Ethereum Mirrors Bitcoin’s Surge—Will ETH Smash Through $3,000 Despite Retail Sell-Off?

Ethereum's price action is shadowing Bitcoin yet again—but this time, the $3,000 resistance level is the make-or-break moment. Retail traders are dumping, whales are circling, and the charts are screaming volatility. Here's why ETH's next move could redefine the altcoin market.

The Bitcoin Effect: ETH's Double-Edged Sword

When Bitcoin rallies, Ethereum usually follows—but not always with the same ferocity. This time, ETH's correlation is tighter than a trader's stop-loss, and the $3,000 psychological barrier is the line in the sand.

Retail Exodus: A Blessing or a Trap?

Small-time investors are cashing out, spooked by regulatory noise and meme-coin fatigue. But history shows retail panic often precedes institutional buying sprees—just ask the hedge funds quietly accumulating at these levels.

The $3,000 Question: Technicals vs. Sentiment

On-chain metrics hint at bullish accumulation, but technical resistance at $3,000 looks stiffer than a banker's upper lip during a rate hike. A clean breakout could trigger FOMO; a rejection might send ETH back to the $2,600 support zone.

Either way, Ethereum's next move won't be boring—unlike traditional finance, where 'volatility' means a 0.5% dip in the S&P 500. Buckle up.

ETH/BTC Correlation Climbs

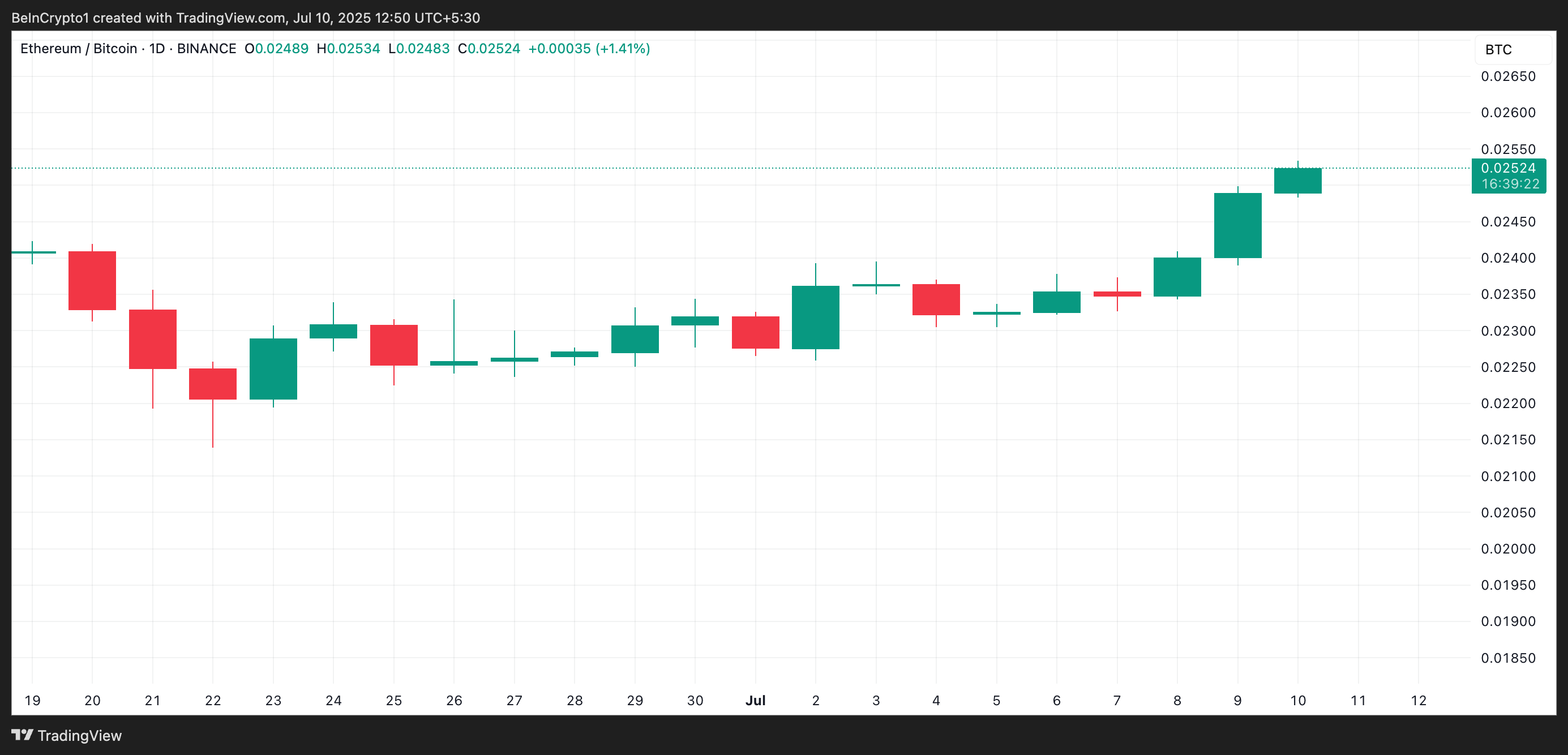

Ethereum’s correlation with Bitcoin has climbed sharply since late June. The ETH/BTC correlation coefficient, which measures how closely ETH’s price movements track those of BTC over a given period, now sits at 0.02.

A value close to 1 indicates that both assets move in the same direction, while a value NEAR -1 means they move in opposite directions.

With BTC nearing its all-time high, ETH’s price could follow suit and rally. This is because, historically, high correlation in bull phases has preceded joint rallies for both assets.

ETH Targets $3,000 as Institutions Load Up

Ethereum’s institutional investors appear to be locking in positions as they take advantage of the climbing ETH/BTC correlation. With both assets historically rallying in tandem during bullish phases, this group is positioning for a likely breakout above $3,000.

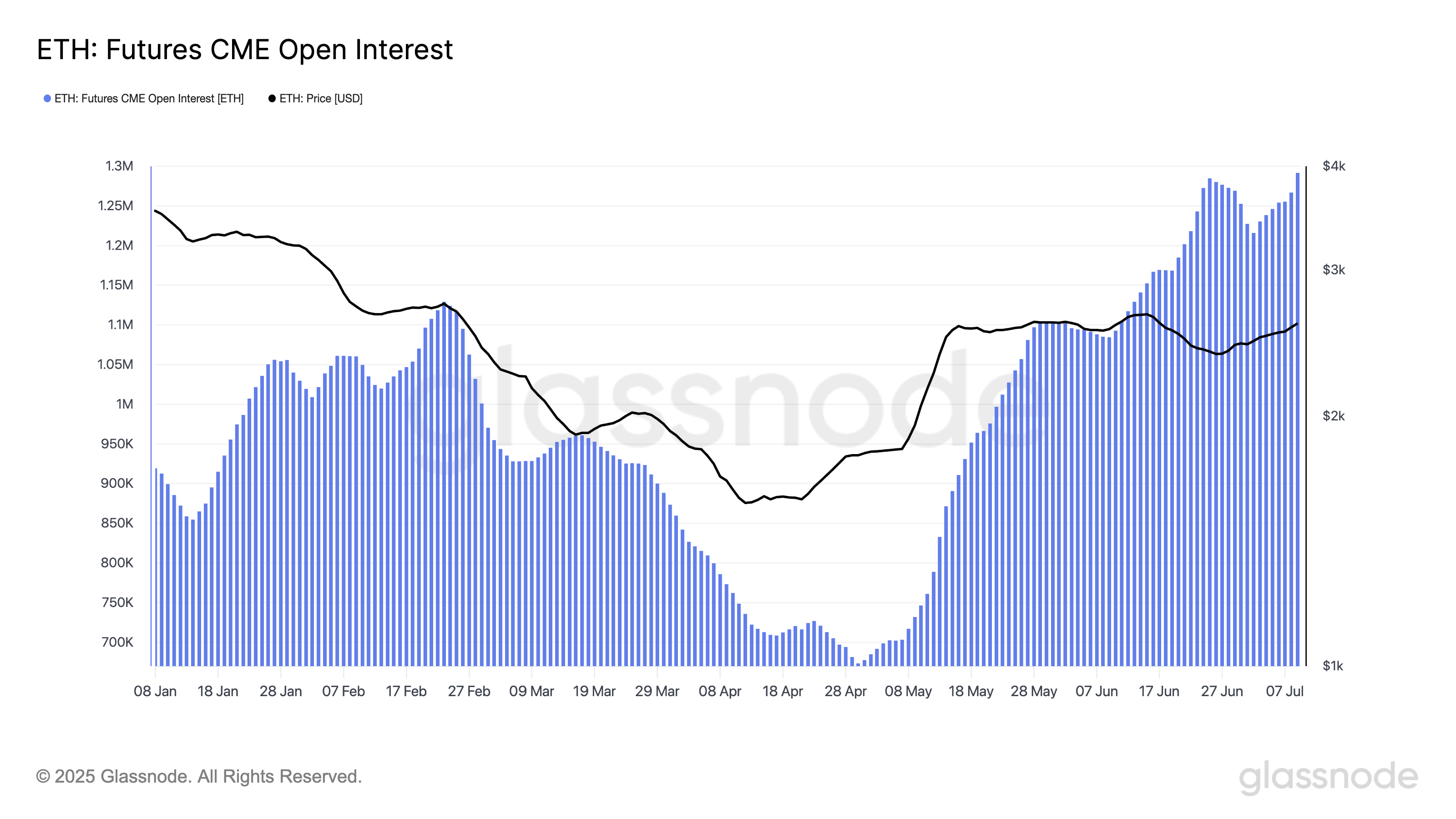

According to on-chain data from Glassnode, open interest in ETH futures on the Chicago Mercantile Exchange (CME), measured by the 7-day simple moving average, has surged to a record high of $3.34 billion.

This reflects rising institutional positioning as key market players accumulate ETH in anticipation of further upside.

Open interest refers to the total number of outstanding futures contracts that have not been settled. When it surges like this, it indicates rising trading activity and increased capital entering the market.

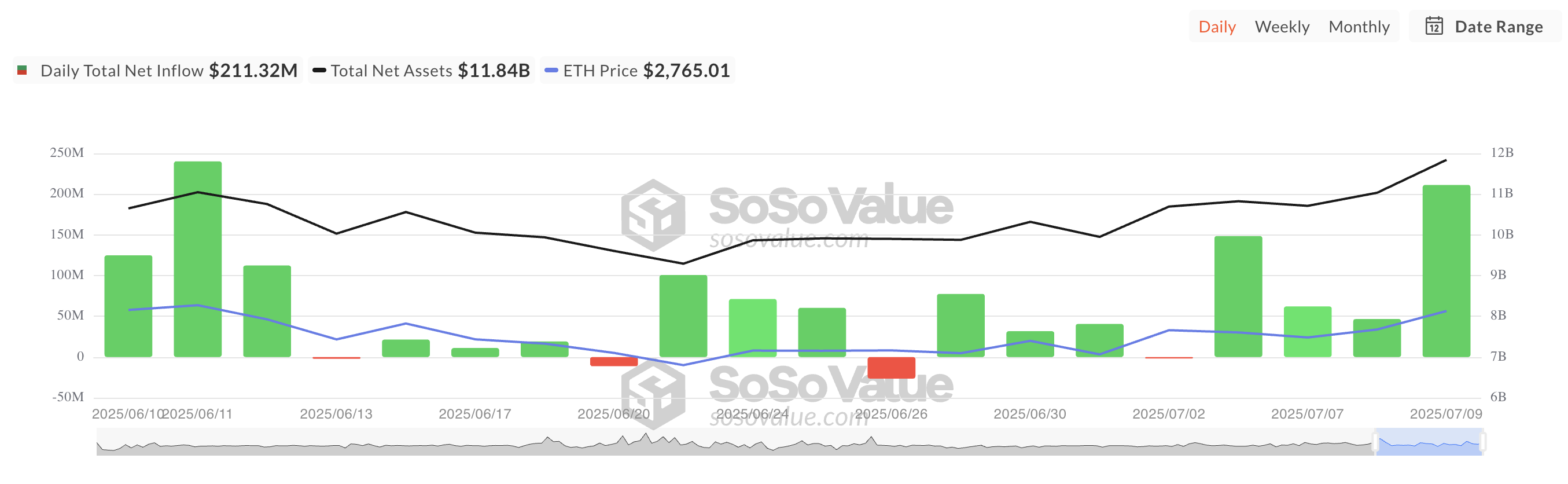

Furthermore, the consistent weekly inflows into spot ETH ETFs highlight the strengthening confidence in the altcoin among these key investors.

According to SosoValue, ETH-backed funds have recorded uninterrupted weekly inflows since May 9. Last week alone, over $219 million in capital flowed into ETH spot ETFs despite the coin’s largely sideways price action.

This sustained investment confirms the rising confidence in ETH’s long-term value as sophisticated investors position ahead of an anticipated breakout above $3,000.

However, there is a catch.

ETH Bulls Stall Below $3,000 as Retail Traders Tap Out

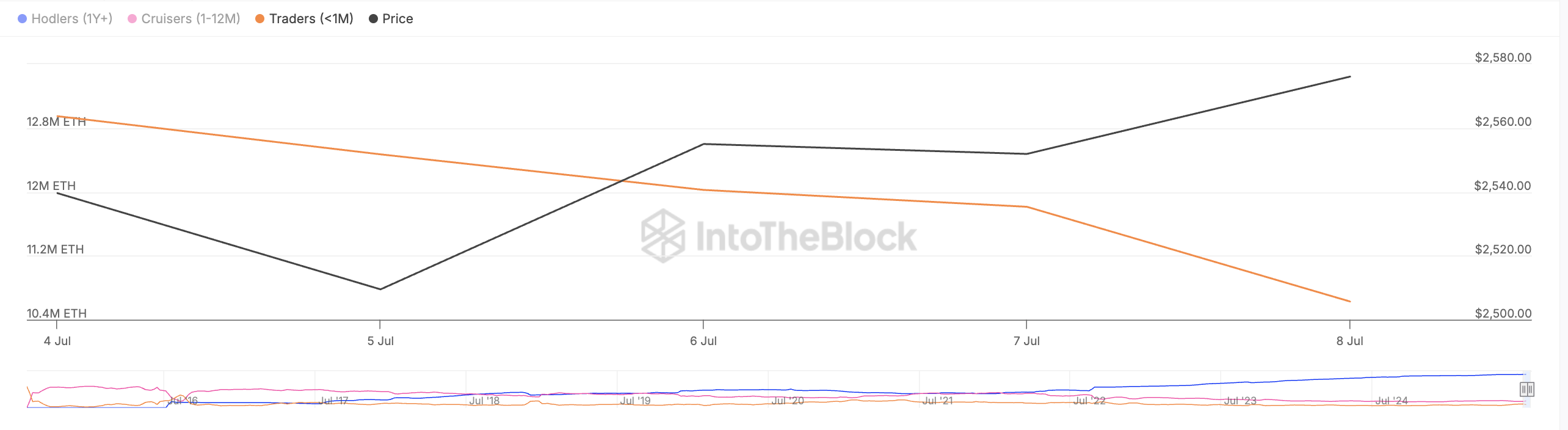

As key holders chase a rally above $3,000, ETH’s short-term price action continues to be weighed down by “paper hands.” These retail traders have held the coin for less than 30 days and are selling into its recent strength.

IntoTheBlock’s data shows that this group’s balance has dropped by 16% since July 4, slowing down the coin’s price growth amid strong institutional support.

Retail traders drive an asset’s short-term price performance through frequent, emotion-driven buying and selling. Unlike institutional investors who tend to hold through fluctuations, retail participants are more reactive to news, sentiment, and short-term price moves.

When they begin to sell, downward pressure increases, stalling rallies or triggering corrections.

Although institutional interest in ETH is a good sign of long-term confidence, retail traders are needed to catalyze a rally above $3,000 in the short term. If they remain aloof and demand falls, the coin could lose some of its recent gains and fall below $2,745.

However, a resurgence in new demand could push ETH’s price above $2,851 and toward $3,067.