$5.76B Crypto Showdown: Bitcoin & Ethereum Options Expiry Sparks Market Frenzy

The crypto markets brace for impact as $5.76 billion in Bitcoin and Ethereum options approach expiry—will bulls or bears seize control?

The Gamma Squeeze Gamble

Market makers are scrambling to hedge positions, creating volatility powder kegs under both BTC and ETH. This isn't your grandma's expiration cycle—we're talking leveraged derivatives fueling 20%+ price swings.

Wall Street's Crypto Casino

Institutional players now dominate options flows, turning crypto into just another playground for their delta-neutral strategies. (Because clearly stocks and bonds weren't speculative enough.)

The Aftermath Playbook

Watch for post-expiry liquidity crunches as traders reposition—history says we'll either get a violent squeeze or a cascade of stop-loss triggers. Either way, retail gets the front-row seat to the carnage.

What Traders Should Expect from Today’s Expiring Options

With crypto markets riding a bullish wave, a major options expiry could shake up the markets today, potentially influencing market behavior into the weekend.

Specifically, over $5.76 billion in notional value is tied to Bitcoin and ethereum contracts scheduled to expire this Friday.

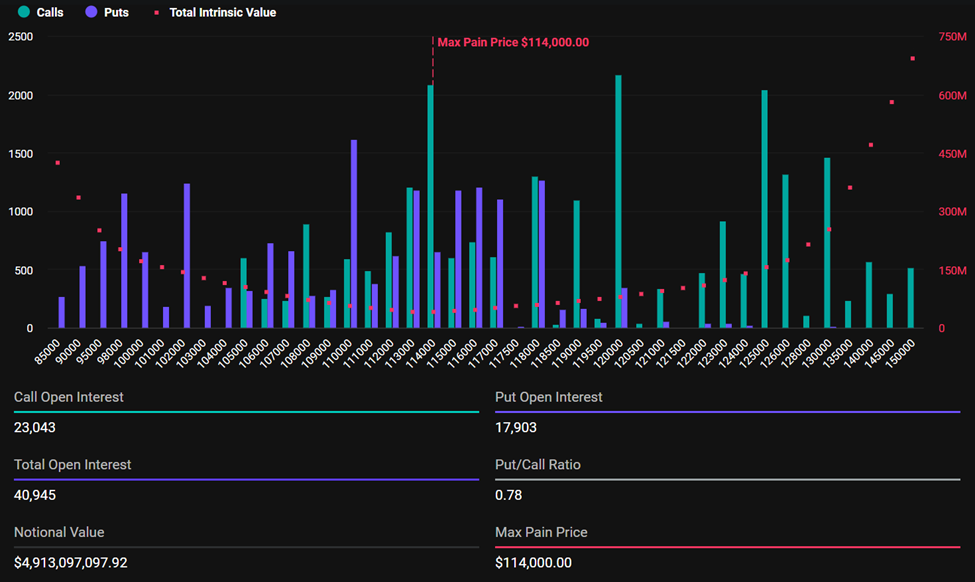

According to derivatives exchange Deribit, Bitcoin’s total open interest stands at 40,945 contracts, representing a notional value of $4.91 billion.

The max pain point, which is the price at which most options expire worthless, is a staggering $114,000. This is significantly below current spot levels, with BTC trading at $120,259 as of this writing.

With a put-to-call ratio of 0.78, traders appear to be leaning bullish, favoring call purchase options that WOULD profit from price appreciation.

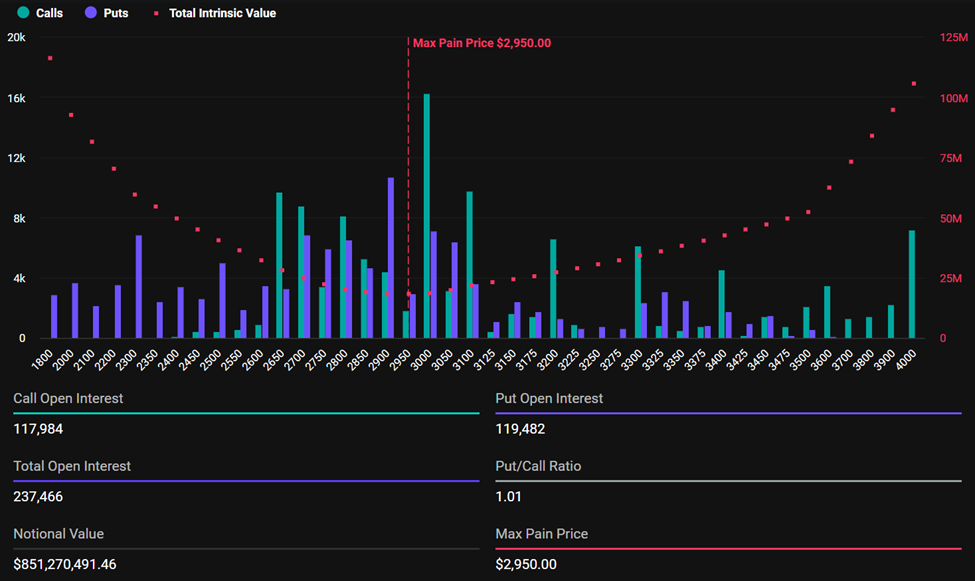

In contrast, Ethereum’s options market is showing a more neutral tone. The open interest is 237,466 contracts.

Meanwhile, the notional value is $851 million, and the put-to-call ratio is 1.01, signaling a nearly balanced sentiment between bearish and bullish bets. The max pain level is $2,950, significantly lower than ETH’s current market range.

Notably, this week’s expiring options are slightly more than last week’s contracts. As BeInCrypto reported, 36,970 BTC contracts with a notional value of $4.31 billion expired on July 11. In the same tone, 239,926 Ethereum contracts expired, with a notional value of $712 million.

Cautious Optimism Ahead of Options Expiry

Analysts at Greeks.live describe the broader sentiment as mixed. Some traders believe the top is in following recent rallies, while others continue to target higher valuations later in the year.

“…expecting 150,000 BTC by Q4 but anticipating a correction until September,” the firm noted.

In the NEAR term, however, traders employ risk reversal strategies, a classic tactic in options markets. This involves selling 30-day puts and buying 30-day calls, expressing a bullish stance while adding small put positions for black swan protection.

This strategy suggests that some market participants expect upside continuation but remain cautious about sudden downside shocks.

As traders brace for volatility, current market positioning reveals diverging sentiment across Bitcoin and Ethereum markets.

Volatility also remains a key focus. Ethereum’s implied volatility is hovering around 70%, even after its recent price spike. Analysts say this creates opportunities for basis trades and volatility squeeze plays.

According to Greeks.live, traders actively manage their exposure before today’s options expiry, expecting significant turbulence. In particular, the combination of large notional value, skewed max pain levels, and diverging sentiment sets the stage for potential volatility.

With both assets trading above their max pain levels, bitcoin and Ethereum prices will likely pull back as these options are near expiration. However, the market could stabilize thereafter as traders adjust to new trading environments.