Bitcoin Hits All-Time High Mining Difficulty—Why Aren’t Retail Investors FOMOing Yet?

Bitcoin's mining difficulty just smashed records—again. Meanwhile, Google searches for 'Bitcoin price' flatline like a dead cat bounce. Is this the bull market growing up... or just institutional money playing musical chairs?

The hash rate's relentless climb proves miners are all-in. But where's the retail frenzy? Either we're witnessing a 'mature' market (read: whales control the casino now), or Main Street hasn't gotten the memo that digital gold is back in vogue.

Funny how 'low interest' in crypto always coincides with Wall Street quietly accumulating positions. Remember: when your Uber driver stops giving you trading tips, that's usually when the smart money starts stacking.

ATH Price, ATH Mining Difficulty

According to data from Blockchain.com, Bitcoin mining difficulty has increased by 7.96%, reaching 126.27 T, with a seven-day average network hashrate of 908.82 EH/s. This figure shows the growing computational power of miners, especially as Bitcoin‘s price recently touched $122,000.

If this trend persists, it could reduce miners’ efficiency, particularly given the lackluster mining results in June.

However, a notable upcoming adjustment is the next bitcoin mining difficulty change, projected to decrease by 6.69% on July 27, 2025. This could be a positive signal for miners, optimizing their operational efficiency.

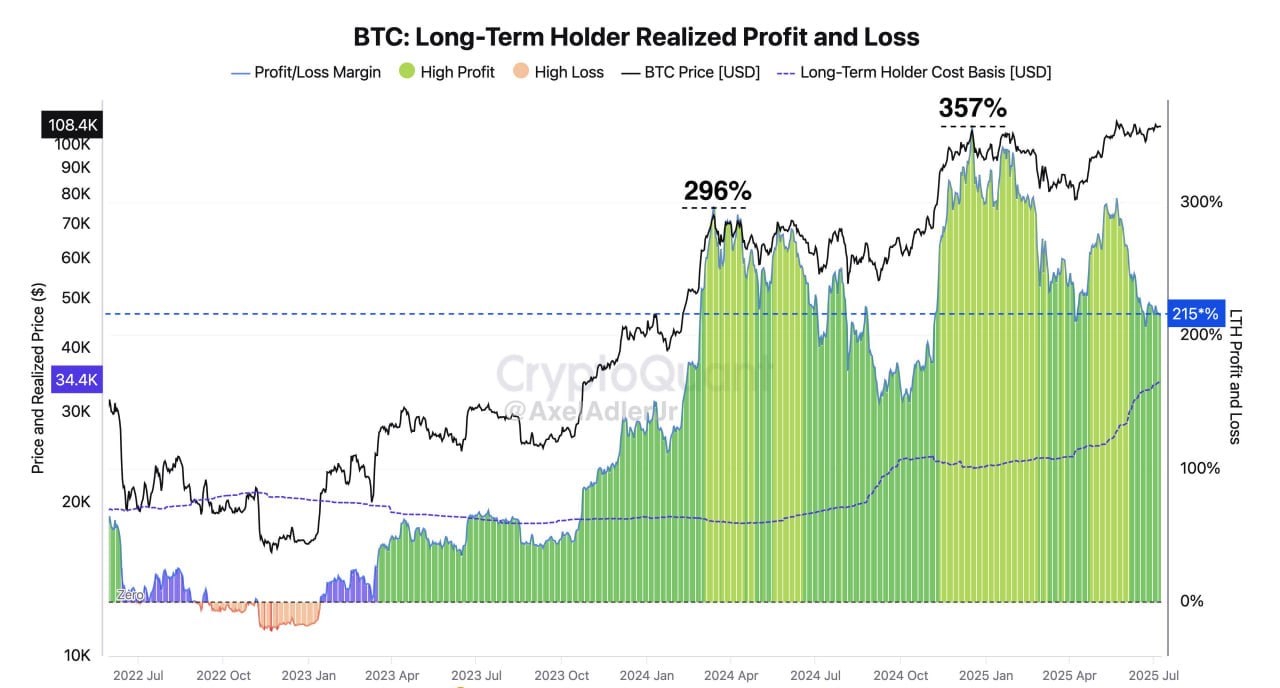

Furthermore, the Glassnode chart, shared by NekoZ on X, offers DEEP insights into Long-Term Holders (LTH) behavior. Their realized profit has surged to $108,400, with a profit ratio of 357% in July 2025. Their average cost basis remains significantly lower than the current price.

This suggests that most LTHs have no intention of selling off, even as BTC reaches ATHs. From 2022 to now, the chart indicates that high-profit phases (such as 296% in mid-2024) often accompany sustainable price rallies. This reinforces the view that the current market is not yet saturated.

Yet, a thought-provoking factor is the low Google search interest in Bitcoin, which remains subdued and shows little improvement compared to previous bull markets. This could reflect investor maturity, shifting from Fear of Missing out (FOMO) to a long-term strategy rather than short-term speculation.

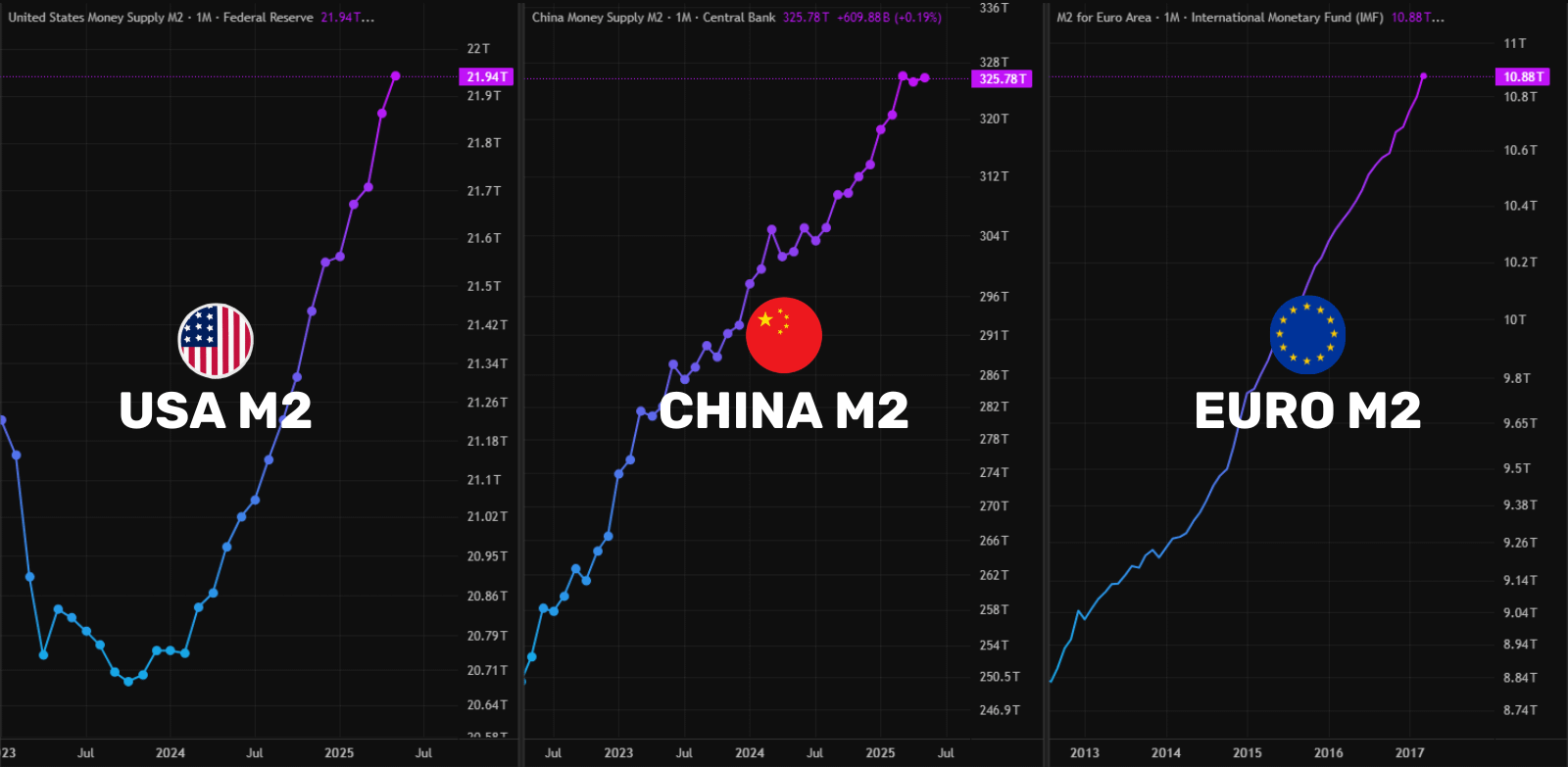

Overall, the synergy of BTC’s ATH, high Bitcoin mining difficulty, and LTH holding behavior creates an encouraging yet risky outlook. With global liquidity rising (as M2 in the US, China, and Europe also hits an ATH), Bitcoin holds significant short-term potential.

However, investors should closely monitor key indicators like hashrate, Bitcoin mining difficulty adjustments, and market sentiment to mitigate risks from potential price corrections.