Metaplanet Doubles Down: Bitcoin-Powered Acquisition Spree Kicks Off Phase 2 Expansion

Tokyo's crypto darling Metaplanet just flipped the 'aggressive growth' switch—and they're paying in bitcoin.

The BTC M&A Playbook

No JPY, no USD—just pure digital gold. The publicly traded firm's Phase 2 strategy reads like a crypto maximalist's shopping list: strategic acquisitions funded entirely through their bitcoin treasury. Because why sell your stack when you can spend it?

Wall Street Meets Cypherpunk

While traditional firms dilute shareholders with secondary offerings, Metaplanet's playing 4D chess. Their bitcoin-heavy balance sheet (currently worth ¥4.2B) now moonlights as a corporate takeover war chest—take that, fiat-funded competitors.

One hedge fund manager quipped: 'Finally, a use case for corporate bitcoin holdings beyond Twitter flexes.' The market seems to agree—shares jumped 8% on the announcement.

The Fine Print

No targets named yet, but insiders hint at web3 infrastructure plays. Because nothing says 'long-term hodl' like buying the picks and shovels.

Memo to short-sellers: you're now short bitcoin by proxy. Sweet dreams.

What Metaplanet Plans To Do With Its Bitcoin Holdings

In an interview with the Financial Times, Gerovich explained that Phase 1 focuses on accumulating as much Bitcoin as possible. The goal is to reach a point of “escape velocity.” This represents a point where the company has amassed a significant amount of Bitcoin, making it difficult for competitors to catch up.

“Four to six years is probably phase one in this bitcoin accumulation phase, and then beyond that it becomes incrementally more difficult,” he stated.

Notably, Metaplanet has ramped up its Bitcoin purchases this year. The firm started its Bitcoin treasury in April 2024. Yet, it has already become the fifth-largest publicly listed holder of cryptocurrency.

Moreover, the Japanese (Micro) Strategy boosted its holdings to 15,555 BTC yesterday by purchasing 2,205 BTC for approximately $238.7 million. This aligns with its updated goal of holding 1% of the total Bitcoin supply by 2027.

Thus, the firm is increasingly focused on building a large Bitcoin stockpile, which it can later leverage for financial purposes in Phase 2. In this stage, Bitcoin WOULD be used as collateral to secure financing.

The company envisions a scenario where banks will likely treat Bitcoin like traditional financial assets, such as securities or government bonds. This would allow Metaplanet to deposit Bitcoin with these financial institutions to get attractive financing options against those Bitcoin holdings.

The funds raised could then be used for acquisitions. The concept is to use Bitcoin not just as a store of value but as an asset to secure financing for further business expansion.

“We’ll get cash that we can use to buy profitable businesses, cash-flowing businesses,” Gerovich added.

He outlined potential targets, including a digital bank in Japan that provides better digital banking services than existing banks. Moreover, Gerovich stressed that he would never sell any Bitcoin and plans to continue raising capital to buy more.

While he is open to issuing preferred shares, he is against using convertible debt like Strategy does. He noted that it could create uncertainty regarding repayment linked to fluctuating share prices.

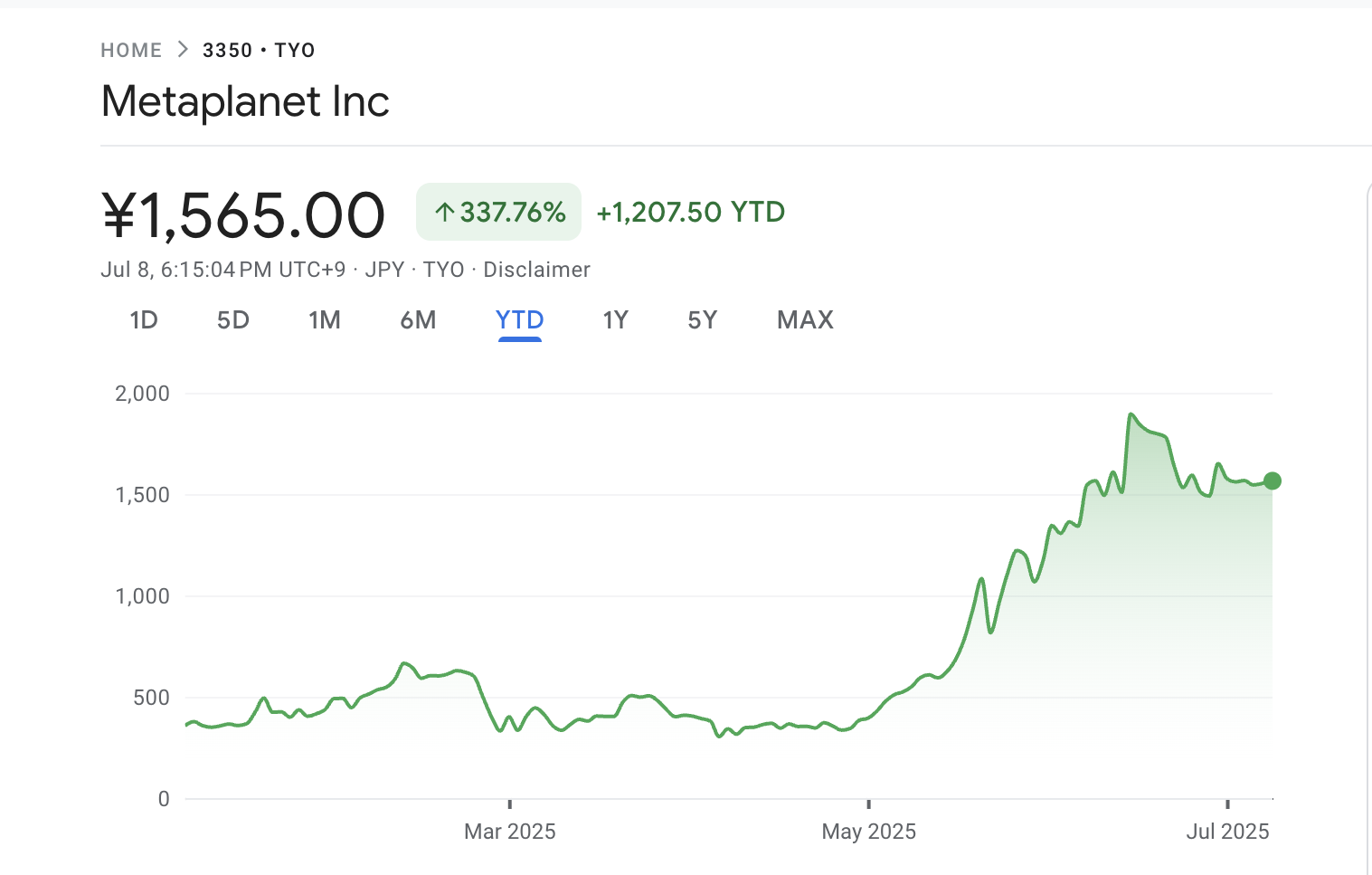

Meanwhile, betting on Bitcoin has paid off well for Metaplanet. Google Finance data showed the stock (3350.T) appreciated 337.76% year-to-date.

Metaplanet Stock Performance. Source: Google Finance

Moreover, Reuters reported that the stock saw a significant increase in trading volume in June, reaching 1.869 trillion yen. It outperformed major corporate giants such as Toyota and Sony. Since November, the stock has also held the top position in the standard market.