ZORA Price Skyrockets 360% to ATH: The Hidden Forces Behind the Meteoric Rise

ZORA just ripped through its previous ceiling—so what’s fueling this parabolic rally?

The NFT Infrastructure Play No One Saw Coming

While legacy finance was busy shorting meme stocks, ZORA’s decentralized protocol quietly became the backbone for NFT creators. Now, traders are piling in as Ethereum’s ecosystem heats up.

Liquidity Tsunami Meets FOMO

With a 360% pump in record time, even crypto OGs are double-checking charts. Is this sustainable growth or just degens chasing the next dopamine hit? (Spoiler: Wall Street still doesn’t get it.)

The token’s defying gravity—for now. But in crypto, what goes up… usually goes sideways.

Why is ZORA Coin’s Price Up?

For context, ZORA launched in late April, with 10% of its total supply of 10 billion tokens earmarked for an airdrop to early users. The token also secured listings on major exchanges.

Yet, the initial excitement was short-lived. As user engagement and traffic dwindled, the token’s price followed suit.

Nonetheless, the coin regained momentum in mid-July after its integration with the Base App. As reported by BeInCrypto, Coinbase launched the app on July 17 as a rebranded version of its wallet.

This app utilizes Farcaster and Zora’s infrastructure. It enables users to tokenize and trade content.

The ZORA token plays a crucial role in minting content coins, paying referral fees, and participating in ecosystem incentives. This integration kicked off a rally, which was further boosted by more catalysts.

NEWS: $ZORA is up 21.6% after its integration with the rebranded @baseapp app. pic.twitter.com/Oldeqlt3I1

— CoinGecko (@coingecko) July 17, 2025On July 25, Binance Futures listed ZORAUSDT Perpetual Contract with 50x leverage. The combination of increased accessibility and the utility boosted the altcoin’s value by 360% over the past week.

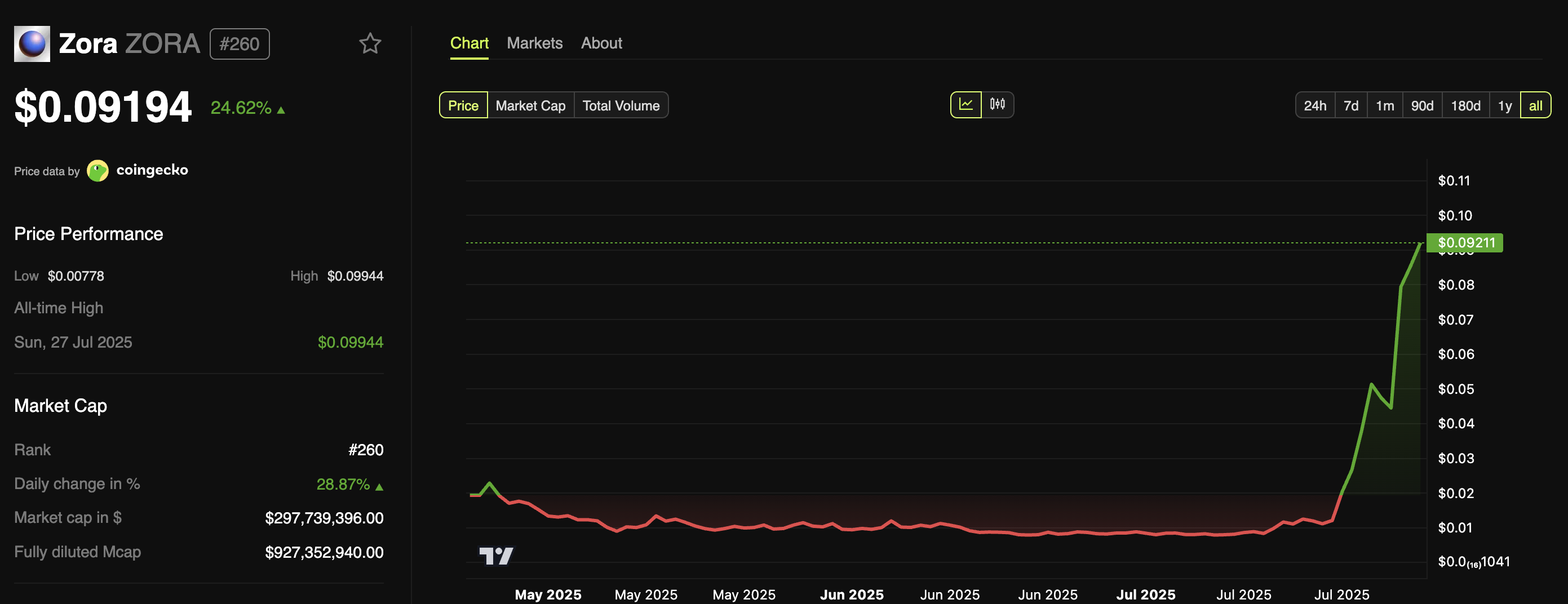

BeInCrypto data showed that ZORA reached a record peak of $0.099 on July 27 before experiencing a modest correction. Despite this, the token saw a 24.6% uptick over the past 24 hours. At the time of writing, ZORA was trading at $0.091.

With this price pump, the token’s market capitalization has also risen from around $35 million to nearly $300 million, benefitting numerous investors.

“As ZORA touched a market cap of over $300 million, a whale holding a 3x long position on ZORA is having a floating profit of over $2.2 million,” Onchain Lens posted.

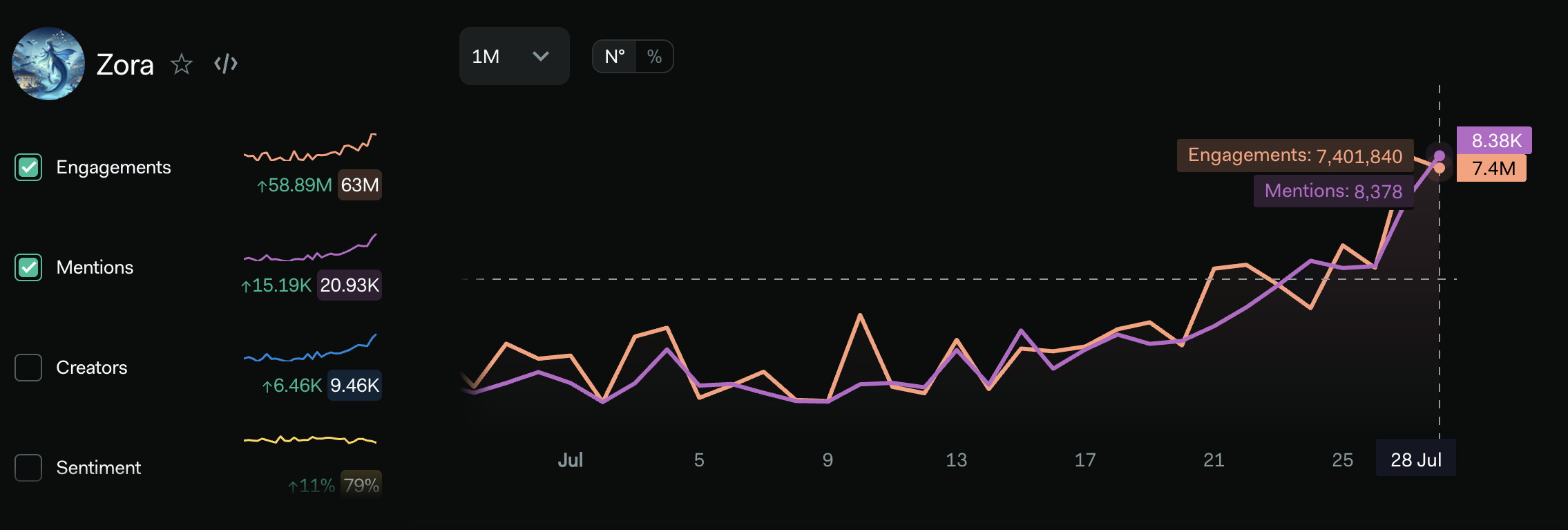

It’s not just the price that has surged. According to LunarCrush data, ZORA mentions increased from 2,893 to 8,378, marking an approximate rise of 189.6% over the past week. Similarly, engagements grew from 4.2 million to 7.4 million.

This reflected an increase of around 76.2%. The coin has also secured a spot as one of the top trending cryptocurrencies on CoinGecko.

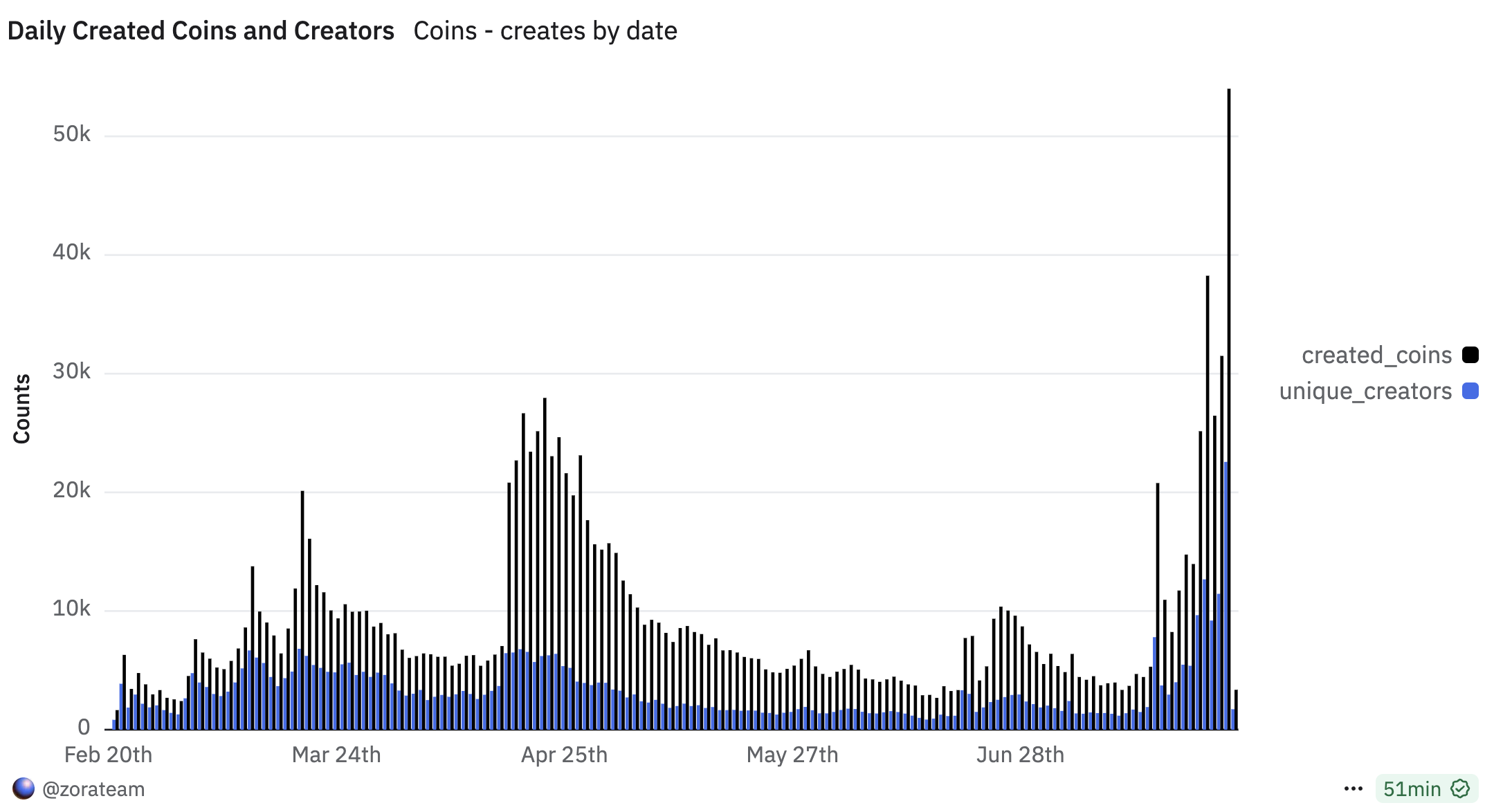

The Zora platform activity also climbed. According to the latest data from Dune Analytics, the total number of coins created peaked at over 54,000 on July 27. Moreover, the number of unique creators reached a record high of 22,567.

These numbers reflect ZORA’s impressive comeback, demonstrating not only its recovery but also its growing influence. While the token’s future will depend on market conditions, its current trajectory highlights the potential of combining social, financial, and blockchain technologies.