$1.3 Billion Unstaking Tsunami Hits Ethereum — Will ETH Sink or Swim?

Ethereum's staking ecosystem braces for impact as $1.3 billion worth of ETH prepares to flood the market. Here's why this could be a make-or-break moment for the second-largest crypto.

Liquidity Onslaught Looms

Validators are unlocking stakes at a pace not seen since the Shanghai upgrade—market makers are already adjusting order books for the coming volatility. This isn't your average sell pressure; it's a fundamental test of Ethereum's post-Merge economic model.

The Institutional Angle

Watch the OTC desks. Whale-sized unstaking requests (because why exit gracefully when you can rug-pull with paperwork?) could trigger cascading liquidations if ETH price dips below key collateral thresholds.

Silver Lining Playbook

Some degenerate traders see this as the ultimate buy-the-dip opportunity—after all, nothing pumps like a coordinated 'sell the news' event gone wrong. Just ask anyone who survived the last Celsius unlock.

Bottom line: The next 72 hours will separate the diamond hands from the leveraged longs getting margin called. Welcome to Proof-of-Stake economics—where the yields are made up and the staked ETH doesn't matter (until it does).

Over 350,000 ETH Waiting to Be Unstaked—What’s the Implication?

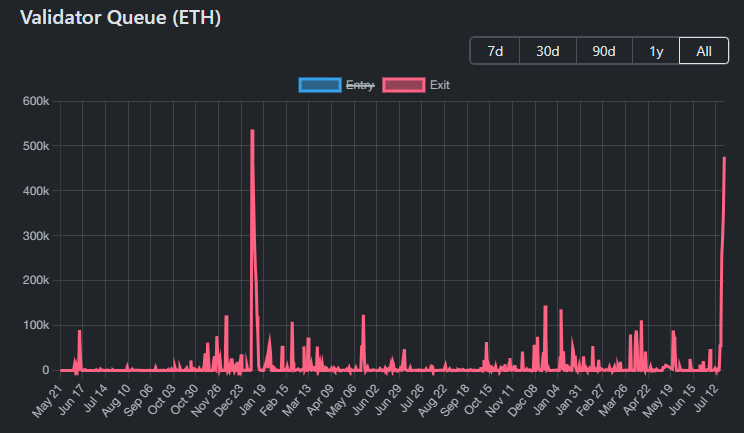

Udi Wertheimer, a prominent investor in the crypto community, raised concerns after discovering that more than 350,000 ETH—worth approximately $1.3 billion—are currently waiting in the unstaking queue.

“There’s 350,000 ETH queued up to unstake. About $1.3 billion. The last time that much ETH was being unstaked was in January 2024, following a 25% rally in ETH/BTC in a single week. [price] went down only from there,” Udi Wertheimer said.

Unstaking allows users to withdraw their ETH from staking smart contracts, turning it back into freely usable assets.

A large wave of unstaking could signal potential selling pressure. This is especially true if investors are looking to take profits after ETH’s 160% rally since its April lows.

Earlier in 2024, more than 500,000 ETH were unstaked before ETH surged from $2,100 to over $4,000, and later dropped back to $2,100.

Where Might This Unstaked ETH Go?

Viktor Bunin, OG Protocol Specialist at Coinbase, suggested that this ETH might be moved into internal treasury funds. These funds could serve financial strategies like long-term investment or portfolio diversification.

If that’s the case, this isn’t a sign of panic selling—it’s more likely a FORM of asset management. This could actually help stabilize the market in the long term.

Meanwhile, a report from Lookonchain shows that on-chain data indicates around 23 whales or institutions have accumulated 681,103 ETH (worth $2.57 billion) since July 1.

And the accumulation hasn’t stopped. In the fourth week of July, more institutions continued to add billions of dollars worth of ETH.

“The new ETH treasury—The Ether Machine—announced $1.5 billion in ETH this morning. That’d be the biggest yet. But then last week, Tom Lee from Fundstrat Capital said he was going to buy $20 billion in ETH, and Joseph Lubin said he was in for at least another $5 billion. I have no idea who’ll end up as the biggest. But I do know this—there’s not enough ETH to go around,” crypto investor Ryan Sean Adams said.

What About ETH Being Staked?

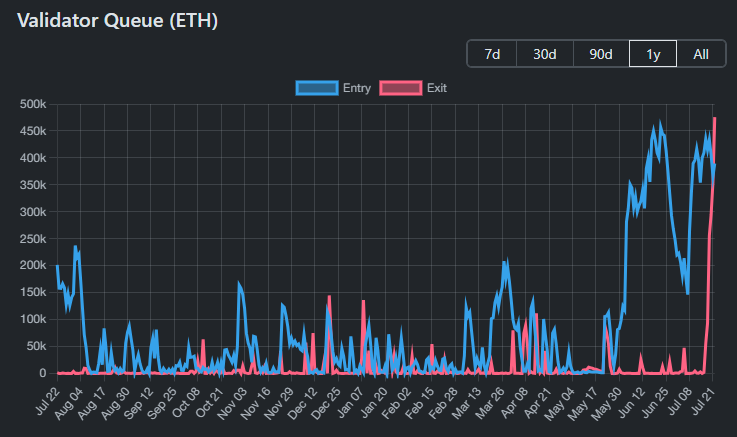

Udi Wertheimer’s concern may sound alarming, especially when compared to historical patterns. However, it lacks a key perspective: the amount of ETH currently waiting to be staked.

Data from ValidatorQueue shows that the ETH queued for staking actually far exceeds the amount queued for unstaking. Since June, this queue has surged, with over 450,000 ETH waiting to be staked on certain days.

This reflects continued investor interest in participating in the ethereum network through staking.

“Also, there’s a healthy amount of ETH queued up for staking at this time,” Wertheimer added.

Data from beaconcha.in shows that over 35.7 million ETH is currently staked across various protocols. This accounts for 29.5% of the circulating supply.

Ultimately, the balance between ETH entering and leaving staking protocols is a critical factor. It helps determine whether the market is facing real selling pressure or simply witnessing strategic reallocation by institutions and individual investors.