FOMC Shockwave: Bitcoin Tumbles—Is This the Start of a Sustained Sell-Off?

Another day, another Fed-induced crypto rollercoaster. Bitcoin got sucker-punched after the FOMC report dropped—because apparently, decentralized money still dances to centralized bankers’ tune.

Blood in the streets? Not so fast. Every dip is a buying opportunity disguised as a panic attack. The sell-side pressure looks nasty, but remember: Bitcoin’s obituary gets rewritten more often than a Wall Street analyst’s price target.

Here’s the real question: Will weak hands fold, or is this just the market’s way of shaking out tourists before the next leg up? (Spoiler: The suits still don’t get it.)

Bitcoin is Showing Signs of a Decline Ahead

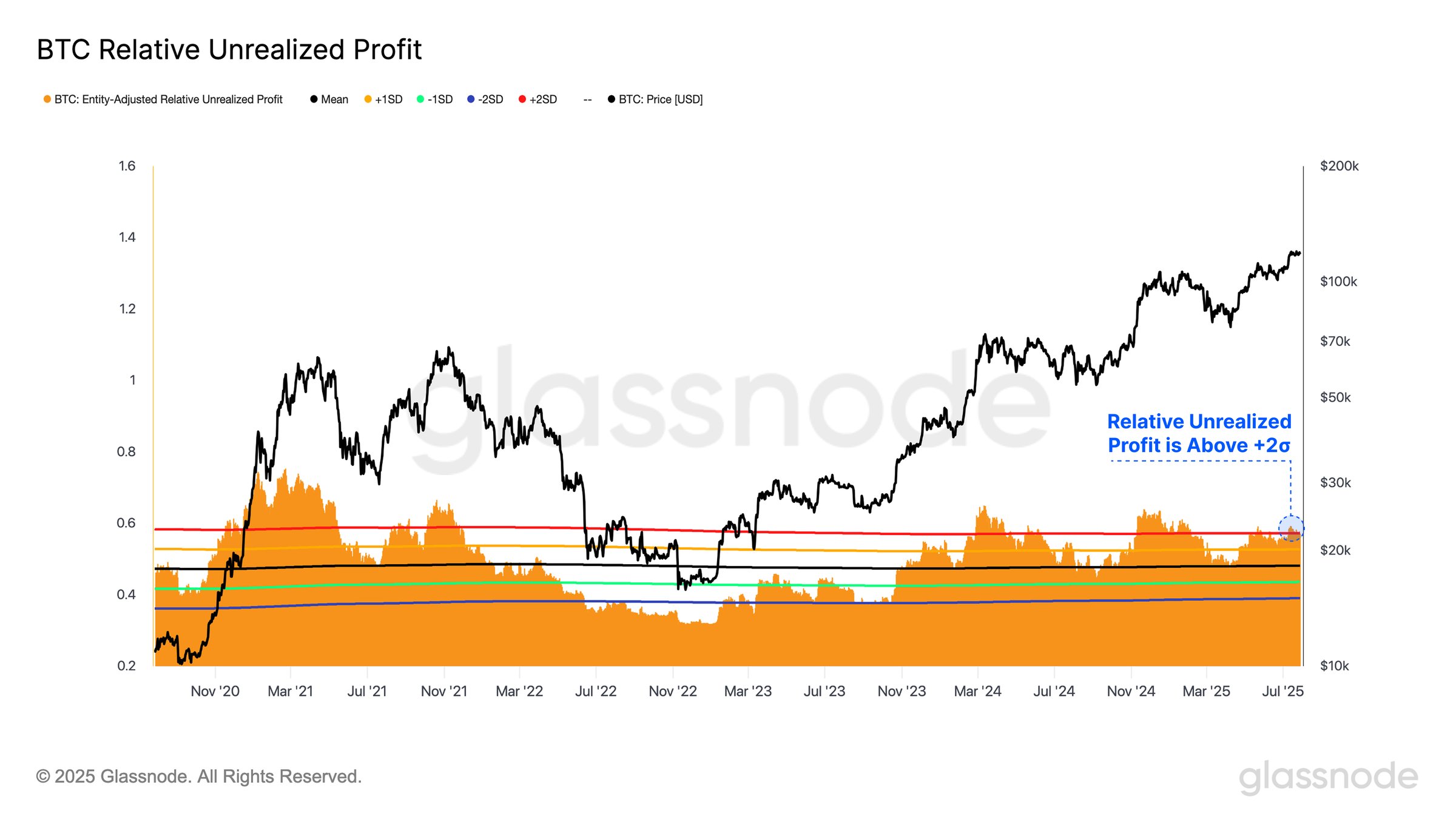

The Relative Unrealized Profit (RUP) has recently broken above the +2σ band, a level often associated with euphoric market phases. Historically, this setup has preceded market tops, signaling a latent sell-side pressure that could eventually drag prices lower.

The current state of the RUP indicates that a pullback may be likely in the coming days, potentially pushing Bitcoin’s price out of its consolidation range. Given past patterns, a shift toward selling could result in further downward pressure.

: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

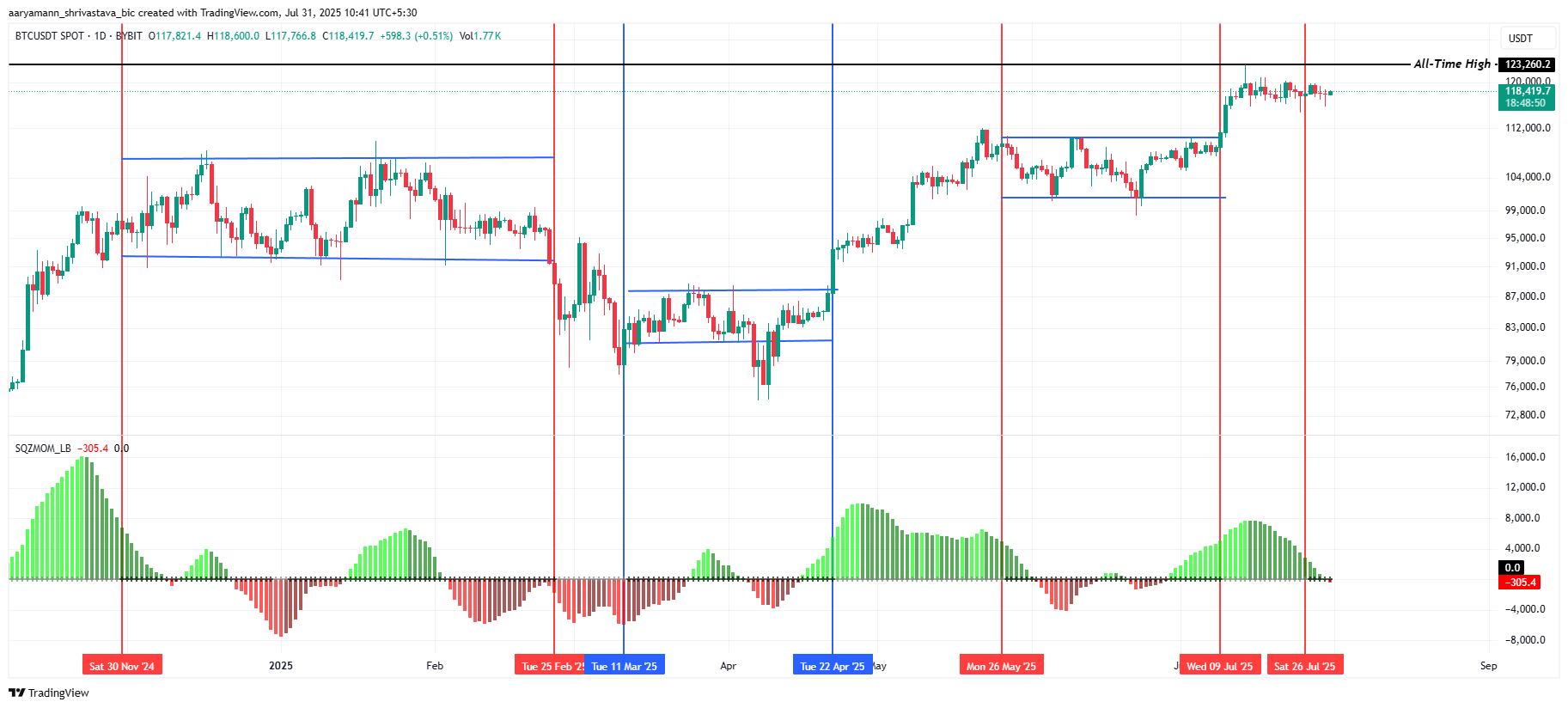

The Squeeze Momentum Indicator (SMI) is signaling that bitcoin is entering a consolidation phase. Historically, these periods of consolidation, where price movement becomes more limited, have preceded significant price moves once the squeeze is released.

As the squeeze continues to build, Bitcoin’s price is poised for a sharp MOVE in one direction. If the broader market remains bearish, Bitcoin could see a sharp decline, particularly if the SMI confirms this negative trend in the coming days.

BTC Price Needs To Jump

Bitcoin is currently trading at $118,410, after falling to $115,700 on Wednesday as the FOMC report came out. The market’s response to the Federal Reserve’s decision to keep interest rates unchanged led to BTC’s recovery, but the underlying market conditions still pose risks.

Bitcoin’s price is susceptible to further declines if investors start booking profits, potentially pushing the cryptocurrency below the $117,261 support level. A drop past this support could lead Bitcoin’s price to $115,000 or even lower.

The only way this bearish outlook WOULD be invalidated is if Bitcoin manages to hold above $120,000 and reclaim $122,000 as support. A surge above these levels would likely provide the momentum needed to push Bitcoin toward new highs. However, until that happens, Bitcoin’s price remains vulnerable to fluctuations and market pressures.