Bitcoin (BTC) August Outlook: Key Trends to Watch as Markets Heat Up

Bitcoin braces for a pivotal August as institutional interest clashes with macro headwinds. Here's what seasoned traders are tracking.

Liquidity Crunch or Breakout Fuel?

With Q3 capital flows drying up faster than a DeFi rug pull, BTC's historical August volatility (averaging ±18% since 2020) could get amplified. CME open interest suggests big money positioning for a move—but which way?

The ETF Effect 2.0

BlackRock's spot BTC ETF now holds 3% of circulating supply. Watch for ripple effects as pension funds dip toes in crypto—assuming they can navigate the KYC paperwork.

Miner Capitulation Cliff

Hashprice languishes at $0.08/TH—below break-even for older rigs. Either hash rate drops 15% (bullish supply shock) or forced selling pressures prices. Pick your poison.

As always in crypto: the 'narrative' will change twice before lunch. But one truth remains—Wall Street still can't decide whether to adopt blockchain or sue it into oblivion.

Bitcoin’s Bullish Run Pauses as Miners Shift From Holding to Selling

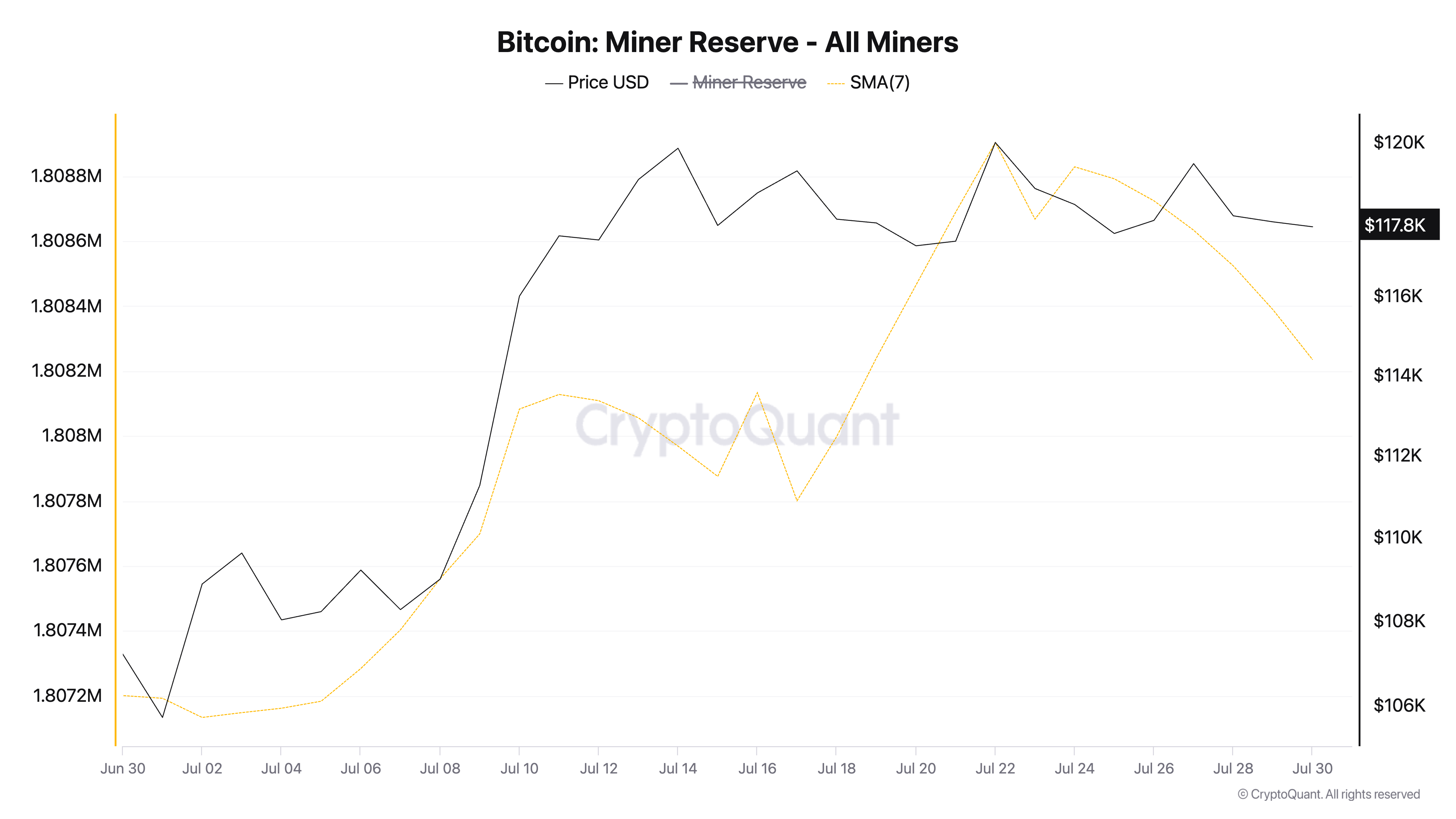

As BTC’s value began to climb at the start of the month, miners on the Bitcoin network also ramped up accumulation, reflected in the uptick in the coin’s Miner Reserve.

According to CryptoQuant data, this metric—observed using a seven-day moving average (7-day SMA)—rose by 0.05% between July 1 and July 22, peaking at 1.808 million coins.

: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

The Miner Reserve metric tracks the total amount of BTC held in wallets associated with mining entities. When the reserve climbs, it signals that miners are holding onto their coins rather than selling, reflecting bullish sentiment or expectations of continued price growth.

However, following BTC’s rally to its July 14 peak and the subsequent consolidation phase—within which it continues to trade—bullish sentiment among miners has begun to wane. According to CryptoQuant, the Miner Reserve has trended downward since July 22, indicating increased profit-taking or reduced confidence in BTC’s short-term price outlook.

Given that miners control a significant portion of BTC’s newly issued supply, changes in their behavior can impact price direction. A decline in miner reserves like this can worsen selling pressure, raising the risk of a BTC price correction in August.

Institutional Inflows Could Offset Miner Sell Pressure in August

In an exclusive interview with Abdul Rafay Gadit, Co-Founder and Chief Financial Officer at Zignaly, he said that the recent uptick in miner reserves earlier in July was “likely a short-term pause rather than the start of aggressive accumulation.”

“The uptick in miner reserves suggests they’re choosing to hold onto their BTC, likely waiting for stronger market signals or more favorable price conditions. It doesn’t yet reflect broad-based accumulation; rather, it appears to be a strategic slowdown in selling. If Bitcoin’s price stabilizes or trends upward, we could see accumulation resume gradually, but for now, it’s more about preserving capital than making bold bets,” he told BeInCrypto.

When asked about the relative influence of miner activity compared to institutional demand on BTC’s current price performance and what to expect, Gadit noted that:

“Institutional demand is the real backbone of Bitcoin’s current price structure. Flows from ETFs, particularly those managed by BlackRock, Fidelity, and Ark, are creating a consistent structural bid that’s supporting price levels more effectively than reduced miner selling.”

He added:

“While miner behavior does play a role in easing short-term supply pressure, the real force behind the market’s direction is shaped by institutional capital, broader participation, and growing expectations of a more favorable regulatory climate. The reality is that miners are no longer setting the pace; institutions are.”

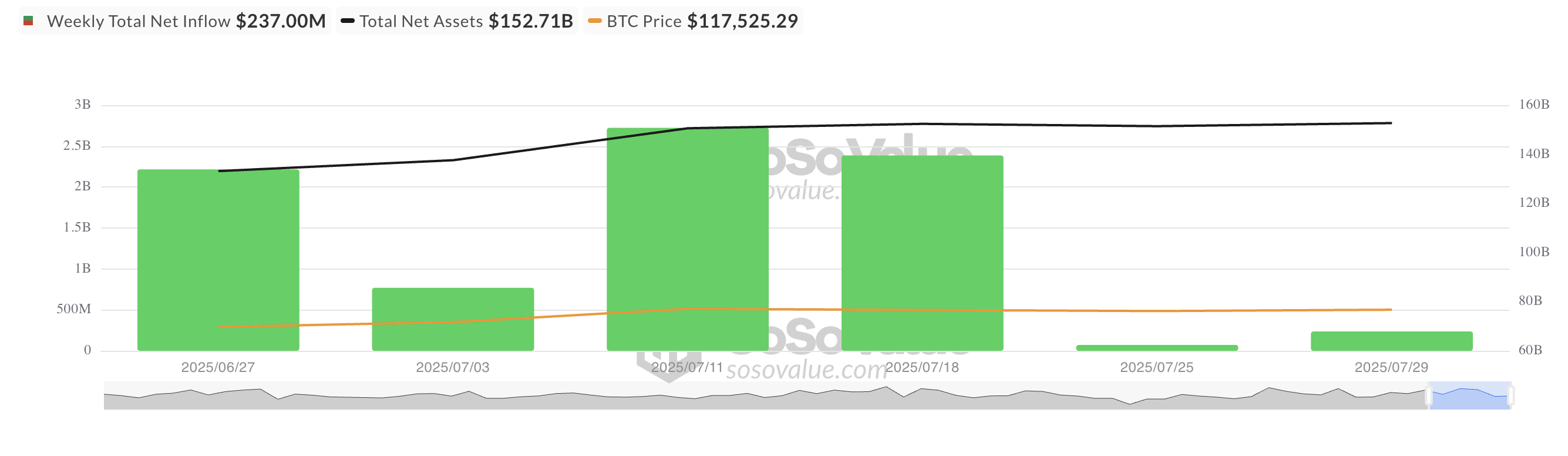

With growing institutional demand for BTC—reflected in the steady inflows into BTC-backed ETFs—any potential sell-side pressure from miners could be effectively counterbalanced, helping to keep the coin’s price stable in August.

According to data from SoSoValue, BTC ETFs have recorded $237 million in net inflows so far this week, despite the coin trading mostly sideways.

Total bitcoin Spot ETF Net Inflow. Source: SosoValue

This confirms Gadit’s view that institutional capital, rather than miner activity, is the primary force supporting BTC’s price and could help stabilize it in the coming month.

Can Bitcoin Shake Off the Sideways Trend?

At press time, BTC trades at $117,826, hovering between the support floor formed at $116,952 and the resistance at $120,811. If institutional demand increases and general market sentiment improves, it could push the coin’s price past the $120,811 resistance and toward its all-time high in August.

On the other hand, if bearish pressure climbs, the coin could break below $116,925 and fall to $114,354.