Litecoin Soars to 4-Month Peak – But Whale Dumping Looms as Hidden Threat

Litecoin bulls are riding high as LTC punches through its best price level since March 2025. The silver to Bitcoin's gold just flashed its most convincing breakout in 120 days—but seasoned traders are eyeing the dark clouds forming.

Whale alert: Big players are circling

On-chain sleuths spot massive LTC movements to exchanges—the classic prelude to a sell-off. When crypto's 1% start parking assets on trading platforms, retail investors often wind up holding the bag. Remember kids: in decentralized markets, the house always wins.

The institutional paradox

Ironically, Litecoin's strength comes from the same whales now threatening its rally. Their earlier accumulation drove the price surge, proving once again that crypto markets are just hedge funds playing hot potato with greater fools.

Will Litecoin's infrastructure save it?

Faster transactions and lower fees than Bitcoin give LTC real utility. But in a market where Dogecoin once hit a $80B market cap, fundamentals have a funny way of losing to hype. One thing's certain—when the whales start singing, everybody else dances.

Litecoin Support Could Be Fading

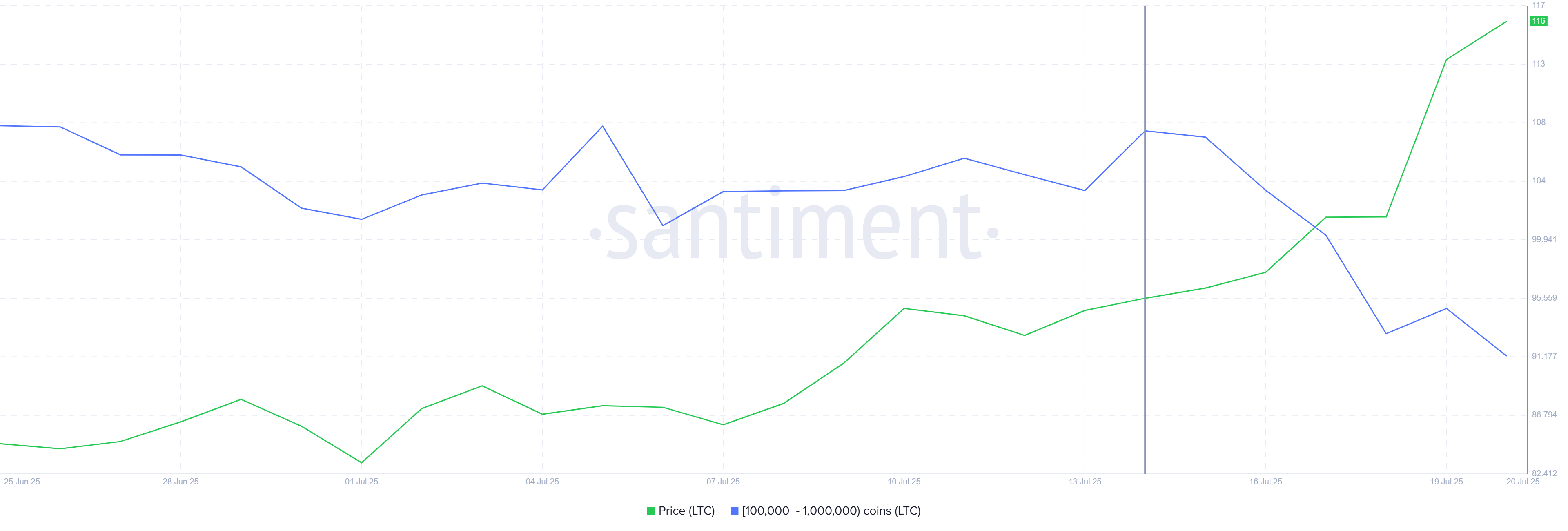

In the past five days, whale wallets holding between 100,000 and 1 million LTC offloaded more than 500,000 coins. This massive selloff is equivalent to roughly $58 million and suggests a cautious sentiment among major investors. Their actions imply they may doubt the longevity of the current rally.

The sudden spike in selling pressure signals potential instability ahead. These large-volume trades often influence market direction due to their impact on liquidity.

If selling continues at this rate, retail sentiment could turn bearish, compounding the pressure on Litecoin’s short-term performance.

Despite the whale selloff, on-chain data from the Mean Coin Age (MCA) indicator suggests a different story. Long-term holders (LTHs) are showing resilience, opting not to follow suit in selling their holdings. These wallets, known for their conviction, continue to hold, which is a positive sign for price stability.

LTHs typically dictate mid- to long-term trends, and their minimal participation in the recent selloff indicates confidence in Litecoin’s outlook. This counterforce could offer the support Litecoin needs to resist further downside pressure and potentially stabilize its price at current levels.

LTC Price Needs To Breach Key Resistance

At the time of writing, Litecoin trades at $116, just shy of the $117 resistance level. While the price has climbed 14% in the last 24 hours, the looming whale selloff could create friction.

A strong bullish push is needed to overcome the overhead barrier and maintain upward momentum.

If bearish sentiment driven by whale activity intensifies, Litecoin could retrace its steps to $105. This level serves as the next significant support and may become the base for sideways consolidation if selling persists.

Alternatively, continued support from retail buyers and LTHs could help Litecoin break past $117. Breaching this resistance WOULD signal strength and open the door for a move toward $124, marking a new four-month high and validating the bullish trend.