US Government Dumps 85% of Its Bitcoin Stash – What’s Next for Crypto Markets?

The US Treasury just pulled off one of the largest Bitcoin sell-offs in history—liquidating 85% of its holdings. Was this a strategic exit or a panic move?

Behind the sell-off: While the feds won’t say if they timed the market (they didn’t), the move sent shockwaves through crypto circles. Traders are now scrambling to decode the implications.

Market impact: Bitcoin’s price wobbled briefly, then shrugged it off—proof the asset’s maturing, or just another day in volatile crypto land? Meanwhile, Wall Street analysts are busy revising their ‘digital gold’ PowerPoints.

Closing thought: When governments sell, whales buy. And somewhere in Zug, a crypto VC just ordered another Lambo—using taxpayer-subsidized gains. The irony’s thicker than a blockchain.

How Much Bitcoin Does the US Own?

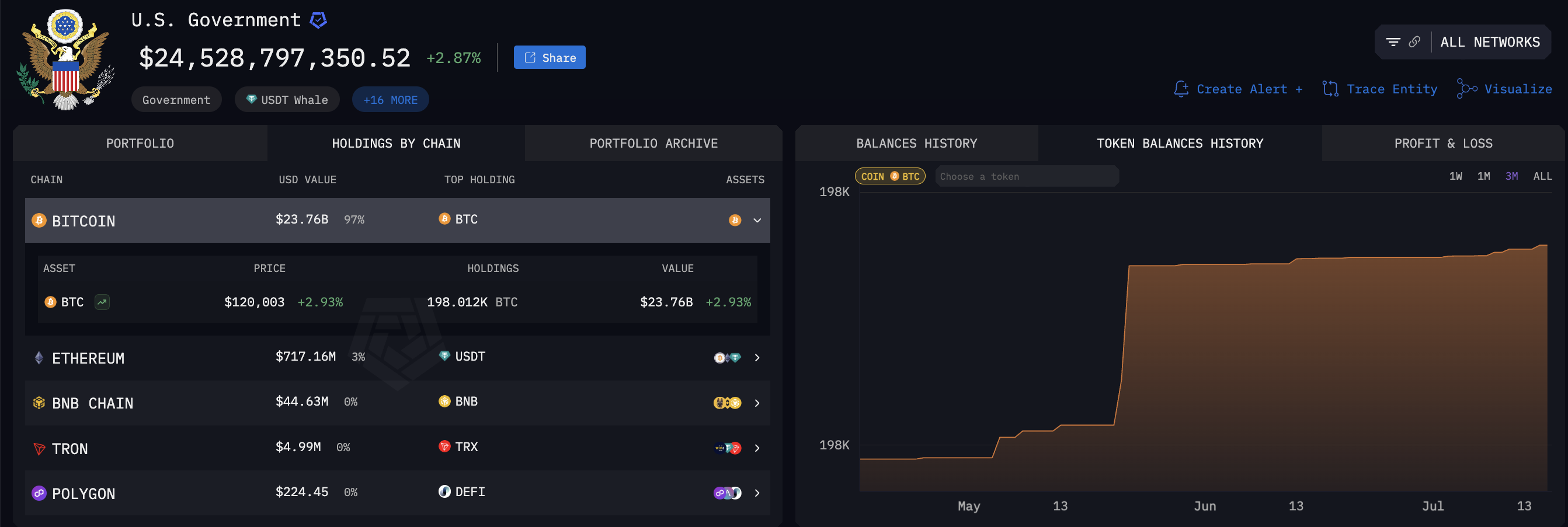

At this point, it’s well known that years of asset seizures have made the US government one of the largest Bitcoin holders.

However, a new report shows that this story may not be so simple. Today, the US Marshals Service confirmed that it only holds 28,988 BTC, only 15% of the purported total. Instead of $24 billion, this stash is only worth $3.47 billion.

Naturally, this revelation caused a huge freakout in the crypto community. Last year was a bad year for government bitcoin liquidation worldwide, and President Biden sold much of the US’ reserves.

Immediately, figures like Senator Cynthia Lummis openly questioned if a major sale had happened in secret.

I’m alarmed by reports that the U.S. has sold off over 80% of its Bitcoin reserves—leaving just ~29,000 coins.

If true, this is a total strategic blunder and sets the United States back years in the bitcoin race. https://t.co/ciYf1uhy0x

To be clear, the disaster scenario does not seem particularly likely. Arkham Intelligence, an on-chain analysis firm, keeps records on the US government’s Bitcoin holdings.

Intraledger transactions may or may not cause the 200,000 figure to be a slight overestimation, but we WOULD know if Biden sold off all 85% of the government’s BTC.

Seized vs Forfeited Assets: A Key Distinction

Nonetheless, this discrepancy is still extremely important. As the report’s author pointed out, the US Marshals hold all the government’s forfeited Bitcoin.

Over the years, plenty of major crypto criminals have forfeited billions in BTC, officially making these assets government property. This is the aforementioned $3.4 billion, and Uncle Sam can do whatever he wants with it.

However, plenty of criminals do not forfeit their Bitcoin to the US government. These are seized assets, not government property. The President doesn’t necessarily have the authority to do anything with these tokens while they exist in this limbo.

For example, law enforcement holds several billion BTC from the Bitfinex hack, totaling around 94,000 BTC. Depending on a few things, most or all of these assets might get returned to the exchange’s creditors.

If that happens, that’s almost half of the government’s “stockpile” right there.

Overall, Trump’s Strategic Bitcoin Reserve is not going to work as advertised. The FBI, DEA, and other government agencies currently custody a lot of Bitcoin, but the US doesn’t necessarily own it.

Generally, observers can expect that the Reserve will hold more than $3.4 billion. However, the purported total of $24 billion was only ever a fantasy.