Breaking: SOL Hits DeFi Milestone as Korea Doubles Down on Stablecoin Adoption

Solana's ecosystem just shattered another barrier—DeFi protocols on the chain now process over $3B daily, cementing its position as Ethereum's fiercest competitor. Meanwhile, South Korean regulators greenlight a pilot for a won-pegged stablecoin, because nothing says 'financial innovation' like recreating fiat on-chain.

Here's what's fueling the fire:

-

SOL's DeFi Surge

: Transaction volumes spiked 40% this quarter as developers flock to Solana's low-fee environment. Move over, 'ETH killers'—this chain's writing its own playbook.

-

Seoul's Stablecoin Gambit

: The FSA-approved project aims to bridge crypto and traditional finance. Skeptics whisper this might just be a Trojan horse for CBDC testing—but hey, progress wears many masks.

-

The Bigger Picture

: With Asia accelerating crypto integration and layer-1 networks hitting escape velocity, 2025's shaping up to be the year decentralized finance stops asking for permission.

Funny how 'stablecoins' always seem to emerge from governments watching stablecoins work. Stay tuned—the real disruption starts when these systems start bypassing middlemen entirely.

DeFi Development Hits Million SOL Milestone

DeFi Development Corp, dubbed the “SOL version of MicroStrategy,” continues its solana treasury strategy. The NASDAQ-listed firm announced holdings reached 999,999 SOL tokens worth $181 million.

Between July 14-20, they purchased 141,383 SOL for $19 million through spot and locked tokens. Additional staking rewards boosted weekly gains by 867 SOL from validator activities.

The company operates internal Solana validator nodes generating consistent yield from delegations. They raised $19.2 million through equity facilities with $4.98 billion remaining credit capacity. DeFi Development’s SPS reached 0.0514 SOL per share valued at $9.30.

The SOL price surged 8% on Monday, approaching $200 amid expectations of corporate buying. The strategy provides direct Solana exposure while supporting ecosystem growth through validation services.

The Ether Machine Plans NASDAQ Debut with Massive ETH Holdings

The Ether Machine announced its formation through SPAC merger with Dynamix Corporation Monday.

The new entity plans to secure minimum 400,000 ETH by end-2025, worth approximately $220 billion. Trading under ticker ETHM after reverse merger completion, targeting largest public ethereum holder status.

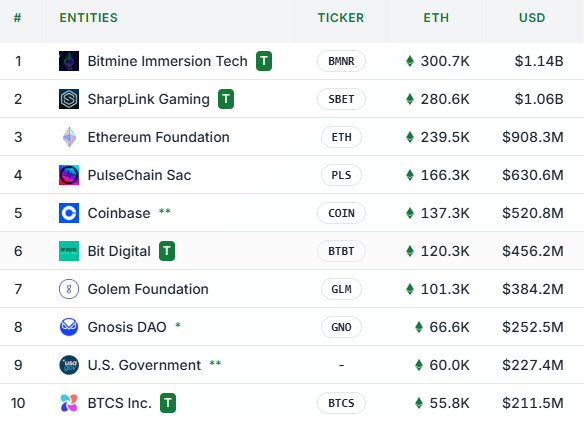

Current leaders include Bitmine Immersion Tech with 300,700 ETH and SharpLink Gaming holding 280,600 ETH.

The company will be led by former ConsenSys executive David Merin and PayPal board member Jonathan Christodoro. Major investors include Pantera Capital and Kraken exchange, providing over $800 million in funding.

The company positions itself as “Ethereum generation company” focused on DeFi strategies and ecosystem development. Merger completion targeted for Q4 2025 with institutional-grade transparent yield generation mechanisms planned.

Korean Ruling Party Advances KRW Stablecoin Legislative Push

Democratic Party of Korea’s research group held an internal seminar on KRW-denominated stablecoin development Tuesday. The currency of South Korea is the won, abbreviated as KRW.

Lawmaker Min Byung-duk, who filed Korea’s first comprehensive digital assets legislation last month, delivered a keynote lecture. Min emphasized protecting monetary sovereignty against dollar stablecoin dominance in global payments. He called KRW stablecoins “last golden opportunity” to capture market share from USD alternatives.

The party plans to establish a dedicated digital assets committee within the National Assembly for systematic policy coordination. Min also indicated to the press after the seminar that Security Token Offering legislation will advance in August after previous delays.

The seminar represents growing political momentum for Korea’s digital asset regulatory framework development.

Paul Kim and Shigeki Mori Contributed.