BlackRock’s IBIT Smashes Records: Fastest ETF Ever to Hit $80B in Assets

Wall Street's crypto love affair hits new heights as BlackRock’s IBIT ETF shatters the speed record—$80 billion in assets faster than a Bitcoin miner cashes out.

How it happened: The institutional floodgates opened. Pension funds, hedge funds, and even your conservative aunt's portfolio manager finally surrendered to the digital gold rush.

The irony? Traditional finance spent a decade dismissing crypto as a 'fraud'—now they're tripping over themselves to package it in their boring old ETF wrappers. Some things never change.

BlackRock’s Bitcoin ETF Climbs Into World’s Top 25 Funds

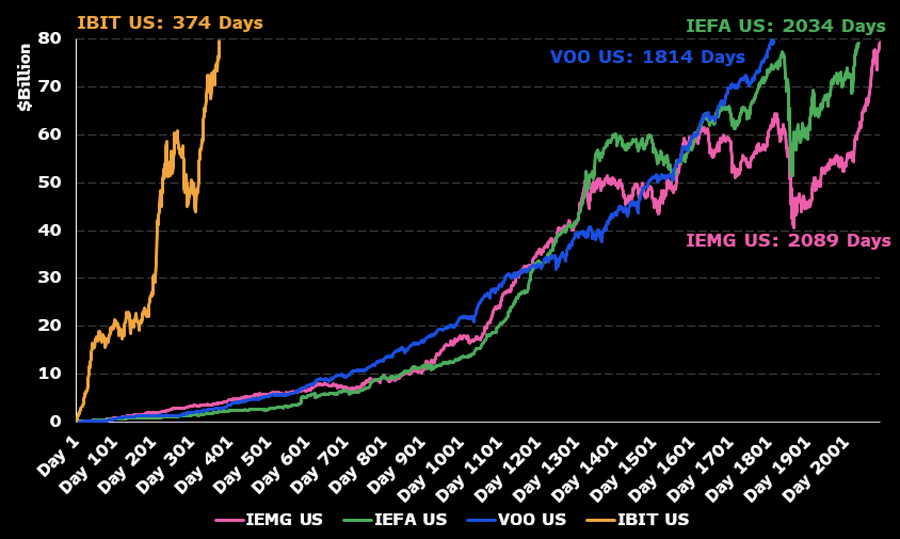

Notably, the previous record-holder, Vanguard’s S&P 500 ETF (VOO), took nearly five times longer to reach the same threshold.

According to Bloomberg ETF analyst Eric Balchunas, IBIT’s rapid ascent signals a major shift in how investors are accessing Bitcoin.

He noted that while the fund attracted over $1 billion in inflows in a single night, much of the recent AUM growth is also due to Bitcoin’s sharp price rally.

As of this week, IBIT holds more than 700,000 BTC, which accounts for roughly 3.55% of all Bitcoin in circulation.

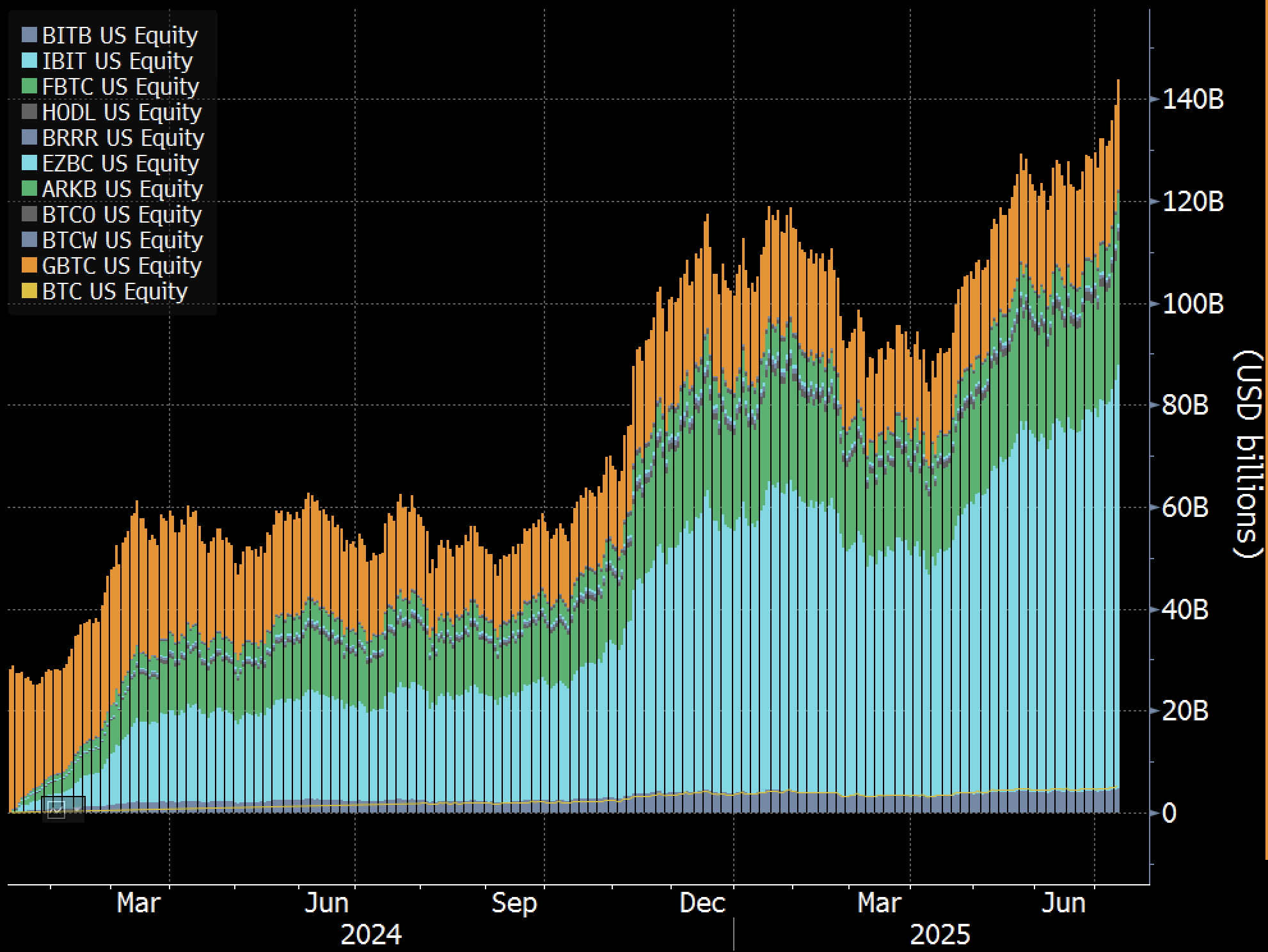

The broader market for US spot bitcoin ETFs is also seeing record-breaking activity. Total assets held across all US-listed spot Bitcoin ETFs have now surpassed $140 billion for the first time, with IBIT alone representing nearly 59% of that value.

This wave of growth has pushed IBIT into the top 25 largest ETFs in the world, ranking it 21st by AUM.

Data from SoSoValue shows that US spot Bitcoin ETFs have now seen cumulative inflows of more than $50 billion, including $2.7 billion in just the past week.

Nate Geraci, president of NovaDius Wealth, pointed out that there have been seven days since January when daily inflows exceeded $1 billion, two of them occurring this week.

The success of IBIT and its peers highlights the growing demand for regulated, easy-to-access Bitcoin investment products.

For both retail and institutional investors, these ETFs offer a simplified path to Bitcoin exposure without the challenges of self-custody or navigating crypto-native platforms.