Pi Coin Primed for a 114% Surge? History Says Buckle Up

Another day, another crypto moonshot—but this one’s got traders buzzing. Pi Coin, the mobile-mined underdog, is flashing signals of a potential 114% price explosion. Could lightning strike twice?

Patterns or Prayers?

Chartists are dusting off their Fibonacci retracements, pointing to eerie similarities between Pi’s current consolidation and its last parabolic run. Liquidity pools are tightening, and OI in derivatives markets just hit a three-month high—classic pre-pump ingredients.

The Retail FOMO Factor

Mainnet V3 rumors are doing the Telegram rounds, sparking the kind of frenzied speculation that turns grocery-store conversations into trading signals. Never mind that 80% of ‘Pi millionaires’ still can’t cash out—hope springs eternal.

Regulatory Sword of Damocles

SEC scrutiny? Tokenomics tweaks? The usual crypto landmines lurk. But since when did risk assessments stop a good hype train? (Cue eye-roll from every CFA who just lost a client to ‘Pi-to-$100’ YouTube algorithms.)

Bottom line: In a market where Dogecoin became legal tender on Mars (metaphorically speaking), a 114% Pi pump might just be Tuesday. Whether it’s genius or gambling depends entirely on whose balance sheet you’re reading.

Pi Coin Is Receiving Market Support

At the time of writing, Pi Coin’s Bollinger Bands are converging. This technical pattern typically signals incoming volatility, and the last similar event occurred in May. Back then, Pi Coin recorded a massive 114% price increase shortly after the bands widened. A repeat of this move would depend on the broader crypto market’s direction.

Currently, as Bitcoin consolidates and ethereum leads altcoins upward, conditions favor another bullish breakout for Pi Coin. The tightening Bollinger Bands are hinting at imminent movement, and with sentiment leaning bullish, the next wave of volatility may well push Pi Coin higher once again.

: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

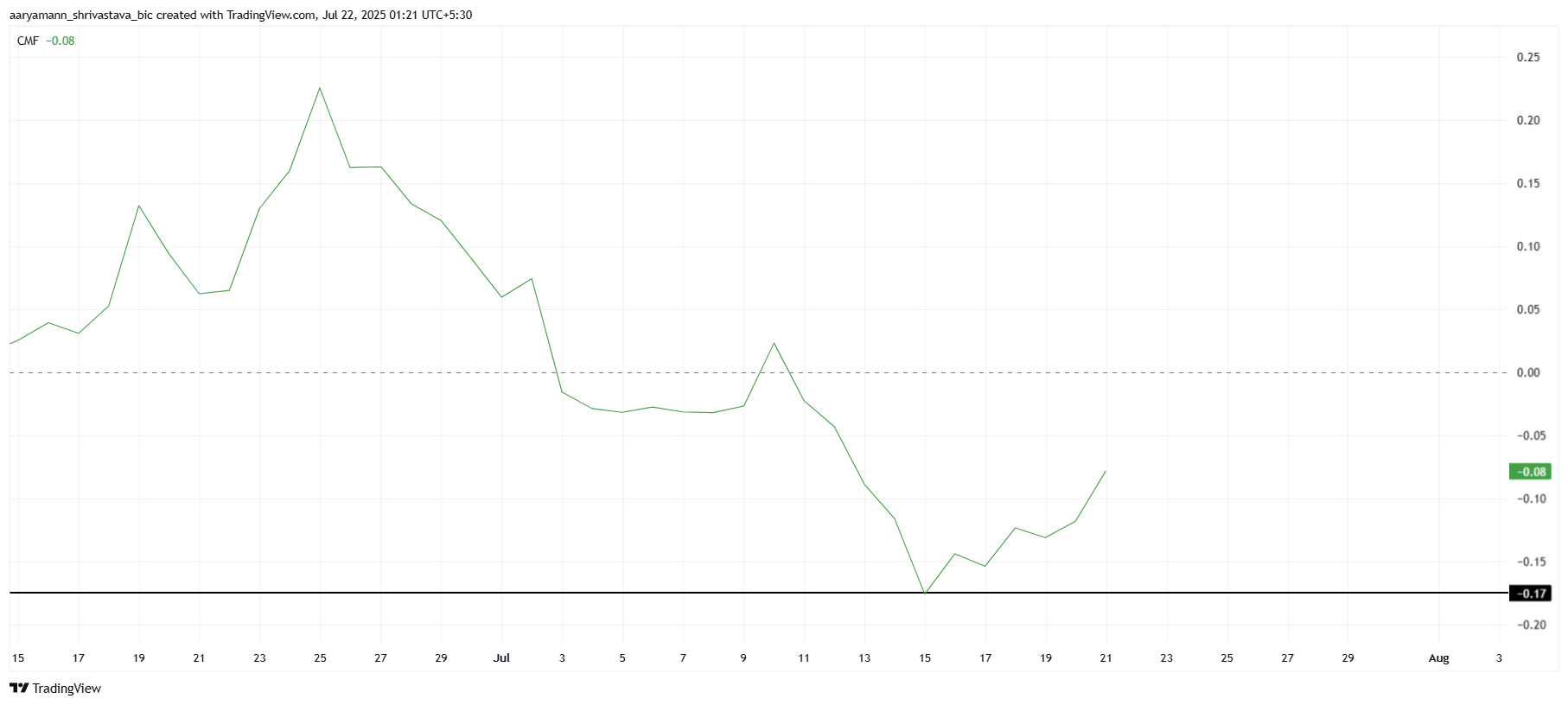

The macro indicators also align with a bullish forecast. The Chaikin Money FLOW (CMF) is trending upward, indicating capital inflow into Pi Coin. This inflow suggests that investors are gaining confidence and could be positioning themselves ahead of a possible altcoin rally.

As money enters the ecosystem, PI Coin benefits from renewed market participation and rising demand. These factors often precede price breakouts and are especially influential when combined with technical signals of volatility.

Can PI Price Bounce Back?

Pi Coin is currently trading at $0.47 after consolidating sideways for several days. This consolidation has worked in its favor, helping the altcoin escape its two-month downtrend. Investors are now watching closely for the next resistance to be broken.

Despite being only 15% from its all-time low of $0.40, the technical indicators suggest this support will hold. If Pi Coin can flip $0.45 into a reliable support level, it could initiate a rally toward $0.51 and beyond, especially if the altcoin season intensifies.

However, if holders begin to exit their positions prematurely, Pi Coin could slip back toward $0.40. Such a move WOULD invalidate the bullish scenario and place the altcoin at risk of retesting its historical low.