Conflux (CFX) Soars to 7-Month Peak—On-Chain Data Suggests the Rally Isn’t Done Yet

Conflux just punched through its highest price level since December 2024—and the blockchain's own metrics hint this could be just the warm-up act.

Why the surge matters

CFX isn't just riding crypto's usual hype cycle. On-chain activity shows real accumulation, not just traders chasing the next meme coin. (Though let's be honest—Wall Street still thinks all of this is digital Beanie Babies.)

What's fueling the momentum

The network's seeing spikes in both active addresses and transaction volume—the kind of organic growth that makes chart analysts nod approvingly. No celebrity tweets or vague 'partnership' announcements required.

Where it goes next

Key resistance levels are crumbling faster than a Bitcoin maxi's arguments during a bull market. If the network keeps delivering, even the suits might have to stop pretending they 'never doubted it.'

CFX Price Doubles in a Week as Asia-Focused Roadmap Unfolds

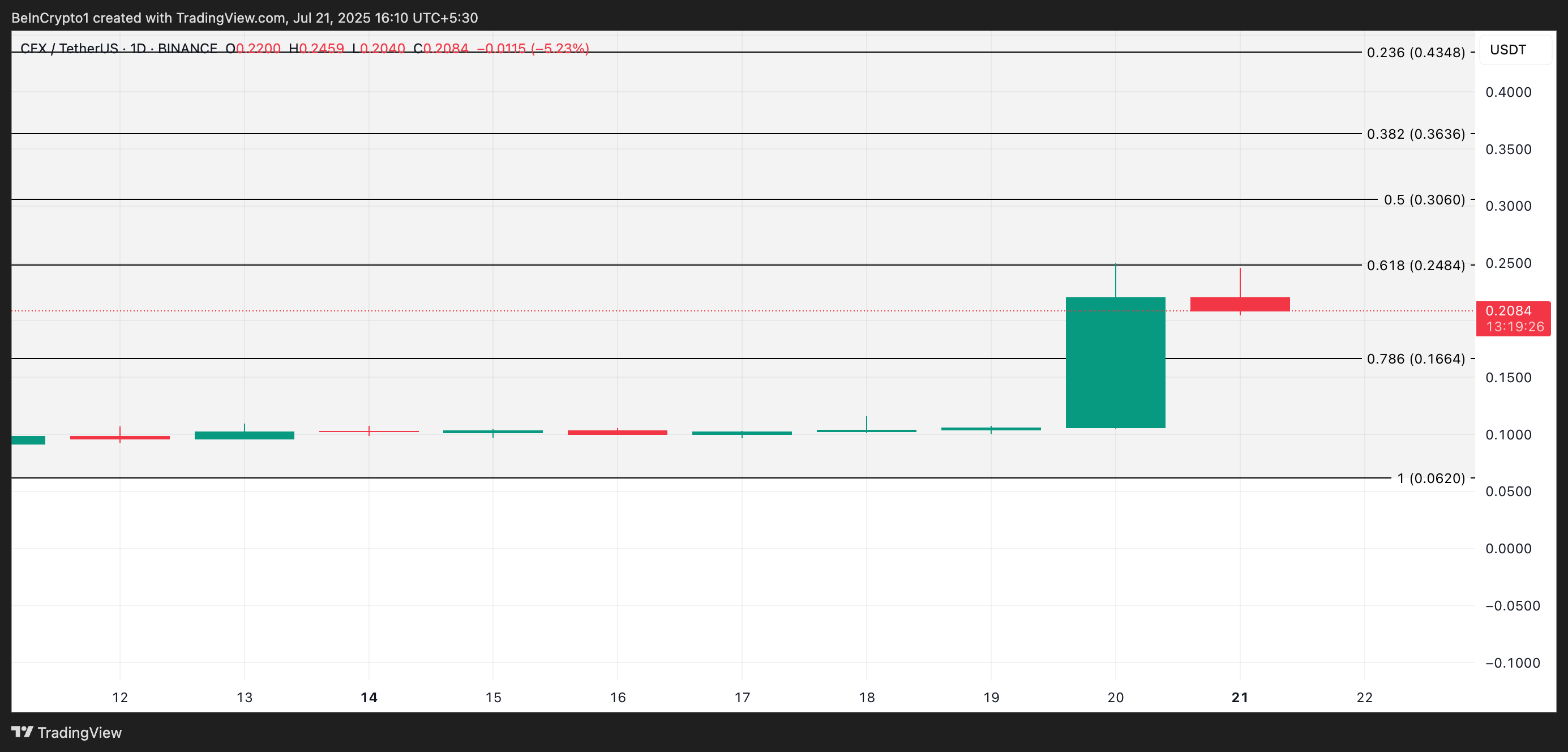

CFX currently trades at $0.23, climbing 83% over the past day. Over the past week, the coin’s price has increased by over 110%.

CFX’s price surge is largely driven by anticipation of its Tree Graph 3.0 mainnet upgrade, set to launch in August. The upgrade promises a major performance boost, enabling up to 15,000 transactions per second. It also introduces support for AI agents, real-world asset settlements, and cross-border payments, aimed at strengthening Web3 infrastructure in Asia.

Further, Conflux is developing an offshore RMB stablecoin in collaboration with AnchorX, Dongxin, and Ping An. The stablecoin is expected to gain traction through upcoming pilot programs in Central and Southeast Asia, expanding Conflux’s regional relevance.

Adding to its momentum, Conflux recently partnered with MetYa, an AI-centric SocialFi platform. These updates have culminated in a surge of demand for CFX, significantly driving up its value over the past few days.

CFX Rallies on Smart Money Accumulation

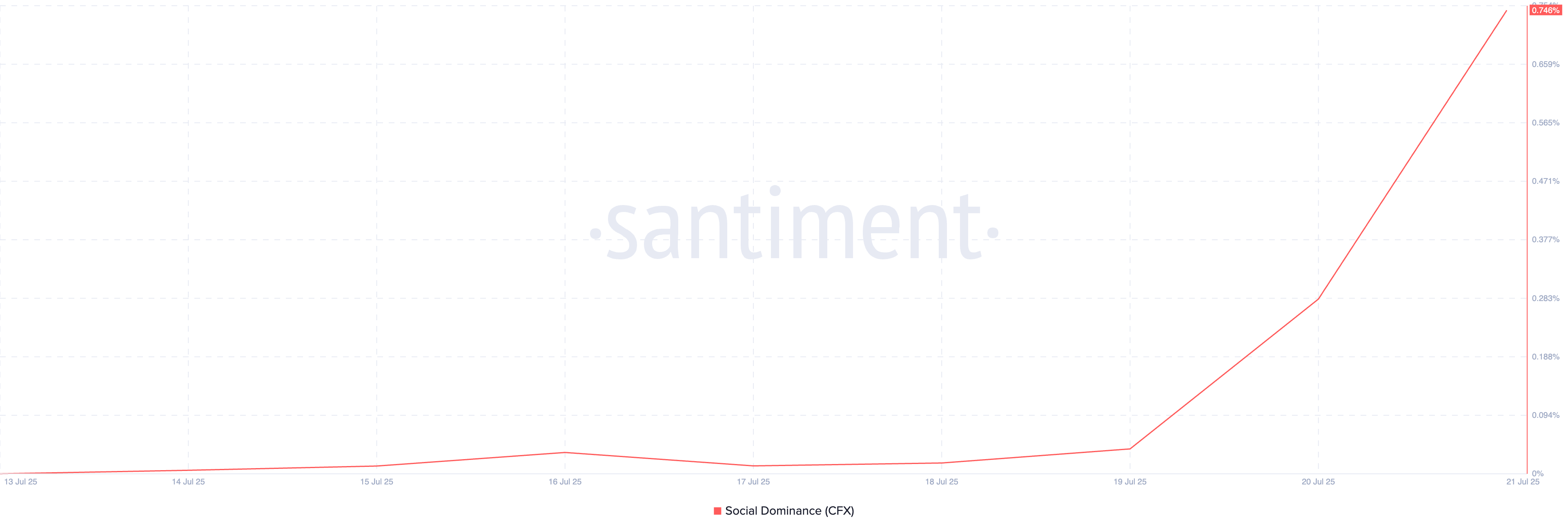

According to Santiment, CFX’s social dominance—a metric that tracks the percentage of crypto-related discussions focused on the asset—has soared to an all-time high. Per the on-chain data provider, this stood at 0.74% at press time, confirming the notable surge in online chatter about CFX.

: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

This confirms that the altcoin has captured significant attention in the broader market conversation, a trend that is often a precursor to increased retail activity and short-term price momentum.

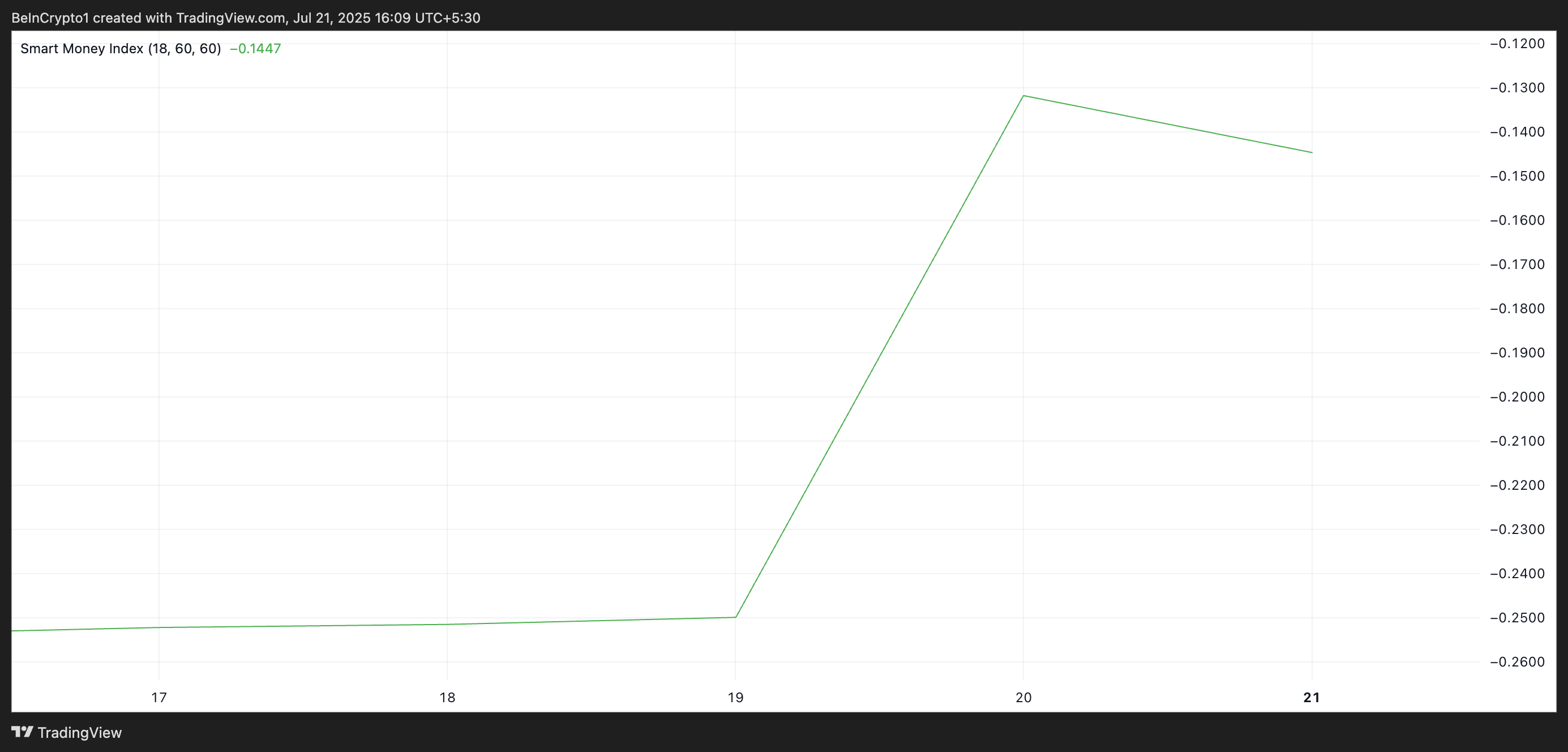

Moreover, over the past three days, CFX’s Smart Money Index (SMI) has climbed, indicating rising interest from influential investors and large holders. Readings from this indicator show that its value has risen by 46% since July 19.

Smart money refers to capital controlled by institutional investors or experienced traders who understand market trends and timing more deeply. The SMI tracks the behavior of these investors by analyzing intraday price movements.

It measures selling in the morning (when retail traders dominate) versus buying in the afternoon (when institutions are more active).

A rising SMI like this signals that smart money is accumulating CFX, often ahead of major price moves — a trend primarily driven by the upcoming launch of the Tree-Graph 3.0 mainnet upgrade, which is set for the next few days.

CFX Eyes Breakout Above $0.25 — Can Bulls Push Toward April 2024 Highs?

Sustained buying pressure could see CFX break above its immediate resistance at $0.2484. A successful breach of this level could drive its price toward $0.306, a high last reached in April 2024.

However, if market participants resume profit-taking, this bullish projection will be invalidated. In that case, the coin’s price could fall to $0.1664.