Wall Street’s $1 Billion Ethereum Gamble Fails to Halt ETH’s Relentless Price Plunge

Wall Street threw a billion-dollar lifeline to Ethereum—but the crypto market shrugged. Here's why institutional money isn't moving the needle.

The Whale That Couldn't

When nine-figure bets can't reverse a downtrend, retail investors start asking hard questions. ETH's slide continues despite the so-called 'smart money' doubling down.

Liquidity vs. Sentiment

Turns out even $1B can't outweigh trader psychology. The market's treating Wall Street's crypto debut like another overhyped IPO—initial excitement followed by brutal reality checks.

Defi's Cold Comfort

While bankers play with ETH futures, the real action's still in decentralized protocols. Traditional finance's big entrance? Just another Tuesday in crypto land.

Another day, another reminder: when Wall Street adopts your asset class, you've either won—or lost the plot entirely.

Ethereum Inflows Hit 11-Week Streak as Price Falls Below $3,600

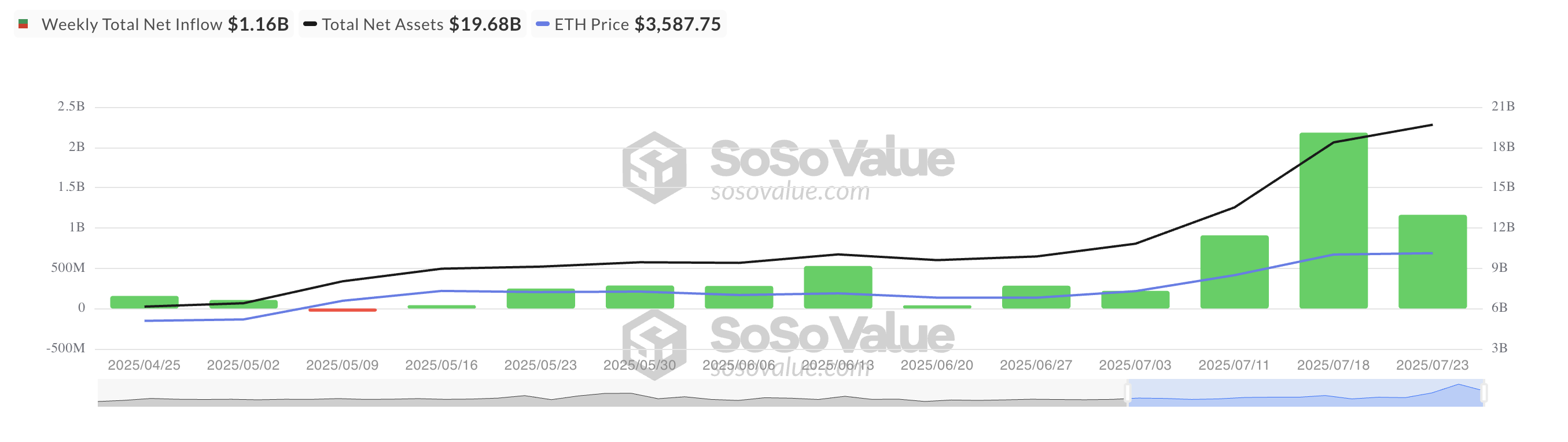

According to SosoValue, the second-largest crypto by market cap is currently in its eleventh consecutive week of net inflows into ETH ETFs. This is in sharp contrast to Bitcoin (BTC), which has witnessed notable net outflows recently as its price decline appears to have shaken investor confidence.

: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

Yet, despite this strong wave of institutional support for ETH, the inflows have not translated into upward price momentum. On the contrary, ETH’s price continues to fall, weighed down by a surge in profit-taking activity.

At press time, the altcoin trades at $3,553, down 5% since Monday. What is triggering this dip?

Smart Money Is Quietly Heading for the Exit

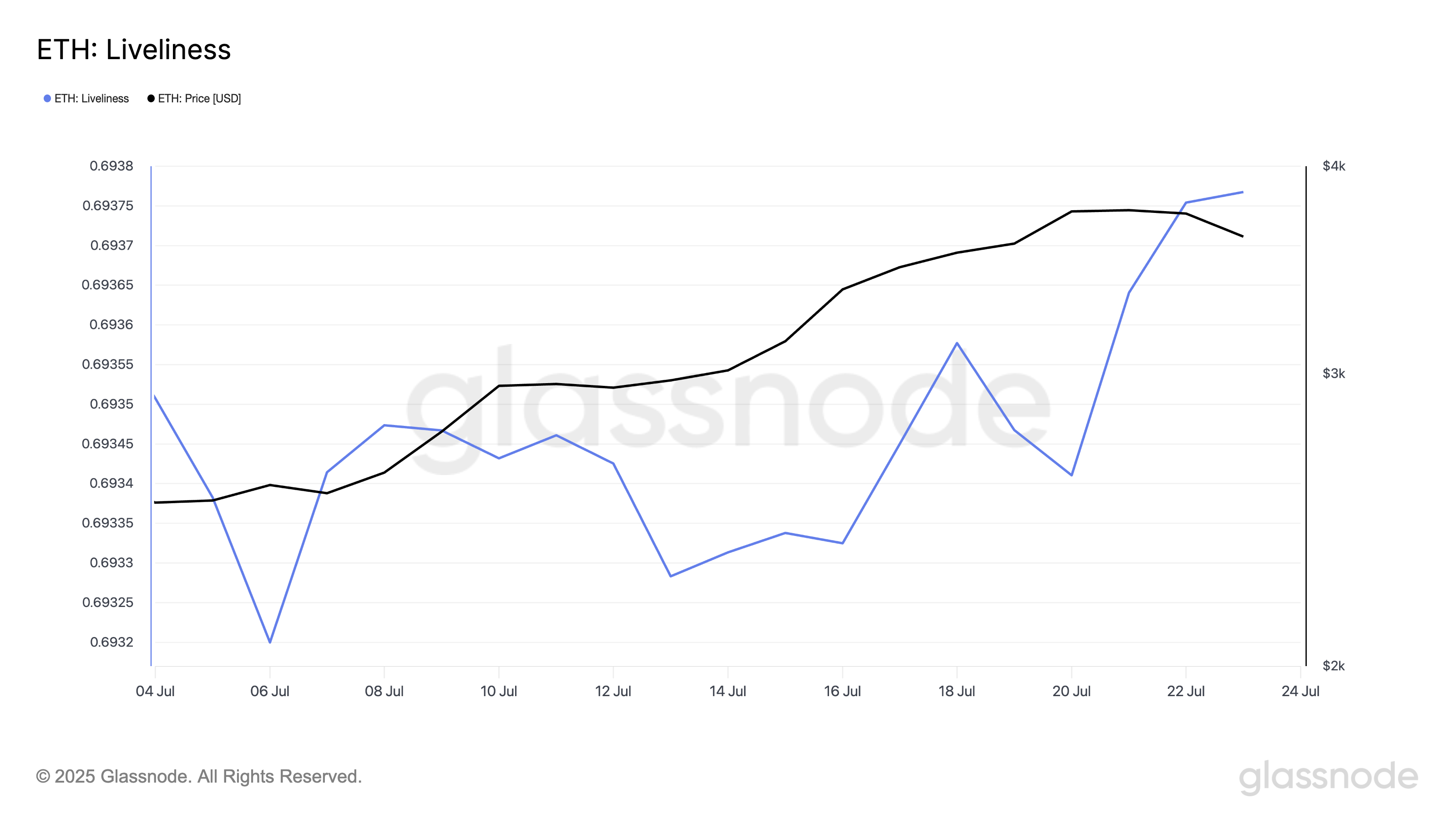

On-chain data shows an uptick in ETH’s Liveliness, which implies that long-term holders (LTHs), typically the most resilient hands in the market, are increasingly selling their coins. At press time, this stands at 0.69.

Liveliness measures the movement of long-held tokens by calculating the ratio of coin days destroyed to the total coin days accumulated. When it falls, LTHs are moving their assets off exchanges and opting to hold.

Conversely, when it rises like this, more dormant tokens are being moved or sold, signaling profit-taking by long-term holders.

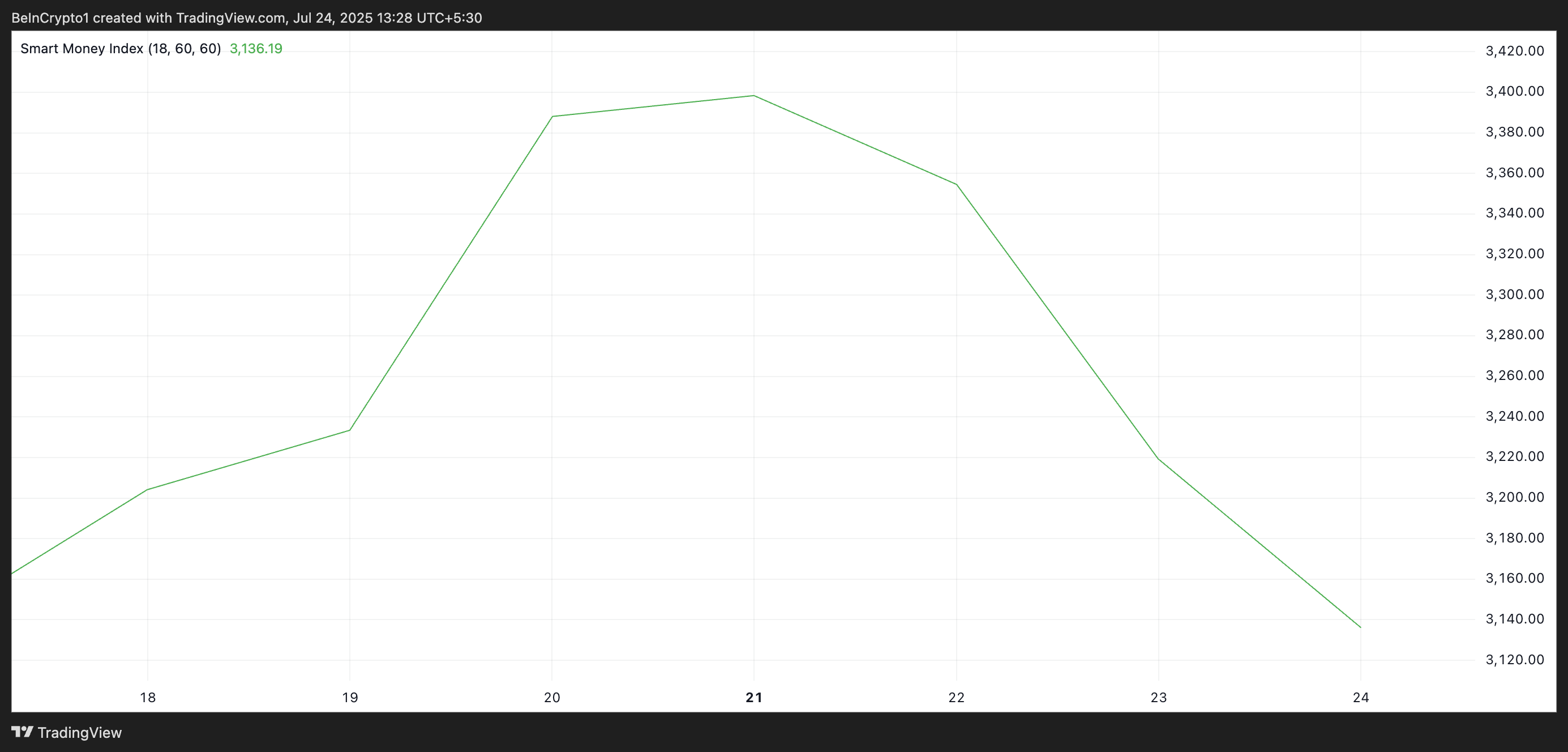

Furthermore, on the ETH/USD one-day chart, the decline in ETH’s Smart Money Index (SMI) confirms the selloff among key coin holders. Readings from this indicator show that its value has dipped by 7% since July 20.

Smart money refers to capital controlled by institutional investors or experienced traders who understand market trends and timing more deeply. The SMI tracks the behavior of these investors by analyzing intraday price movements.

Specifically, it measures selling in the morning (when retail traders dominate) versus buying in the afternoon (when institutions are more active).

When an asset’s SMI falls like this, smart money is offloading its positions—and in ETH’s case, this distribution appears to be driven by a desire to lock in gains from its recent rally.

ETH Faces Tug-of-War Between Smart Money Sellers and Dip Buyers

ETH eyes a decline below $3,524 if its key holders continue to sell. If this level gives way, the altcoin could exchange hands around $3,314. A failure by the bulls to offer support at that point could trigger a deeper correction toward $3,067.

However, if buy-side pressure increases, this bearish outlook WOULD be invalidated. In that scenario, ETH’s price could revisit its recent cycle peak at $3,859 and potentially attempt a breakout above that level.