Dogecoin Surges to February Peaks—But Why Are Long-Term Holders Sneaking Out?

Dogecoin's latest rally has traders cheering—but the smart money might be heading for the exits.

Meme coin mania strikes again as DOGE blasts past February resistance levels. Retail FOMO is pumping the price, while on-chain data shows OGs quietly cashing out.

The great crypto contradiction: When the rocketship takes off, someone's always jumping out the airlock. Institutional-grade irony at its finest.

DOGE Surges 32%, But Long-Term Holders Are Quietly Cashing Out

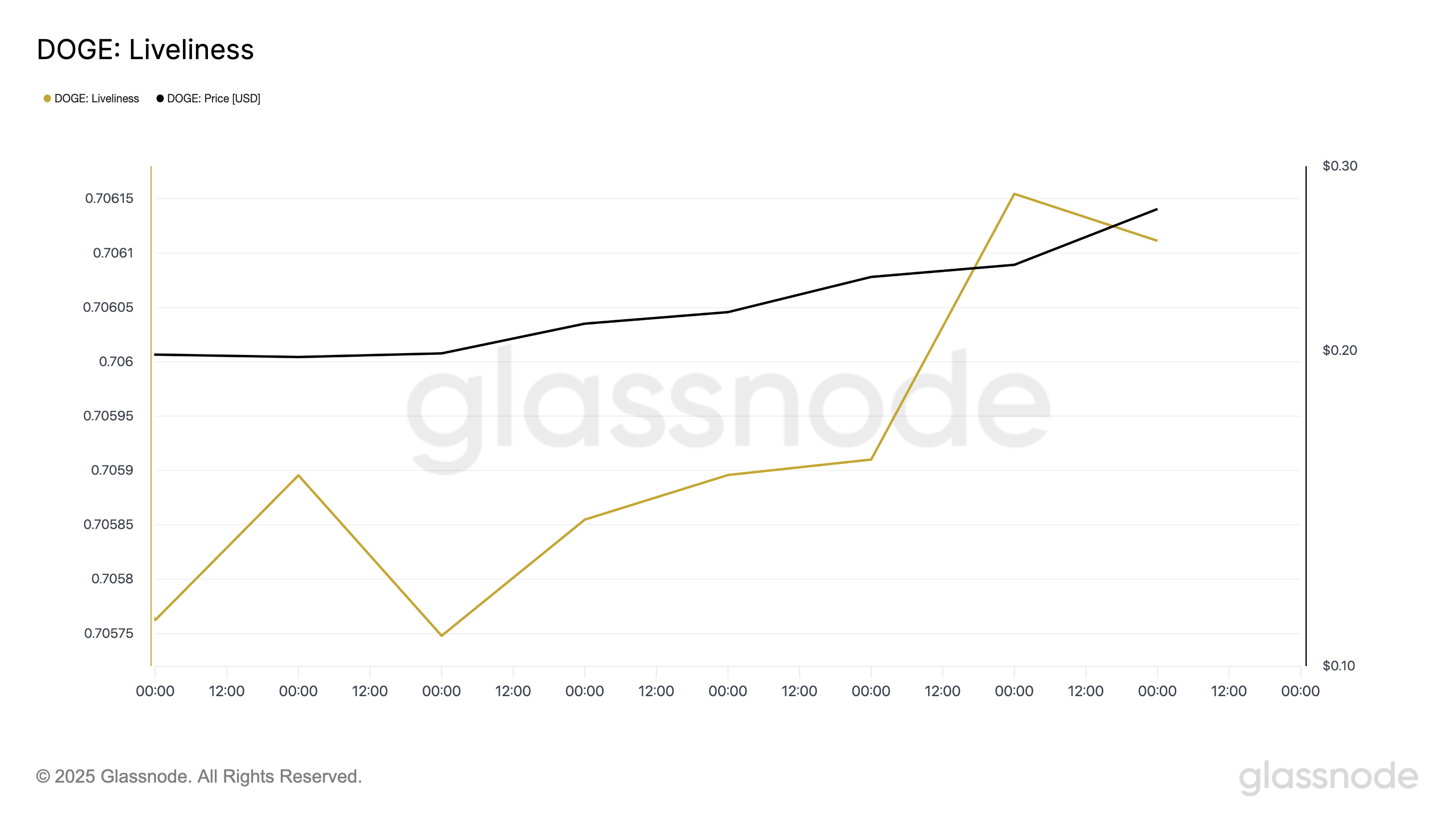

DOGE is up 32% over the past week, trading at $0.2743 at press time. This double-digit price rally comes even as on-chain data shows a sharp rise in the coin’s Liveliness metric—a signal that long-term holders (LTs) are actively moving or selling their holdings.

According to Glassnode, its Liveliness has also grown amid DOGE’s price surge over the past week. It closed at 0.706 on July 20, rising by 0.14% since July 13.

Liveliness measures the movement of long-held tokens by calculating the ratio of coin days destroyed to the total coin days accumulated. When it falls, it indicates that LTHs are moving their assets off exchanges and opting to hold. This is often a sign of accumulation and could drive an asset’s price rally.

Conversely, when it climbs, it suggests that more dormant tokens are being moved or sold, often signaling profit-taking by long-term holders.

Paper Hands Drive Price to February Highs

Interestingly, despite this wave of selling pressure among its LTHs, DOGE’s price remains resilient, maintaining its upward trajectory and showing no immediate signs of reversal. This confirms that short-term holders—or so-called paper hands—are the ones currently driving the rally, capitalizing on the broader market momentum.

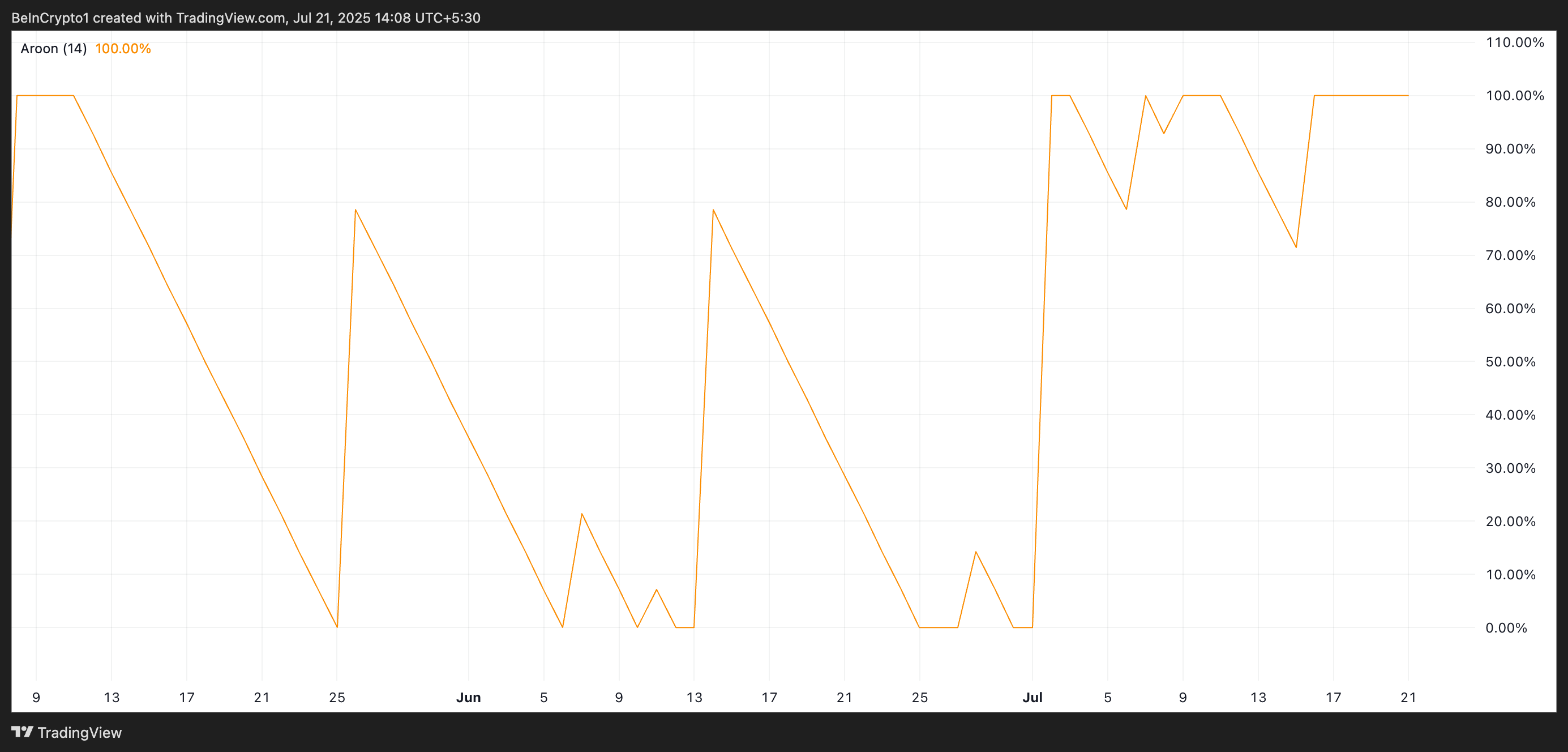

DOGE’s Aroon Up indicator, which currently reads 100%, supports this bullish momentum. The Aroon indicator is a technical analysis tool used to identify trend direction and strength by measuring the time elapsed since the most recent highs or lows.

When the Aroon Up line is at or close to 100%, it suggests that recent price action has consistently hit new highs, indicating strong bullish momentum. This is true of DOGE, which trades at a price level last observed in February.

At 100%, DOGE’s Aroon Up Line signals that the coin is making new highs, and is doing so every single period in the Aroon’s lookback window. This shows an exceptionally strong and consistent uptrend.

DOGE Breaks Into Bullish Formation—Is $0.33 the Next Stop?

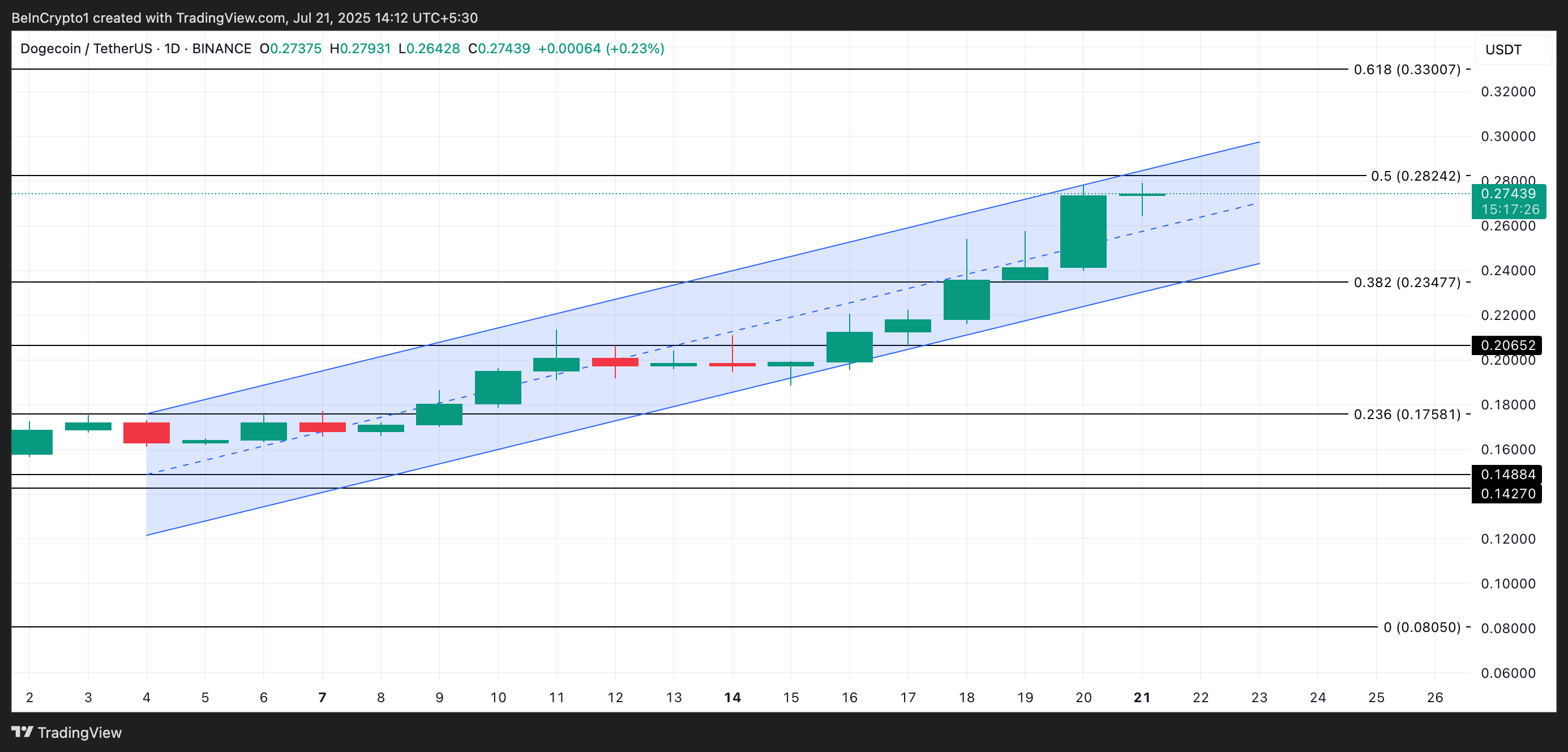

DOGE’s double-digit rally has caused it to trend within an ascending parallel channel on the daily chart. This pattern forms when an asset’s price moves between two upward-sloping, parallel trendlines, one acting as resistance and the other as support.

It indicates a strong, steady uptrend with higher highs and higher lows. The bullish momentum is considered intact as long as the price stays within the channel. If buy-side pressure remains strong, Doge could break above $0.28 and extend its gains to $0.33.

However, DOGE’s value could slip to $0.23 if demand falls.