🚀 XRP Futures Explode to Record Highs as Whales Move $70M – What’s Next?

XRP futures just smashed through all-time highs—and a single whale dropped $70 million to fuel the rally. Is this the start of a bigger surge, or another pump waiting to dump?

The Whale Effect: Big Money Talks

When crypto whales move, markets ripple. This time, they’re betting heavy on XRP futures, pushing open interest to unprecedented levels. No fancy derivatives jargon—just cold, hard cash flooding in.

Futures Frenzy: Retail FOMO Incoming?

Record highs in futures often lure the crowd. Will retail traders chase the momentum, or is this another 'smart money' play before the inevitable pullback? (Spoiler: Wall Street tactics work just as well in crypto.)

The Cynic’s Take

Sure, $70M moves the needle—until it doesn’t. Remember: in crypto, 'all-time high' is just another way to say 'future liquidation target.' Trade accordingly.

XRP Futures Hit Record $11 Billion as Institutional Bets Grow Amid Bullish Surge

This transaction has sparked speculation that the whale could be preparing to take profits following the token’s recent rally.

Historically, transfers to centralized exchanges are often interpreted as precursors to selling pressure, especially during market upswings.

However, the MOVE has yet to affect XRP’s upward momentum.

According to BeInCrypto data, the token briefly touched a high of $3.54, extending a weeklong rally that has seen it gain 25%. This surge brings XRP close to its 2018 all-time high of $3.84.

The rally reflects a wider recovery in the crypto sector, with total market capitalization recently crossing the $4 trillion milestone.

Investor sentiment appears to be improving as US regulatory conditions ease, thereby attracting more interest to the sector.

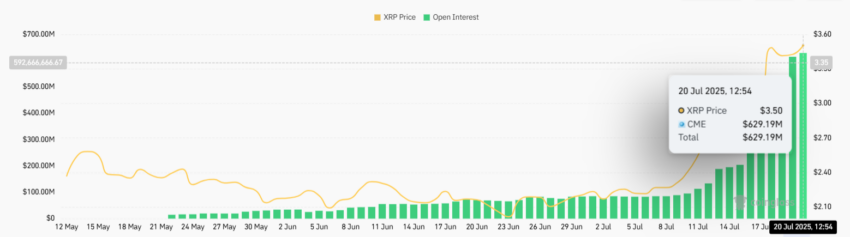

Meanwhile, XRP is also gaining momentum on derivatives platforms and not just in the spot market.

According to CoinGlass data, open interest in XRP perpetual futures has surged past $11 billion, representing roughly 3.1 billion tokens in Leveraged positions.

This marks a new high and eclipses the previous $8 billion peak seen in late January ahead of Donald Trump’s second presidential term.

Typically, a rising open interest alongside price growth often signals increased institutional participation and confidence in the asset’s long-term prospects.

Bitget leads the futures market, holding over 20% of open positions valued at $2.2 billion. Notably, CME’s futures also reflect rising institutional interest, reaching a record high of $630 million.

Meanwhile, this growth aligns XRP with other top-tier digital assets like Bitcoin and Ethereum. These assets have attracted strong institutional interest in the derivatives space over the past year.

XRP’s renewed strength comes on the heels of Ripple’s legal resolution with the US Securities and Exchange Commission (SEC) and key upgrades to the XRP Ledger.

These developments have helped position the digital asset for sustained relevance in an evolving market.