Ethereum at a Crossroads: Can It Hold $3,000 or Will the Bears Take Over?

Ethereum's $3,000 support level is under the microscope as traders brace for volatility. Will the second-largest crypto defy gravity—or succumb to a correction?

The Bull Case: Institutional Demand Meets Scarcity

Whales are accumulating, and staking yields remain juicy. With ETF whispers growing louder, ETH's fundamentals look stronger than a Wall Street banker's espresso.

The Bear Trap: Technicals Flash Warning Signs

RSI's flirting with overbought territory while funding rates spike. History suggests this combo often precedes pullbacks—but since when does crypto follow the script?

The Bottom Line

Whether this is the springboard to $4K or a pitstop before $2.5K depends on who blinks first: the leveraged longs or the profit-taking OGs. One thing's certain—the market's about to separate the diamond hands from the paper-handed tourists.

Ethereum Holders Move To Sell

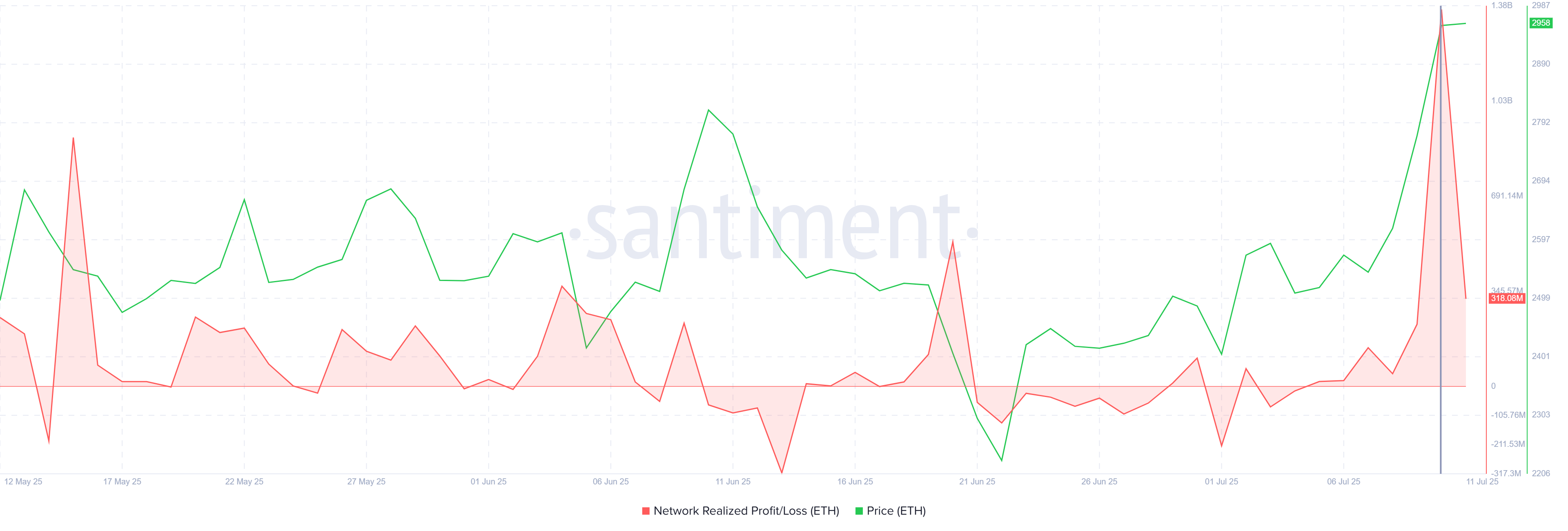

Ethereum’s Network Realized Profit/Loss metric has spiked to $1.36 billion, marking the largest increase since December 2022. This sharp uptick in realized profits indicates a significant amount of selling pressure.

The selling observed in the last 24 hours is the highest in 31 months, suggesting that many investors are capitalizing on recent price gains.

Historically, such large sell-offs have been followed by price corrections. Given the magnitude of the current selling activity, investors should be cautious, as it may signal a near-term pullback in Ethereum’s price.

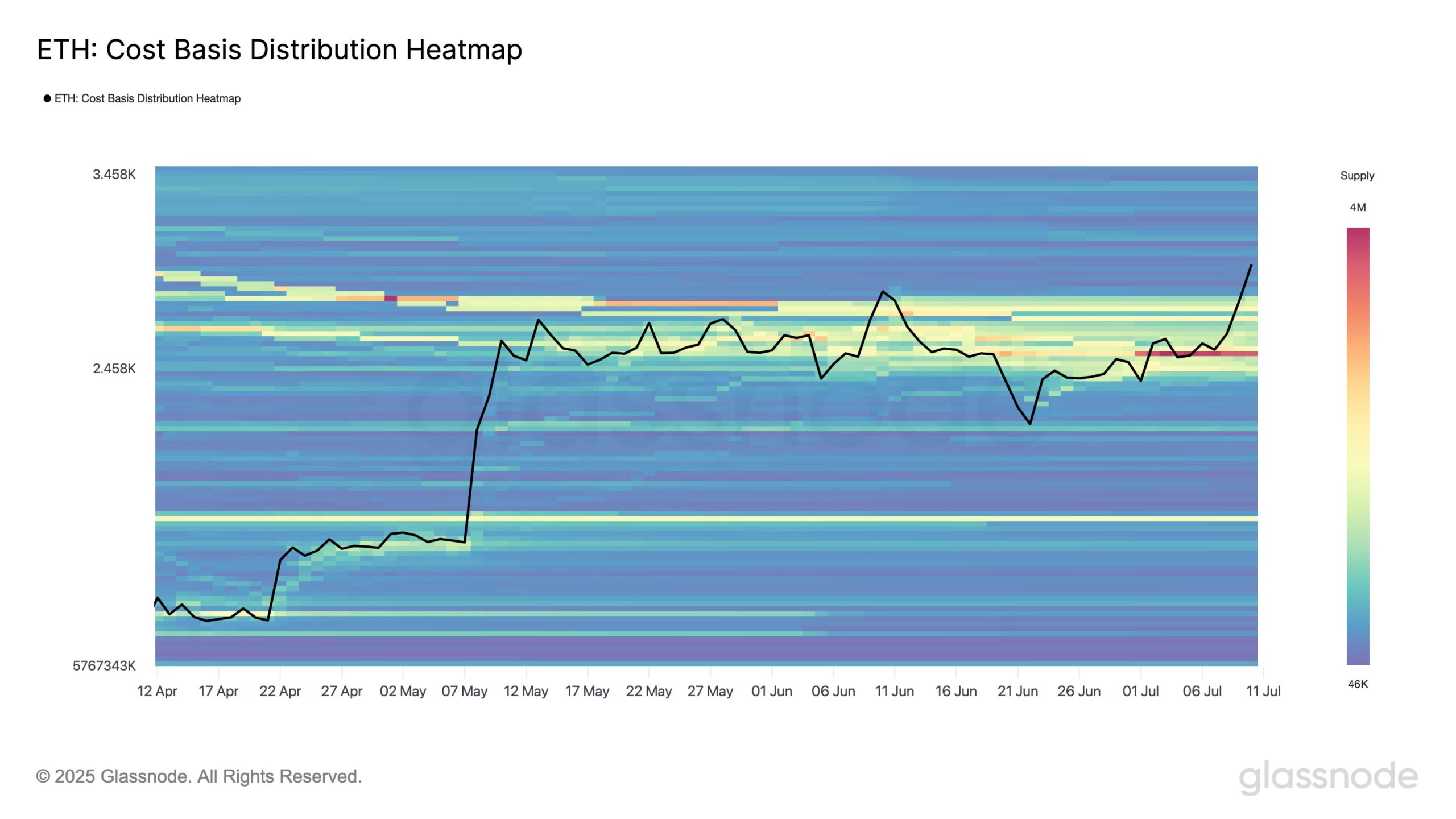

A key indicator of Ethereum’s potential support lies in its cost basis distribution, which shows that $2,500 has become a strong accumulation zone.

Over 3.45 million ETH had a cost basis near this level, providing significant support for the altcoin. As Ethereum recently bounced off $2,533, this level has become an important launchpad for its current rally.

This $2,500 support level is crucial if Ethereum faces a price decline due to profit-taking. Should ETH’s price retrace, the strong accumulation around $2,500 will likely act as a cushion, preventing a deeper pullback and supporting a potential rebound.

ETH Price Needs To Find Support

Ethereum is currently trading at $2,975, just below the crucial $3,000 resistance. After waiting five months to breach this level, Ethereum has finally crossed it.

However, the challenge remains in securing $3,000 as support. If ETH fails to hold this level, the rise could face significant resistance, limiting further gains.

Profit-taking could continue to weigh on Ethereum’s price in the short term. Yet, if Bitcoin’s uptrend continues and broader market conditions remain bullish, flipping $3,000 into support will likely push Ethereum towards the next resistance at $3,530. This move WOULD indicate that the current bullish momentum is still intact.

Should profit-taking surge, Ethereum’s price could fall back below $3,000. The 19% gain seen this week could be undone, but ETH is expected to hold above $2,495, thanks to the strong support established at the $2,500 level.

However, this would extend the wait for seeing Ethereum above $3,000 further into Q3.