🚀 Must-See Crypto Headlines: MicroStrategy’s Bold Earnings, Jupiter Lend’s Game-Changing Registration, Trump’s Crypto Bombshell & More

Crypto markets never sleep—here's what's shaking the digital asset world this week.

MicroStrategy Doubles Down

Michael Saylor's BTC-hoarding machine drops Q2 earnings. Spoiler: They bought more Bitcoin. Because when your treasury strategy is 'HODL or bust,' why stop now?

Jupiter Lend Opens Floodgates

DeFi's latest lending protocol launches registration with promises of 'institutional-grade yields'—which in crypto-speak means 'prepare for APY whiplash.'

Trump Drops Crypto Manifesto

The former president's campaign releases a pro-blockchain policy paper. Because nothing says 'financial revolution' like political opportunism in an election year.

Bonus Finance Jab

Meanwhile, traditional bankers still think 'stablecoins' are a type of orthopedic footwear.

Resolv Fee Switch Activation

The activation of Resolv’s (RESOLV) fee switch mechanism on July 31 marks a notable protocol upgrade. The mechanism adjusts transaction fees to enhance liquidity and redistribute rewards to token holders.

Resolv is activating the fee switch — targeting 10% of daily protocol profits to the Foundation treasury.

The rollout will be carried out from 31 July to 21 August, increasing weekly over four increments (2.5% → 5% → 7.5% → 10%). pic.twitter.com/sprBNF8Fs2

Data on BeInCrypto’s price index shows RESOLV trading at $0.219, with a 14% 24-hour gain and a market cap of $58 million. This reflects positive sentiment following similar updates reported by Binance.

The mechanism, designed to optimize ecosystem sustainability, could drive short-term price surges.

“Resolv is activating their fee switch, directing 5M revenue from their huge TVL pool towards their token at just 45m Market Cap Here’s why this will change everything… This enables an economic loop that rewards long-term stakeholder alignment… Fees apply to positive daily profits from the collateral pool… This adaptive execution and capital discipline highlight sustainable yield generation,” one user explained.

However, long-term success depends on sustained user adoption. Investors should monitor trading volume spikes and prepare for potential volatility, as the market reacts to this novel fee model’s effectiveness.

Fluid DEX Lite Launch

Fluid DEX Lite’s launch introduces a capital-efficient decentralized exchange (DEX) powered by the Liquidity Layer.

Introducing the first credit-based protocol on top of Fluid:

Fluid DEX Lite![]() pic.twitter.com/ZVOOBX8H3U

pic.twitter.com/ZVOOBX8H3U

![]()

It promises up to $39 in liquidity per $1 in total value locked (TVL). This launch builds on Fluid’s reputation for scalability, integrating smart debt and collateral features. It comes only months after Fluid expanded to the Base chain.

“Fluid DEX is expanding to Base. Built for the builders. Powered by the Smart Collateral & Smart Debt,” the network revealed in a May 30 post.

Market participants should anticipate increased trading activity and potential price volatility as early adopters engage.

Watching FLUID’s TVL and user adoption metrics will be key to gauging its impact, with opportunities for gains if the DEX meets its ambitious efficiency claims.

Jupiter Lend Registration

Registration for Jupiter Lend, a new money market on Solana powered by Fluid, closes today, July 28, at 09:48 AM EAT. The deadline is ahead of Jupiter Lend’s imminent debut, which is scheduled for sometime around mid-August.

![]()

![]()

![]()

Jupiter Lend to go live in mid-August

Jupiter Desktop Wallet in development

[REDACTED], enabling Jupiter to enter one of the hottest financial sectors, is coming in Q3 pic.twitter.com/YR6cePrx2w

Jupiter Lend aims to unlock instant liquidity and maximize returns. Participants missing the deadline will lose early access, potentially missing out on initial yield opportunities. Post-registration, focus on user feedback and liquidity provision rates to assess long-term viability.

Investors should swiftly register and monitor JUP’s price action, as the launch could trigger a rally.

CoinGecko data shows Jupiter’s JUP was trading for $0.6064 as of this writing, up by nearly 6% in the last 24 hours.

Trump Administration’s Crypto Report

The Trump administration’s major crypto report, due on July 30, could reshape the regulatory playing field in the US, building on its pro-crypto executive order earlier in the year. This report may outline policies to support blockchain growth, reversing prior restrictive measures.

Investors should brace for potential price volatility, since the report will coincide with several US economic signals on Wednesday.

“The WHITE House Crypto Report is expected to be released on the 30th. That’s on the same day that we will get GDP, PCE data & the Fed Rate Cut Decision,” one user observed.

MicroStrategy Q2 Earnings

Another crypto news item to watch this week is MicroStrategy (MSTR) ‘s (NYSE: MSTR) earnings release on July 31. Known for its aggressive BTC acquisition strategy, MicroStrategy’s earnings report could influence its stock and, by extension, Bitcoin’s price.

![]() PRESS RELEASE

PRESS RELEASE![]()

STRATEGY Q2 EARNINGS RELEASE DATE CONFIRMED FOR JULY 31ST 2025 AFTER MARKET CLOSE! pic.twitter.com/wjmtJ2Ca94

Positive earnings, especially tied to Bitcoin holdings, may boost both assets, while disappointing results could trigger sell-offs.

Market participants should analyze bitcoin exposure details and guidance on future purchases, preparing for heightened volatility around this date.

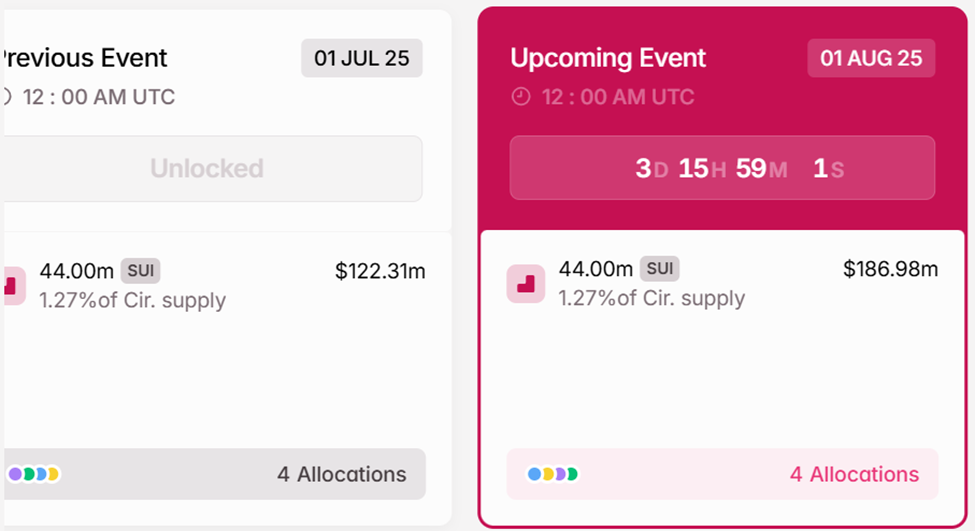

$186 Million Worth of SUI Unlocks

Data on Tokenomist.ai shows that the sui blockchain will hold a $186.98 million token unlocks event on Friday, August 1. The event comprises 44 million SUI tokens to be unleashed to the market.

The tokens, comprising 1.27% of its circulating supply, will be allocated to the community reserve, early contributors, Series B funding, and the Mysten Labs treasury.

This supply shock could influence the SUI price. Recent reports indicated that 90% of large token unlocks drive token values down.

If token recipients cash in for early profits, the sui price could drop. As of this writing, it was trading for $4.25, up by a modest 0.74% in the last 24 hours.