PI Price Teeters on Critical Support: Will It Rebound or Collapse?

Crypto's latest drama unfolds as PI claws to a pivotal support level—will traders catch the falling knife or get sliced?

The make-or-break moment

Market watchers hold their breath as PI flirts with a price floor that's either a springboard or trapdoor. No fancy indicators needed—this is pure gladiator combat between bulls and bears.

Volatility alert: Tread carefully

One false move could trigger cascading liquidations or a vicious short squeeze. Remember kids, 'support' is just a fancy word for 'last hope' in crypto-land.

As degenerate gamblers place their bets, the real winners? Exchange platforms collecting fees from both sides—because house always wins in this casino.

Open Interest and Funding Rate Signal a Pause

PI Price is showing signs of hesitation. Aggregated Open Interest on Coinalyze (in the 4-hour timeframe) is hovering around $10.09 million and is also showing no major directional conviction over the past few days. This means traders are not aggressively building new long or short positions, suggesting indecision.

Meanwhile, the Aggregated Funding Rate climbed to +0.0274, and the Predicted Funding Rate spiked even higher to +0.0516. In simple terms, this means Pi Coin longs are slightly dominant and willing to pay a premium to hold their positions, usually a bullish sign.

Open Interest refers to the total number of unsettled contracts in the market. A rising Open Interest generally confirms that more traders are entering the market, supporting the current trend. Funding Rate is the periodic fee paid between long and short traders. Positive values mean longs are dominant; negative ones suggest shorts are in control.

Overall, the flat Open Interest with rising Funding Rates shows a mild long bias, but in the case of PI Coin, it is without strong conviction.

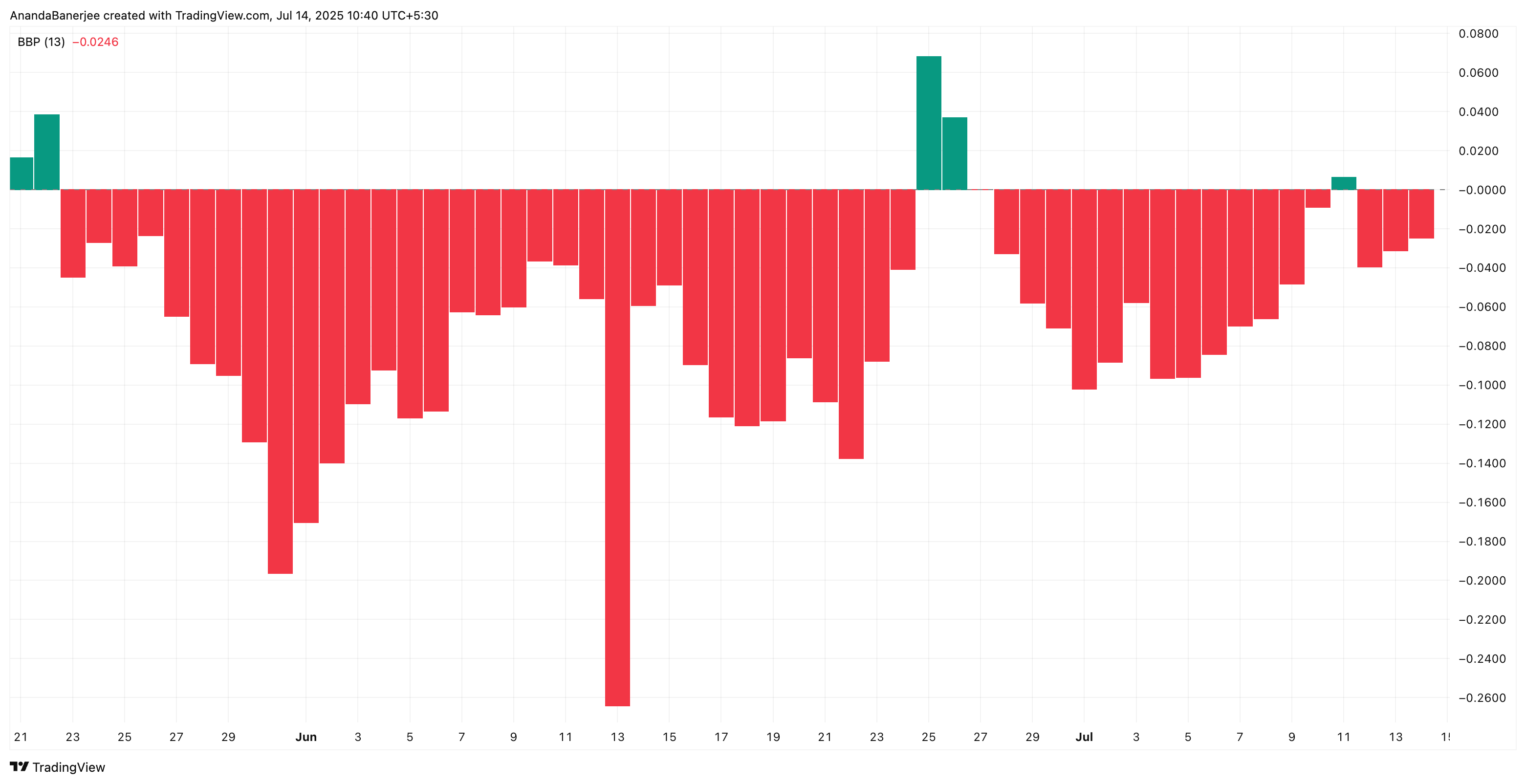

Bear Power is Losing Steam

With Funding Rates rising and Open Interest staying flat, the market leans slightly long but without conviction. This hesitation is mirrored in the Bull Bear Power indicator, part of the Elder RAY Index, which tracks the strength of buyers/sellers in the market.

At the time of writing, Bear Power has continued to weaken, signaling that bearish momentum is fading.

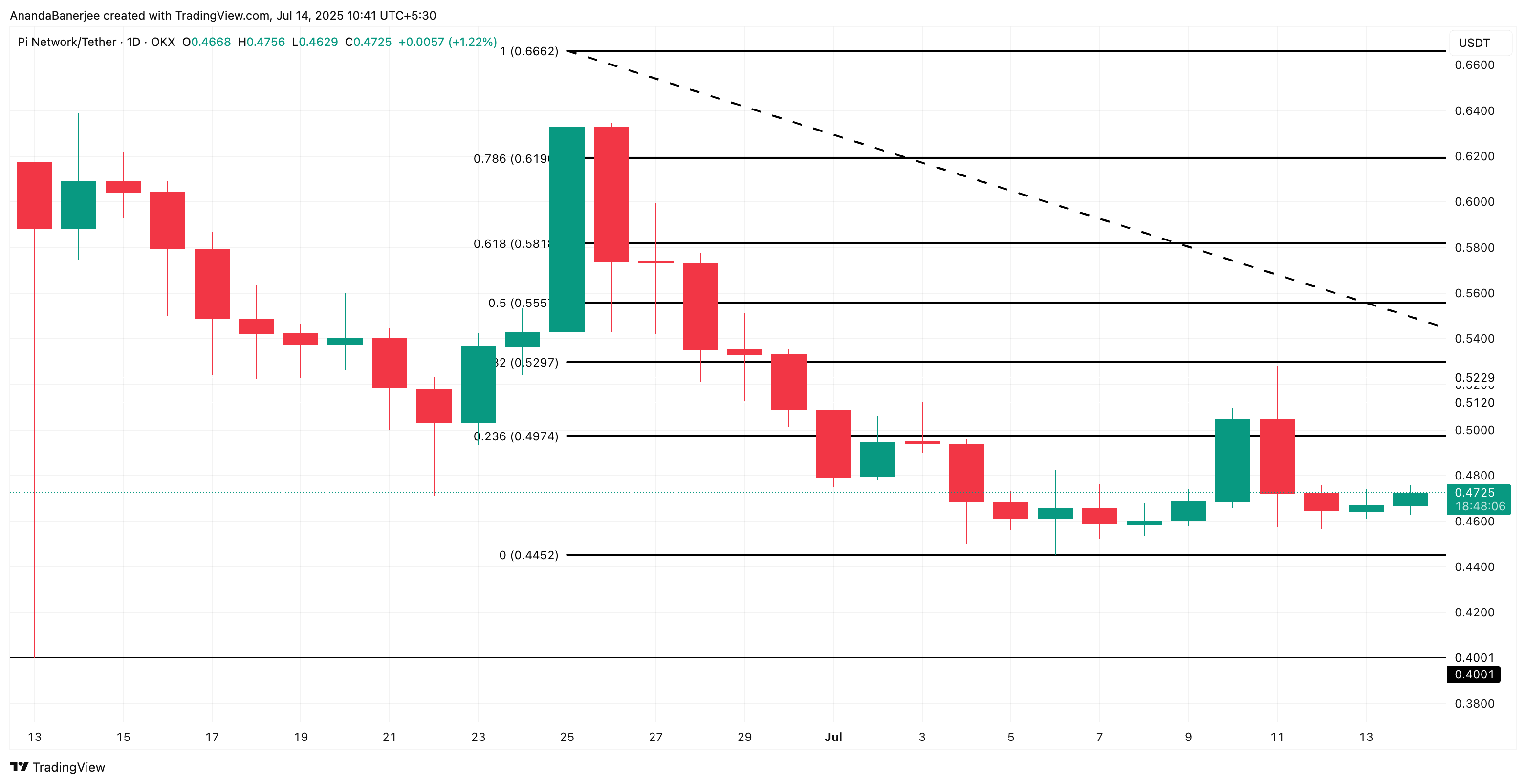

PI Price Analysis: Key Support Still Holding

Pi Coin (PI) is currently trading at $0.4725, hovering just above the key support level at $0.4452. This level was derived using the Fibonacci retracement tool, drawn from the late June high to the July 6 low.

Fibonacci retracement is a technical tool traders use to identify potential support and resistance levels by measuring how far the price has pulled back from a recent move.

So far, this support has held despite PI’s broader downtrend. A breakdown below $0.4452 could expose Pi Coin to a sharper correction toward $0.4001, the next major support.

On the flip side, if momentum builds, the next upside resistance is at $0.4974, a level where the Pi Price has been rejected a few times. A daily close above $0.4974 could flip the structure short-term bullish, invalidating the bearish hypothesis.