Bitcoin Battles $109,500 Resistance: Can the Crypto King Break Through?

Bitcoin's latest rally hits a wall at $109,500—classic crypto drama meets textbook technical resistance. Will bulls muster the momentum to smash through, or is this another 'buy the rumor, sell the news' setup?

The Standoff: Price action coils like a spring near the six-figure threshold. Traders eye liquidity pools while institutional players quietly adjust derivatives books (because why take a position when you can hedge all sides?).

Macro Meets Crypto: Traditional markets yawn at BTC's stalemate—Wall Street still thinks 'digital gold' means Beanie Babies with blockchain. Meanwhile, the Fed's balance sheet quietly balloons to $12 trillion, but sure, Bitcoin's the speculative asset.

Next Moves: Watch for either a decisive close above $109.5K (cue 'ATH incoming' tweets) or a rejection that sends BTC back to retest $98K support. Either way—someone's leverage is about to get liquidated.

Bitcoin Holders Sell

The age consumed metric, which tracks the selling activity of long-term holders, recently showed a sharp uptick. This marked the highest surge in over a year, signaling that LTHs are losing patience as they await a new ATH.

These holders, who control a significant portion of Bitcoin’s supply, have historically impacted the price negatively when they decide to sell. Typically, such sell-offs signal weakening market sentiment.

Despite the recent selling activity from LTHs, Bitcoin’s price has not experienced a significant decline. This suggests that investor sentiment, while cautious, remains resilient. The uncertainty of LTHs did not trigger a long-term downturn, indicating that the market is still holding steady and that other factors may be mitigating the impact of their selling.

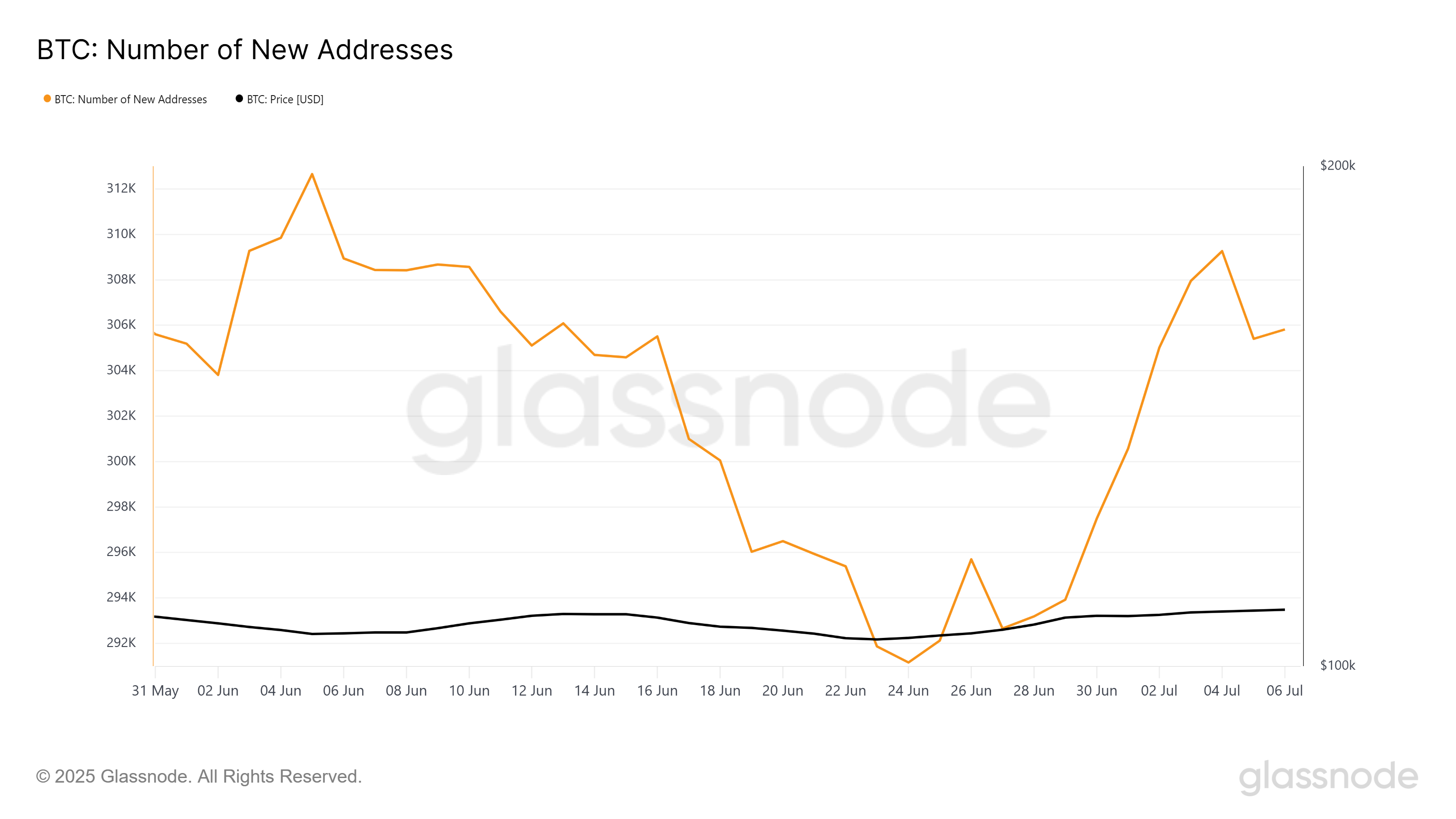

Bitcoin’s broader market momentum is showing positive signs as well. The number of new addresses surged at the beginning of this month, signaling renewed interest and Optimism in Bitcoin. This surge in new addresses suggests that the market is gaining traction, with more investors entering the space.

Interestingly, although the number of new addresses dipped slightly over the weekend, the decline was not significant. This indicates that Bitcoin’s recent price movements have not deterred new investors.

BTC Price Faces Resistance

Bitcoin is currently trading at $109,404, just under the resistance level of $109,476. The recent bounce from $108,000 has placed Bitcoin in a strong position, with the next target being the $110,000 level. If Bitcoin successfully breaches this resistance, it will set its sights on the ATH of $111,980.

Bitcoin is currently 2.3% away from its all-time high of $111,980. The path to this level will likely be supported by both new investors and long-term holders. However, for bitcoin to reach this level, LTHs will need to demonstrate restraint and avoid significant sell-offs, which could hinder the price movement.

If the resistance at $109,476 holds and Bitcoin fails to break through, the price may slide back toward $108,000 or even lower, potentially dropping to $105,585. This decline WOULD invalidate the current bullish thesis and suggest that the market is not ready for a breakout at this time.