Bitcoin Primed for August Breakout: Sell-Side Pressure Hits Historic Lows

Bitcoin's coiled spring is tightening—and the August launchpad looks clearer than ever.

Why traders aren't sweating the sell-side

On-chain metrics show exchange reserves drying up faster than a Wall Streeter's empathy. With leveraged shorts at yearly lows and spot accumulation accelerating, the path of least resistance points north.

The FOMO trigger nobody's watching

While institutional desks obsess over ETF flows, retail's quiet accumulation below $70k could spark the mother of all liquidity grabs. Remember: markets climb walls of worry—and right now, the bears are fresh out of bricks.

One hedge fund manager's 'cautious optimism' disclaimer does little to mask the elephant in the room: TradFi still can't decide whether to short BTC or beg for a job at Coinbase.

Bitcoin Investors Are Sending Positive Signals

The current sell-side risk ratio for Bitcoin is at 0.24, marking a 6-month high. Nevertheless, it is well below the neutral threshold of 0.4 and closer to the low-value realization threshold of 0.1. This suggests that the market is experiencing consolidation, with investor behavior indicating a pause in large sell-offs.

Historically, periods of low sell-side risk have signaled market bottoms or accumulation phases, where investors wait for a favorable moment to drive prices higher. This accumulation is important because it suggests that Bitcoin’s price may be primed for a shift.

: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

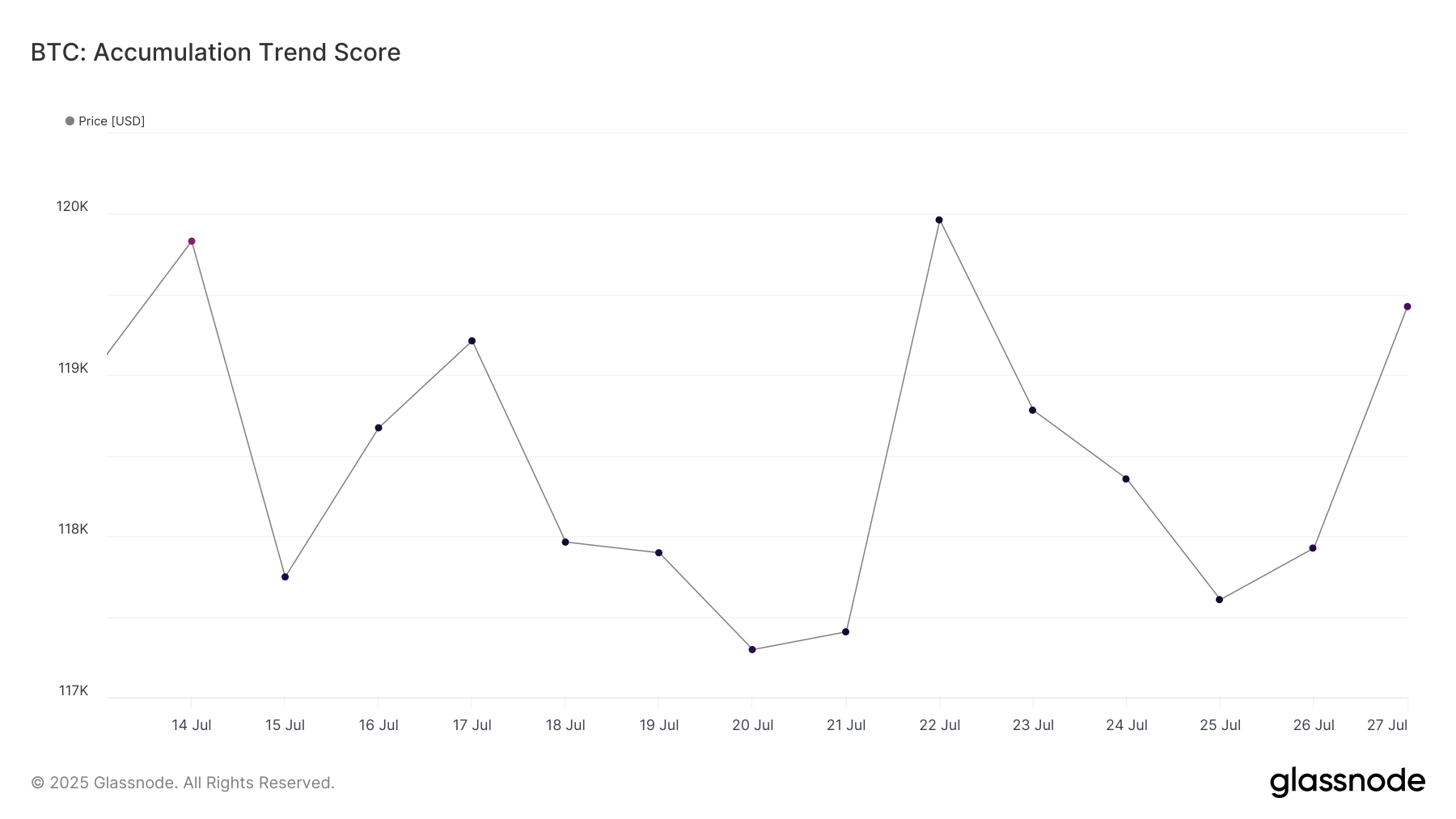

Bitcoin’s accumulation trend score is currently NEAR 1.0 for the past two weeks, indicating that large holders, including whales, are actively accumulating Bitcoin. This trend is essential as these whales have significant influence over the price of the cryptocurrency.

An accumulation score closer to 1 suggests a solid bullish momentum among institutional and high-net-worth investors. This could provide a solid base for bitcoin to break through the resistance levels it has struggled with recently.

The steady accumulation by larger entities implies that there is growing confidence in Bitcoin’s long-term value. This could lead to an increase in Bitcoin’s price as more capital is injected into the market by investors.

BTC Price Can Find Its Way To The ATH

Bitcoin’s price is currently hovering at $118,938, within a consolidation range between $117,261 and $120,000. While this range has held steady, the possibility of breaking through $120,000 is high if investor sentiment remains strong.

Historically, August has been a bearish month for Bitcoin, with the median monthly return sitting at -8.3%. However, given the current accumulation trend and the low sell-side risk, Bitcoin may defy its historical trend this year. If Bitcoin can secure $120,000 as support, it WOULD likely push past $122,000 and move toward the ATH.

However, there remains a risk that the market could turn bearish if investors shift their stance due to unforeseen market factors. In this case, Bitcoin could lose support at $117,261 and slide to $115,000, reversing the bullish thesis.