Story (IP) Skyrockets 20%—Here’s Why Demand & Spot Inflows Are Igniting the Rally

Another day, another crypto moonshot—except this time, it's Story (IP) stealing the spotlight with a blistering 20% surge. What's fueling the frenzy? A perfect storm of retail FOMO and institutional spot inflows. Because nothing pumps a token like a cocktail of hype and fresh capital.

Demand Outpaces Supply (Again)

Buy orders are swallowing the order book whole. Whether it's speculative traders chasing momentum or long-term holders doubling down, the appetite for Story (IP) just hit a fever pitch. Meanwhile, spot inflows suggest even the 'smart money' is playing along—or front-running the next exit liquidity.

The Cynical Take

Let's be real: 20% pops are great until they're not. Remember, in crypto, today's 'narrative-driven rally' is tomorrow's 'rug pull waiting to happen.' But hey—enjoy the ride while it lasts.

IP Is Climbing, and $5 Million in Spot Inflows Say It’s Just Beginning

Story’s native token, IP, currently trades at $5.11, holding firm above a key technical support that has underpinned its rally.

A review of the IP/USD one-day chart shows that the token has consistently traded above an ascending trendline since July 11. This trendline is a bullish formation that emerges when higher lows are formed over time, signaling strong and sustained buying interest.

This trendline has acted as dynamic support. It continues to fuel IP’s price uptick despite the slight market weakness recorded over the past few trading sessions.

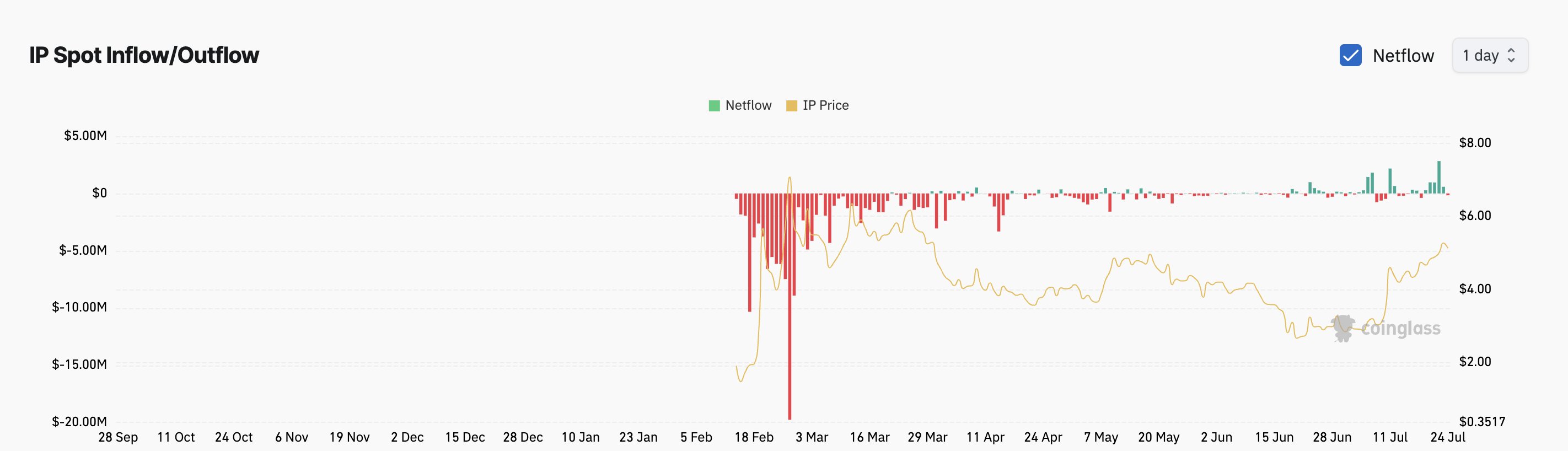

Moreover, spot inflows into IP have remained steady over the past few days, a sign of sustained investor interest and conviction. According to Coinglass, despite the market-wide profit-taking trend, IP recorded consistent spot net inflows over the past four days, exceeding $5 million.

When an asset sees spot net inflows like this, more capital is entering the asset through spot market purchases than exiting. This signals growing investor demand and confidence in IP’s near-term prospects.

Although today has seen a modest $157,000 net outflow from the IP spot market as some traders lock in profits, overall sentiment around the token remains strongly positive.

Futures Traders Bet Big on IP Rally

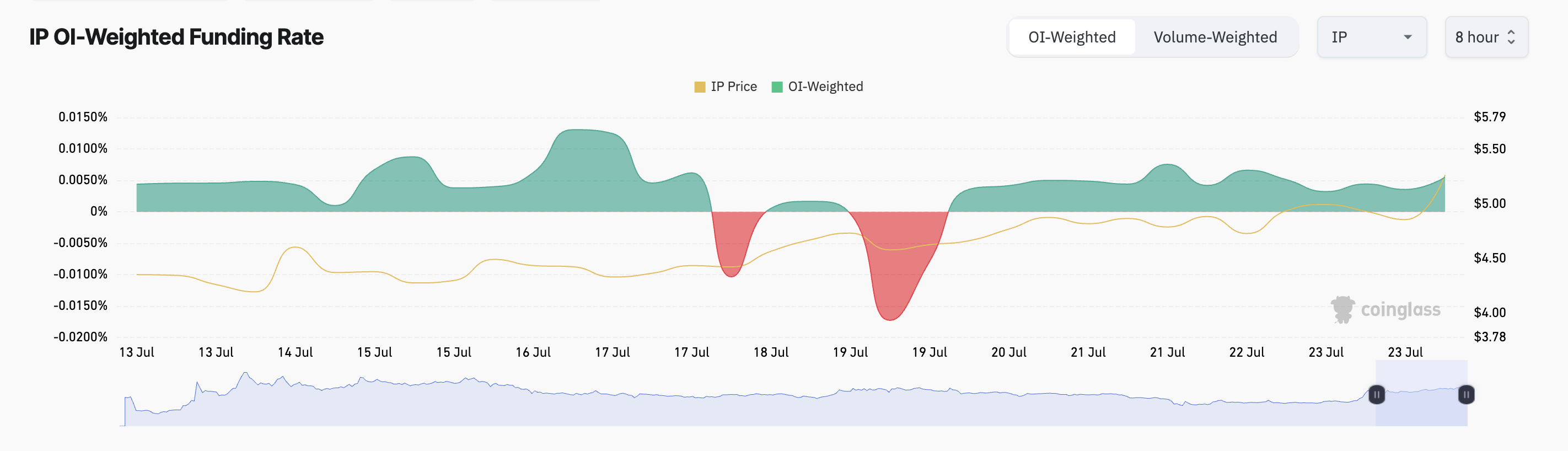

The positive on-chain activity reinforces expectations for further upside in the short term, and this sentiment is also shared among IP futures traders. This is reflected by IP’s funding rate, which has remained positive since July 20.

As of this writing, the metric is at 0.0055%

The funding rate is a periodic fee exchanged between long and short traders in perpetual futures markets. It keeps contract prices aligned with spot prices.

A positive funding rate means traders are paying a premium to hold long positions, indicating bullish market sentiment.

IP’s positive funding rate shows that its futures traders are leaning heavily toward long positions. This strengthens the altcoin’s rally and signals confidence in a continued price surge.

IP Clears $4.92 Wall; Momentum Could Fuel Run Toward March High

IP’s ongoing rally has pushed it above a long-term resistance at $4.92, a price ceiling it struggled with for months. If this level becomes a solid support floor, the token could build on its recent gains and rally toward $5.59, a high last seen in March.

However, weakening demand could see IP retrace its steps. The token could potentially test the $4.92 level, and failure to hold that floor may open the door for a deeper correction toward $3.83.