3 Altcoins Primed for a Binance Listing This July – Don’t Miss Out!

Crypto’s hottest rumor mill is churning again—these three altcoins are flashing all the right signals for a potential Binance debut.

The Binance Effect: Your Ticket to Early Gains

Nothing pumps a coin’s price like the world’s largest exchange hitting the ‘list’ button. Just ask the last meme token that mooned 300% on pure speculation (before crashing harder than a Lehman Brothers intern).

1. The Layer-1 Dark Horse

Scaling solutions are back in vogue, and this chain’s throughput numbers could make even Solana blush. Exchange wallets are already accumulating.

2. The DeFi Darling

A protocol so audited it makes Swiss banks look reckless. TVL’s climbing faster than Wall Street’s bonus pool during QE.

3. The AI Token That Might Actually Do Something

Forget vaporware—this project’s GitHub commits are more active than a crypto influencer during bull season.

*Pro tip: DYOR before FOMO-ing—because nothing hurts more than buying the rumor and selling the regulatory crackdown.*

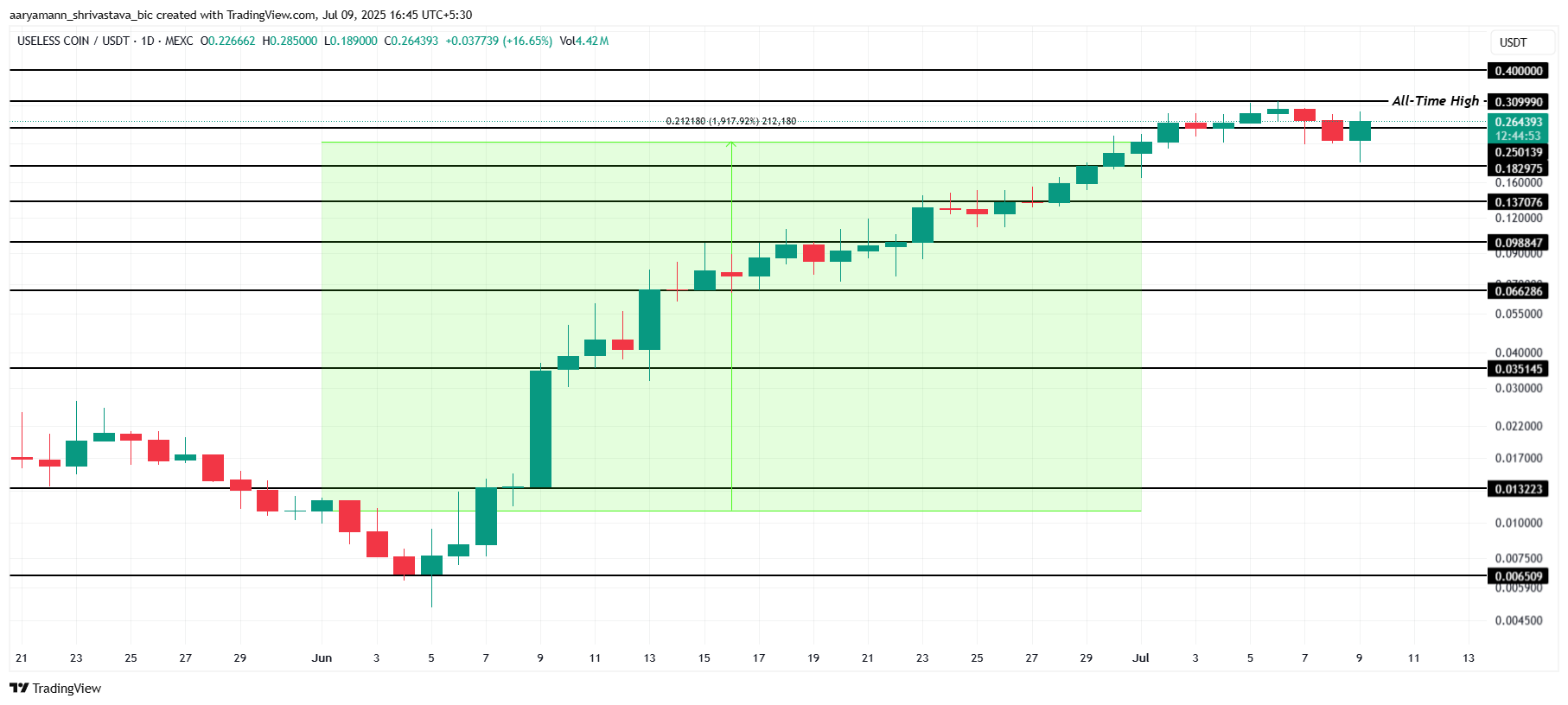

Useless (USELESS)

USELESS has emerged as one of the top-performing altcoins this month, thanks to its unique take on meme coins. By embracing its own irony of being “useless” while gaining significant attention, the token has piqued investor interest, making it a sought-after asset in the current crypto market.

In the past month, USELESS has seen explosive growth, rising from a market value of $9 million to $217 million, marking an incredible 2,311% increase.

The demand for USELESS is expected to continue as the token forms new all-time highs (ATHs), following a 1,917% rise in price in June.

Binance often targets coins that can generate substantial trade volume, and USELESS fits this profile. With its rising popularity and unique market appeal, the altcoin could attract significant attention from the exchange, helping push its price toward $0.400 and potentially forming a new ATH in the process.

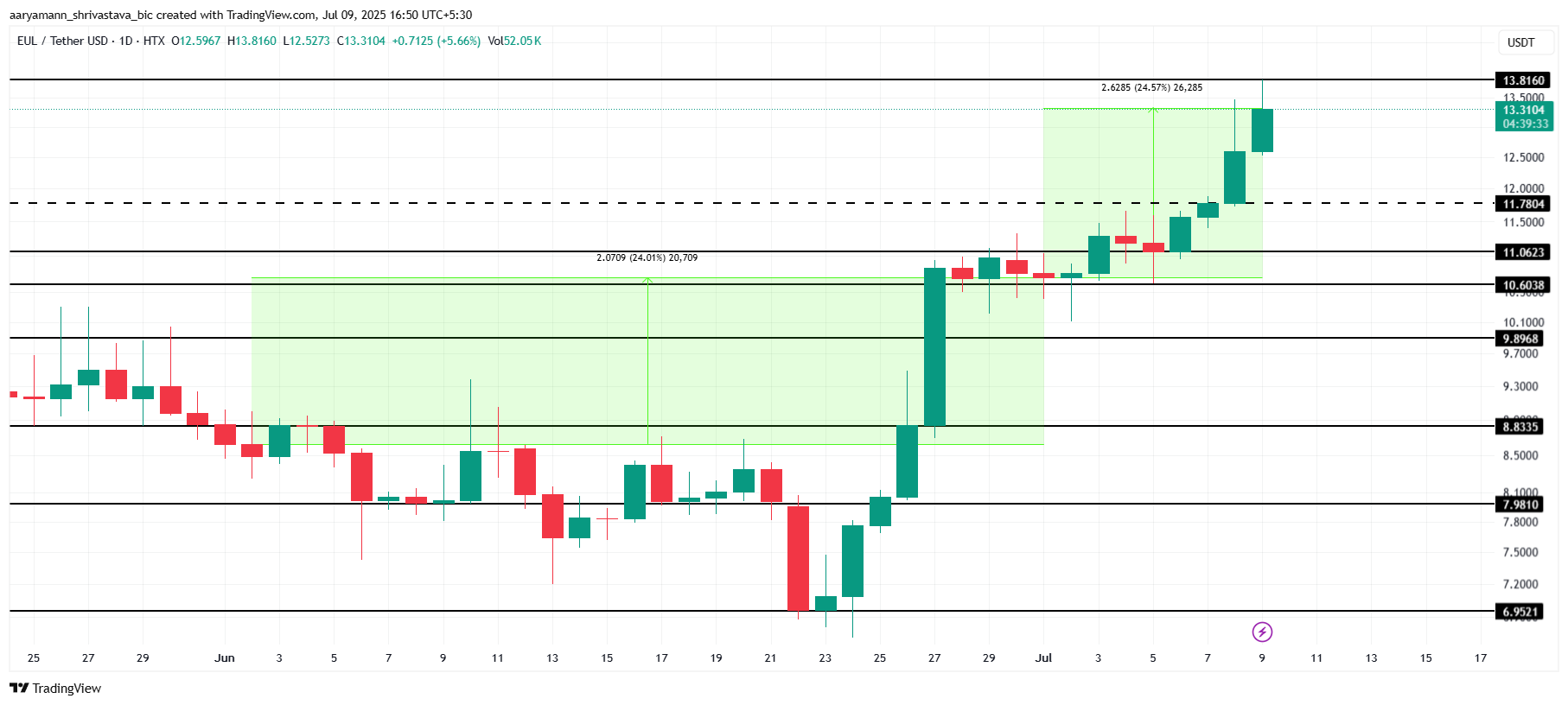

Euler (EUL)

Euler has made a strong comeback after facing a $197 million exploit in 2023. The DeFi protocol gained significant attention earlier this year when BlackRock selected Euler to enable its tokenized Treasury fund, BUIDL, as collateral on the Euler lending platform.

In June, exchanges accumulated $3.55 million in EUL, resulting from a balance between inflows and outflows. This helped the altcoin’s price rise by 24% since the beginning of July, with the current trading price at $13.31. The recent price increase suggests growing market interest in Euler.

With a total value locked (TVL) of $1.15 billion, Euler is well-positioned to attract attention from platforms like Binance. If the demand continues, Euler’s price could surpass $14.00 this month, marking further growth for the protocol and its native token.

Cronos (CRO)

Cronos (CRO) is a leading candidate for a Binance listing in July, following the proposed Crypto Blue-Chip ETF filed by Truth Social. The fund includes 70% Bitcoin, 15% Ethereum, 8% Solana, 5% Cronos, and 2% XRP.

This positions Cronos as a key asset in the fund.

Of the tokens in the proposed fund, only Cronos (CRO) is not currently listed on Binance. If the SEC approves the Crypto Blue-Chip ETF, Binance could fast-track Cronos’ listing. This move WOULD likely draw more liquidity and investor interest toward CRO, fueling its price growth.

Cronos’ price surged by 18% over the last 24 hours, signaling strong momentum. If the SEC approves the ETF listing and Binance acts swiftly, CRO could break through key resistance levels and surpass $0.1007. The upward movement would benefit investors, continuing the positive trend for the altcoin.