HBAR Whales Go on a Buying Spree – 5% Surge in Holdings Signals Imminent Price Explosion?

Whale alert: HBAR's big players just stacked another 5% this week. Are they front-running a major move?

When crypto whales start feeding, retail traders scramble for life jackets. The latest on-chain data shows Hedera's heavyweight investors loading up—fast. No fancy derivatives here, just cold hard accumulation.

Price coiled like a spring? Technicals suggest HBAR's consolidation phase might be reaching its expiration date. The token's been trading like a stablecoin while whales treat it like a blue-chip stock.

Funny how 'decentralized' networks still dance when the 1% snaps their fingers. Maybe Web3's more Wall Street than we'd like to admit.

Whale Wallet Surge Signals Confidence

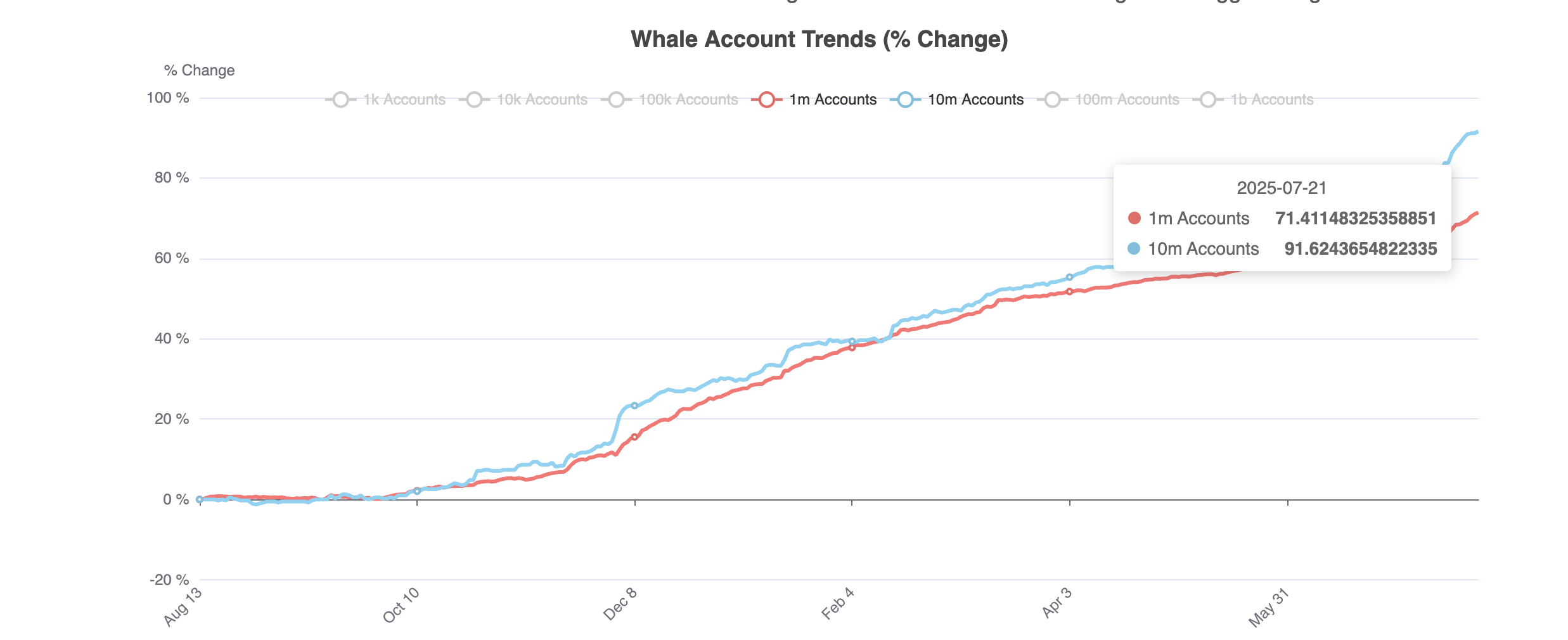

Whale wallets have continued their accumulation spree. Over the past week, the number of wallets holding 1 million HBAR or more rose from 67.28% to 71.41%. Also, wallets with 10 million+ HBAR jumped from 86.29% to 91.62%. That’s a more than 5% rise in a matter of days.

: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

Such a concentrated increase in whale holdings typically reflects growing confidence in near-term price action. It also suggests that larger players are positioning themselves before a potential continuation rally.

Whale wallet data tracks the percentage of supply held by large wallets, helping measure accumulation pressure.

Funding Rate Spikes Show Aggressive Longs

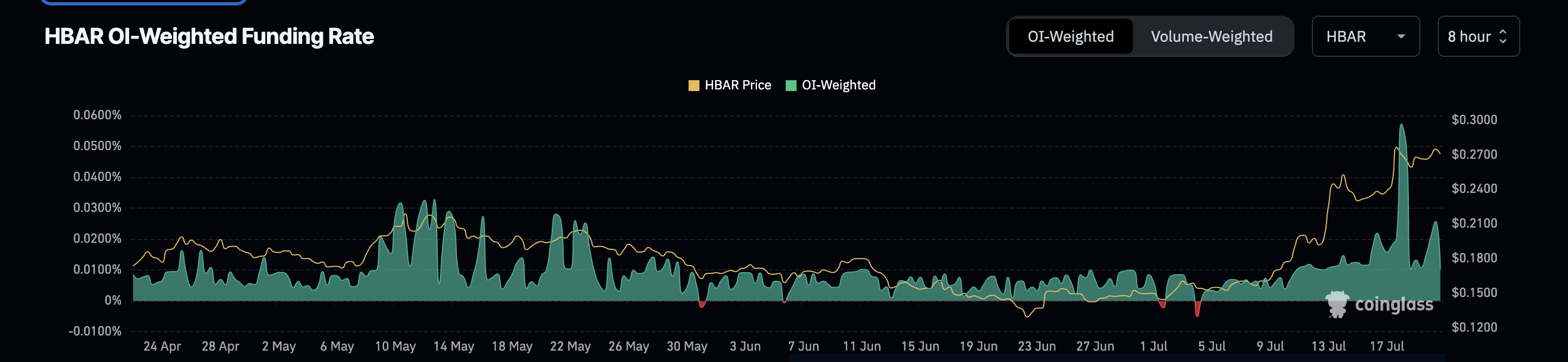

The open interest-weighted funding rate for HBAR reached 0.057% on July 18, its highest level in months. As of July 21, it sits at a still-elevated 0.01%, suggesting that long positions are maintaining their dominance.

This spike in funding rates mirrors HBAR’s recent price rally and implies that leverage is building in favor of bulls. Typically, a rising funding rate indicates aggressive long positioning. It can foreshadow continued upward momentum, especially when backed by whale accumulation.

The good thing here is that the Funding rates (despite being positive) aren’t overheated, suggesting that Leveraged positions do not dominate the derivatives market. This pattern keeps the risk of a long squeeze out for now.

A long squeeze occurs when over-leveraged long positions are forced to exit as prices dip, triggering a cascade of liquidations that accelerates the price drop.

Funding rates reflect the cost of holding leveraged long vs. short positions. A positive rate means longs are paying shorts, suggesting bullish sentiment.

HBAR Price Action Hints at a Breakout Zone

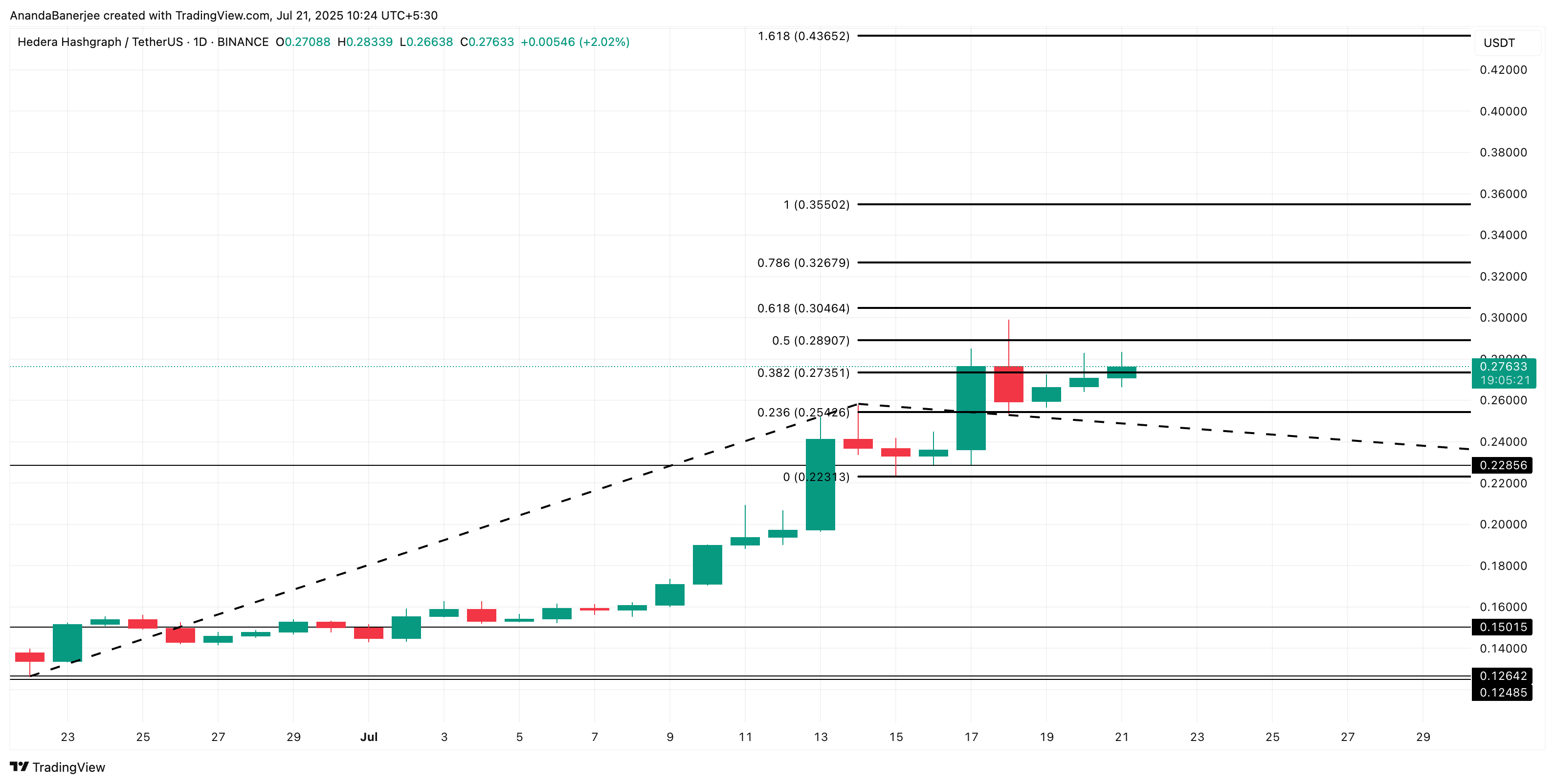

From a technical perspective, HBAR is currently hovering around the 0.382 Fibonacci extension level at $0.27, after cleanly breaking above the 0.236 resistance or the $0.25 price level. This region has acted as a consolidation zone over the past few sessions, with price finding consistent support.

If this level holds, the next resistances lie at $0.28 (0.5 Fib) and $0.30 (0.618 Fib), followed by the $0.32 (0.786 Fib) level. A confirmed breakout from the 0.382 and 0.5 Fib levels could open up the HBAR price path toward $0.35+, which aligns with the 1.0 Fib extension and previous swing highs.

Fibonacci extension levels are used to identify potential targets or resistance zones by utilizing the previous impulse MOVE and a subsequent price retracement. In this price chart, the $0.22 level is used as the retracement zone, as the current swing is still under development.

As $0.25 serves as one of the strongest support levels, a dip below it can invalidate the bullish trend for now. Also, if the HBAR price corrects below $0.22, the short-term trend might not remain bullish anymore.