3 Altcoins Facing a Liquidation Bloodbath in July—Will Your Portfolio Survive?

July’s crypto reckoning is here—and these altcoins are first in line for a margin call massacre. Buckle up.

### The Ticking Time Bombs

Leveraged traders are sweating bullets as three major altcoins flirt with liquidation thresholds. One wrong move, and cascading liquidations could trigger a domino effect.

### The Overleveraged Trio

High-risk bets on these tokens now face a brutal squeeze. Exchanges are licking their chops—nothing fills order books like forced selling.

### The Silver Lining (For Sharks)

Smart money’s circling. Volatility like this? Pure profit fuel—if you’ve got the stomach (and the dry powder).

Remember: In crypto, ‘risk management’ is just something VCs pretend to care about during bear markets.

1. Solana (SOL)

Data from Coinglass shows that Solana’s Open Interest in July reached $7.9 billion, its highest level since January 2025, when SOL peaked at $294.

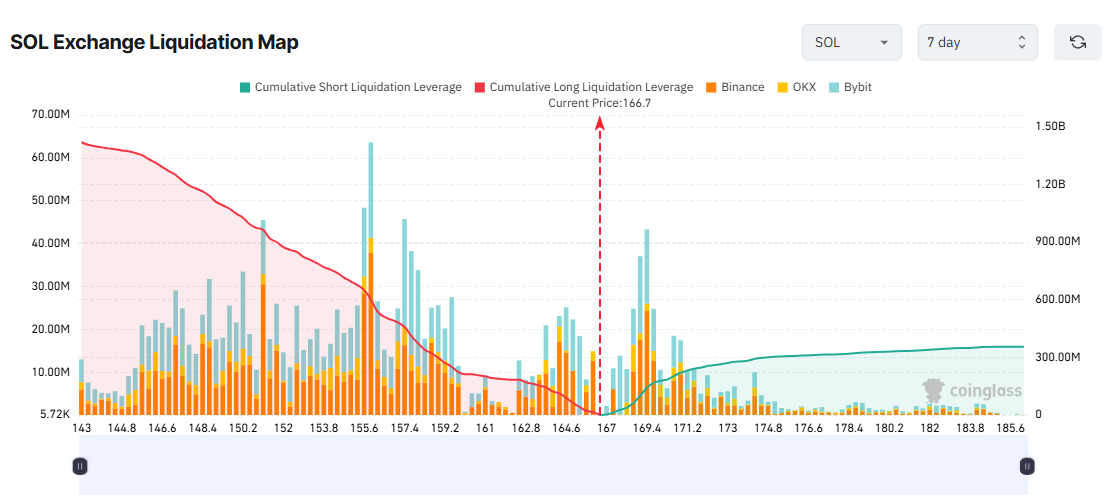

The liquidation map for SOL reveals a clear imbalance between long and short positions. Most traders are betting on further short-term price increases, allocating capital and leverage to long positions.

As a result, the total accumulated long-side liquidation volume could reach $1 billion if SOL drops below $150. This WOULD represent a decline of over 10% from the current price of $167 at the time of writing.

Although solana flashed a bullish five-year signal, BeInCrypto recently reported that FTX unstaked nearly 190,000 SOL, worth around $31 million. This move came amid rising creditor pressure, sparking fears of market impact.

2. XRP

XRP’s Open Interest hit $7.6 billion entering the third week of July. That’s just $250 million below its highest OI level in January.

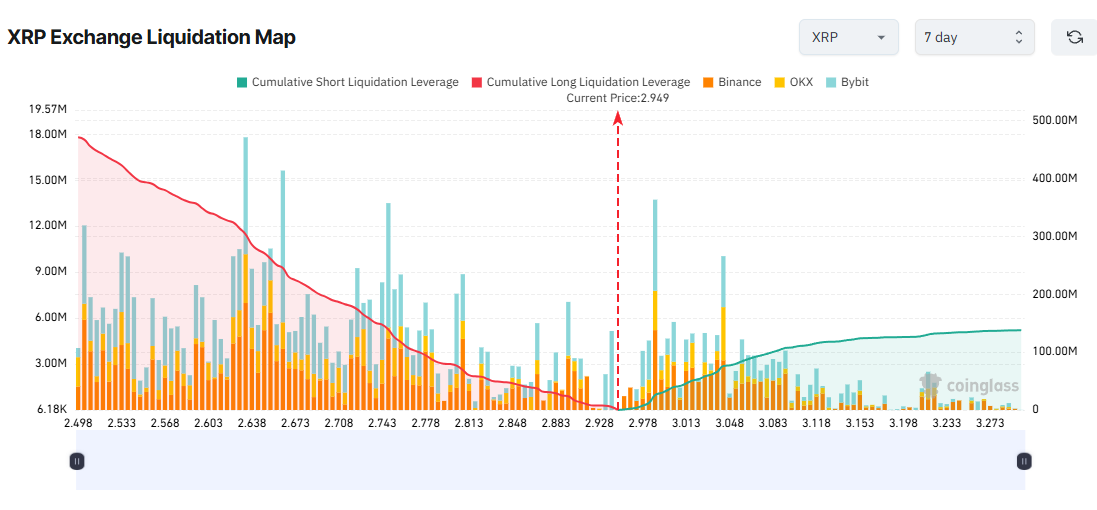

The liquidation map for XRP also shows short-term traders are confident that the price will continue rising. This is evident from the imbalance between cumulative long and short liquidations.

The data suggests that up to $500 million in long positions could be liquidated if XRP falls below $2.5. Historical price action shows XRP often experiences wide daily ranges, 20% to 30% moves.

Furthermore, recent analysis suggests XRP’s rally may be losing momentum, as some traders could be preparing to take profits.

3. Hypeliquid (HYPE)

In July, Hypeliquid (HYPE) set a new all-time high in Open Interest at $2.1 billion. The Long/Short volume ratio — as well as the Long/Short ratio among top accounts on Binance and OKX — exceeds 1, signaling short-term bullish sentiment.

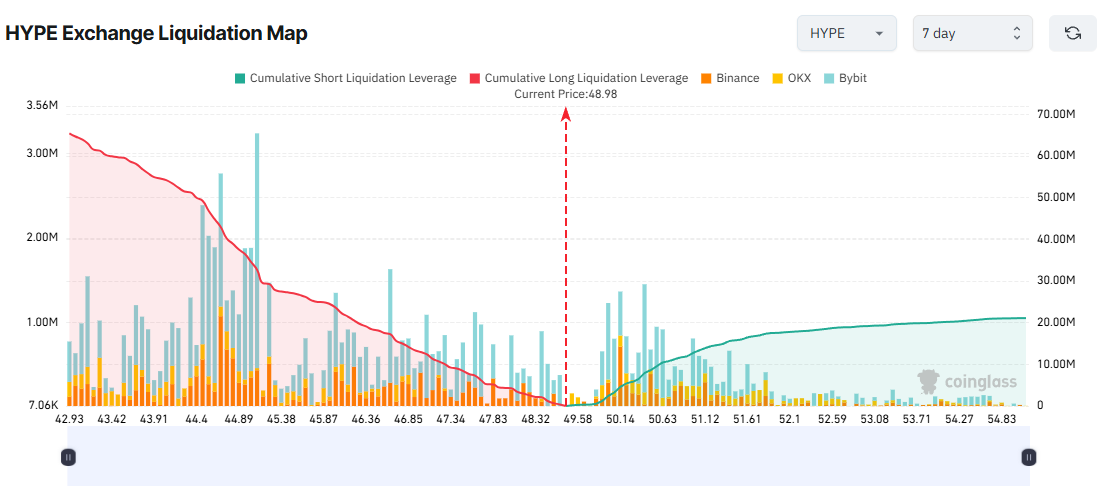

Meanwhile, HYPE’s price has climbed for six consecutive days. It hit a new high of $49.8 today. Traders are still aggressively pursuing long positions, which increases liquidation risk if a pullback occurs.

The liquidation map shows that over $60 million in cumulative long positions could be liquidated if HYPE drops below $43.

In July, HYPE’s price closely mirrored Bitcoin’s. With BTC now exceeding $122,000, any correction in Bitcoin could trigger a deeper retracement in HYPE, leading to large-scale liquidations.

The Crypto Derivatives Market is Hotter Than Ever

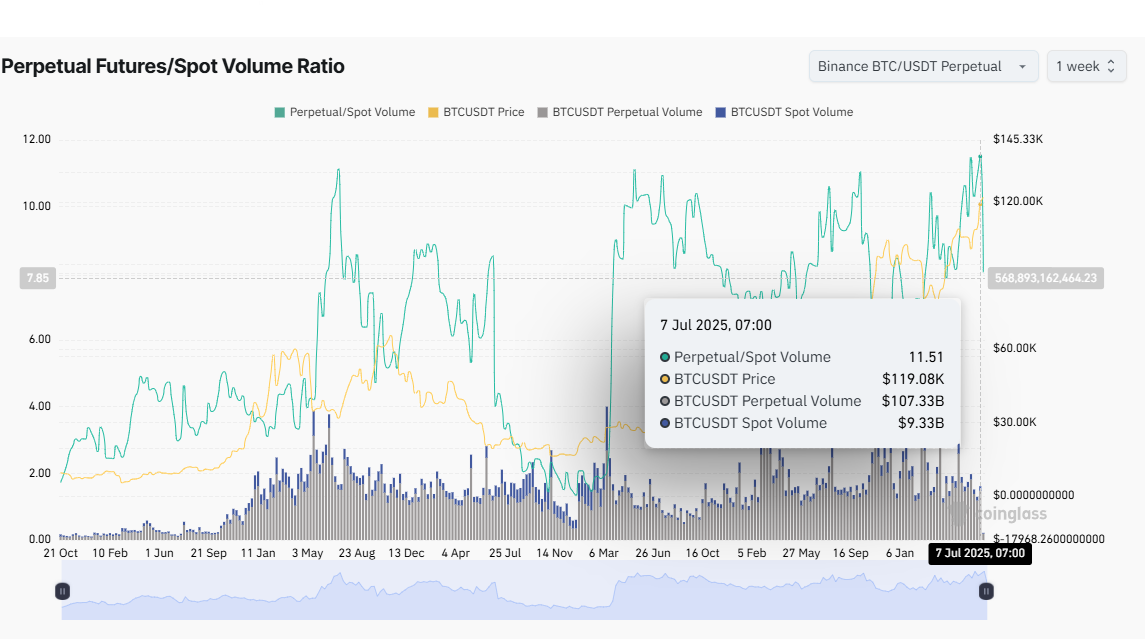

According to Coinglass, Bitcoin’s futures trading volume last week was over 10 times its spot trading volume. The Perpetual Futures/Spot Volume Ratio reached 11.5, the highest in history.

Additionally, the total crypto market Open Interest hit a new all-time high of over $187 billion on July 14. Open Interest represents the total number of outstanding contracts yet to be settled.

It reflects investor participation in both altcoins and bitcoin at the moment.

These figures suggest that traders are engaging more with derivatives than spot markets despite the bull market. This is a warning sign that major liquidation events may be on the horizon.

“In the past 24 hours, 127,894 traders were liquidated. Total liquidations reached $732.59 million,” Coinglass reported.

At the time of writing, 24-hour liquidation volumes have already surpassed $700 million, and most losses continue to fall on short positions.