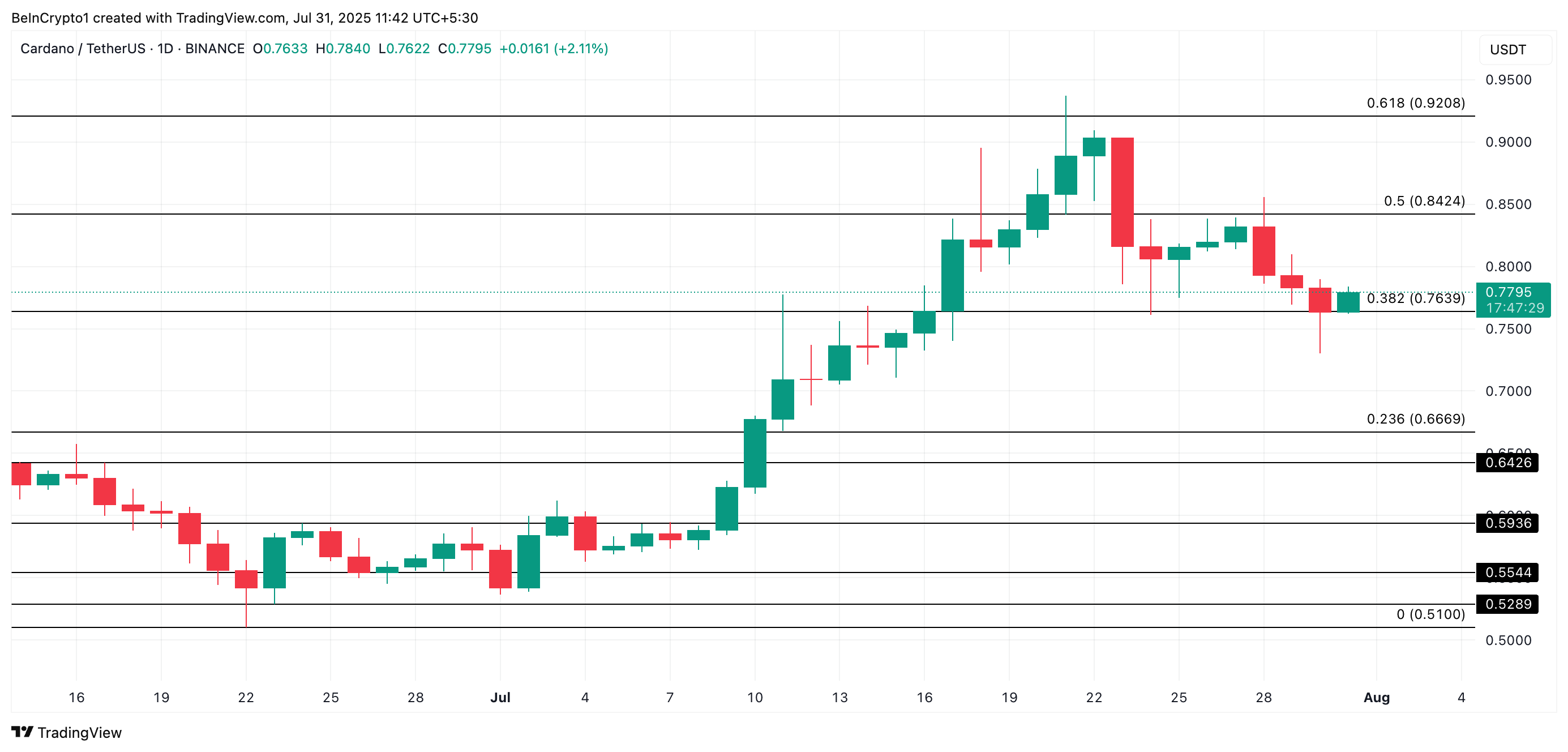

This accumulation comes amid a recent pullback in ADA’s price. The altcoin has slipped from its cycle peak of $0.93 on July 21 to trade at $0.77 at press time. Despite the correction, the sustained interest from high-net-worth investors signals continued confidence in ADA’s long-term prospects.

If their accumulation persists and counterbalances the supply rise, it could stabilize ADA’s price and stall its decline. In this scenario, the coin could initiate a bullish reversal and climb to $0.84.

: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

On the other hand, if whale demand falls, ADA could extend its decline, break below $0.76, and fall to $0.66.

Tron (TRX)

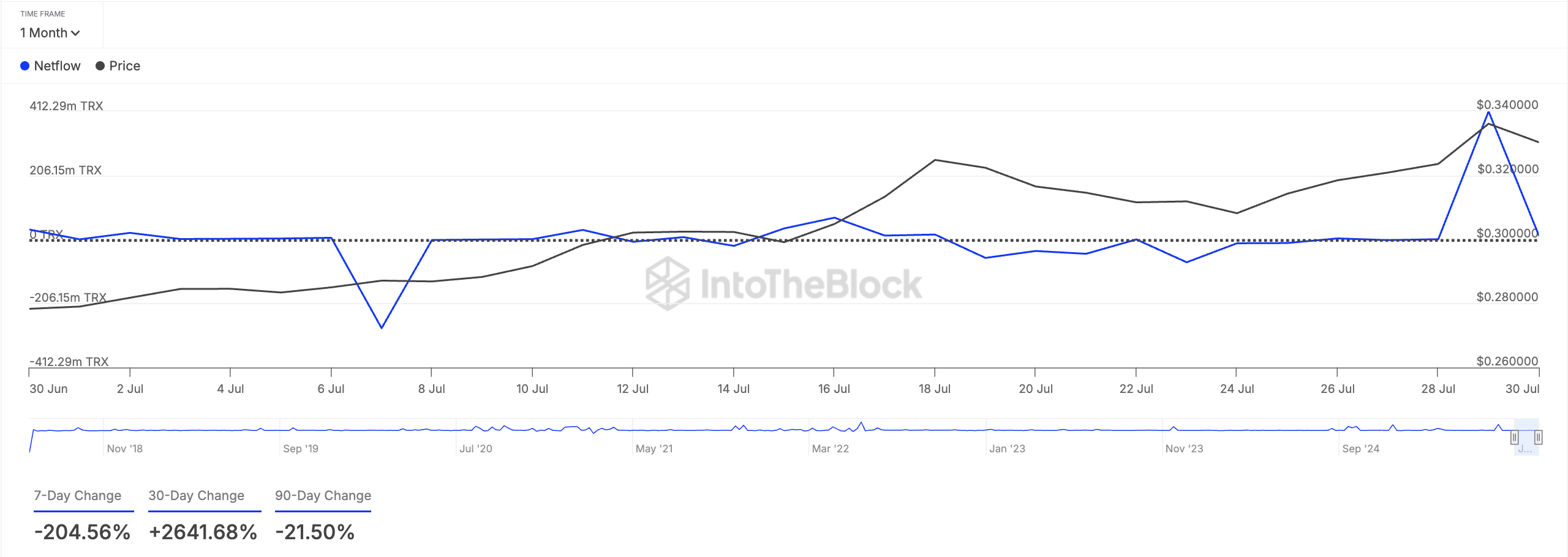

TRX has trended within an ascending parallel since June 22, noting a 24% price rise. By July 29, the altcoin had reached a six-month high of $0.35, driven by increasing whale accumulation.

This is highlighted by its large holders’ netflow, up over 2,600% in the past month, per IntoTheBlock.

The large holders’ netflow measures the difference between the amount of tokens that whales buy and sell over a specified period.

When an asset’s large holders’ netflow sees a positive spike, wallets holding more than 1% of the asset’s circulating supply are accumulating more coins. This signals growing confidence among these key holders and hints at a sustained TRX price rally if they maintain demand.

TRX could extend its rally and climb to $0.35 in this scenario.

However, a resurgence in profit-taking activity WOULD invalidate this bullish outlook. If market demand falls, the altcoin’s price could crash below $0.30 to trade at $0.29.

Solana (SOL)

SOL’s modest 2% price pullback over the past week has presented whales with a buying opportunity, as many anticipate an extended bullish rebound in August. For context, SOL has trended downward since climbing to a peak of $206.18 on July 22.

Trading at $180.67 at press time, the popular altcoin has seen its value dip by 12% since then.

However, whale wallets holding more than $1 million in SOL are not deterred. In fact, they’ve treated the recent dip as an entry point, increasing their holdings by 6.4% over the past week.

If this accumulation trend continues into August, it could reignite broader bullish sentiment toward the coin. Should retail traders follow suit, SOL’s price may resume its upward trajectory and attempt to reclaim levels above $190.

Conversely, if selloffs persist, SOL’s price could slip below the $180 support to test a lower level around $176.33.