Solana Teeters on the Brink: Can $200 Hold as Profit-Taking Hits 5-Month Peak?

Solana's rally faces a critical test as traders cash in at levels not seen since February. The $200 support line isn't just a psychological barrier—it's become the battleground for SOL's near-term fate.

Warning signs flash as profit-taking spikes

Network activity and trading volumes tell two different stories. While Solana's ecosystem buzzes with DeFi and NFT projects, the charts show whales dumping bags at what might be the worst possible moment for retail holders.

The institutional perspective

Hedge funds that piled into SOL during the Q2 dip now face their first real stress test. Their exit strategy could turn this healthy correction into a full-blown rout—because nothing builds confidence like watching 'smart money' sprint for the exits.

Bottom line: In crypto, even the most promising tech stacks crumble when traders smell blood in the water. Solana's proving it's no exception.

Solana Profits Pile Up

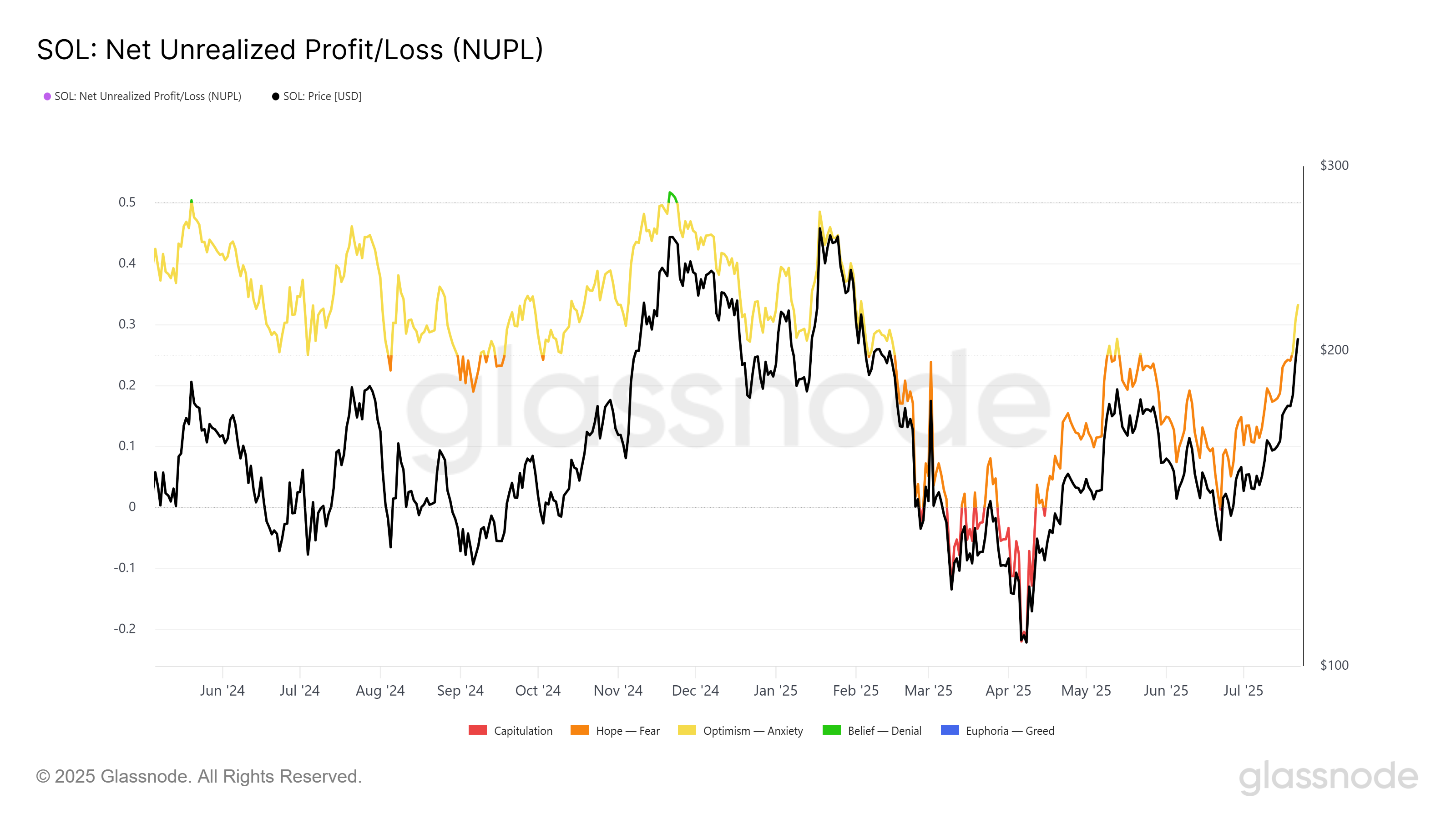

The Net Unrealized Profit/Loss (NUPL) indicator for Solana shows that profits have reached a five-month high. This signals that many investors are in profit, raising concerns about a potential sell-off. Historically, when profits rise sharply into the Optimism zone, it triggers a wave of profit-taking.

This investor sentiment, marked by rising profits, could weigh heavily on Solana’s price action. With increased selling pressure potentially on the horizon, Solana’s recent gains could quickly evaporate if these profit-taking behaviors take hold.

: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

Solana’s technical indicators also signal caution. The Relative Strength Index (RSI) currently sits in the overbought zone, above 70. This suggests that Solana is due for a potential correction, as such levels have historically been followed by price pullbacks. The RSI’s previous forays into this overbought zone have led to price corrections, and this time may be no different.

While the overbought conditions point to a potential decline, it’s also worth noting that the market can remain in overbought territory for extended periods during bullish trends. The key for Solana will be whether investor sentiment shifts towards caution or if the broader market conditions continue to support further gains.

Can SOL Price Secure $200 Support?

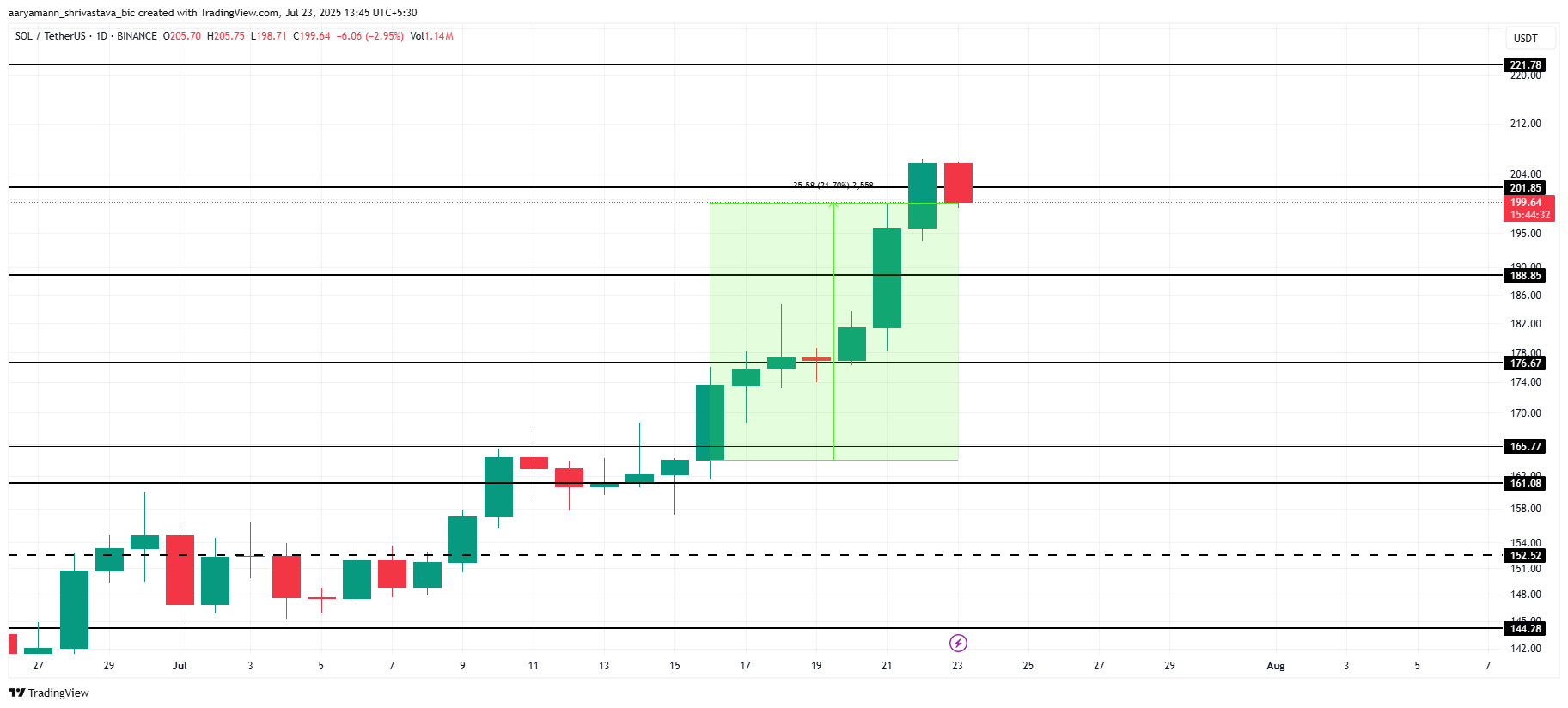

Solana’s price has risen 21% in the past week, now trading at $199. Despite breaching the $200 mark, Solana has failed to maintain this level, marking a five-month high. The altcoin is now facing resistance and potential reversal due to the factors outlined above, including investor profit-taking and overbought conditions.

If these factors hold true, Solana’s price could decline toward the support levels of $188 or even drop to $176. A MOVE below these levels could erase a significant portion of the recent gains and shift the altcoin into a bearish trend.

However, if investor confidence remains strong and the market continues to show bullish signs, Solana could stabilize above $200. Securing this level as support could propel the price back toward $221, invalidating the bearish outlook.