SPARK (SPK) SOARS TO ATH THEN CRASHES 25%—BULL TRAP OR BUYING OPPORTUNITY?

Spark just gave crypto traders whiplash—pumping to record highs before nosediving 25% in a brutal correction. Was this a classic 'buy the rumor, sell the news' play, or just another Tuesday in DeFi?

THE RISE AND FALL

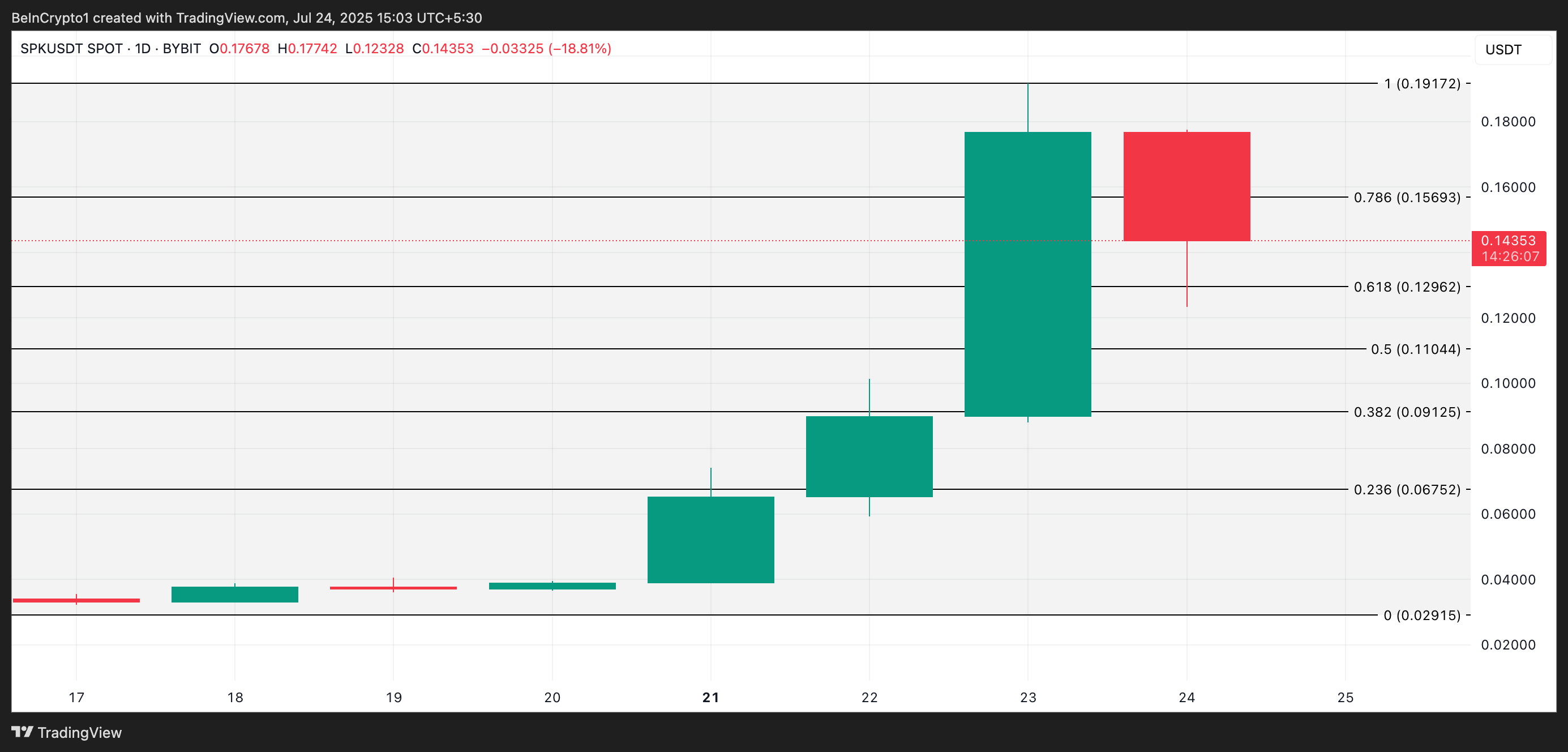

SPK rode a wave of hype to smash its all-time high, only to get smacked down by profit-takers. The 25% plunge left bagholders screaming—and contrarians licking their chops.

WHAT'S NEXT?

Technical analysts are split: some see a healthy pullback before the next leg up, others spot a textbook bull trap. Meanwhile, degens are already YOLOing into leveraged longs (because clearly, that worked so well last time).

One thing's certain—when SPK moves, it doesn't do subtle. Strap in or step back, but either way: maybe don't check your portfolio before your morning coffee.

SPK’s Rally Stalls: Net Outflows Surge and Bearish Bets Rise

An assessment of SPK’s spot netflow provides insight into the cooling rally. According to Coinglass, the altcoin has witnessed a significant spike in net outflows from its spot markets during today’s session, totaling $4.53 million as of this writing.

: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

A spike in spot net outflow means that more tokens are being withdrawn from exchanges than deposited. This trend reflects sell-offs by SPK holders who capitalized on the token’s month-long rally to secure profits.

As a result, downward pressure on its price has intensified, raising the likelihood of a further pullback from its all-time high.

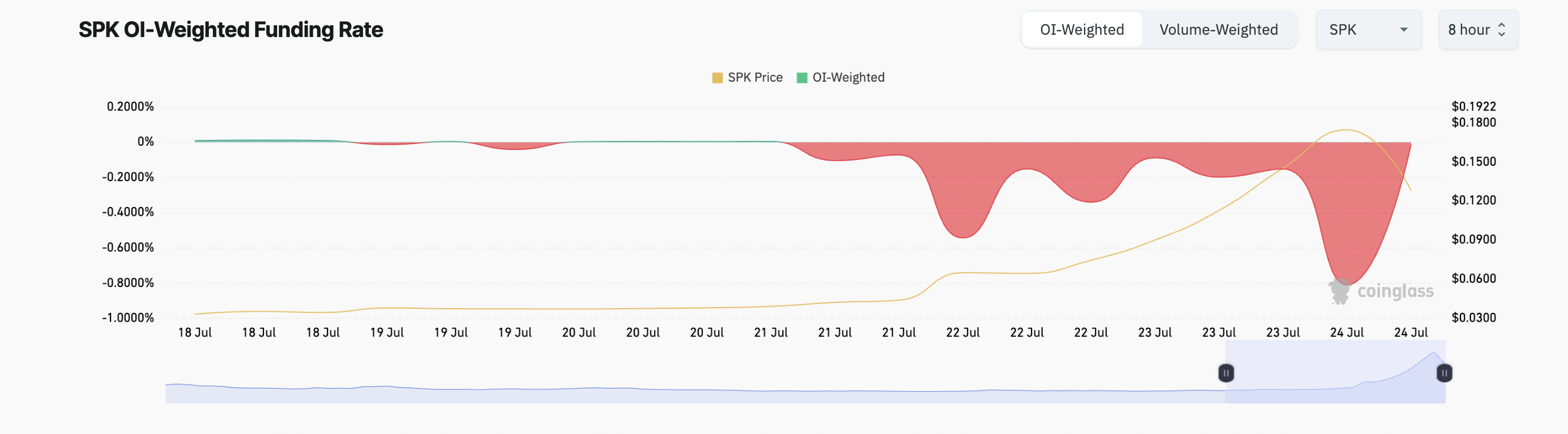

Additionally, SPK’s futures market sentiment has remained increasingly bearish. This is reflected by its funding rate, which has returned only negative values since July 21.

The funding rate is a periodic payment exchanged between long and short traders in perpetual futures contracts to keep the contract price aligned with the underlying asset’s spot price. When its value is negative, short sellers are paying long holders.

This indicates that bearish sentiment dominates the SPK market, with more traders betting on the price to fall.

Profit-Taking Drags SPK Lower; Will $0.12 Hold or Is $0.11 Next?

The surge in SPK net outflows and its negative funding rate suggest the token is entering a correction phase. While the token’s long-term fundamentals may remain intact as DeFi activity climbs, short-term indicators suggest that SPK may face further downside over the next few trading sessions.

In that scenario, its value could fall under $0.12 and trend toward $0.11.

However, if profit-taking stalls, SPK could regain strength and attempt a break above $0.15 to reclaim its all-time high of $0.19.