Bitcoin Whales Trigger Altcoin Frenzy: Is This the Start of a Massive Altseason? | Weekly Whale Watch

Crypto's big players are making waves—again. Bitcoin whales have begun shifting capital into altcoins, sparking speculation of an impending altseason. Here's what's happening under the surface.

Whale Movements: The Hidden Signal

When Bitcoin's titans start diversifying, the market listens. Recent on-chain data reveals unusual accumulation patterns in select altcoins—Ethereum, Solana, and a handful of DeFi tokens are seeing outsized inflows from whale wallets.

The Domino Effect

History shows that when BTC stabilizes after a rally, altcoins tend to catch fire. This isn't organic retail FOMO—it's strategic positioning by players who move markets with single transactions. The last time this happened, altcoin market caps surged 300% in 90 days.

Warning Lights for Bitcoin Maxis?

While Bitcoin purists scoff at 'shitcoin season,' the numbers don't lie. ETH/BTC charts are printing higher lows—a classic altseason precursor. Even Wall Street's latecomers are now forced to acknowledge that crypto isn't a one-coin casino (though they'll still call it gambling).

The Bottom Line: Watch the whales, ignore the noise, and remember—in crypto, the 'smart money' is just whoever bought earlier than you did.

Whale Activity Suggests Bitcoin Is Consolidating

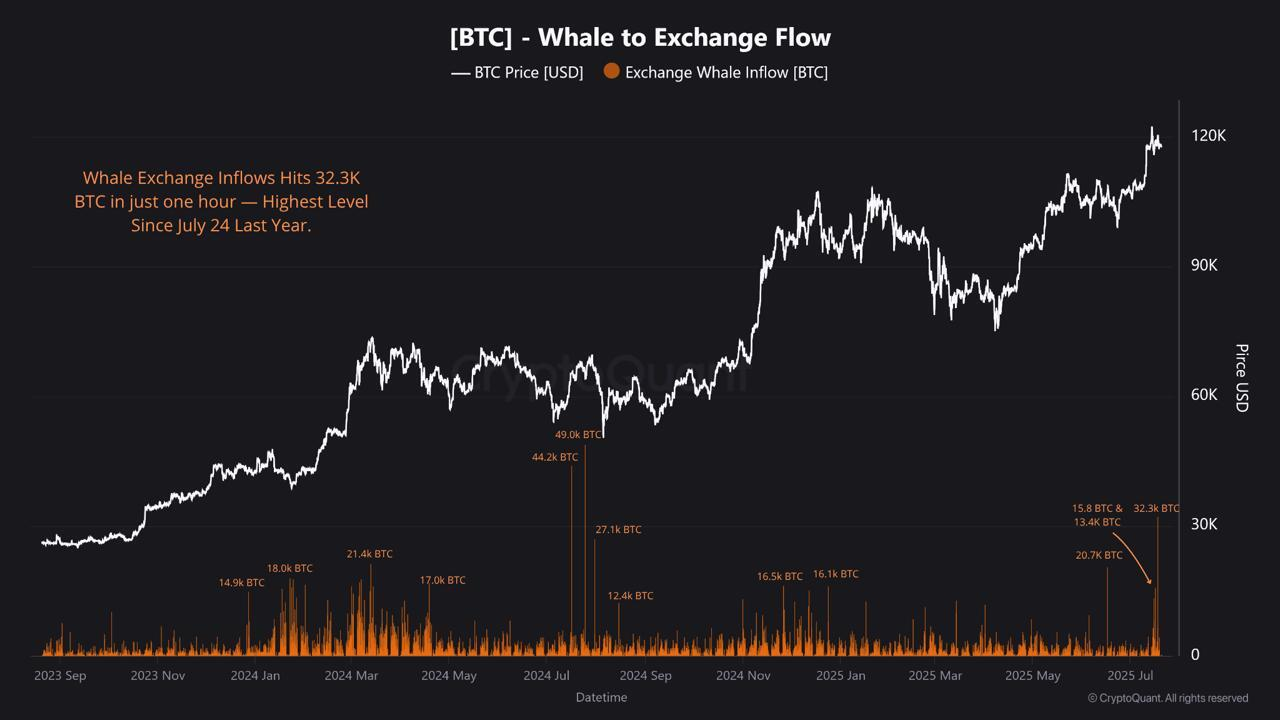

According to data from CryptoQuant, 32,300 BTC flowed into exchanges in just one hour on July 17. That followed two earlier transfers of 15,800 BTC and 13,400 BTC from wallets holding over 100 BTC.

These large movements typically signal profit-taking, especially after bitcoin hit a new all-time high of $123,000 on July 14.

Following the whale inflows, Bitcoin price pulled back and is now trading between $117,000 and $118,000.

Most importantly, the timing aligns with a steep decline in Bitcoin dominance, which fell from 64% to 60% between July 17 and July 21.

A falling dominance metric often indicates that investors are rotating out of Bitcoin and into altcoins. This trend is one of the earliest signs of an emerging altcoin season.

When Bitcoin stabilizes and capital flows into Ethereum, Solana, and mid-cap tokens, altcoins tend to outperform.

Bitcoin’s short-term outlook now leans toward consolidation. If whales continue to sell, further downside pressure is possible.

However, current price support around $115,000 remains intact for now.

Meanwhile, the altcoin market is gaining strength. Ethereum, XRP, and solana have posted double-digit gains in the past week. The meme coin market cap alone has surged 8% today, nearing $90 billion.

The Altcoin Season Index also climbed from 32 to 56, further supporting the shift in market momentum.

In summary, whale activity appears to be cooling Bitcoin’s rally while quietly fueling altcoin gains. The next MOVE depends on whether buyers absorb the sell pressure or if another wave of whale selling occurs.

Overall, this is afor Bitcoin and the. Keep watching whale flows and BTC.D for confirmation of the next phase.