EXCLUSIVE: OKX Europe CEO Breaks Down Bitcoin’s Explosive Rally & What’s Next | US Crypto News

Bitcoin's bull run just hit ludicrous mode—and the suits are scrambling to keep up. We got the inside track from OKX's top European exec on why this rally ain't like the others.

The institutional domino effect

Wall Street's latecomers are panic-buying like tourists before a hurricane. Spot ETF inflows? Please. The real action's in the options market where leveraged whales are placing billion-dollar bets.

Regulatory whack-a-mole

While Brussels drafts its 47th MiCA amendment, traders are already pricing in the next halving. Because nothing motivates like watching bureaucrats race against a codebase that updates itself.

One prediction? This cycle won't peak until your Uber driver starts explaining convexity adjustments on ETH staking yields. We're not there... yet.

Crypto News of the Day: Bitcoin’s Rise Reflects Institutional Shift, OKX’s Erald Ghoos Says

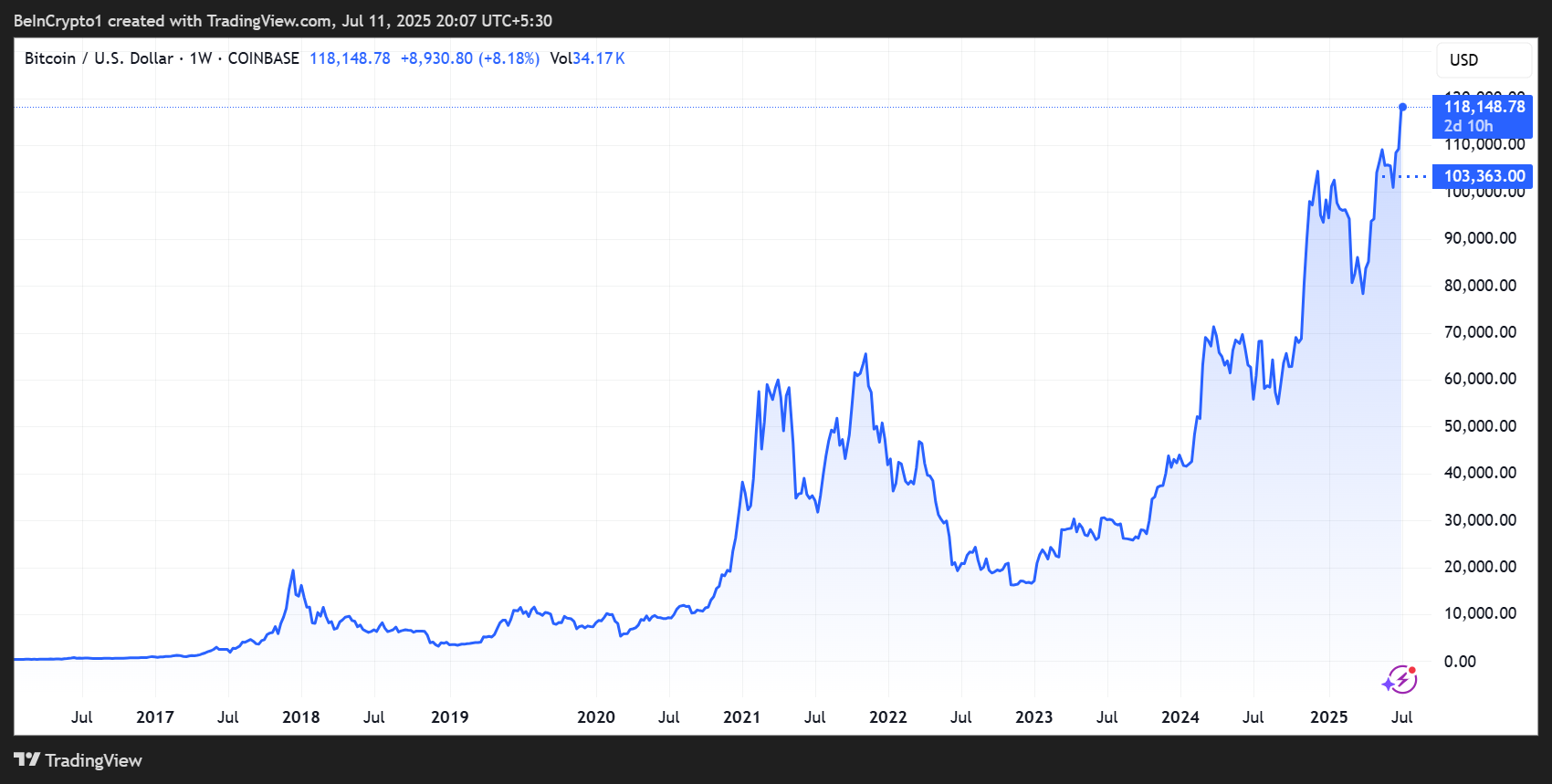

Bitcoin hit a new all-time high (ATH) on Friday, topping at $118,909 on the Coinbase exchange. While the MOVE triggered record liquidations, with thousands of short positions blown out of the water, the latest ATH is more than just a market milestone.

According to OKX Europe CEO Erald Ghoos, it marks a strategic turning point in how institutions view digital assets.

“Bitcoin’s surge to a fresh all-time high isn’t just noise, it reflects its emergence as the ultimate digital macro hedge,” Ghoos said in an exclusive comment.

He noted that rising global trade tensions, looming tariffs, and a liquidity-driven policy environment are pushing a broad spectrum of institutions to adopt bitcoin as “digital gold.”

As highlighted in a recent US crypto News publication, these institutions range from corporate treasuries to sovereign wealth funds.

Meanwhile, with volatility at decade lows and ETF (exchange-traded fund) inflows accelerating, July is shaping up to be “a defining moment” for Bitcoin.

“Bitcoin looks purpose built for it,” Ghoos added.

Despite ongoing ECB caution around a digital euro in Europe, interest in Bitcoin is accelerating. Ghoos highlighted that European institutional investors are increasingly turning to BTC as a portfolio diversifier beyond the traditional crypto-native players. This includes entities seeking non-fiat hedges amid growing macroeconomic uncertainty.

“The convergence of global trade uncertainty, policy shifts, and structural ETF access is elevating BTC beyond speculation, it’s becoming mainstream,” Ghoos said.

His statement aligns with comments from Marcin Kazmierczak, co-founder and COO of RedStone. As featured in a recent US Crypto News publication, the crypto executive highlighted Bitcoin as a portfolio diversifier.

“Bitcoin can add diversity to a portfolio but won’t reliably protect against stock market crashes since it doesn’t consistently move in the opposite direction,” Kazmierczak told BeInCrypto.

As market conditions align in favor of hard assets, Bitcoin appears to be stepping into a broader economic role.

What was once a fringe asset for retail traders is now gaining recognition as a Core hedge against fiat debasement and geopolitical instability.

For many institutional allocators, Bitcoin’s breakout is an intentional, risk-adjusted move into a time of digital macro investing.

Chart of the Day

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

- Bloomberg now shows Bitcoin in millions as price predictions top $1M+.

- The almost Bitcoin millionaires: Tales of fortunes lost to time.

- Ethereum surge sparks altcoin rotation: Here are analysts’ top picks.

- Ethena (ENA) price spikes 19.27% following Upbit’s listing announcement.

- Bitcoin’s breakout to $118,000 triggers record $1.25 billion liquidation.

- 3 Altcoins to watch this weekend | July 12 – 13

- XRP’s rally may be running out of steam—Here’s what on-chain data shows.

- Hyperlane (HYPER) hits all-time high as trading volume surges over 1,600%.

- Ethereum surge sparks altcoin rotation: Here are analysts’ top picks.

- Why Murad’s meme coin portfolio could soon hit a new all-time high.

Crypto Equities Pre-Market Overview

| Company | At the Close of July 6 | Pre-Market Overview |

| Strategy (MSTR) | $421.74 | $435.12 (+3.11%) |

| Coinbase Global (COIN) | $388.96 | $394.53 (+1.45%) |

| Galaxy Digital Holdings (GLXY) | $20.41 | $20.80 (+1.91%) |

| MARA Holdings (MARA) | $18.99 | $19.72 (+3.77%) |

| Riot Platforms (RIOT) | $12.59 | $13.00 (+3.18%) |

| Core Scientific (CORZ) | $13.18 | $13.03 (-1.14%) |