🚀 XRP Futures ETF Volume Explodes 500% as Price Hits 4-Month Peak

XRP just woke up the crypto derivatives market—and Wall Street's algo-traders are scrambling to catch up.

The surge nobody saw coming

Trading desks got whiplash as XRP futures ETF volumes quintupled overnight. The token's 120-day high came alongside a flood of institutional interest—proving once again that 'dead' assets in crypto have nine lives.

When retail FOMO meets institutional FOMO

The volume spike suggests hedge funds are finally dipping toes into crypto's most controversial major token. Meanwhile, retail traders are piling into leveraged positions like it's 2021 again. (Some things never change—like the SEC's ongoing lawsuit hovering over XRP like a regulatory guillotine.)

Cynics' note: Nothing makes TradFi embrace a crypto asset faster than the smell of freshly printed derivatives fees.

XRP Leveraged ETF Hits $249 Million in Assets

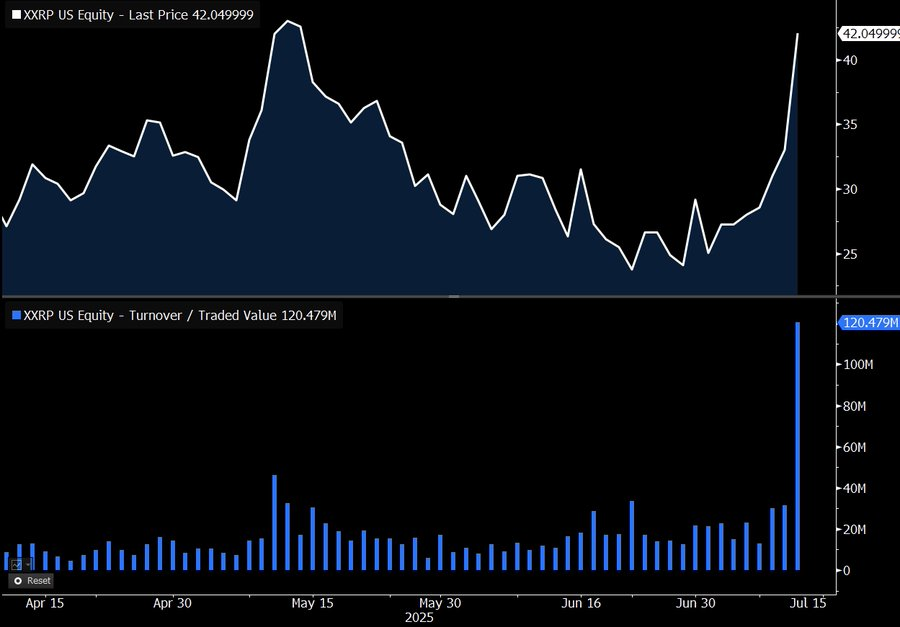

On June 11, Bloomberg ETF analyst Eric Balchunas reported that the product was trading at four to five times its usual volume.

According to him, the fund’s activity jumped by 27% in 24 hours, and by 55% the past week. This helped push the product’s cumulative volume to roughly $120 million.

Data from Yahoo Finance shows that the surge in trading activity has fueled notable price appreciation, with XXRP reaching a high of $42, up 56% from its launch value.

Currently, Teucrium’s leveraged XRP fund holds around $249 million in total net assets, indicating strong investor interest.

Meanwhile, market observers suggested that XXRP’s strong market performance has been partly fuelled by the impressive rally in XRP’s spot price.

Over the past seven days, the token has climbed more than 24% to reach $2.97—its highest level in four months—before slightly correcting to $2.76 at the time of writing.

On-chain data reveals that this strong price performance has been accompanied by heightened network activity.

Blockchain analytics firm Santiment noted a sharp uptick in newly created XRP wallets, suggesting fresh inflows from retail investors.

At the same time, social media discussions around the asset have intensified, adding to the bullish sentiment.

This strong momentum in both the ETF and the underlying asset has reignited conversations about the possibility of a spot XRP ETF.

Analysts point to the success of XXRP as evidence of demand for regulated exposure to XRP’s price movements.

According to Polymarket, the probability of a spot XRP ETF approval this year stands at 88%. Meanwhile, Bloomberg’s internal projections go even further, placing those odds at 95%.