Solana & BNB Just Powered Blockchain’s Most Explosive Week Ever — Here’s Why It Matters

Move over, Wall Street—crypto's new heavyweights are rewriting the rules.

Solana and Binance Coin didn't just rally this week—they dragged the entire blockchain space into record territory. While traditional markets fiddle with 2% yields, these tokens are serving triple-digit ROI platters.

The secret sauce? Developer activity on Solana's chain hit unprecedented levels while BNB's burn mechanism turned deflationary pressure into rocket fuel. Meanwhile, legacy finance still can't tell a smart contract from a Netflix subscription.

One warning though: when crypto moves this fast, even the bulls get whiplash. Buckle up.

Solana, BNB Chain, and Tron On Top

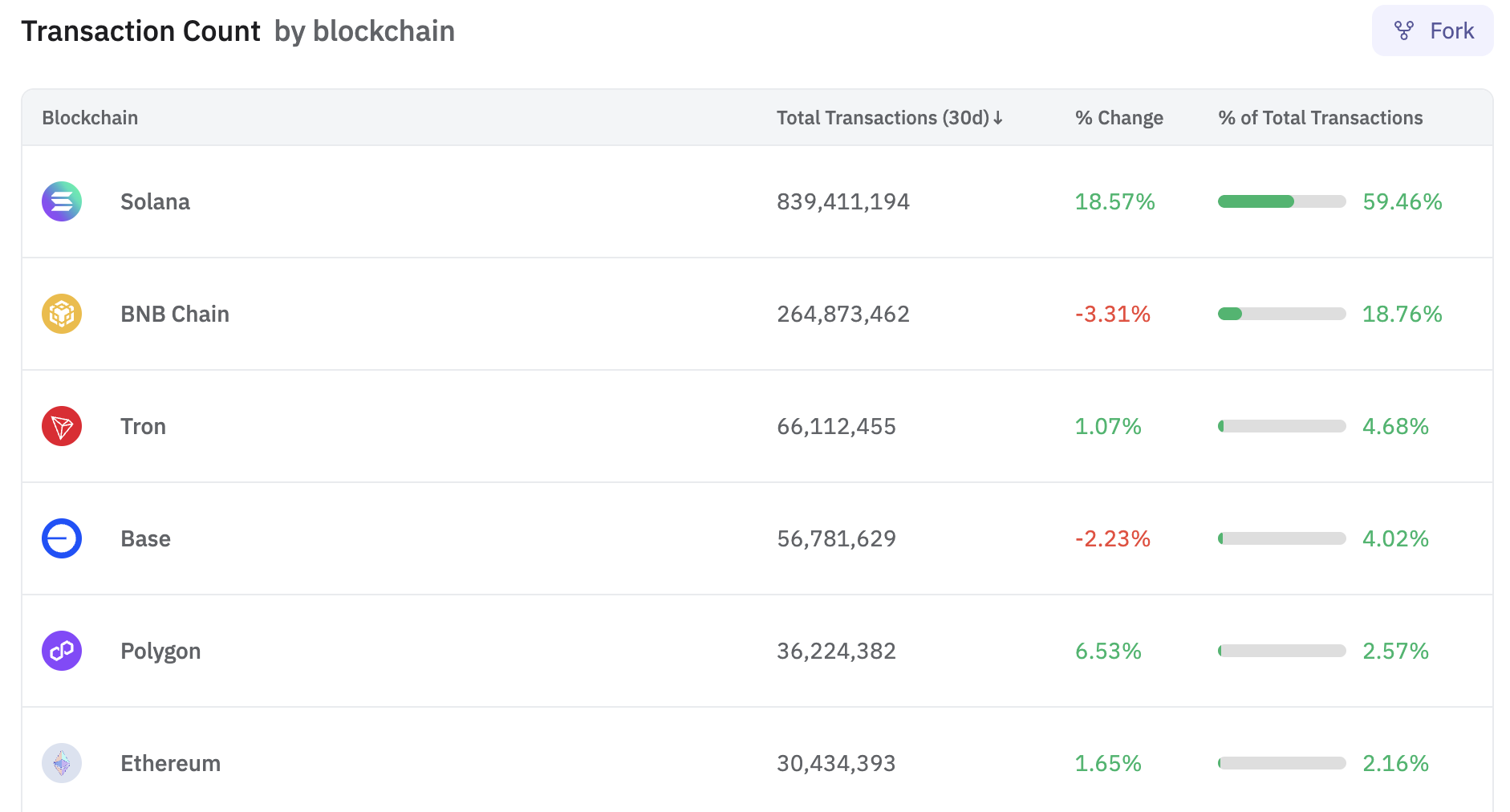

According to data from Dune Analytics, Solana, BNB Chain, and TRON were the three blockchains with the highest transaction volumes over the past week.

Solana (SOL), in particular, is leading in terms of transaction count (59.46%). This can partly be explained by the explosive growth of meme tokens launched via various launchpad projects on the platform.

The top two meme coin launchpads, LetsBonk and Pump.fun, are on Solana. Despite their highly speculative nature, meme tokens have attracted a large influx of new users, driving transaction volumes to unprecedented levels.

Although it only accounts for 18.76% of total transactions, BNB Chain maintains its position as the network with the most decentralized applications (Dapps). With a wide range of Dapps spanning sectors such as DeFi, GameFi, and NFTs, BNB Chain plays a vital role in retaining users and sustaining liquidity across its ecosystem.

This could be a result of the BNB Chain Maxwell Hard Fork update that halved block processing time to 0.75 seconds. The hard fork increases speed and synchronization without compromising network quality or decentralization.

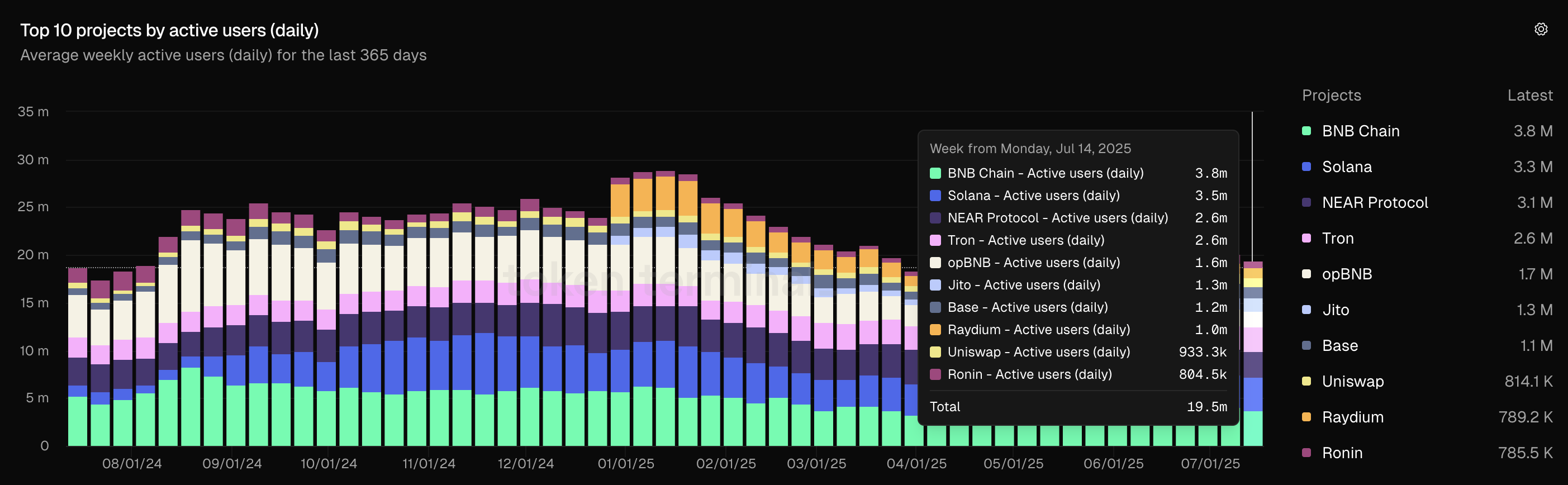

Beyond transaction volume, Solana, BNB Chain, and Tron are also among the top 10 blockchains with the highest daily active users. Moreover, Tron recently outpaced ethereum in USDT volume, fueled by whale trades and over 1 million daily retail transactions.

This highlights consistent engagement from real user communities, a key factor in evaluating the credibility of a blockchain ecosystem.

This strong rebound in network activity could be an early indicator of a new growth cycle for the crypto market. However, it’s important to note that a portion of the transaction volume may stem from speculative, often volatile activities.

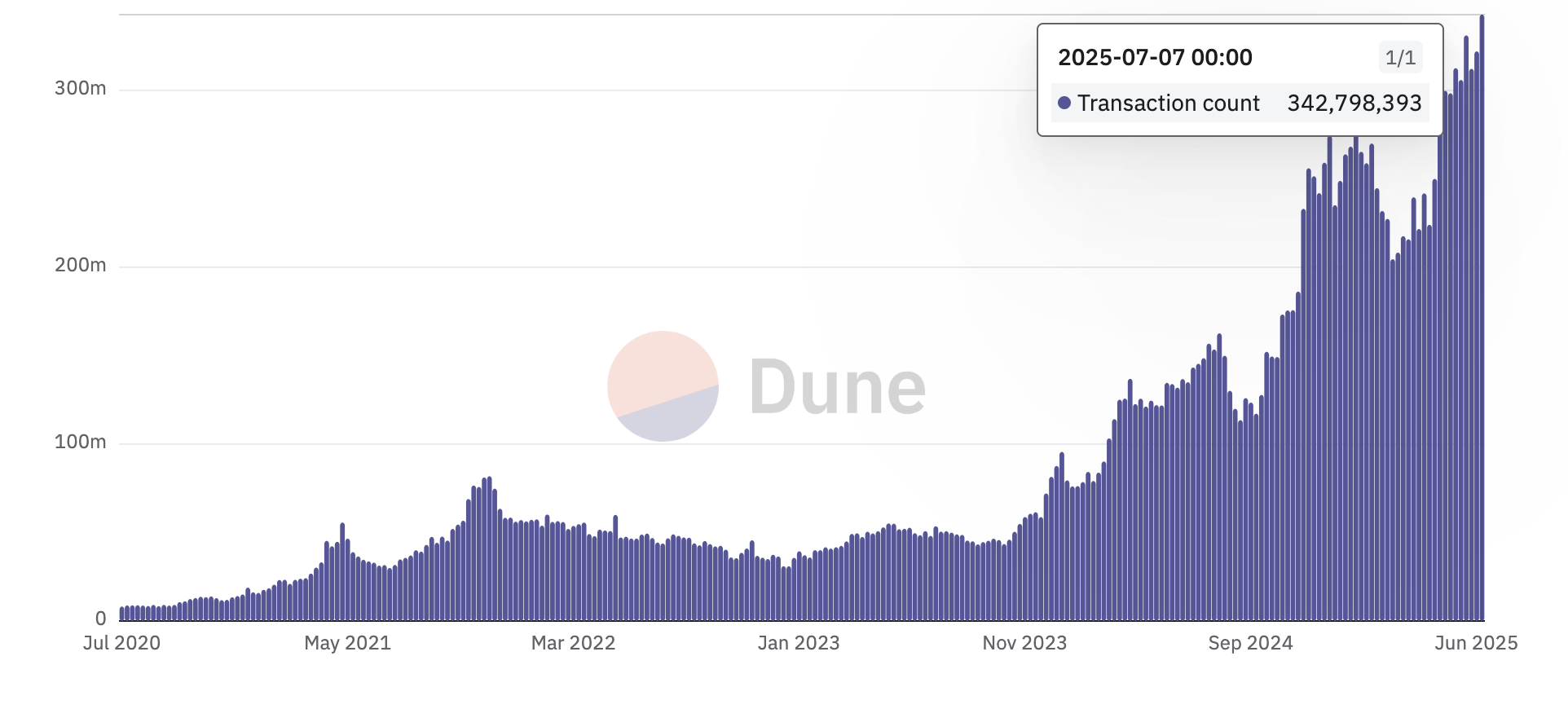

Nevertheless, the 342 million blockchain transactions signal a promising evolution and growing user engagement in the blockchain ecosystem.